Torsten Asmus

Exploring the relationship between Bitcoin and inflation

Prices for just about everything – gas, groceries, housing, cars, clothes, even TVs – have spiked in the past two years. Inflation, which had been scarcely noticeable for decades, is suddenly the top concern most people have about the economy.

Not long ago, prominent investors and hedge fund managers such as Paul Tudor Jones, Ray Dalio and Stanley Druckenmiller supported the thesis that Bitcoin (BTC-USD) would be a good hedge against the “Great Monetary Inflation”, a May 2020 study. At the time the study was published, Bitcoin was below $10.000 and a remarkable bull market had started that led to the price of Bitcoin reaching almost $70.000 in 2021.

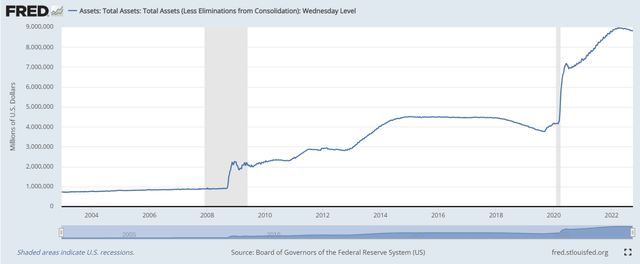

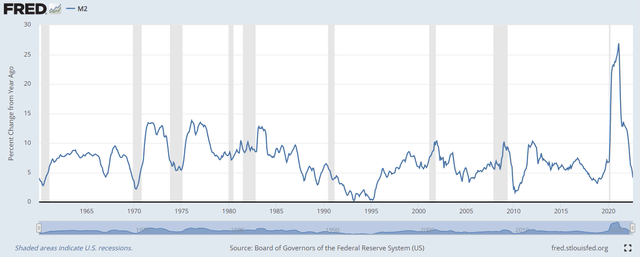

We can observe the effects of what Paul Jones was referring to in the two charts below provided by the Federal Reserve Bank of St. Louis:

*Fed balance sheet expansion during the COVID crisis by a factor of 2.

*M2 expansion of 25% YoY, a measure not seen before since the 1960s.

FED balance sheet (fred.stlouisfed.org/) M2 (fred.stlouisfed.org/)

In 2022 we are experiencing a high inflationary environment which is forcing central banks to act and raise rates at a historic pace. Consumer prices are jumping at a pace we haven’t seen since the 1980s. The inflation which should have been transitory, according to Fed officials, is becoming more persistent and more severe.

In this environment, Bitcoin has been performing badly, falling 70% from its highs. This opens the debate again: Is Bitcoin an Inflation Hedge or not?

Realized versus expected Inflation and the relationship with Bitcoin

Realized Inflation

While the CPI (Consumer Price Index /ie: realized inflation) is a good measure to look at the realized inflation, it is not necessarily a good indicator for the future. Historically, high CPI numbers are encountered with rising Fed fund rates, which slows down economic activity. These rate hikes are targeted at bringing down inflation. The Fed and other central banks, citing Bloomberg: ‘from Ulaanbaatar to Washington’, have declared the fight against inflation and the market is discounting a more restrictive monetary policy for the next months and years.

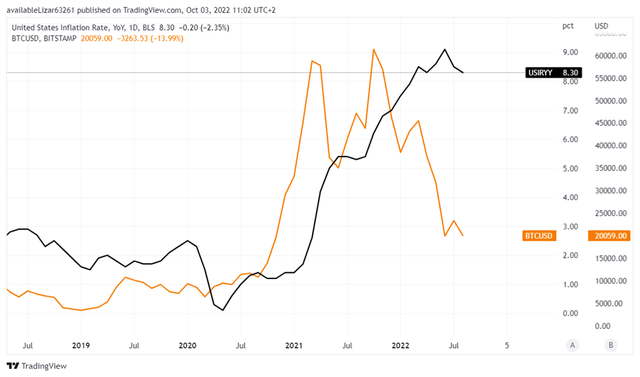

While the CPI rate and Bitcoin did move in a synchronised fashion during 2021, this relationship broke down at the start of 2022. We can observe in the chart below, that the parabolic move of Bitcoin from $10.000 to its all-time highs was mirrored by the inflation lift-off from the 0% line, but the correlation could not be sustained into 2022.

Bitcoin (orange). Inflation-CPI (black) (tradingview.com)

Conclusion on realized inflation rates: Utilizing realised inflation numbers (CPI data), we can conclude that Bitcoin has not been an effective hedge.

Expected Inflation

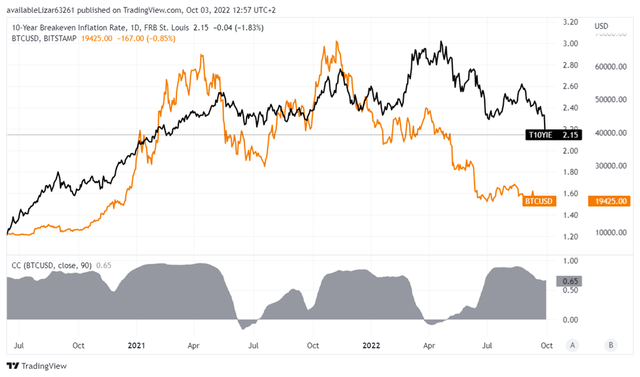

One still-imperfect but arguably better alternative to analyse the relationship between inflation and Bitcoin is to focus on inflation expectations embedded in the U.S. Treasury market or the so-called breakeven inflation rates. These rates are the expectations of the market about future inflation. They are telling us that inflation is to fall and stabilize in the 2% region (chart below). Similar expectations can be found in economist surveys (Bloomberg Sep 2022). According to them, by the first quarter of 2024, inflation is expected to average 2.4%, inching closer to the central bank’s 2% target.

The M2 YoY (chart we have posted on the top) confirms this possibility. In a historical context a rapid fall in M2 expansion has been followed by contracting inflation, which is comprehensible.

Bitcoin (orange). Inflation expectations (black). Correlation (grey) (tradingview.com)

As inflation expectations rose dramatically during the end of 2020 and 2021, the price of Bitcoin followed largely in tandem. Since then, inflation expectation waves have been mirrored by the Bitcoin price in a correlated fashion. Even though the relationship is not perfect, it is still significant. The correlation between the two is largely positive and represented in the chart above in the grey area. In short, the price of Bitcoin is falling in 2022, as inflation expectations have been falling.

Conclusion

We are experiencing a higher realized inflation environment with a falling Bitcoin price. By looking in the rear-view mirror (realised inflation: CPI), Bitcoin is not a good hedge against inflation.

But investors should focus on the road ahead. By measuring and tracking inflation expectations, we can observe that the relationship between Bitcoin and inflation has been strong and is still intact. A slowdown in inflation expectations in 2022 with a consequent fall in the price of Bitcoin.

Forward-looking statements: The rapid deceleration of M2 supply will have the desired effect of lowering inflation by slowing down the money supply and economic activity. At this point, it’s most probably only a matter of time until we see CPI (realised inflation) coming down to pre-pandemic levels. We even see the possibility for the inflation rate to fall below the 2% line. After all, why should inflation magically come down to the 2% level and then stabilize? Since monetary policy has a considerable time delay effect, we are making the case that the Fed is overshooting with its rate hikes, similar to how it overshot with rates cuts and QE during the post-pandemic era which generated an abundance of M2 supply with higher inflation as a consequence.

In the next months, the Fed will transition from restrictive to accommodative turning around the sharp fall in M2 growth. At that point, inflation expectations and the price of Bitcoin will be supported once again and we could see both of them trend higher.

Be the first to comment