da-kuk

“The greatest danger in times of turbulence is not the turbulence. It is to act with yesterday’s logic.” Peter Drucker

To My Partners and Friends:

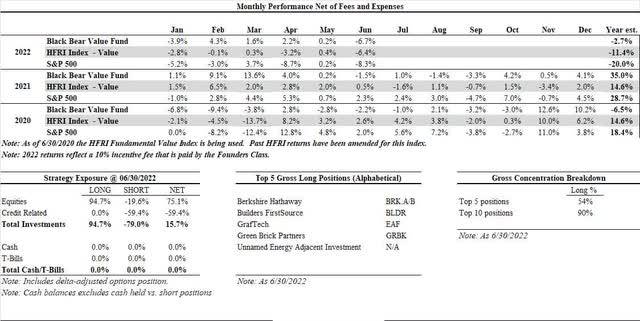

- Black Bear Value Fund, LP (the “Fund”) returned -6.7% in June and -2.7% YTD.

- The S&P 500 returned -8.3% in June and -20.0% YTD.

- The HFRI Index returned -6.4% in June and -11.4% YTD.

- We do not seek to mimic the returns of the S&P 500 and there will be variances in our performance.

- Note: 2022 returns reflect our reduced 10% incentive fee.

Note: Additional historical performance can be found on our tear-sheet.

For the last several years, my experience investing throughout the Great Financial Crisis seemed less valuable as money-losing companies rose to nosebleed valuations and a skeptical perspective was frowned upon. As interest rates rise, margins compress and optimism morphs into fear we enter an environment that should reward our Partnership as experience matters.

Our long-term LP’s and mindset allow us to play the long game in years when others are predicting months or quarters. The key is to be investing throughout a difficult time and not sit on the side “waiting” for clarity. Once clarity arrives, security prices will already have moved up. For better or worse, I am most comfortable investing when others are uncomfortable. Over the coming years this should serve us well.

Since we last communicated, the investment markets have continued to gyrate. The daily discourse is very focused on the risk of recession in addition to inflation. “Are we going to have a recession? When is it going to be? How bad will it be?” As you are aware, I’m dubious anyone knows the exact answer. Recessions are an inevitability to be contemplated when making an investment. If a downturn is going to permanently impair a business, it’s typically not a fit for our Fund. If your thesis relies on being specifically right on recession forecasting you are playing a dangerous game.

We are focused on investing in resilient businesses that can withstand and play offense during trying economic times. This means businesses with healthy balance sheets (not a lot of debt), pricing power (an ability to maintain or push price), a healthy margin structure, good relationships with their customers and suppliers and a quality management team who understand capital allocation. We are not in the game of projecting recessions and think it’s ultimately a waste of time.

The Intersection of Utility and Scarcity: 2 Large Themes and Cryptocurrencies

Scarcity without utility does not create value. While I do not rule out the utility of crypto, I have not been able to figure out what it does. We stay away while shorting adjacent businesses in the space.

On the flipside, scarcity WITH utility can create compelling investment themes, especially if coupled with negative sentiment and pessimism. We have 2 large themes in our portfolio that fit this description: homebuilding and energy.

Housing inventory is scarce due to years of underbuilding post Great-Financial-Crisis. As millennials age out of renting and into homeownership there will be need for homes. While mortgage rates are higher, they are still historically in a normal range and the market will adjust. Ironically, since many existing homeowners are locked into low-rate mortgages they may be less inclined to sell their home, limiting existing home supply. The supply will need to come from new homes which benefitting our homebuilding theme.

Energy and commodity resources are scarce due to chronic underinvestment caused by a combination of issues too lengthy to write in this paragraph. While some of the ESG movement is well-intended, much of the conventional wisdom is simply wrong. We cannot switch off our legacy hydrocarbon businesses and transition over to renewables. We will need decades of parallel systems until we have both enough renewable capacity as well as backup sources of energy. Additionally, the equipment used in renewable energy production has a heavy reliance on petrochemicals (plastics etc.) which is another area of need for hydrocarbons. We do not own the more capital-intensive refiners/drillers (though at some point we could). We do own a variety of low capital intensity, high-margin, high free-cash-flow royalty companies, hospitality companies and suppliers across a variety of commodities that include natural gas, oil, met coal (used for steel), iron ore and electric arc steel.

The scarcity of development coupled with the need (utility) and overall market pessimism leads to extremely attractive opportunities in the energy/commodity and homebuilding industries. These represent a meaningful portion of our capital.

Inflation/Credit Shorts/Pricing Power

I would refer you to Q1 or other letters, so I don’t restate our credit thesis in detail. Bonds remain extremely expensive. As a reminder, emerging market debt makes up a good part of our credit short. As US interest rates go up, there is increasing pressure on emerging market economies with USD denominated debt as well as capital flight into US treasuries.

Some in the media/sell-side are celebrating “peak-inflation” as if reaching the summit means an immediate decline. While a decline in inflation is also inevitable it seems premature to forecast when that will be. Additionally, if the decline is from ~8% to 4-5% we will still have issues to address. Treasuries are currently ~3% and if we presume an interest rate modestly above inflation, there is still a 20+% decline in bond prices and likely further pressure in the stock market. Please note I’m not predicting these events…but I am certainly considering them in the range of outcomes. Beware of those who predict precise answers.

We own businesses that have pricing power and limited/no dependance on the need for external funding. This is important because as input and wage costs pressure profitability of many companies, our businesses should be able to weather the storm and capitalize through both organic market share gains and/or acquisitions of companies that may not have had a healthy balance sheet or operating structure.

Top 5 Businesses We Own

Berkshire Hathaway (BRK.A) (BRK.B)

Below is the rough Berkshire on-a-napkin valuation from Q1 with the month-end price reflecting a bigger discount to fair value. Again, this is a rough exercise to sanity check our assumptions.

- Cash of ~$103,000 per class A Share (vs. $104k 1 year ago)

- Down/Base/Up marks cash at book value to an 8% premium (vs. to 10% a year ago)

- Investments based on December prices ~$248,000 per class A share (vs. $194k a year ago)

- Presume a range of stock prices that result in:

- Down = $149,000 per class A share (-40%- assumes portfolio is overpriced)

- Base = $211,000 per class A share (-15% – assumes portfolio is overpriced)

- Up = $285,000 per class A share (+15%)

- Presume a range of stock prices that result in:

- Operating businesses that should generate ~$17,000 of pre-tax income per Class A share (vs. $15k)

- Down = 9x = $153,000 per share – equates to ~8% FCF yield

- Base = 12x = $204,000 – equates to ~6% FCF yield

- Up = 12x = $204,000 – equates to ~6% FCF yield

- Overall (vs. $409,000 at quarter end)

- Down = $413,000 (+1%)

- Base = $526,000 (+29%)

- Up = $600,000 (47% underpriced)

Going forward I expect Berkshire to compound at above average returns from this price.

BRK is a collection of high-quality businesses, excellent management, and a good amount of optionality in their cash position. If the cash were to be deployed accretively the true value would be greater than an 8% premium (as mentioned above). The combination of a pie that is growing, an increasing share of said pie due to stock buybacks, upside optionality from cash and a tight range of likely business outcomes that span a variety of economic futures gives me comfort in continuing to own Berkshire.

Builders FirstSource (BLDR)

Builders FirstSource is a supplier and manufacturer of building materials for professional homebuilders, subcontractors, remodelers, and consumers. Their products include factory-built roof and floor trusses, wall panels and stairs, vinyl windows and custom millwork.

The fundamental discussion about homebuilders applies to BLDR. As more homes are built across the country, there will be an increased need for scaled sourcing of products to homebuilders. There is a large amount of fragmentation in the supply chain which provides BLDR a long runway for acquisitions and realistic synergies.

BLDR should be able to generate $7-$10 a share in cash in the medium term with significant upside if they can scale through acquisition and/or further penetrate existing markets. We own it at a 13-19% free-cash flow yield so little growth is needed for us to compound value at high rates.

GrafTech (EAF)

GrafTech manufactures graphite electrodes in North America and Europe. The electrodes are necessary to produce electric arc furnace steel, a more environmental process than blast furnace production. EAF benefits from a global push to decarbonize steelmaking which is driving new capacity in electric arc steelmaking. EAF can self-source their main input, pet-needle coke, through their Seadrift subsidiary. Pet-needle coke is increasingly going to be in short supply as it is an important input commodity for electric vehicle battery production. Owning your own input commodity is a strategic advantage as others cannot guarantee production nor guarantee a profit on an order.

EAF is in a unique position. Their product helps steelmakers emit less greenhouse gases which helps drive the topline. They can guarantee their product as they know 2/3 of their capacity can be covered by Seadrift. The market is worried about recession which could result in some short-term pain to the industry. Another area of concern are long-term-agreements (LTA’s) which are starting to roll off. Bears are concerned that as the business shifts to the spot market, the margins will decline. I will concede that historical margins are unlikely to be repeated but it seems likely new LTA’s will be signed.

Recall our earlier discussion on scarcity. Their competitors DO NOT have control of their input costs…this advantage will become more pronounced as pet needle coke becomes scarcer as EV production ramps up. That should lead to higher top-line prices and healthy margins for EAF. I conservatively think we own this business at 11-16% FCF yield and presume no new long-term contracts are signed. In time new LTA’s will be signed and the business should achieve a more appropriate valuation.

Green Brick Partners (GRBK)

Green Brick Partners is a residential land developer and homebuilder. Most of their operations are in Texas, Georgia, and Florida. GRBK was formerly a private partnership between Jim Brickman and entities related to Greenlight Capital (managed by David Einhorn). David is currently the Chairman of the Board.

As discussed earlier, there is a long-term fundamental supply/demand imbalance in housing inventory. This is a direct result of underproduction of new homes amid a challenging mortgage financing environment over the last 10+ years since the Great Financial Crisis. Looking forward we should have increased housing demand from millennials as they enter the family-phase of life and desire more space.

It is rare to be able to partner with an excellent operator and an excellent capital allocator. As evidenced by our investment in AutoNation, when you marry those 2 concepts you can wind up with a wonderful result. GRBK has been reinvesting their cashflow in additional lots/land inventory. This masks the earnings power of the company. The company is valued somewhere between 5-8x steady-state earnings and potentially even cheaper than that. I tend to be more conservative given the potential for rate rises and inflationary increases in development costs. We have high-quality stewards at both the operating and Board level.

Unnamed Energy/Commodity Adjacent Business

We have been accumulating shares in a small-capitalization stock that is an energy/commodity adjacent hospitality business. I believe this business has been through a brutal stretch during COVID yet still generated the equivalent of 12% of its market-cap in cash in a lousy year. In the coming years this business could be worth 2-3x where it’s priced now.

There is limited float and as Black Bear has grown, we have been active purchasing the stock. We now own close to 1% of the company. As I expect to continue buying the business, I am going to keep the name of the company in-house.

Fund Updates

As the Fund continues to grow, the day-to-day financial tasks have increased. With our increase in scale, it seemed prudent to reinvest in the business and hire David Proskin as our CFO.

We have taken a measured approach to growing the business both in terms of LP’s and our infrastructure. Having a long business runway allows us to have a long investment runway and look at opportunities over a multi-year horizon. Adding David’s skills to the team should ease the burden on me and allow additional time to look at investment prospects for us.

Tough times test business models and I am pleased to report things are running smoothly. The more pessimism and fear in the market, the more opportunities we will have. Things will never move straight up but with rising costs of capital, rising costs of labor and rising costs of goods, those with a fundamental skillset across credit and equity will benefit. I continue to find new ideas that are off the radar and look forward to sharing some of those names in the coming quarters. These are the times to plant the seeds that will bear fruit in the coming years.

Thank you for your trust and support.

Black Bear Value Partners, LP | Black Bear Value Partners, LP | USA

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment