Motortion/iStock via Getty Images

In a recent article, we explained why some high-profile billionaires are aggressively going after REITs in today’s environment.

Bruce Flatt and Steve Schwarzman are both self-made billionaires and run two of the biggest private equity firms in the world: Brookfield (BAM) and Blackstone (BX), and just between the two, they have taken 8 REITs private this year alone:

-

American Campus Communities for $12.8 billion (which profited members of High Yield Landlord)

-

PS Business Parks for $7.6 billion (which also profited our members)

-

Preferred Apartment Communities for $5.8 billion

-

Resource REIT for $3.7 billion

-

Alstria REIT for €4.1 billion

-

Hibernia for €1.1 billion

-

Befimmo for €1.4 billion.

-

Tower division of Deutsche Telekom (OTCQX:DTEGF, OTCQX:DTEGY) – Not a REIT, but very similar to American Tower (AMT) and Crown Castle (CCI)

That’s over $40 billion worth of investments!

They are buying REITs so aggressively because they are heavily discounted today.

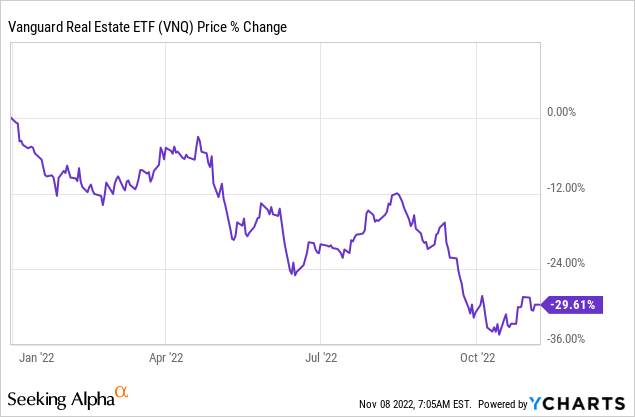

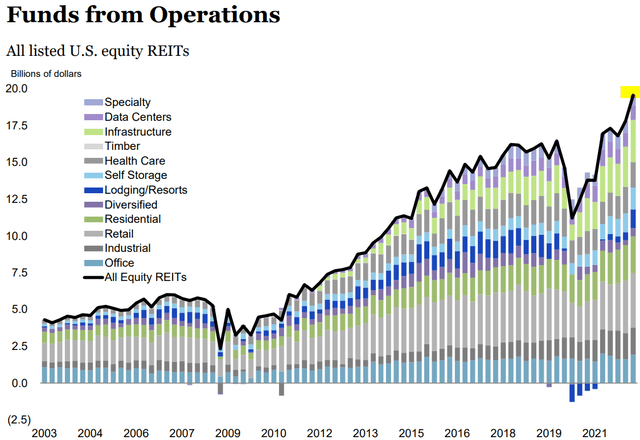

On average, REITs (VNQ) have dropped by 30% in 2022 and there are many individual REITs that are down closer to 50%. Meanwhile, their rents have actually kept rising and REIT cash flows and dividend payments have reached new all-time highs. Take a look at this huge disconnect between share prices and fundamentals:

As a result, valuations are now at historical lows and there are many REITs that trade at 30, 40, and in some cases, up to 50% discounts relative to the value of the real estate they own.

Companies like Blackstone and Brookfield will happily pay a 20% premium relative to the latest share price of a REIT to buy it out because even despite paying a premium, they are still getting the assets at a lower price than what they would have needed to pay in the private market.

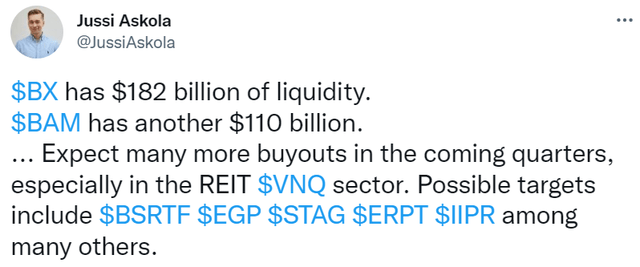

And with REIT valuations hitting new lows, and Blackstone/Brookfield sitting on a huge pile of cash, we can expect many more buyouts in the coming quarters.

I recently speculated on Twitter that likely buyout targets include BSR REIT (OTCPK:BSRTF), EastGroup Properties (EGP), STAG Industrial (STAG), Essential Properties (EPRT), and Innovative Industrial Properties (IIPR):

Twitter Jussi Askola

Here’s why:

BSR REIT owns a portfolio of apartment communities in rapidly growing Texan cities like Austin, Dallas, and Houston. These assets are in high demand today because these are some of the most desirable markets in the whole country. Rents are still affordable but they are growing rapidly as increasingly many companies and people move to Texas from coastal markets. The move is often motivated by the fact that Texas is pro-business, has no state income tax, has lots of talent, and other resources are also cheaper. This pushed a lot of companies to move to Texas and this trend is only accelerating now as a result of the pandemic. Yet, BSR is currently priced at a near 40% discount to NAV, which is exceptional for these assets. The management has lot of skin in the game and would probably welcome an offer from larger private equity players.

BSR REIT

EastGroup Properties is focused on strong sunbelt markets just like BSR. The majority of its assets are in Texas and Florida. But instead of investing in apartment communities, it specializes in urban, in-fill industrial properties. Its fundamentals are stronger than ever with its occupancy at near 100% and its rents are growing rapidly with releasing spreads surpassing 20%. The demand for these assets is growing rapidly as a result of onshoring and the growth of e-commerce, but there are high barriers to entry and limited new supply in urban, in-fill locations. EGP is today priced at a 30% discount to NAV, and lots of private equity players would also appreciate getting EGP’s land bank and property development capabilities.

STAG Industrial is similar to EGP in that it also invests in industrial properties but it has a different focus. It invests typically in Class B properties in Tier 2 or 3 cities, following a value-add approach. It has been very successful over the years, but currently, it is priced at a 30% discount to NAV. STAG’s investment strategy is particularly difficult to execute and private equity players would pay a premium just to get the investment team and its capabilities. They have a lot of cash to invest and STAG has a unique strategy to earn above-average returns with below-average risk.

LXP Industrial Trust

Essential Properties: Recently, EPRT’s closest peer, STORE Capital (STOR), was bought out by Blue Owl Capital (OWL), a private equity firm. We think that EPRT could be next in line because it is very similar but trades at a materially lower valuation. I think that STOR was a great purchase for OWL because, beyond the assets, it gives them a large pipeline of opportunities in the net lease sector that will truly set them apart and allow them to grow their AUM. The same would be true for another private equity firm if it bought EPRT. It is priced at a historically low valuation right now, trading at a 20% discount to NAV.

Essential Properties

Innovative Industrial Properties: The entire cannabis sector (WEED) is today out of favor and cannabis REITs are no exception. IIPR has dropped 55% year-to-date, despite continuing to grow its cash flow and hike its dividend. In the past, the public market has often valued cannabis real estate at a huge premium to NAV, but today, it is the opposite. The public market is valuing it at a discount to private values. Therefore, cannabis REITs are now losing their ability to grow by raising equity and reinvesting it in more properties at a positive spread. Meanwhile, private equity players have lots of cash to invest so it could make sense for IIPR to go private via a buyout and use all that private equity money to keep growing its portfolio. The buyer could then bring IIPR back to the public market via an IPO when the sentiment for cannabis stocks becomes more optimistic again.

Innovative Industrial Properties

Closing Note:

I think that the most likely buyout targets are REITs that are not just discounted and own desirable assets but also have a unique strategy that would allow private equity to deploy a lot more capital over the years.

These 5 REITs are good examples of that.

At High Yield Landlord, we look for REITs that could be possible buyout targets, but we are not relying on them. Whether these REITs get bought out or not, we expect to earn great returns, in the long run, either way.

Buying real estate at a steep discount to fair value is a no-brainer in today’s market. The most sophisticated private equity firms are doing it and so am I.

Be the first to comment