takasuu/iStock via Getty Images

After the bell on Thursday, we received fiscal Q4 results from BlackBerry (NYSE:BB). The company has been undergoing a major turnaround under CEO John Chen for nearly a decade now, and investors have not been rewarded. This week’s report was supposed to show some major progress ahead, but it looks again like this business just continues to struggle.

For fiscal Q4, revenues came in at $185 million, a decline from last year’s $210 million. This missed street estimates by about a million dollars, and don’t forget that estimates came down by $20 million since the bad Q3 report, so this wasn’t exactly a great result. As usual, the company beat on the adjusted bottom line, after management slashed operating expenses and took out its usual round of normal business expenses.

We knew that revenues would drop primarily because of the Licensing and IP segment. As I mentioned in my earnings preview article, monetization efforts stopped while the company looked for a buyer to take its legacy patent portfolio. A deal was finally completed in January, but it caused this segment’s revenue to drop to $11 million in the quarter from $50 million in the prior year period. These also used to be high margin revenues, so their loss meant the company continues to run at a true operating loss (excluding debentures adjustment) of just over 10%.

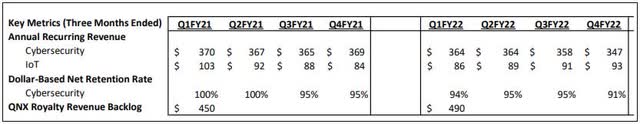

The one good piece of news here is that IoT is finally recovering from the pandemic, growing to revenues of $52 million in Q4, up from $38 million a year earlier. The bad news here was that Cybersecurity revenues were flat from the prior year period. Additionally, investors will likely be disappointed that the Cybersecurity key metrics continued to weaken as shown below. BlackBerry is losing Annual Recurring Revenues (“ARR”) here, while competitors like Cylance are growing their ARRs by leaps and bounds quarter after quarter. The net retention rate here also dipped by 4 percentage points.

BlackBerry Key Metrics (Q4 Report)

On the conference call, management continues to talk about solid billings growth for the Cyber segment, but said that revenues will be roughly flat this year. Additionally, Licensing revenues are expected to be minimal now that the patent deal has basically been completed. The one bright spot here is that IoT revenues are expected to continue their growth to a range of $200 million to $210 million from this year’s $178 million. Unfortunately, this overall forecast seems extremely weak. This year was supposed to be the year where the top line started growing again, but now management seems to be calling for revenues to likely decline.

Given the commentary, it seems like management is calling for a broad range of $670 million to $705 million in revenues for the new fiscal year, if I use $470 million to $485 million for Cyber and zero to $10 million for Licensing. That’s coming off a year where BlackBerry did $718 million. Yes, the big disappointment here is Licensing, potentially dropping $50 million to $60 million, but going into Thursday, the street was looking for revenues of nearly $800 million, so it’s not just that one segment that’s below expectations. Even if Licensing were to be flat for this year, the revenue range would still be quite a bit below estimates. I should also point out that over the last year, the average revenue estimate for this year has come down by $250 million, and yet this is still tremendously bad guidance.

I was listening to the conference call, and as management went through the guidance portion, shares seemed to drop from down one percent in the after-hours session to down almost six percent. This puts the stock barely above $7 and keeps it a lot closer to its $5.80 52-week low than its high above $20. As the chart below shows, BlackBerry shares going into this report were up less than 18% since John Chen took over, compared to a 250% gain for the NASDAQ.

BlackBerry Chart (Yahoo! Finance)

In the end, the story at BlackBerry just hasn’t changed. Despite revenue estimates coming down significantly in the past few months, the top line still missed Q4 expectations. Key metrics for the Cybersecurity business weakened further, with management not calling for any revenue growth from that segment this year. With Licensing revenues expected to be minimal, guidance for the new fiscal year was much weaker than expected, implying another overall sales decline for BlackBerry when we were finally supposed to see some growth. As we continue through the 9th year under John Chen, investors just don’t have too many reasons to be positive at the moment, which is why shares continue to massively underperform.

Be the first to comment