Bet_Noire/iStock via Getty Images

Introduction

Despite oil and gas prices seeing a strong recovery during 2021, sadly Black Stone Minerals (NYSE:BSM) found themselves partly missing out with their hedges costing over one-third of their operating cash flow during the first nine months alone, as my previous article discussed. Whilst this was still able to provide a desirable high distribution yield of 6.69%, when looking ahead their distributions could double during 2022 as their hedge prices increase significantly, thereby lining up the potential for a very high 13%+ yield on current cost.

Executive Summary & Ratings

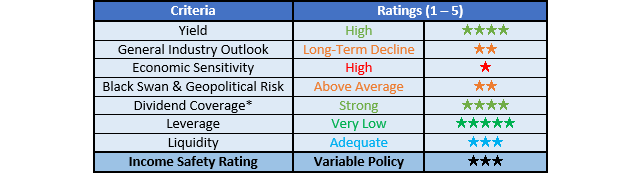

Since many readers are likely short on time, the table below provides a very brief executive summary and ratings for the primary criteria that were assessed. This Google Document provides a list of all my equivalent ratings as well as more information regarding my rating system. The following section provides a detailed analysis for those readers who are wishing to dig deeper into their situation.

Author

*Instead of simply assessing distribution coverage through distributable cash flow, I prefer to utilize free cash flow since it provides the toughest criteria and also best captures the true impact upon their financial position.

Detailed Analysis

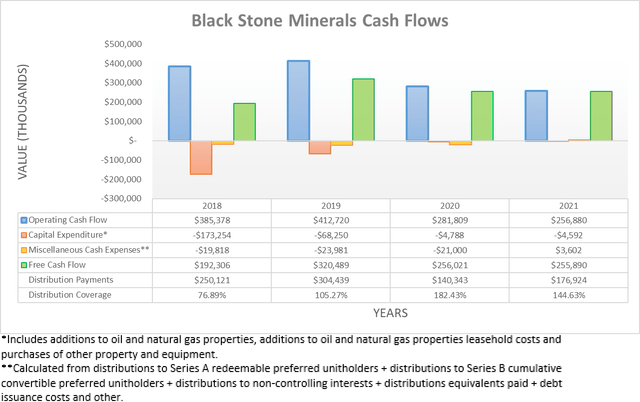

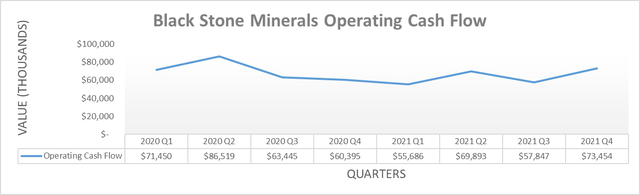

Following the end of 2021, it saw their operating cash flow finish at $256.9m and thus down 8.84% year-on-year versus their previous result of $281.8m during 2020, despite the otherwise strong oil and gas prices. Apart from being weighed down slightly by their temporary working capital movements in both years, the far bigger impact stemmed from the losses they incurred as a result of their hedges that ultimately shaved $112.9m from their 2021 operating cash flow, whereas they added $46.1m to their 2020 results. Despite these weighing down their results, impressively their operating cash flow during the fourth quarter of 2021 still reached its highest point on a quarterly basis since the second quarter of 2020, as the graph included below displays.

It can be seen that despite these hedges, the higher oil and gas prices still managed to pull their operating cash flow to $73.5m during the fourth quarter of 2021. When looking ahead, this would have likely continued even without oil and gas surging during the first quarter of 2022 due to the inherent lag between prices recovering and subsequently flowing through to their financial performance and vice-a-versa, as discussed within my earlier article. Even if ignoring this upcoming future benefit, their outlook for 2022 still appears very strong with their hedges have now placed at significantly higher prices, as per the commentary from management included below.

“And while we don’t normally give distribution guidance, I will note that cash flows will benefit in 2022 from the step up in our average hedge prices. The fixed prices on our oil hedges move up by about 70% from 2021 levels and hedge gas prices increased by about 16%.”

-Black Stone Minerals Q4 2021 Conference Call.

Whilst it remains to be seen exactly where their operating cash flow lands during 2022 given the highly volatile nature of oil and gas prices, it should at least equal their 2021 results plus the $112.9m they lost due to their much lower hedge prices. After being combined with their existing operating cash flow of $256.9m during 2021, it provides an estimate of $369.8m and given their negligible capital expenditure that royalty partnerships enjoy, which was only a mere $4.6m during 2021, almost the entirety should be translated into free cash flow. Considering their current market capitalization of approximately $2.81b, this sees a very high free cash flow yield slightly above 13% that when looking ahead, will see an increasingly high portion of itself directed into distributions, as per the commentary from management included below.

“But we’re getting pretty close to zero in terms of total debt on the balance sheet. I think what that means over time is just that you should see payout ratios go up. So with very little debt left to repay, I think the general thinking of the Board, and of course this could change but it’s something we talk about every quarter, is that we’ll return more of that cash flow to our shareholders through higher distributions.”

-Black Stone Minerals Q4 2021 Conference Call (previously linked).

Upon reaching zero or very close to zero net debt, which they are close to achieving as subsequently discussed, they practically have no choice but to return the entirety of their free cash flow to their unitholders, thereby meaning that their distributions could double versus their payments of $176.9m during 2021 thanks to their estimated free cash flow of circa $370m. To make this potential very high 13%+ distribution yield on current cost even more attractive, it was based upon their unhedged 2021 results, which saw strong but not boom-time oil and gas prices, thereby making it possible to continue well beyond 2022. Since oil and gas prices surged higher following the Russia-Ukraine war, this could be pushed even higher in the short-term but the extent remains impractical to quantify given the higher than normal oil and gas price volatility and the complexities surrounding their hedges, not to mention the time lag between prices and their cash flow performance.

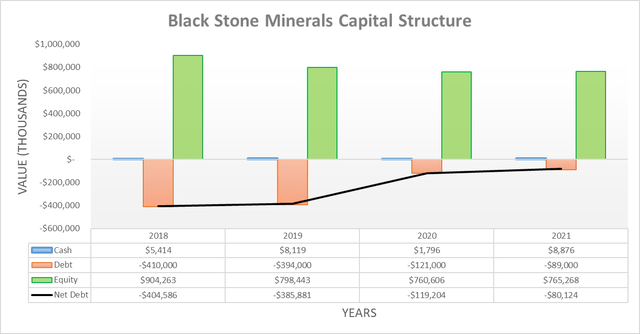

When looking elsewhere at their capital structure, the fourth quarter of 2021 saw their net debt end the year at $80.1m, thereby dropping from its level of $95.7m when conducting the previous analysis following the third quarter. Apart from boosting their potential future distributions, the outlook for free cash flow of $370m or more during 2022 should also send their net debt plunging rapidly, thereby approaching zero and thus supporting their ability to direct the entirety of their free cash flow towards distributions later during 2022 and beyond.

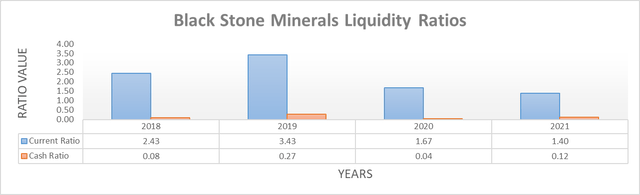

Since their leverage was already very low when conducting the previous analysis, it would be rather pointless to assess their leverage in detail once again, especially given these prospects of reaching zero net debt during 2022. Nor would it be worthwhile to worry about their debt maturities, thereby further taking the load off their liquidity that elsewhere remains adequate with current and cash ratios of 1.40 and 0.12 respectively.

Conclusion

It remains to be seen how oil and gas prices trade going forwards, although the outlook following the otherwise tragic Russia-Ukraine war provides a very strong backdrop. Regardless, even if oil and gas prices tumble to their levels as seen during 2021, thanks to their hedges now being higher, their free cash flow should still surge. Since their net debt is rapidly approaching zero, they are likely to start directing the entirety of their free cash flow into their distributions, which can provide a very high 13%+ yield on current cost even based upon their unhedged 2021 results, let alone the potential upside from these very strong operating conditions and thus unsurprisingly, I believe that maintaining my buy rating is appropriate.

Notes: Unless specified otherwise, all figures in this article were taken from Black Stone Minerals SEC Filings, all calculated figures were performed by the author.

Be the first to comment