peepo/E+ via Getty Images

Main Thesis & Background

The purpose of this article is to evaluate the BlackRock Debt Strategies Fund (NYSE:DSU) as an investment option at its current market price. The fund’s primary objective is “to provide current income by investing primarily in a diversified portfolio of US companies’ debt instruments, including corporate loans, which are rated in the lower rating categories of the established rating services or unrated debt instruments, which are in the judgment of the investment adviser of equivalent quality”.

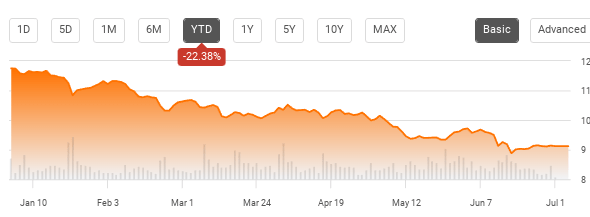

This is my first review of DSU, although I have covered similar funds with floating-rate objectives in the past. But DSU in particular has caught my eye recently due to its inherent objective. As a fund loaded with term loans and floating rate instruments, it should be performing well in a rising rate environment, which we have now. Yet, DSU is down heavily for the year:

YTD Performance – DSU (Seeking Alpha)

This reality has me questioning why, and led me to do a deeper dive in to this CEF. After review, I actually see some value here, and will initiate my coverage on this fund with a “buy” rating. While there are certainly risks to buying now, which I will discuss in this review, I believe the opportunity outweighs those considerations, and I will explain why in detail below.

Contrarian Plays Always Pique My Interest

To start, I want to discuss a key reason for why I am looking at loan funds to begin with. This relates to DSU, but also to the plethora of funds that exist in this space. With markets rattled in 2022, and DSU similarly being hit hard – why should readers even be giving this option any thought at all?

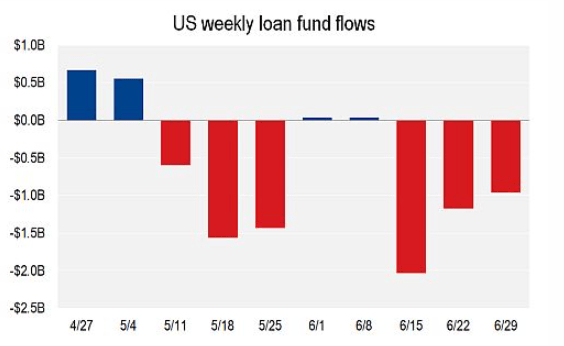

One aspect that stands out for me is that this is an area that investors are fearful of right now. While that may sound counter-intuitive, my followers know that I often take a contrarian stance – with respect to the market as a whole, specific sectors, or even individual funds. This is relevant to DSU right now because, as a CEF filled mostly with business loans, readers would be interested to do that this sector has been under pressure recently. In the short-term, fund outflows have been sharply negative over the past few weeks, continuing a trend that started in mid-May:

Loan Fund Flows (S&P Global)

The conclusion I draw here is that this is clearly an unloved corner of the market at the moment. While there are some justifiable reasons for this, which I will cover later, the focus here for me is that this can be a greedy when everyone is fearful play. Investors are bailing on this sector, and that is the time when you want to buy-in, assuming you have a positive view of the sector for the longer term.

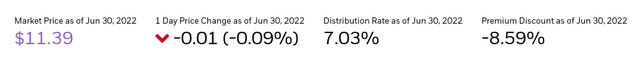

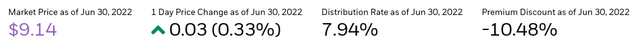

Discount to NAV Very Attractive

Diving in to why I like DSU specifically, a positive attribute in my view is the fund’s valuation. At current market prices it is offering a very steep discount to NAV, which is something I almost always view favorably. Right now, investors can pick this fund up for less than 10% what its underlying holdings are worth:

To me this suggests at least some consideration of DSU is warranted right off the bat. This is a very cheap price in isolation, and certainly has me thinking now is a reasonable buy-in point.

However, one does not invest in isolation. When considering loan CEFs from BlackRock, there are a number of options. Two in particular that has similar, floating-rate objectives are the BlackRock Floating Rate Income Strategies Fund (FRA) and the BlackRock Floating Rate Income Trust (BGT). In fairness, both of these options are also ones I would consider a “buy” right now. But in relative terms, DSU seems to win out if one was to purchase in the immediate term, as its discount is wider than both those options, respectively:

FRA Valuation (BlackRock) BGT Valuation (BlackRock)

The takeaway here is straightforward for me. All of these funds offer a compelling value right now, but DSU takes the cake in terms of larger absolute discount. When I own BGT already, this divergence suggests the best play for me at this juncture is to start a position in DSU, as opposed to adding to my existing BGT position. Ultimately, all of them seem like reasonable buys given my broader positive outlook for floating rate loans as a whole.

DSU Should Be Performing Well, But It’s Not

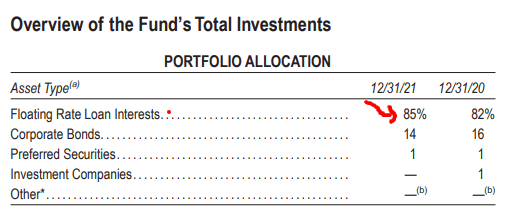

My next point is a bit of a mixed bag. Simply, it shows why DSU has had such a push-pull year. It has had some moments of positive momentum, but the broader trend has been decidedly negative. This may seem logical given all the weakness in the market as a whole. Yet, it really shouldn’t, since DSU holds assets that should actually be performing strongly in this environment. Simply, this fund is made up mostly of loans, most of which have floating rate debt. While this is not as obvious compared to BGT and FRA, since those funds have “floating rate” in their name, DSU has a similar make-up. While its objective allows for term loans that include both fixed and floating rate debt, the fund currently is heavily tilted towards floaters:

DSU’s Floating Rate Allocation (BlackRock)

With this understanding, why is it that DSU should be in a positive market environment?

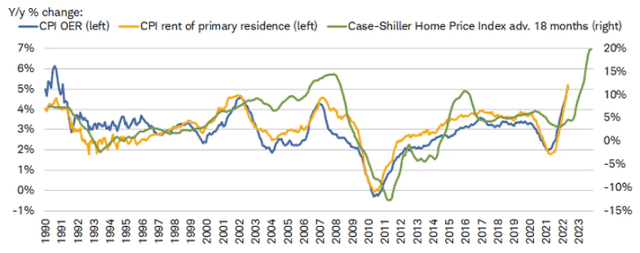

This primarily rests on the fact that floating rate debt is positively linked to inflation and rising interest rates. This is because as benchmark rates rise, these loans see their interest rates reset at the prevailing, higher rates. This increases the income derived from these securities, which helps investors keep up with inflation. Importantly, many term loans are often short-term in nature, meaning that even some of DSU’s securities that are fixed-rate may be maturing soon. If so, they can be replaced sooner with higher bearing securities, rather than fixed-rate bonds that tend to have longer dated maturities.

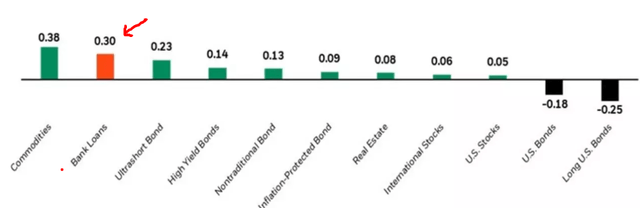

Because of this inherent structure, floating rate instruments tend to have a positive correlation with inflation (when it leads to rising interest rates). While other sectors may suffer in that environment, floating rate debt tends to see positive gains, as the correlation exhibit indicates:

Correlation to Inflation (BlackRock)

So, why does this matter now? Because inflation has been red-hot in 2022. While this had taken some market participants by surprise at the start of the year, everyone has now realized that inflation is persistent, high, and not going away any time soon. In fact, it has accelerated during the first half of the year, rather than peaking as many were hoping for:

What I am getting at here is that the environment seems ripe for floating rate debt, and therefore DSU, to be registering gains. With inflation rising and central banks hiking interest rates, that seems logical. Yet, as the YTD performance showed, DSU is down by a wide margin. In the paragraphs that follow I will explain some of the reasons why, which relate to the headwinds this fund faces in the coming months. Yet, it is important to recognize that, broadly speaking, DSU is in a favorable environment as long as macro-economic conditions do not deteriorate meaningfully.

Riskier Debt Not Worth A Premium As Recession Risks Loom

Through this review, I have painted a bright outlook for DSU. Yet, the fund is in bear market territory for the year (including distributions) and the steep discount to NAV suggests investors are not keen on this concept for the time-being. With an inflationary backdrop and rising interest rates, DSU should be a no-brainer, but it’s not. This begs the question – why?

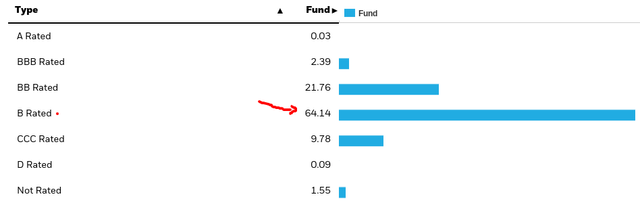

A point to emphasize is that while floating rate loans should perform well during inflationary time periods, there are caveats to this reality. One is that if inflation gets too hot, too fast, that can lead to a decline in economic growth and/or a recession. Sound timely? That is because it is precisely what many investors and economists are worried about at the moment. This impacts floating rates and funds like DSU in a disproportionate way because the underlying securities are often below investment-grade debt. In fact, DSU has hardly any IG holdings, and the majority of its assets are “B” rated:

DSU’s Credit Quality (BlackRock)

The simple take is that below investment-grade credit is riskier. Default rates are higher, and it is more prone to delinquency. This can impact repayment and, ultimately, the income a fund like DSU is able to deliver if the underlying borrowers fall behind. Emphasizing this point is that DSU holds debt that is B and CCC rated. These are on the lower end of the credit quality spectrum. By contrast, BB rated debt is just one notch below investment-grade, and is seen as a safer credit play. The point of focus here is that DSU holds riskier types of loans. So even though the floating rate attribute is a positive, we have to balance this against the weak credit profile.

In times of strength, this is less of a concern. But as investors are surely aware, the U.S. economy (as well as the global economy) is in a tight spot right now. Tightening central banks, inflation, and low levels of consumer sentiment are all combining to make recession fears a very concerned headwind for the second half of 2022. This hits home on why DSU has been performing so poorly. While duration risk is minimal, credit risk is not, and these are exactly the assets that will under-perform if economic conditions deteriorate. This is in stark contrast to IG credit CEFs. Those assets should hold up well in terms of credit repayment during times of stress, but the duration risk is too high for comfort. So there is no “sure thing” in the credit markets at this juncture.

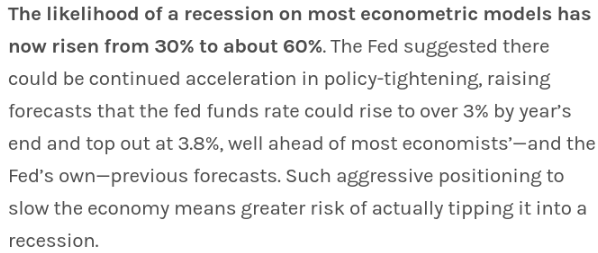

Therefore, I want to reaffirm that this option is not for everyone. Do I see merit to buying DSU here? Yes, and I probably will be starting a position myself. But whether or not this is right for everyone is subjective. This is not a play for the risk averse, nor for those who are forecasting a severe deterioration in economic conditions – whether in the U.S. or elsewhere around the world. This backdrop explains pretty clearly why DSU is sitting in double-digit discount territory. Investors are scared to pick up this debt as recession fears climb, which they have been in the short run:

Recession Outlook (Morgan Stanley)

This is critical to understand because while I have a “buy” rating on DSU, this doesn’t guarantee positive returns. Yes, I think there is an environment where DSU can register strong returns in the second half of the year, but the opposite is also true. DSU is ripe for plenty of pain if a recession does hit and financial conditions tighten. Readers need to factor that prospect in to their analysis before deciding to buy DSU, and in what quantity.

Bottom-line

The bank loans within DSU’s portfolio mostly pay a floating interest rate that rises with higher central bank rates. This is a good backdrop for investors as the Fed has been raising rates this year and has plans to continue doing so in the coming months. While generally good for investors, this has limitations. When rates rise rapidly, higher debt servicing costs can put borrowers in trouble quickly, especially if economic growth slows and/or the economy hits a recession. This is the fear now, and speaks to why DSU is in the red for the year and trading at such a deep discount.

However, there are bright spots that make me optimistic. The almost 11% discount is one. Another is the contrarian element – investors are fleeing this sector, piquing my interest to go the other direction. Finally, loan issuance is down considerably in the short-term. While this indicates trouble in the market, it has kept forthcoming supply low:

Loan Issuance (By Quarter) (Bloomberg)

If the dire economic predictions do not pan out, DSU is a pretty good bet here. The underlying holdings are seeing a shrinking supply market, so that will help shore up prices. Couple this with the valuation and potential for a rising distribution stream, I am willing to take the gamble at these levels. As a result, I will look to initiate a position in DSU during the next trading week, and I suggest readers give this idea some consideration at this time.

Be the first to comment