Roman Bjuty/iStock via Getty Images

Introduction

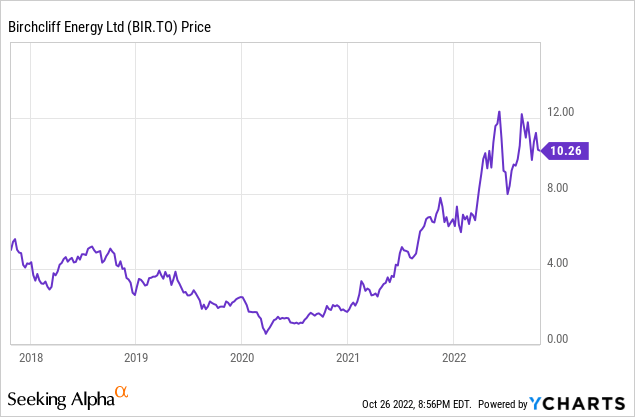

During the COVID crisis, I was able to buy the Birchcliff Energy (OTCPK:BIREF) preferred shares at a discount to the par value of C$25/share. I was happy with my 8%+ yield which was a pretty good deal in a low-yield environment but the very strong natural gas price this year meant Birchcliff’s financial situation improved very fast and the company decided to call the preferred shares. I have been mulling over the possibility to use the proceeds from the preferred call to purchase the common shares of Birchcliff, especially as the company promised to ten-fold its dividend, and considering it announced a special dividend earlier this quarter. Now BIREF has released its guidance for 2023, I am feeling sufficiently confident to indeed initiate a long position in the common shares of Birchcliff.

Birchcliff has its primary listing in Canada where it’s trading with BIR as its ticker symbol. The average daily volume on the TSX is approximately 1.6 million shares, making it the most liquid trading venue. I will use the Canadian Dollar as a base currency in this article. The Canadian listing of Birchcliff also has options available, and this creates additional possibilities.

Looking at the 2023 guidance, Birchcliff seems to have all its ducks in a row

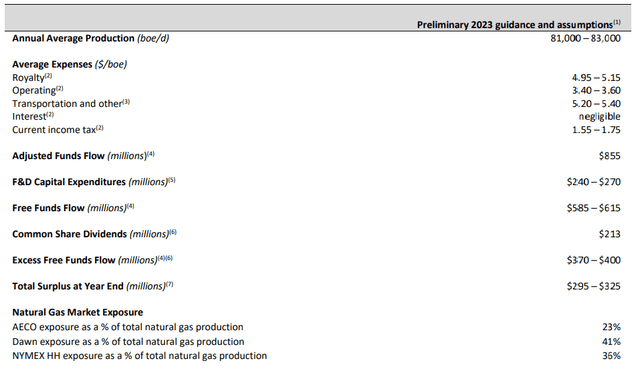

Although Birchcliff still needs to report on its third quarter and although we aren’t even a third into the fourth quarter, the company has already provided a 2023 guidance to the market. The company is still pursuing its moderate growth strategy and anticipates to increase its output in 2023 by approximately 5% to 81-83,000 boe/day. Birchcliff will use two drill rigs to complete about 30 wells and expects to spend C$240-270M on capital expenditures to execute its strategic plan.

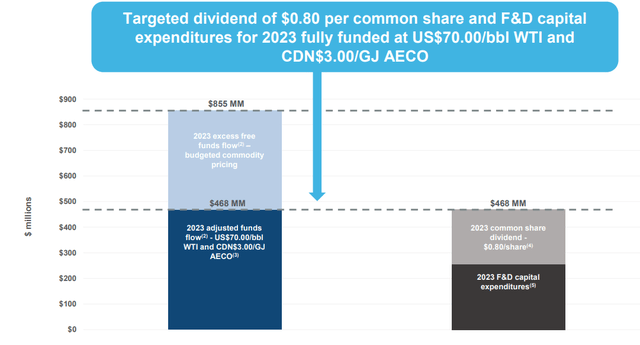

As you can see below, Birchcliff expects to generate approximately C$855M in adjusted funds flow and after deducting the higher end of the capex guidance from the anticipated adjusted funds flow, Birchcliff will likely report a free funds flow of C$585M.

Birchcliff Energy Investor Relations

Considering there are currently approximately 266 million shares outstanding, this implies a free cash flow result of approximately C$2.20. Based on the current share price of just over C$10 this would imply a 22% free cash flow yield.

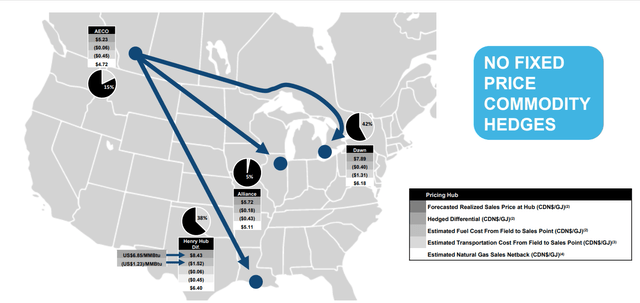

Of course it is important to look at the details and the fine print to see what Birchcliff is actually using for its base case scenario. As you can see in the image above, the company has exposure to three main natural gas markets with having allocated the lowest exposure to the rather volatile local AECO market.

Birchcliff Energy Investor Relations

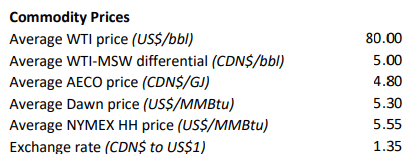

As you can see below, Birchcliff is using a natural gas price around the C$5 and US$5 level for the respective key markets.

Birchcliff Energy Investor Relations

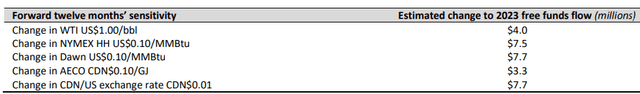

Birchcliff also released a sensitivity analysis. If we would assume the natural gas price is approximately C$1.5 and US$1.50 below the base case scenario in the three core markets (resulting in the following realized prices: C$3.3 AECO, US$3.80 Dawn and US$4.05 Henry Hub), the free cash flow result would decrease by C$278M to approximately C$300M.

Birchcliff Energy Investor Relations

That’s important because that effectively means Birchcliff’s dividend plans are still more than fully funded. Based on the current share count and the anticipated 900% dividend increase, the C$0.80 annualized dividend will cost the company approximately C$213M. And this lends more credibility to Birchcliff’s claim the dividend will be fully covered at US$70 WTI and C$3 AECO prices.

Birchcliff Energy Investor Relations

Investment thesis

I liked Birchcliff’s preferred shares as the preferred dividend payments to the tune of 8% were quite attractive. Now Birchcliff has called my preferred shares I had been on the fence whether or not I should reinvest the proceeds in the common shares of Birchcliff Energy. While I like preferred shares due to the better visibility and seniority of the preferred dividends, I think Birchcliff is offering a compelling case for a sustainable 8% dividend yield. While not preferred, I would also be exposed to potential capital gains as even after making the dividend payments, Birchcliff would still generate additional ‘excess’ funds flow which could be used for special dividends or stock buybacks.

I have no position in Birchcliff at this point, but I started writing put options that are currently slightly out of the money. However, I have made up my mind that I will also buy stock on the open market when there’s a weak moment on the market. While I realize I perhaps waited too long and should have initiated a long position in Birchcliff even before my preferred shares were called, I don’t think I’m too late just yet. The company will be debt-free and the value is underpinned by a 35-year reserve life index based on the 2P reserves.

And for what it’s worth, the after-tax PV10 for the 2P reserves is estimated at C$5.1B while the PV15 comes in at C$3.5B. That’s respectively C$19 and C$13.25 per share and that is based on a long-term natural gas price of C$3 AECO and US$3.3-3.5 Henry Hub with 2% annual increases.

Be the first to comment