Adene Sanchez/E+ via Getty Images

Biohaven (NYSE:BHVN) is a biopharmaceutical company with proven leadership in both industry and research. The company has a significant portfolio of innovative product candidates across neurological and neuropsychiatric diseases. The pharmaceutical company has a strong team of drug developers with a record of delivery and accountability. Biohaven has a history of working with various renowned institutions such as AstraZeneca (AZN), Massachusetts General Hospital, and Yale University School of Medicine.

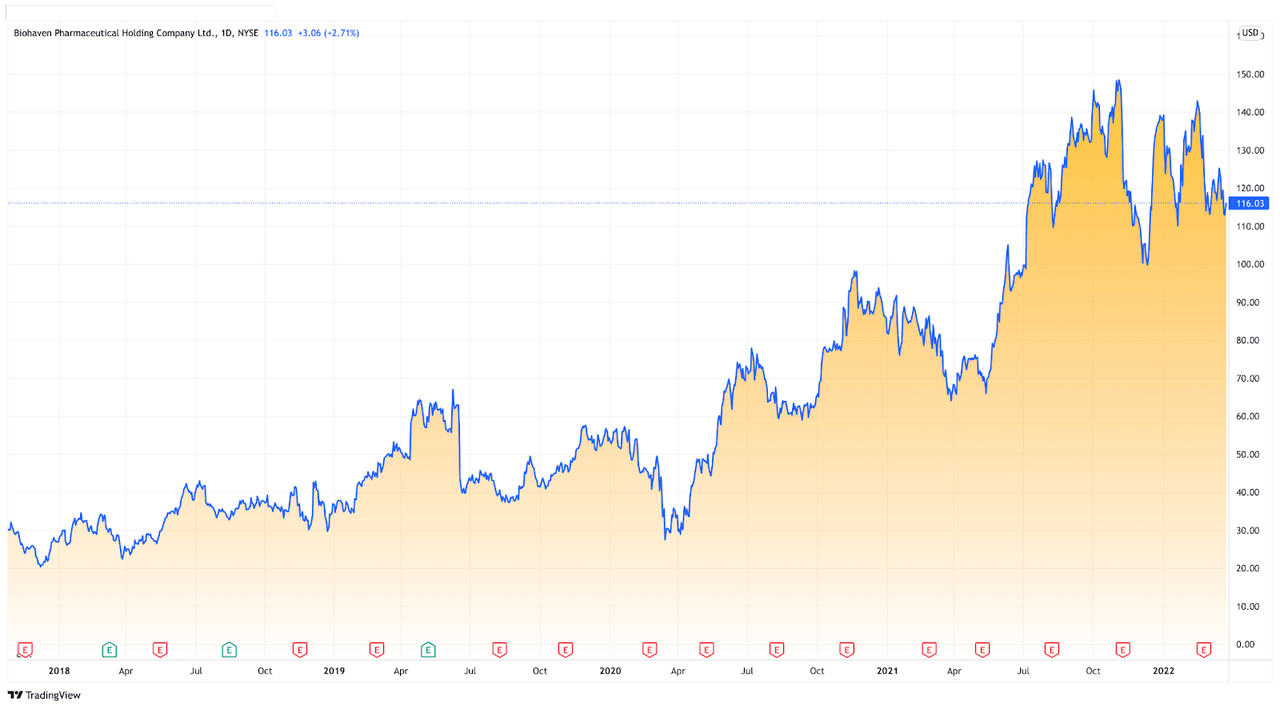

tradingview.com

Founded in 2014, the Connecticut-based company has had excellent performance in the last financial year, with the company maintaining a historical yearly growth rate of 97% during the last five years. It is undeniable that Biohaven Pharmaceutical Holding Company Ltd has grown faster than most of its peers in the industry. With the company’s accelerated growth and recent breakthroughs in its neurological research, Biohaven showcases enormous potential, and consequently, investors might desire to take a bullish position on the company.

Migraine Incidence

Migraines are a neurological condition that can cause multiple symptoms. The World Health Organization classifies migraine as one of the ten most disabling medical illnesses, with about 40 million people in the United States suffering from them. Migraines are primarily headaches of various intensity, often accompanied by nausea or vomiting and sensitivity to light (Photophobia) and sound (Phonophobia). Migraines affect 1 of every 6 American adults. There is a significant unmet need for new treatments as more than 90 percent of people with migraines cannot work or function normally during an attack. Different prescriptions such as NURTEC ODT and Ubrogepant are used to treat or prevent migraine.

The migraine drug market is still relatively small, projected to reach $2.2 billion by 2025. This is, however, not a bad thing. As there are few viable competitors, an effective migraine medication will allow Biohaven to capture a large market share quickly, thus allowing the company to grow with the migraine market over time with what will hopefully be a best-in-class drug.

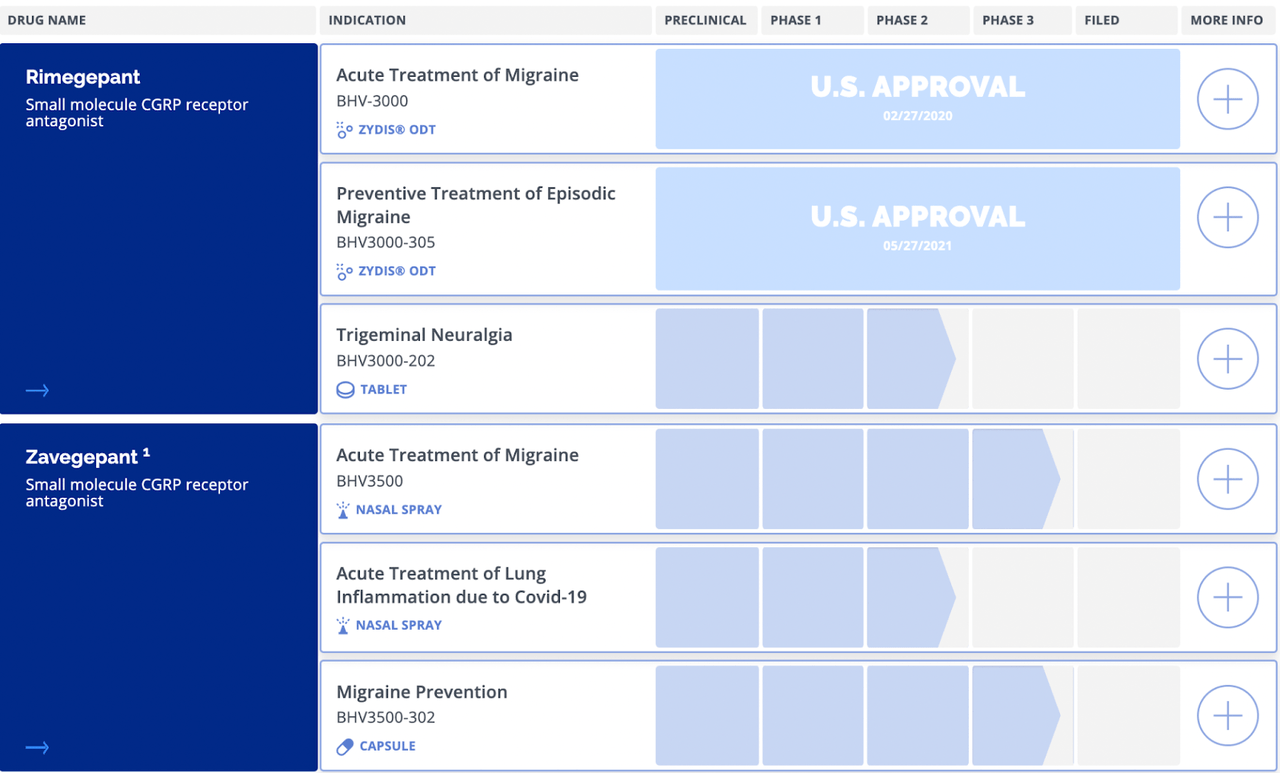

biohavenpharma.com

NURTEC ODT (Rimegepant)

NURTEC ODT, also known as (Rimegeplant), is the only oral Calcitonin Gene-Related Peptide (CGRP) approved for dual therapy of migraines. The drug received FDA approval for the acute treatment of migraine in February 2020, while it also got approval for the preventive treatment of episodic migraines in May 2021. Rimegelanta, a small molecule CGRP receptor antagonist drug, is the company’s best-selling product. Rimegeplant can work quickly to treat migraine and can treat or prevent migraines for up to 48 hours at a time. NURTEC ODT is expected to be taken by mouth to dissolve on or under the tongue. The drug takes effect within an hour. NURTEC ODT has also been approved in the United Arab Emirates and Kuwait to treat acute migraine, while it has been approved for both acute and preventive treatment in Israel. In January 2021, Biohaven signed a $1.2 billion agreement with Pfizer to market NURTEC ODT outside America. Biohaven has sold more than 1.6 million NURTEC ODT after debuting in March 2020. However, competing drugs with NURTEC ODT (Rimegeplant) include Qulipta (Atogepant) and Ubrelvy (Ubrogepant).

Zavegepant (BHV-3500)

Zavegepant is another antagonist of Calcitonin Gene-Related Peptide receptor intranasal formulation for treating migraine developed by Biohaven. It is structurally different from NURTEC ODT. Zavegepant is suitable for multiple routes of delivery, including nasal, subcutaneous, inhalation, and oral administration. The efficacy and safety of zavegepant for the acute treatment of migraines, as compared to placebo, was demonstrated in Phase 2 and 3 dose-ranging trials with a total of over 1000 patients who received zavegepant. Zavegepant showed ultra-rapid pain relief at the earliest measured time point of 15 minutes and sustained efficacy through 48 hours after a single intranasal dose. Therefore, with this result, Biohaven intends to file for regulatory approval in the United States and other countries in 2022.

Financials and Valuation

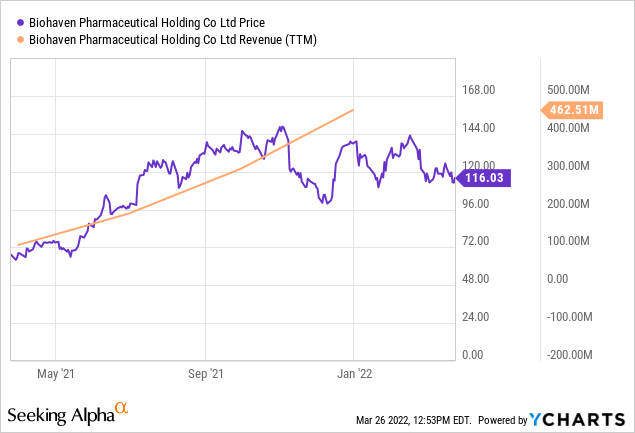

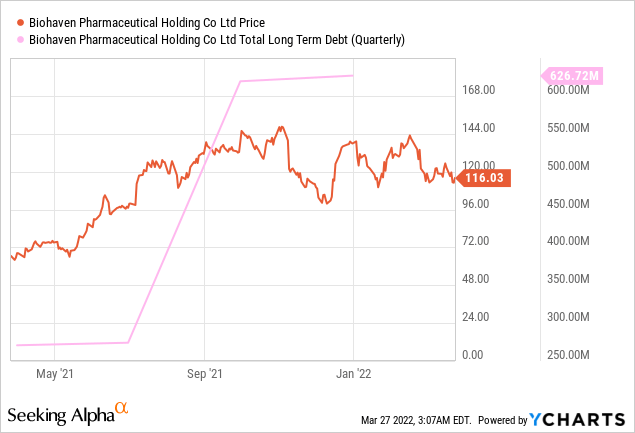

ycharts.com

Biohaven reported consolidated revenue of $462.5 million in FY 2021. Biohaven ended the last financial year with a series of partnerships and commercialization agreements. NURTEC ODT, which is produced by Biohaven, is a preventive migraine treatment, and it is the first and only migraine therapy approved by FDA to both treat and prevent migraine attacks. More than 1.6 million NURTEC ODT has been delivered after launch. Several factors, including those above, boosted the company’s annual revenue from $63.6 million recorded in FY 2020 to $462.5 million achieved in 2021.

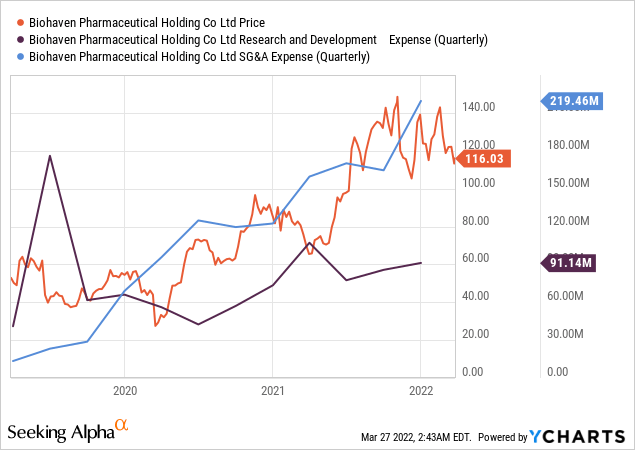

ycharts.com

Biohaven product NURTEC ODT had full sales in Q1 2021. This was an important reason for the company’s skyrocketed revenue. As a result of the constant activities in the company, especially on one of its products, zavegepant, Biohaven doubled its Research and Development expenses in this quarter from $56.1 million in Q1 2020 to $107.1 million in Q1 2021. The company’s running cost for the quarter, however, increased from $95.6 million in Q1 2020 to $159.5 million in Q1 2021. In Q2 2021, Biohaven’s star product NURTEC ODT maintained its mass adoption, and its performance continues to exceed expectations. Net product revenue of $92.9 million was reported this quarter, an astronomical increase from $9.7 million recorded in Q2 2020. Significant revenue generation was a result of NURTEC ODT outstanding sales. Research and Development for Q2 2021 was $77.4 million, which was a $35 million increase from $42.4 million recorded in Q2 2020. Running cost for the quarter was $170.1 million compared to $124.8 million for Q2 2020.

ycharts.com

In Q3 2021, Biohaven Pharmaceutical achieved a net product revenue of $135.7 million, an increase of $118.1 million from $17.7 million recorded in Q3 2020. R&D for the quarter was $85.7 million compared to $57 million recorded in Q3 2020. SG&A expenses increased by $45 million from $119.5 million in Q3 2020 to $164.5 million in Q3 2021. As expected, the increase in SG&A supported the increased commercial sales of NURTEC ODT, which has now become mainstream in treating migraines. Biohaven net product revenue for Q4 2021 was $190 million, representing an increase of $154.9 million compared to $35.1 million made in Q4 2020. The increase in revenue as of the beginning of the FY 2021 resulted from the massive adoption of NURTEC ODT.

In terms of a just valuation, admittedly, this is a growth play as opposed to a pure value play. For biotech companies still in the development stage, a proper assessment is more accurately based on the technology’s promise than metrics. That being said, the company’s EV/sales ratio of 17.88 is well below the sector average of 4.94. This is to be expected, as the company has still not filed for Zavegepant’s approval; this will cause a large spike in sales once completed. The forward price/sales is more promising, with a ratio of 8.32 in comparison to the sector median of 5.11. It is my expectation that this will further improve once all the company’s drugs are being actively marketed assuming there are no regulatory setbacks. As stated earlier, my determination of this company’s potential is primarily based on the technology and its growth potential. While the valuation metrics may not clearly indicate so, I believe the recent growth has not resulted in an overvaluation, and that anticipatory growth will continue at least until Zavegepant’s approval has been filed for.

Risks and Competitors

Mentioning regulatory setbacks, these tend to be the biggest risk to a biotech with drugs still in development. Zavegepant has had excellent results in all its phases in clinical trials, and there is no reason to believe that it will not make it past approval once filed for. Beyond that, there is the risk of another company releasing a potential best-in-class drug that would render Biohaven’s drugs obsolete.

As mentioned earlier in the article, this is not a very pressing risk because the migraine drug market is still very small. This leaves little room for competitors, and an incredible opportunity to assert market dominance early on. If Biohaven’s drugs are well-received going forward, given the security on intellectual property that successful biotech companies receive, there will be virtually no significant risk of being outcompeted in the near future by any competitors, no matter how viable their products may be.

Key Takeaways

Biohaven is a pharmaceutical company with a strong history of organic growth and acquisitions. Located in New Haven, Connecticut, United States, Biohaven Pharmaceutical completed the acquisition of Kleo Pharmaceutical in the first quarter of 2021 in a deal worth $20 million. The acquisition of Kleo will enable Biohaven to advance its bi-specific compounds that emulate or enhance the activities of biologics. Furthermore, in the first quarter of 2021, Biohaven acquired the Kv7 ION platform to treat epilepsy and other neurologic disorders. The acquisition will take Biohaven a step further in meeting the unending needs of neurological disorders patients. The technology platform has the potential to accelerate Biohaven in delivering new treatment options for patients suffering from epilepsy.

The strong financials and the recent growth of Biohaven Pharmaceutical are a clear testimony that the company will play a vital role in the development of mainstream biotechnology products. In addition, the company is one of the favorites among big institutional investors. Some of the company’s shareholders include Capital World Investors US and BlackRock Fund Advisors. Interestingly, some of these institutional investors recently added to their portfolio, which signifies a bullish sentiment among institutional investors. Several factors, which include its recent acquisitions, the success of its migraine prescription, the company’s partnership with Pfizer, and the potential future opportunities in the biotechnology industry, showcase substantial reasons for short-term and long-term bullishness. For these reasons, I believe that Biohaven is a solid buy given the current circumstances, and see no reason why the recent growth should not continue.

Be the first to comment