Shidlovski/iStock via Getty Images

Investment Summary

Back in 2012, Smith & Nephew (SNN) spun out its biologics and clinical therapies business into a joint venture, dubbed Bioventus Inc. (NASDAQ:NASDAQ:BVS). Last year the company floated its stock on the Nasdaq and since, it’s been a walk down south. BVS has spent most of 2022 marching down the stairs, nudging past its 52-week closing low $7.49 last month. However, the stock drew buyers following its Q1 FY22 earnings, as market pundits rallied BVS forward following its FY22 sales outlook.

Exhibit 1. BVS 12-month price action

Data&Image: Bloomberg

Diving deeper into the business, BVS presents with a diversified portfolio of novel offerings that compete with the orthopaedic surgery segment. BVS’ solutions aim to prevent ortho surgery, and act as a primary line of care. As such, BVS is differentiated from many of its medtech/medical devices peers, in that it has direct access to spread of end markets, including many adjacent ones. Its Duralone segment is a prime example of the above, but BVS continues to build out its core offering to offer a suite of injection protocols (1-5 shot regimes) that diversifies and adds additional sources of value to its top line. Key differentials are found throughout the remainder of its product portfolio. Valuations are extremely attractive and BVS has untapped long-term value yet to be realised by shareholders at the FCF and earnings level. Rate speculative buy on long-term value proposition.

Q1 results set pace of recovery on the chart

BVS’ latest earnings indicate the company is poised for growth into the coming years. The company’s sales trajectory is in line with national patient statistics that have shown a substantial uptick YoY from FY20, explicitly showing that patient volume trends have normalised to pre-pandemic levels. Relevant to BVS is that US outpatient revenue was up 16.1% in April FY22′ compared to February. It was also up 35% vs. March 2020. The company printed sales of $117 million, up 43% YoY and well ahead of the street’s estimates. The growth was underlined by restorative therapies turnover that grew ~58% YoY and contributed $34 million to the top. Specifically, the segment saw upticks in Misonix Wound sales and its advanced rehab business. International sales were propped by the Bioness and Misonix acquisitions, plus the wind-down of Covid-related disruptions, with an 82% YoY growth.

Meanwhile, BVS’ pain treatment segment grew 25% YoY to ~$51 million, whilst surgical solutions grew 67% to ~$31 million. However, it’s the BVS’ Duralone and Exogen offerings that present as the key value propositions in the investment debate. In the hyaluronic acid (“HA”), chondral, glucocorticoid, and osteoarthritic (“OA”) treatment markets’, Duralone is a standout in our opinion. With the database of clinical evidence on HA’s efficacy now well filled, Duralone’s clinical effectiveness is a clear upside for patients in an entire realm of osteogenic and arthritic-type pathology – in particular, OA.

Defensible, diversified portfolio to drive top-line, earnings growth

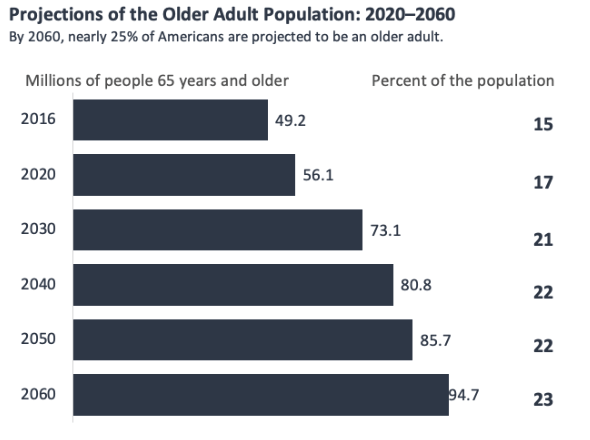

Duralone, combined with the Gelsyn protocol, holds more than 20% of the single and three-injection knee OA treatment markets. Per CDC data, OA has an adult prevalence of 32.5 million in the US, Leighton and colleagues (2014) demonstrated the Duralone is effective in providing patient analgesia that holds up to 6 months post injection. It reports around 24% or ~58.5 million people have ‘doctor-diagnosed’ OA. Moreover, the incidence and prevalence of OA increases markedly with age. More than 21% of the US population is set to be over the age of 65 by the year 2030, accounting for more than 73 million adults. Henceforth, BVS’ total addressable market (“TAM”) continues to widen each year, and with the push away from invasive treatment into OA treatment, the stage is set for BVS to grab market share of several key end markets (pain, musculoskeletal dysfunction, medical rout, geriatrics, rehabilitation) and adjacent markets like surgery. On this note, BVS is well positioned to capitalise on industry-tailwinds advocating a pivot shift towards single–three injection treatments for OA-related pain. There’s also its positioning in the emergence of cross-linked hyaluronic treatments, widening the value proposition even further. As a key differentiator, Duralone has the longest residual time in situ (in the joint space of the knee) due to it having the highest molecular weight of any single-injection protocol.

Importantly, Duralone also has the potential to – yes, provide a remedial breakthrough in this complex, multivariate segment – however, as a second-line therapy, can be embedded into the OA standard of care. It is typically administered when oral analgesics and other orally administered regimes fail to control symptomology. As a second-line defence, Duralone could also be embedded into the standard of care, and not directly competing against it. This prevents cannibalisation of its own end markets, but also adds another source of value (even if unsuccessful, patients still have Surgery as a last line). The company builds this segment out in an extended product mix such as in the Supartz, 5-injection protocol. It has 40% of this market and is a sector-leader in that regard. Net-net, the company’s portfolio setup is actually quite a clever model. It’s akin to a pizza restaurant, where the pizza base/dough is the core/base ‘ingredient’, and all other ingredients are built around the 1 offering – the pizza. Fixed costs are more predictable, and variable costs are embedded into each sale. It’s the same with BVS’ offering as it continues to innovate around its core offering of OA knee pain management/HA (it’s ‘pizza dough’) whilst extending revenue streams in injection protocols and the likes.

Exhibit 2.

Data: US Census Bureau 2020; Image: HB Insights

Adding weight here is the company’s Exogen segment. This is an interesting device; a potential long-term compounder with interesting economics tied into the mix. It’s the only approved device clinically able to treat a selection of acute fractures. It offers a same-day treatment in as little as 20 mins, using ultrasound (“US”) long bone stimulation. We feel BVS can grow this segment to be a market leader as more fracture types are added to its indicated treatment list. Having this kind of troop in BVS’ battle arsenal is a key upside driver that has us keen to harvest ongoing upside in this name.

Guidance reaffirmed – further inflection point

More evidence of BVS capacity to jump was in its most recent earnings, where management reiterated sales guidance of 26%–31% in FY22, calling for $545–$565 million at the top. It envisions ~$75–$80 million revenue from its Bioness and Misonix play’s, implying ~$40 million in sales accretion per acquisition. Adding bullish weight to the risk/reward calculus is the normalisation of patient volume trends that looks to have sorted through backlog and has robust demand-pull to be realised at the back end of the year. Patient flow data also submits that patient turnover also increases markedly towards the back end of the calendar year.

Potential headwinds are in the shift in pricing/reimbursement rates for HA away from wholesale acquisition cost over to average selling price in the coming months. Management is firm this won’t pose an issue to the bottom line. There’re also the post-pandemic healthcare workforce pressures with management estimating there’s around 400,000 fewer healthcare workers than before the pandemic.

Acquisitions add FCF leverage

We forecast a 28% YoY growth schedule at the top into FY22 calling for $554 million at the top, followed by a diminishing growth schedule into FY26. This should normalise to CAGR 7% each year. It’s not unreasonable to forecast $730 million at the top by then for BVS. We are in line with management’s forecasts on its acquisition-based revenue. As such, operating expenses are forecasted to spike up in FY22 as the company awaits cost synergies to realise on full integration of the pair.

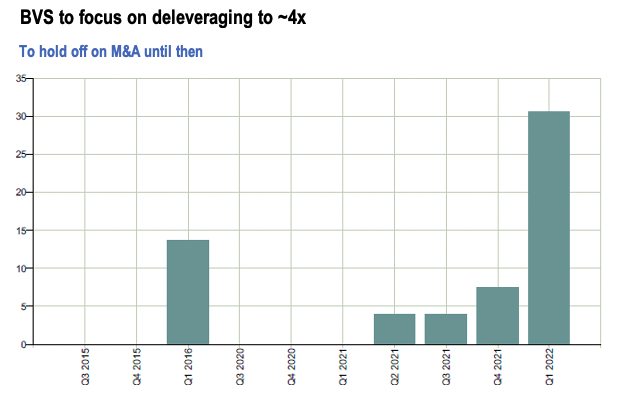

Its most recent target is CartiHeal, however, BVS recently cancelled its proposed $14 million senior notes offering, on a background of higher financing cost and shifting market conditions. The cost of capital is expected to be too high for the transaction, that BVS would use to partially fund the CartiHeal transaction. There’s good chance the deal could still go through, per management’s language. It’s received PMA approval from the FDA, and it exercised its option to purchase the remaining shares in the company back in April. It is now exploring alternative ways to finance the transaction, especially seeing as BVS views CartiHeal as “the revolutionary and game changing device for multitudes of patients suffering from knee osteoarthritis and osteochondral defects.” It will, however, stop all M&A activity until it’s returned to a net debt to adjusted EBITDA of 3x–4x.

Exhibit 4.

Data & Image: Bloomberg; HB Insights

The adding of these complementary tuck-ins to the portfolio are accretive to margins and therefore growth below the bottom line. In fact, examining its pre-listing data, public data, and its SEC filings, BVS has been a long-term cash compounder from the last 7 years to date. From 2020 it’s printed FCF of $68 million and $17 million, respectively, with FY21’s result down from acquisitions. We’ve projected annualised 14.75% YoY growth to FCF over the coming years for BVS, averaging a FCF margin of 16% in the same forecast period. BVS’ capital management has seen it generate a -0.55x FCF leverage on a quarterly basis since listing in 2020. This is, paradoxically, a good and bad thing. Bad in the sense that a smaller amount of each dollar in revenue is carried vertically down & horizontally across the P&L in FCF. However, it also means that FCF conversion isn’t heavily sensitive to changes in revenue, and thus BVS likely can maintain a stable FCF margin in the event of a sales anomaly. With the integration of cost synergies from its M&A activity, we reckon BVS can steepen up its FCF leverage as operating costs begin to stabilise.

Valuation

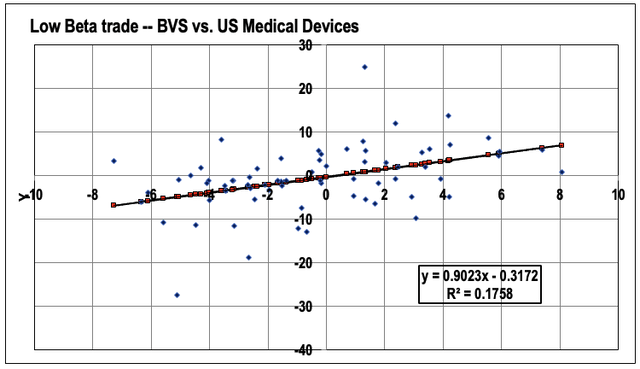

Shares are trading at ~12x forward EPS, whilst trading at 2x FY22 sales. The stock also trades at 1.6x book value, having grown its book value per share to $6.09 in FY21, up from $3.47 in FY20, a 75% YoY gain that outstripped the SPX’s annualise return. The stock is also a low-beta offering that confirms with current factor-premia driving equity returns in 2022. The high-beta and growth trade has doubtlessly unwound this year in favour of low beta, cash-compounding names with superior fundamentals.

Exhibit 5. BVS vs. US Medical Devices – low beta / R2

Data: Bloomberg, HB Insights; Image: HB Insights

As such, BVS presents with a high factor of idiosyncratic drivers that are uncorrelated to the systematic risks currently plaguing equity markets. As mentioned, the TAM of OA is widening by the year in line with age/population trends, and this isn’t so much impacted by inflation etc.

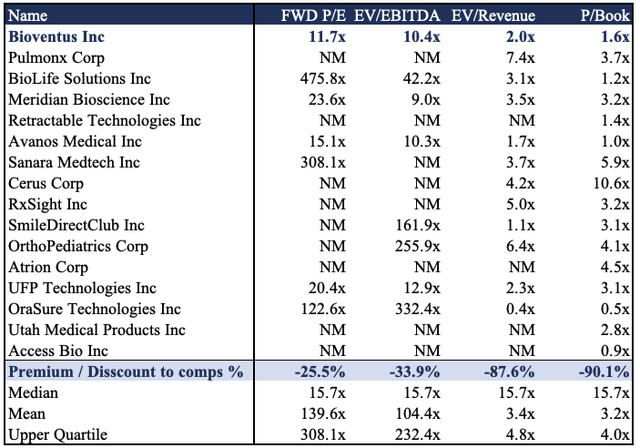

Exhibit 6. Multiples & Comps

Data & Image: HB Insights

Still, shares are trading at a significant discount to shares on key multiples in the GICS Industry peer group, trading at a 90% discount to the peer’s book value alone. Trading at just 2x forward sales is also a respective discount, whilst the stock is also priced at 23x FCF. These are exciting forward earnings targets that has us even more constructive on the stock. However, it doesn’t deserve this discount, and we must adjust our forward targets to reflect the premium it should trade at. It’s FCF positive, growing earnings and has a robust portfolio. We set a 2x adjustment to our forward P/E and target.

Assigning the 23x forward P/E to our FY22 estimates of yields a price objective of $17.25. Applying the same target to our FY23 EPS estimates of $0.80, and discounting this back at 12.5% – one that reflects the opportunity cost of holding the SPX plus the yield on long-dated treasuries – lands us $16 per share.

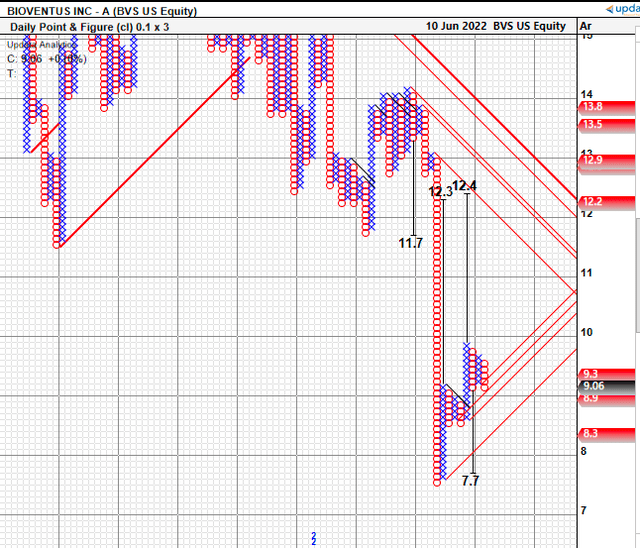

On a forward-cash basis, we value the stock at 23x FY22 FCF calling for a price target of $26 per share, whereas with the same process we value it at 23x FY23 FCF estimates, discounting this back in the same fashion to arrive at a target of $37. Moreover, forecasting BVS’ future cashflows into 2032E we see a total pool of unrealised FCF/share of roughly $37 per share as well. Using a set of unambiguous targets to cancel out noise and for cleaner data, the daily point and figure chart suggest price targets in a cluster of ~$12 per share. The Short-term price action therefore appears to be bullish in support of a directional move to the upside in the range of our price objectives. Collectively, assigning a composite of these measures on an equal weight basis sees a target of $21.6 per share, suggesting there’s still 140% upside potential to be priced into this stock. We’re seeking a near-term objective of $12 to confirm the uptrend, with further confirmation seen via trend indicators, fundamentals, and underlying price action.

Exhibit 7. Upside targets to ~$12

Data & Image: Updata Analytics

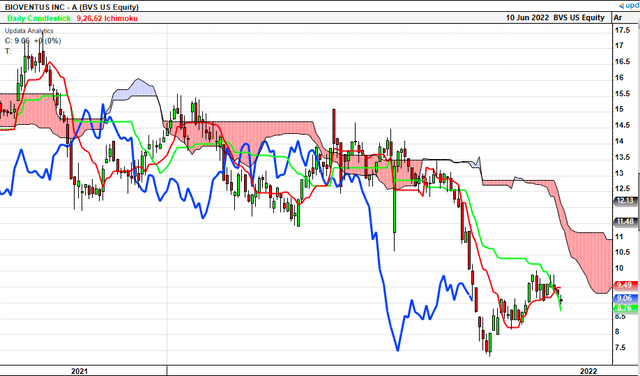

Shares are trading below cloud support after sinking below that level 2 months ago. Since prices have tracked back north towards the cloud and look set to punch back through at the $9 level, with clear support at the $9.50 level should it make that move.

Exhibit 8. Heading back towards cloud support

Data & Image: Updata Analytics

A confluence of factors confirms the near-term trend, with OBV and momentum both ticking up in recent times off lows and reversing a longer-term trend for both. The sharp uptick in both, combined with the upside targets identified earlier, gives us optimism on the upward trajectory of this name, on an objective basis.

Exhibit 9. Trend indicators supportive of near-term upside

Data & Image: Bloomberg

In short

BVS’s diversified product portfolio diversifies its revenue stream and offers the company multiple sources of value to grow its top line. We’ve modelled a period of heavy growth for the company these coming 5 years, noting the company’s leading position in several adjacent market segments.

Tilting the risk/reward scale to an asymmetrical bullish is this and the confluence of factors suggesting the stock is worth $21 per share and looks set to head that direction should trends prevail. BVS is also a low-beta play that offers market pundits exposure to an asset that’s separate to the unwinding high-beta/growth trade. Rate speculative buy on long-term value proposition, valuation, and idiosyncratic risk drivers.

Be the first to comment