zim286/iStock via Getty Images

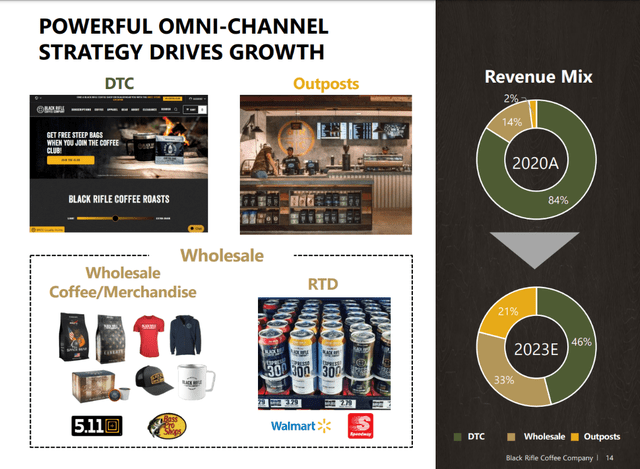

Black Rifle Coffee Company (NYSE:BRCC) recently de-SPAC’d, and has performed tremendously well. The business is comprised of Direct-To-Consumer (“DTC”) coffee sales, Wholesale (Ready-To-Drink (“RTD”)) coffee and merchandise, and their new Outpost segment with actual Brick-and-Mortar points of sales for coffee and gear.

BRCC Verticals (BRCC IR Deck)

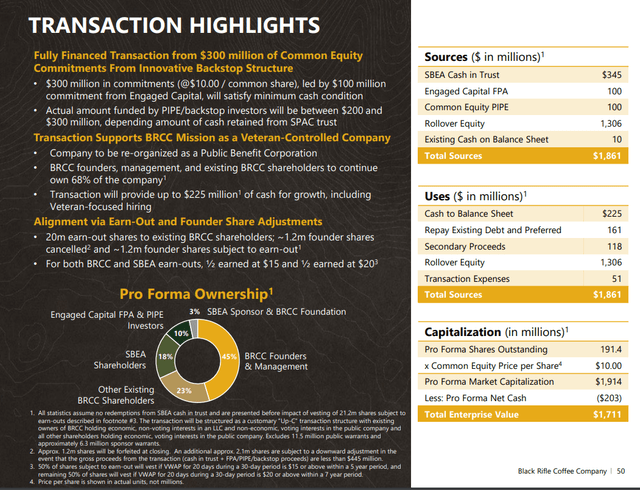

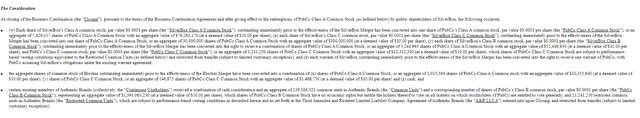

At their current $26 share price, and with pro-forma 191.4m shares outstanding, BRCC is valued at $5.0B, less $203m net cash, for an EV of $4.8B. In addition, there are 17.8m warrants (BRCC.WS) with $11.50 strikes that have a net dilutive impact of 6.4m shares ($154m – more below). Lastly there are 21.2m shares that vested for pre-SPAC owners and founders based on share price performance:

BRCC Share Structure (BRCC IR Deck)

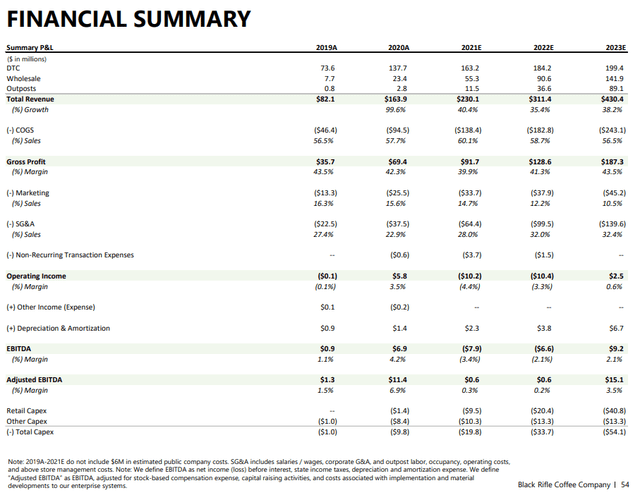

The $15 tranche vested in March, and the $20 tranche vested on 4/5. These additional shares, at $26, represent another ~$509m of EV. Per their SPAC projections, Black Rifle expects the following:

BRCC Projections (BRCC IR Deck)

After Q4 earnings were released, BRCC raised FY22 guidance from $311.4m revenue to…$315m. This, against an EV of ~$5.4B if warrants exercise at full value. Based on the earnings call, this revenue increase seems more related to price increases to combat inflationary pressures rather than incremental sales growth.

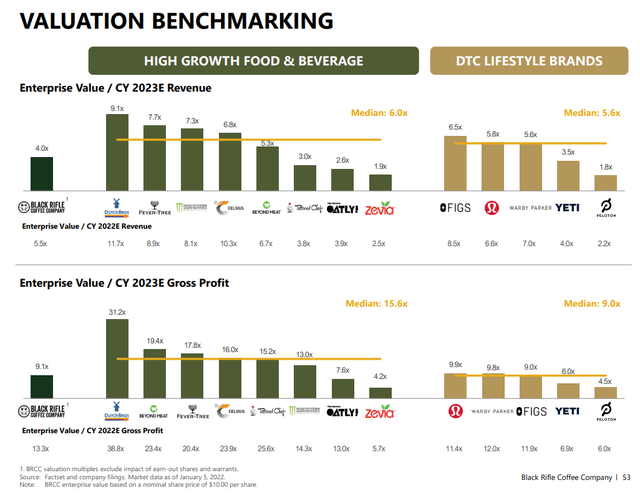

Black Rifle made a valiant effort going into the merger to appear reasonably valued at $10/share against a forecast of $187m of FY23E gross profit and $430m of FY2EE revenue, but updating the below now suggests they are grossly overvalued against their peers (~29.1x gross profit and 12.6x revenue):

BRCC Valuation Comps (BRCC IR Deck)

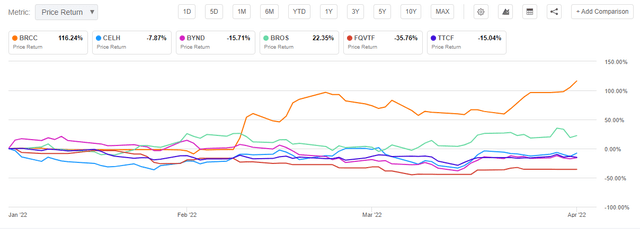

Black Rifle Coffee has a very loyal following, but does this justify a $5B+ valuation for a coffee business which is not even projecting to earn 1/10th of that amount of revenue next year? To make the comparison even more jarring, consider the price action for some of the identified peers since the Jan 5th date used above:

BRCC Performance Vs Peers (Seeking Alpha)

Comparison valuations are compressing even as Black Rifle’s stock price ascends to the stratosphere.

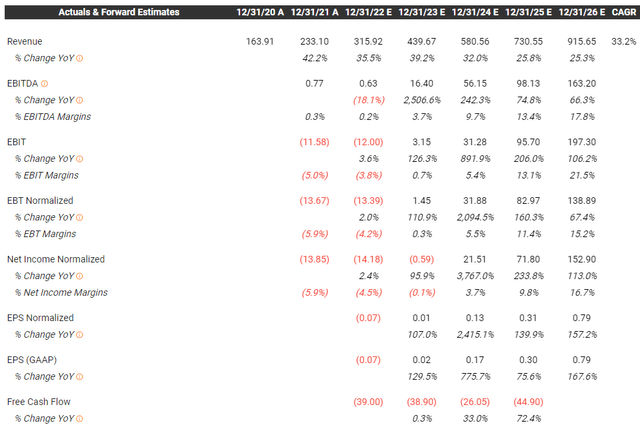

Checking in on analyst estimates, even their targets suggest $916m of revenue and $163m of EBITDA by 2026 (5.9x revenue and 33.4x EBITDA):

BRCC Projections (TIKR.com)

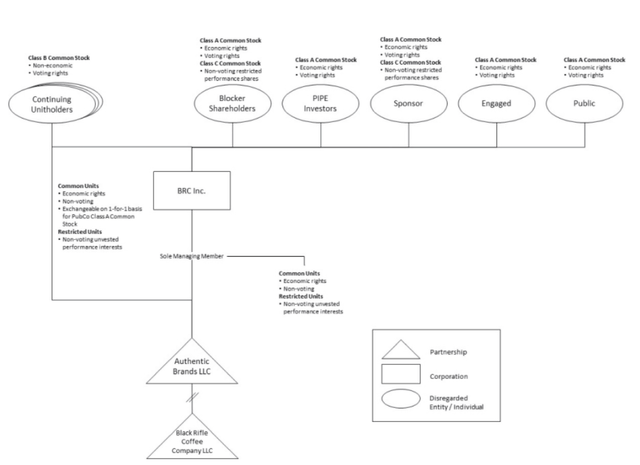

So, what explains the recent price action? I believe the complicated capitalization structure and tight float at BRCC, which is poised to unwind quickly, may leave shareholders dizzy.

BRCC Structure (BRCC Prospectus)

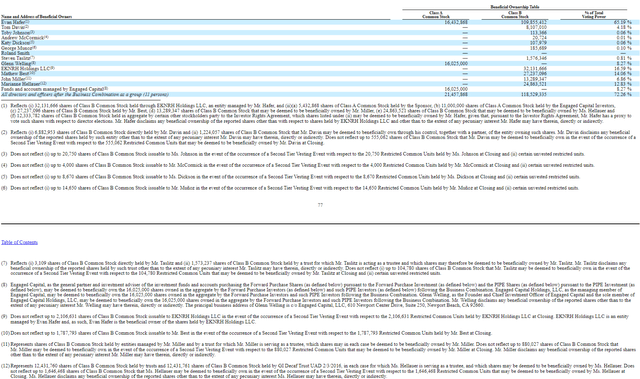

BRCC Pro-Forma Ownership (BRCC 10-K)

BRCC De-SPAC Share Structure (BRCC 8-K)

At close, there were only ~27.6m shares floating freely, of which about 20m were controlled by the sponsor (SilverBox) and another ~1.8m were controlled by Citadel. In other words, the float was heavily restricted to only ~$60m worth of shares at de-SPAC, vs the implied $2B valuation at that time. So why might now be the time to bet against Black Rifle’s Share Price?

-

The low-float trading is coming to an end, as the warrants were redeemable and notices of redemption were delivered to holders after conditions were met. If not exercised, they will be redeemed for a mere $0.10/warrant in May, though exercise cannot commence until their registration is deemed effective. Perhaps there’s a chance they are redeemed before the S1 becomes effective? The warrants are interesting in that the value delivered to the holder will equal the excess of the VWAP over the 10 following (not preceding) days, and will not exceed 0.361/share per warrant. This translates into ~6.4m shares of cashless dilution at current prices. From the 4/4 PR:

“Payment upon exercise of the Warrants will be made on a “cashless basis” in which the exercising holder will receive a number of shares of Class A Common Stock to be determined in accordance with the terms of the Warrant Agreement and based on the Redemption Date and the volume weighted average price of the Class A Common Stock for the ten (10) trading days immediately following the date on which the Redemption Notice is sent to the registered holders of the outstanding Warrants.”

-

Shares from the PIPE, Backstop, and Forward Purchase agreements (30m shares) were not subject to lockup, but remain unable to be sold until the S1 filed on March 15th is deemed effective (along with the warrants).

Once these 30m shares and the warrant shares are sold, the public float will expand significantly, which will likely leave many holders seeking to capitalize on high prices in case BRCC faces the sub $10 fate to which so many SPACs have succumbed. Without clear valuation support above $10, and fears about decelerating growth of the core DTC business, those fears may be justified.

Risks/Other Considerations

-

Due to low float and lack of shares available to borrow, price action may be very volatile. Price action to date suggests being long or short this stock could quickly backfire.

-

Significant red flags regarding Management have been alleged in this post which are worthy of consideration.

-

DTC growth is rapidly decelerating (SPAC forecast calls for single digit 2023 growth). An investment in BRCC is becoming a bet on their deployment of Outposts in the coming years as the key growth driver.

-

This is an actual quote from the Q4 conference call:

…We have three writers on the ground in the Ukraine right now providing real-time news for Coffee or Die, the only coffee company in the world providing real-time news from the ground with veteran war correspondents.

Conclusion

I don’t think Black Rifle Coffee Company is a bad business, growing revenues 20-30% per year with ~40% gross margins is a great business model. However, the combination of a stratospheric valuation and heavy technical selling on the horizon does not make me want to own the stock at this time. I am closely monitoring the timing of effectiveness for PIPE, Warrants, and Backstop shares, which should more than quadruple the current public float. In the event these shares are about to begin trading, I may enter a short position via puts.

Be the first to comment