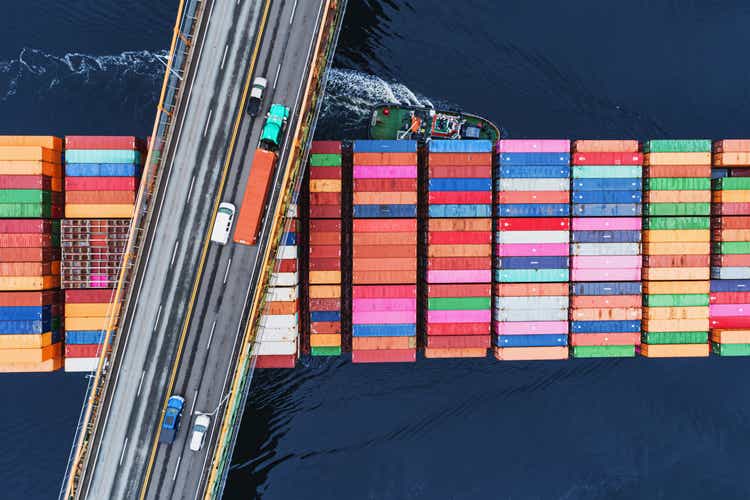

shaunl/E+ via Getty Images

Oaktree’s/Brookfield’s (OAK)(BAM) Howard Marks recently pointed out that lingering impacts from COVID-19 restrictions and soaring geopolitical tensions between the world’s major powers in the wake of increased Chinese aggression around Taiwan and Russia’s incursion into Ukraine are pushing:

… the pendulum to swing back toward local sourcing.

As a result, he said that the broad and seemingly irreversible globalization trend of the past several decades is declining:

And after many decades of globalization and cost minimization, I think we’re about to find investment opportunities in the swing toward reliable supply... For how long will the pendulum swing away from globalization and toward onshoring?... The answer depends in part on how the current situations are resolved and in part on which force wins: the need for dependability and security or the desire for cheap sourcing.

This trend will likely favor companies that have in-house manufacturing or access more reliable/localized supply chains. Furthermore, oil and gas and semiconductor supply chains are particularly susceptible at the moment (given that Russia is a major supplier of oil and gas to Europe and Taiwan is a major producer of semiconductors for the world via its giant Taiwan Semiconductor Manufacturing Company (TSM)).

As he noted in his letter, these industries are…

… marked by inadequate supply of an essential good demanded by countries or companies that permitted themselves to become reliant on others.

Given the current challenges, it’s very likely that Mr. Marks is correct in assuming that companies and countries will place a premium on local sourcing. At the same time, it would be ill-advised to bet entirely against globalization as eventually the current headwinds should dissipate and the allure of lower costs offered by globalization combined with technological innovation’s (ARKK) relentless march towards making our world ever-smaller will undoubtedly restore some wind to the sails of globalization.

As a result, we think the follow three stocks are particularly well positioned – and priced – to generate outperformance in the current environment.

#1. Triton International (TRTN)

As an investment-grade lessor of shipping containers with lengthy terms, TRTN is a great way to bet on long-term globalization trends while also enjoying more downside protection through its conservatively structured long-term lease contracts if global trade declines precipitously.

The company is enjoying extremely strong momentum at the moment as its Q4 FY2021 results revealed:

- Adjusted earnings per diluted share increased by 9.9% sequentially on the strength of a Q4 ROE of 30.7%, though management acknowledged that the ROE was boosted by extremely high container disposal prices which they do not view as sustainable. Even aside from that benefit, however, the ROE is expected to remain very high for the foreseeable future.

- The ongoing supply chain bottlenecks continue to benefit TRTN by increasing demand for containers and TRTN is locking in the current favorable conditions for many years to come by increasing the company’s revenue earnings assets by 31% in 2021. Management is signing new container lease contracts with high lifetime equity IRRs to lengthy terms that averaged 13 years in 2021. By net book value, the average remaining duration of long-term and finance leases is 78 months (6.5 years), giving the company a very stable cash flow profile, especially considering that it trades at just 6 times 2022E normalized earnings.

- TRTN is also enjoying earnings tailwinds from debt refinancing activity at significantly lower interest rates thanks to its newly achieved investment grade credit rating.

After reducing the share count by 1.1% in Q4 alone and 3.3% over the past year, TRTN plans to continue buying back shares opportunistically – and likely aggressively – moving forward as market conditions warrant. Based on Q4 numbers, the company boasts a free cash flow yield north of 17% net of maintenance and replacement capex as well as debt amortization, but not including growth capex. As a result, it has enormous flexibility to grow the dividend further, buy back shares hand-over-fist, and/or continue to invest in long-term leases at attractive IRRs. Based on management’s comments, we expect them to continue pursuing a combination of all three in a manner that will keep the dividend at a level that is on course for long-term sustainability and growth.

#2. Hanesbrands (HBI)

HBI is uniquely positioned to outperform in the current environment due to its in-house supply chain capabilities (such as operating its own manufacturing facilities at diverse geographic locations) that make it less reliant on others to deliver and gives it opportunities to improve its efficiencies. Management is doubling down on its Full Potential Plan, which includes investing in organic efficiencies. This includes improve its manufacturing input by 15% over the past four years and now over 70% of its products are manufactured in plants under HBI’s control.

On top of that key strength, the stock looks undervalued by virtually any metric:

- Its EV/EBITDA is 8.26x compared to its five-year average of 9.73x and 10-year average of 10.69x. This implies share price upside potential of between 29% and 48%.

- Its price to earnings ratio is 8.42x compared to its 5-year average of 10.24x and 10-year average of 12.46x. This implies share price upside potential of between 22% and 48%.

- The dividend yield is 4.24% compared to its 5-year average of 3.74% and its 10-year average of 2.72%. This implies share price upside potential of between 21% and 36%.

These metrics imply that the company should be financially distressed or at the very least in decline, right? Actually, it’s anything but the contrary here. Under their new CEO the company has been thriving. Over the past 12 months, HBI has generated a 20.6% return on capital, has improved its gross margin by 200 basis points, its net income margin by 60 basis points, and its asset turnover ratio by 17 basis points.

On top of that, the balance sheet has improved over that time frame as well, with the EBITDA/interest ratio improving from 6.73x to 7.77x and the leverage ratio improving from 3.23x to 2.53x. As a result, it’s now within its target leverage range and is able to begin deploying its substantial free cash flow towards shareholder capital returns. Given that the stock is so undervalued at the moment, management announced a $600 million buyback program (10.9% of the current market cap) that it very likely began deploying in the first quarter and plans to continue deploying it throughout the year.

The company also continues to take market share in its core businesses and brands, and as a result, management raised its 2024 target guidance.

While it’s true that HBI is facing lingering COVID-19 challenges as well as inflationary, foreign exchange, and supply chain headwinds, the company is adapting and overcoming these challenges and it’s showing up in the results.

Moving ahead, HBI is expected to continue generating solid earnings per share growth, with consensus analyst estimates expecting an 8.8% EPS CAGR through 2026. Free cash flow also is expected to be very robust in the coming years, with analysts expecting the company to generate nearly $3 billion in free cash flow (nearly 60% of the current market cap) over the next half decade. When combined with the very safe (34% payout ratio) and attractive dividend and likely multiple expansion moving forward, the annualized total return expectation easily reaches the mid-teens over the next half decade.

Adding to our conviction is the fact that the CEO recently bought over half a million dollars’ worth of shares on the open market at prices ranging from $14.6099 to $14.8600, which is well above where shares trade as of this writing.

#3. Energy Transfer (ET)

Last, but not least, as Mr. Marks pointed out: Europe’s dependence on Russia for oil and natural gas is a potential Achilles Heel for the West. As a result, the U.S. is already making deals with Europe to increase natural gas exports in order to reduce dependency on Russia for energy supplies.

Given that ET is a leading North American energy commodity exporter and boasts one of the largest and best diversified energy infrastructure portfolios in North America, it’s highly likely to benefit from this trend. Furthermore, with soaring gas and energy prices in the United States itself, there are growing calls for the U.S. to increase domestic energy production. This trend should also benefit ET immensely.

On top of that, ET continues to be severely undervalued, trading at a steep EV/EBITDA and Price to Distributable Cash Flow discount to fellow investment grade midstream peers like Enbridge (ENB), Kinder Morgan (KMI), Enterprise Products Partners (EPD), Plains All American Pipeline (PAA), The Williams Companies (WMB), Magellan Midstream Partners (MMP), and MPLX (MPLX). With management rapidly deleveraging the balance sheet and set to continue growing the distribution rapidly in the coming months, we expect the unit price to continue its current strong momentum and soar higher over the next few years.

Investor Takeaway

Is globalization dead like the Economist recently claimed? That’s very unlikely and probably a dramatic overstatement of current trends. However, Mr. Marks’ recent comments that there’s a shift toward more localization is a very reasonable model for where things are headed, at least in the near term.

As a result, it’s likely prudent for investors to focus on businesses that will benefit from shifting supply chain patterns while not completely punting on long-term globalization trends. We believe that TRTN provides a hedged bet on long-term globalization while HBI and ET are poised to benefit from countries, companies, and investors placing an increasing premium on more localized and more reliable supply chains.

Be the first to comment