Andrii Yalanskyi

Thesis

BlackRock Income Trust (NYSE:BKT) is a closed end fund that purchases AAA Agency MBS securities and leverages them up to enhance the yield paid to investors. With the quantitative tightening program set to ramp up this September and with a housing market that is just beginning its decline, all signs point towards lower pre-payment speeds on the MBS securities, higher durations and price pressures on the bonds from one of the largest buyers in the market (the Fed) disappearing.

BKT is the CEF version of the much flashier mREITS such as Annaly (NLY) and AGNC Investment (AGNC). BKT does not sport the same high yield, but the CEF’s long-term performance puts in the same cohort. BKT has a simpler structure and lower leverage, with no hedges. The main risk factor boils down to MBS prices. BKT will keep being under pressure until MBS prices stabilize, and unfortunately for the rest of 2022, we foresee only headwinds. The article provides an update on the Fed’s Quantitative Tightening program and explores the state of the Housing Market to gauge when we should expect MBS price stabilization.

Update on the Fed’s Quantitative Tightening

Quantitative tightening is a monetary policy tool used by central banks to reduce the level of money supply and liquidity in an economy. Quantitative tightening is the process whereby a central bank sells its accumulated assets (Treasuries and MBSs for the Fed) in order to reduce the supply of money circulating in the economy. This is also referred to as ‘balance sheet normalization’ – the process whereby the central bank reduces its inflated balance sheet. ‘Tapering’ is a term often associated with the quantitative tightening process but actually describes the transitional period between QE and QT whereby large-scale asset purchases are cut back or ‘tapered’ before coming to a complete halt. During QE, maturing bond proceeds tend to be reinvested in newer bonds, pumping even more money into the economy. Tapering, however, is the process whereby reinvestments are cut back and eventually come to a halt.

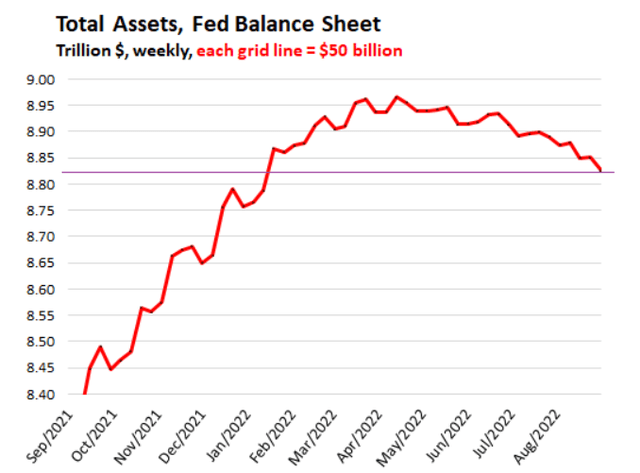

In September, the pace of QT roughly doubles with the caps doubling to $60 billion per month for Treasury securities and to $35 billion for MBS:

Fed balance sheet (Wolf Capital)

The Fed balance sheet has been shrinking, but not fast enough for certain officials. A faster-deleveraging pace for the Fed’s balance sheet can spell further trouble for MBS bonds, with wider spreads in sight.

State of the Housing Market

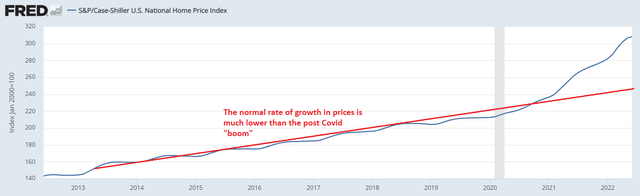

Due to the zero rates environment, the housing market has seen ever-increasing prices:

As we can see from the above graph the post-Covid Fed policy resulted in a massive acceleration in house prices, significantly outside the normal growth rate witnessed in prior years. Prices will come down towards the normalized growth rate. Nothing goes up parabolically.

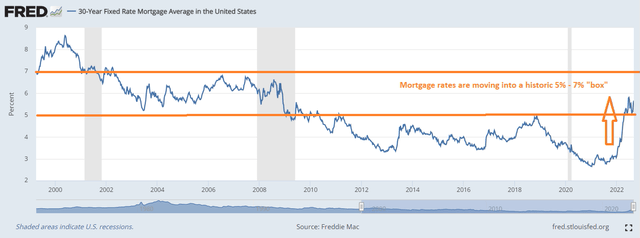

Mortgage rates have risen significantly, and we anticipate them to stay elevated:

We can see from the above chart that post the Great Financial Crisis, mortgage rates moved below the 5% threshold and stayed there. In the new higher inflation for longer macro environment, and with an overbought housing market, we expect mortgage rates to re-establish a 5% to 7% range for the next few years. This results in tighter financial conditions and fewer people re-financing.

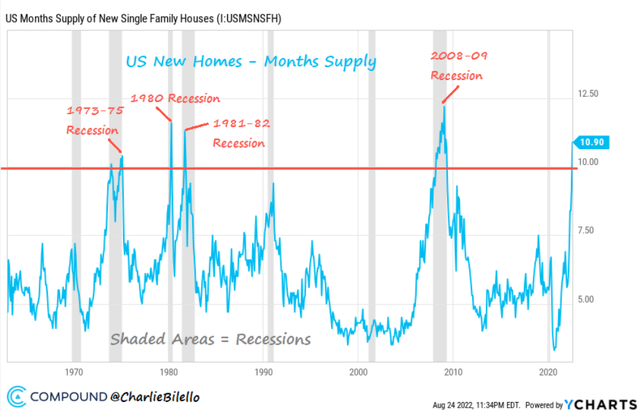

We are already starting to see the tighter financial conditions feedback in the housing market:

Supply of new homes (Compound Capital)

Higher mortgage rates have resulted in fewer people buying houses, which in turn have started to create a glut of unsold homes. This will translate into lower prices next.

BKT Performance

The CEF is down -16% year to date, in line with the largest m-REITS:

YTD Total Return (Seeking Alpha)

On a 5-year basis the performance is very similar:

5Y Total Return (Seeking Alpha)

BKT does not have the flashy yields that NLY and AGNC display, but the fund has virtually the same total return profile.

Conclusion

BKT is a fixed income CEF that purchases AAA Agency MBS bonds and leverages them up to enhance the yield paid to investors. With a similar but more simplified structure when compared to the large mREITs NLY and AGNC, the CEF has posted very similar total returns year to date and on a 5-year lookback period. The main risk factor for BKT is represented by MBS bonds pricing. With the Fed engaging in QT and the housing market just beginning its decline, the rest of 2022 will remain rough for BKT.

Be the first to comment