BT Series

Bitcoin (BTC-USD) had an epic decline after peaking at about $64,000 around a year ago. The peak-to-trough drop has been massive, equating to roughly 76%. Many other digital assets have been brutalized during this bear market phase, declining by 90% or more during the recent rout. Bitcoin got ahead of itself, and as the Fed started tightening, Bitcoin began deflating. Moreover, Bitcoin could drop lower soon, hitting my long-term buy-in target of $10-12K. However, Bitcoin is far from worthless, and the crypto segment is still alive. We have a massive market for Bitcoin and other functional and transactional digital assets. While the sentiment is poor now, confidence should return to the cryptocurrency market, and Bitcoin’s price should appreciate significantly in the coming years.

Bitcoin 3-Year Chart

Bitcoin chart (coinmarketcap.com)

After putting in a major double top in 2021, Bitcoin’s price returned to its pre-breakout level in 2020. The 2021 run-up was phenomenal, but the 2022 crash has been epic. So, what’s next for Bitcoin? We can expect a similar phenomenon we’ve seen in prior cycles. While sentiment remains poor, we could see more downside in the near term. However, as sentiment improves, price action should stabilize, and Bitcoin could advance much higher in the coming years.

Prior Cycles Set to Repeat

BTC: Long-Term Chart

BTC chart long-term (coinmarketcap.com)

We’ve seen several major Bitcoin peaks in the last decade. In late 2013, Bitcoin peaked at about $1,200. This initial peak was followed by an 85% decline that lowered BTC’s price to roughly $200. The next prominent peak occurred in late 2017 at around $19,500. This top was followed by an 82% decline that dropped BTC to approximately $3,500 before the subsequent recovery and bull market started. Bitcoin already hit a low of around $15,000 in this bear market, and a decline to the $10-12K range would equate to a traditional bear market decline of 80-85% for Bitcoin. Therefore, the $10,000-12,000 may be the ideal buy-in point for Bitcoin, but even around current levels, Bitcoin is a good buy as its price will likely move much higher in the coming years.

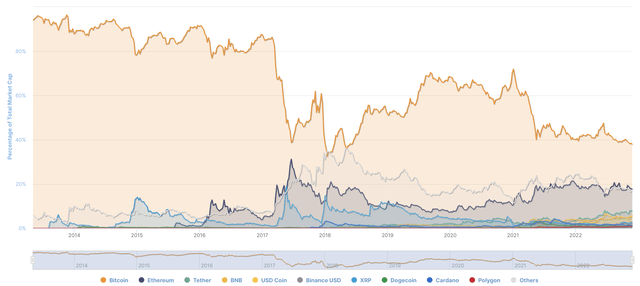

Bitcoin: Not Alone – Other Cryptocurrency Performance

Bitcoin dominance (coinmarketcap.com)

While Bitcoin’s dominance is nowhere near the levels before 2017, its market cap still accounts for roughly 38% of the entire cryptocurrency complex. Moreover, if we consider Ethereum’s (ETH-USD) 18% share, the top two assets account for approximately 56% of the 22,000 crypto asset $820 billion market cap. There are many assets in the crypto space, and many “coins” present significant functionality potential. We see many promising projects developing and trading on more than 5,000 exchanges. Therefore, the digital asset market is alive and well. While it’s going through a mild downturn, Bitcoin and other top digital assets should recover and advance significantly in future years.

Top Coins: Trough-to-Peak Declines

- Bitcoin: 76%

- Ethereum: 78%

- Litecoin (LTC-USD): 87%

- Solana (SOL-USD): 95%

- ChainLink (LINK-USD): 88%

- Bitcoin Cash (BCH-USD): 93%

- ZCash USD (ZEC-USD): 88%

The Takeaway

We’ve seen 75-95% declines from 2021 highs in most major cryptocurrencies. Therefore, it is highly probable that the near-term downside is limited now. Moreover, as the market stabilizes and sentiment improves, substantially higher prices will likely materialize in future years.

Significant Future Potential

You may be surprised how many major companies now accept Bitcoin and other cryptocurrencies. Some of the most significant corporations include Microsoft, PayPal, Whole Foods, Overstock, Starbucks, and many more. Bitcoin and other transactional coins are still in the early stage of their adoption cycle. The trajectory to mass adoption should drive prices significantly higher as the industry continues to expand and develop. As of November 2022, around 85 million people created unique Bitcoin wallets on Blockchain.com. That’s roughly 6 million users more than a year earlier and about 42 million users more than in 2019 (a 102% increase).

The Bottom Line

Despite the transitory slowdown effect and subsequent bear market phase, Bitcoin is a precious asset. I don’t need to remind most readers that Bitcoin has a set supply of only 21 million. About 92% of all Bitcoins have been mined already. Therefore, we are dealing with an asset with a minimal supply, but demand can expand exponentially, leading to dramatically higher prices in future years. The digital asset segment experienced a substantial downside during this bear market. While the ultimate bottom may not have been reached, we’ve come very close. Improved sentiment, increased popularity, higher adoption, limited supply, increased demand, historical trends, speculation, and other macroeconomic elements should drive Bitcoin’s price substantially higher in future years. My long-term buy-in range remains $10-12K for Bitcoin, with a price target of $100-150K in the next bull market phase.

Bitcoin Risks

Bitcoin remains a volatile asset and is not suited for everyone. Numerous factors like increased government regulation, hacking, functionality issues (such as speed, cost, and scale), fraudulent activity, and other detrimental elements could negatively impact Bitcoin’s popularity/sentiment and affect its price.

Therefore, for investors with low to mild risk tolerance, a position size of 3-5% of total portfolio holdings may be appropriate. A position size of 10% of portfolio holdings may be suitable for investors with higher risk tolerance.

It remains to be seen how Bitcoin’s future will play out. The digital asset could be worth a lot more than it is now several years down the line, or it may be worth less if harmful elements prevail in the long run.

Be the first to comment