Khosrork

Closed-end funds (“CEFs”) have long been among the best vehicles in the market for investors that are seeking income. This is because these funds offer investors easy access to a diversified portfolio of assets that can typically deliver a higher yield than pretty much anything else in the market. Although rising interest rates have definitely made it easier for income-seekers, this has not been nearly enough because inflation is much higher than interest rates. This is very evident in necessities such as food and energy, a fact that has been straining the budgets of many Americans. In fact, we have seen a sharp uptick in the number of people taking on second jobs just to feed themselves and their families. When we consider that the market’s performance this year has been rather disappointing, it becomes ever more important to increase the amount of money that comes in so that we can maintain our standard of living.

In this article, we will discuss the BlackRock Income Trust (NYSE:BKT), which is one of the many closed-end funds that are available to help income-seeking investors. This fund yields 8.41% as of the time of writing, so it is clearly able to deliver a higher yield than most other assets available in the market. As this is likely a thesis that is attractive, let us investigate and see if this fund could be a good addition to a portfolio today.

About The Fund

According to the fund’s webpage, the BlackRock Income Trust has the stated objective of providing its investors with as high a level of current income as possible while still ensuring the preservation of capital. This is not surprising, since this is the usual objective of fixed-income funds like this one. This is because fixed-income securities deliver nearly all of their return to investors via the direct payments that they make. These assets also tend to be good for preserving capital since they will repay their face value at maturity regardless of what happens to the bond’s price in the meantime.

With that said, bond prices do vary inversely with interest rates so when interest rates increase, bond prices decline, and vice versa. This is because, in a rising rate environment, newly-issued bonds will have a higher yield than existing bonds so nobody will buy the existing bonds unless their value decreases so that they give the same yield as similar brand-new bonds. Again though, changes in bond prices have basically no effect if you hold the bond to maturity. In addition to this, bonds are first in line to collect in the event of a bankruptcy or similar event so bond investors are less likely to be completely wiped out than stockholders. This enhances their security over common stocks.

The BlackRock Income Trust goes one step further in ensuring safety than most other fixed-income closed-end funds. This fund invests at least 65% of its assets into mortgage-backed securities, principally mortgage-backed securities insured by Fannie Mae, Freddie Mac, or Ginnie Mae. As all three of these are government-backed entities (and Ginnie Mae is explicitly backed by the U.S. Treasury), these securities are considered to have essentially no default risk. In addition to this, mortgages are secured loans so in the event that any individual homeowner defaults, the mortgage originator will foreclose on the house in order to recover the money to cover the loan.

Overall, these are very safe securities, but as already mentioned, the fund will only be 65% invested in these bonds. In fact, though, fully 80% of the fund’s assets will be invested in U.S. Treasuries, agency securities (such as mortgage-backed ones), or AAA-rated bonds. Only Johnson & Johnson (JNJ) and Microsoft (MSFT) have AAA ratings, apart from the U.S. government. As neither one of these companies has much debt, especially when compared to the Federal government, we can assume that most of these are basically risk-free securities as far as default risk goes. This is something that should certainly be pleasing to risk-averse investors that are concerned with principal protection.

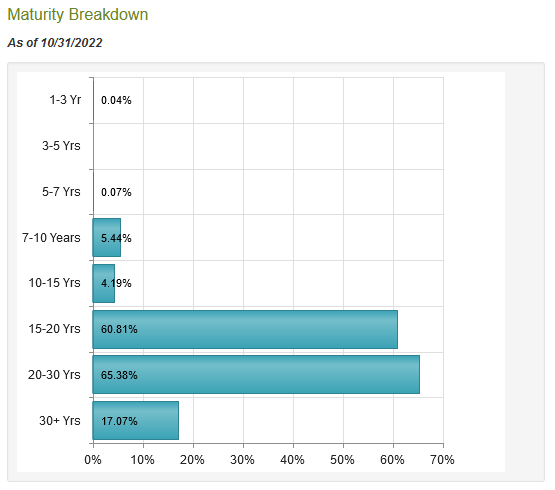

With that said, the bonds held by the fund are mostly long-term bonds, with fully 82.45% of the bonds having a maturity date at least twenty years into the future:

CEF Connect

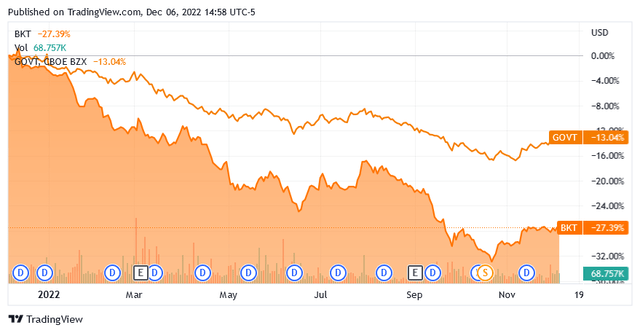

This is important because longer-term bonds have a higher interest rate risk than short-term bonds. As already mentioned, bond prices move inversely to interest rates. In addition to this, the later the bond’s maturity date, the more its price will move when interest rates change. This is because the investor has to wait longer to get their money back with a long-term bond than a short-term one. As a result of this, we will likely see the BlackRock Income Trust move more in response to interest rate changes than a fund containing primarily short-term bonds. This is immediately apparent when we compare the BlackRock Income Trust to the iShares Core U.S. Treasury ETF (GOVT):

As we can see, the BlackRock Income Trust has fallen 27.39% over the past year while the index is only down 13.04%. The biggest differences here in the portfolio composition are that the closed-end fund has a higher allocation to agency securities than the exchange-traded fund (“ETF”), and the closed-end fund does not include short-term securities. The BlackRock Income Trust also uses leverage to boost its yield, which we will discuss later. Overall, though, we can still see how the closed-end fund is more subject to interest-rate risk. This is something that all potential investors should consider because the Federal Reserve is likely to continue to raise rates, at least in the near term. This is because inflation is still at levels that are well above the Federal Reserve’s long-term target.

The most recent CPI report put month-over-month inflation at 0.4%, which translates into 5% annualized. Jerome Powell also suggested in his remarks last week that the bank would again raise rates in December, although he was cautious about suggesting how large an increase we would see. Analysts are currently expecting a 50-basis point increase in December and another 75-basis point increase in early 2023 before the Federal Reserve pauses on tightening to evaluate the situation. However, others expect that this will not be enough. Regardless, the consensus view is that interest rates will continue to increase in the near term, which means that the fund’s share price will decline a bit more over the next few months.

Leverage

As mentioned in the introduction, closed-end funds like the BlackRock Income Trust have the ability to use various strategies to increase their yield beyond that of the assets that are in the portfolio. It should be pretty obvious that this fund is using strategies to accomplish this considering that it is invested in U.S. Treasuries and agency securities, yet is yielding far more than any government bonds. As hinted earlier, one of the strategies that the fund is utilizing is the use of leverage. Basically, the fund is borrowing money and using those borrowed funds to purchase fixed-income securities. As long as the return from these securities is higher than the amount that it has to pay on the borrowed funds then this strategy works pretty well to boost the overall portfolio yield. The fund is able to borrow at institutional rates so this will usually be the case, particularly since it can borrow at short-term rates and lend at long-term ones.

However, the use of debt is a double-edged sword. This is because leverage boosts both gains and losses. This is one reason why the fund saw its share price decline much more than unlevered fixed-income index funds over the past year. As a result of this characteristic, we want to ensure that the fund is not using too much leverage since that would expose us to too much risk. I do not generally like to see a bond’s leverage above a third as a percentage of its assets for this reason. The BlackRock Income Trust only has a leverage ratio of 31.41% though so it is well below this level. Thus, this fund appears to be striking a reasonable balance between risk and reward. Overall, we cannot really complain about this leverage even though it has caused the fund’s shareholders to take some unrealized losses this year.

Distribution Analysis

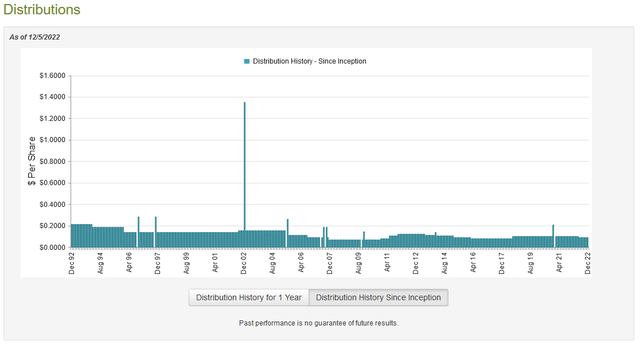

As stated earlier, the primary objective of the BlackRock Income Trust is to provide its investors with a high level of current income. The fund achieves this by investing in some of the safest fixed-income securities in the market, which admittedly does not lend itself well to paying a high yield to shareholders, but the fund still does manage to achieve a yield that will turn anyone’s head. The fund currently pays a monthly distribution of $0.0882 per share ($1.0584 per share annually), which gives it an 8.41% yield at the current price. The fund has varied its distribution quite a bit over the years and unfortunately had to cut it earlier this year:

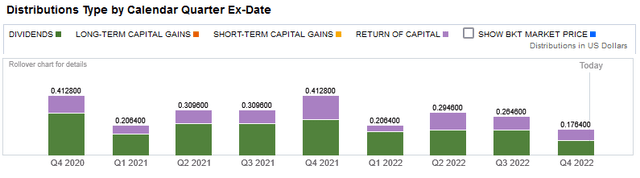

The fact that the fund’s distribution has varied over time is something that likely will be a bit of a turn-off for any investor that is seeking a stable and secure source of income that they can use to pay their bills or otherwise support their incomes. With that said, very few funds are able to consistently maintain a stable payout over extended periods so this is certainly not unusual. A not immaterial portion of the fund’s distributions are also classified as a return of capital, which also may concern some investors:

The reason that this may be concerning is that a return of capital distribution can be a sign that the fund is returning the investors’ own money back to them. This is obviously not sustainable over any sort of extended period. However, there are other things that can cause a distribution to be classified as a return of capital, such as the distribution of unrealized capital gains. As such, we should investigate exactly how the fund is financing its distributions so that we can determine how sustainable its distributions are likely to be.

Fortunately, we do have a relatively recent document that we can consult for that purpose. The fund’s most recent financial report corresponds to the six-month period that ended on June 30, 2022. As such, it will give us some insight into how well the fund performed during the early stages of the interest-rate hiking cycle. The fund also cut its distribution in June so this report should give us some insight into why that happened. During the six-month period, the BlackRock Income Trust received a total of $19,286 in dividends and $6,264,957 in interest from the investments in its portfolio. This gives the fund a total of $6,284,243 in income over the period. It paid its expenses out of this amount, leaving it with $4,492,030 available for shareholders. This was unfortunately not nearly enough to cover the $10,673,445 that it paid out in distributions over the same period. This is something that is undoubtedly going to be somewhat concerning as the fund is clearly failing to cover its distributions.

There are other ways that the fund can generate the income that it needs to cover its distributions, however. The most common of these ways is capital gains. As might be expected from the Federal Reserve’s monetary tightening policy that started during the period though, the fund failed to accomplish this. During the six-month period, the fund had net realized losses of $2,879,740 along with another $41,587,016 in net unrealized losses. Overall, the fund’s assets declined by $50,583,211 during the period after accounting for all inflows and outflows. This clearly explains the distribution cut as the fund needs to reduce the bleeding until the environment improves. It is unfortunate for investors but a reasonable choice for management to make.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to generate a suboptimal return on that asset. In the case of a closed-end fund like the BlackRock Income Trust, the usual way to value it is by looking at the fund’s net asset value. The net asset value of a fund is the total current market value of all the fund’s assets minus any outstanding debt. It is therefore the amount that the shareholders would receive if the fund were immediately shut down and liquidated.

Ideally, we want to purchase shares of a fund when we can acquire them at a price that is less than the net asset value. This is because such a scenario implies that we are purchasing the fund’s assets for less than they are actually worth. This is fortunately the case with the BlackRock Income Trust today. As of December 5, 2022 (the most recent date for which data is currently available as of the time of writing), the fund had a net asset value of $13.55 per share but its shares only trade for $12.57 per share. This gives the shares a 7.23% discount to net asset value at the current price. This is a very reasonable price to pay and it is somewhat more attractive than the 6.74% discount that the shares have averaged over the last month. Overall, the price looks very attractive here.

Conclusion

In conclusion, there is a lot to like about the BlackRock Income Trust. The portfolio of government securities will undoubtedly appeal to any investor looking for safety and the 8.41% yield will appeal to anyone looking for income. The biggest risk here is interest rate risk and unfortunately, rising interest rates will likely be a drag on the fund’s share price for quite some time. However, the price is quite good and this could make a reasonable long-term position for a portfolio. The best way to invest may be to dollar cost average over time so that your losses due to rising interest rates are minimized. Overall, BlackRock Income Trust looks like a winner among bond funds.

Be the first to comment