mikeinlondon

Co-produced with Treading Softly

When looking for an excellent income, I do not limit myself to the United States. I am willing to look elsewhere as needed. For instance, I enjoy many Canadian specialties.

Having grown up in Canada, I am still partial to Tim Hortons’ Iced Capps and donuts. I love poutine and watching hockey on TV.

I also love getting income from great Canadian sources to supplement my income generated from American investments.

These sources can often be overlooked as investors worry about complications or the perception of low volume on U.S. OTC tickers for Canadian companies.

These misconceptions can lead to excellent high-yield opportunities for investors will to look deep and understand further. For retirees needing income, sidestepping excellent income sources on misconceptions alone is a foolhardy method.

So today, we’re looking at two great Canadian income opportunities!

Let’s dive in!

Pick #1: AQNU – Yield 8.3%

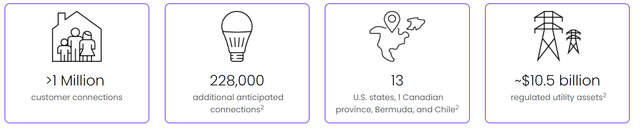

Algonquin Power & Utilities Corp. (AQN) (AQN:CA) is a large utility operation focused on many various aspects of providing the basic essentials for our society to operate. AQN, while best known for its power generation and renewable energy operations, also operates a large amount of water utility operations as well throughout the United States and Canada

Since AQN has completed its takeover of New York American Water, this brings water utilities to 15% of AQN’s Adjusted EBITDA from their regulated utilities business.

AQN is also in the midst of closing its Kentucky Power acquisition from American Electric Power (AEP). This purchase is progressing well and is expected to close before the year ends.

So what do we like about a 4.8% yielding utility? Quite a bit, except for its low yield.

To remedy this, we climb higher into AQN’s capital stack and land on Algonquin Power & Utilities Corp. Equity Units Due 06/15/2024 (AQNU). These equity units are slated to convert to AQN common shares in June 2024, approximately two years from now. In the meantime, we can get a great 8.3% yield on our investment and can look forward to being AQN common shareholders in the future.

AQNU converts to AQN shares on a sliding formula, and as such often AQNU trades on its conversion value of AQN shares more than its PAR value:

“The stock purchase settlement rate will be 2.7778 shares per unit if the then current market price is equal to or greater than $18.00 and 3.3333 shares per unit if the market price is equal to or less than $15.00. For market prices between those values the settlement rate will be $50 divided by the market value”

Currently, AQN trades for $14.15, meaning AQNU would convert to 3.3333 shares of AQN. Thus AQNU has a value of $47.16, while trading hands for $46.35, so AQNU is at a discount to its current conversion value, adding to its attractiveness. (Prices as of August 28th)

AQN itself has been a fantastic investment historically:

So while AQNU is trading at high yields, we can enjoy a couple of years of high yield, low-risk income before joining common shareholders in enjoying the growing dividend and success of AQN.

AQNU pays US$0.96875 quarterly and “dividends” are treated as interest, so taxed as ordinary income. Be aware that some sources incorrectly report AQNU as paying in Canadian dollars, so after currency exchange, their yield calculations are way too low. The prospectus is very clear about being USD.

The next ex-dividend date is Wednesday, August 31st.

Pick #2: BEVFF – Yield 7.7%

When inflation causes stores to raise prices, we all collectively groan. Imagine instead if that price hike could immediately mean more money for your pocket? You’d have to be first in line to collect money from the stores.

Let’s talk about royalties for a moment.

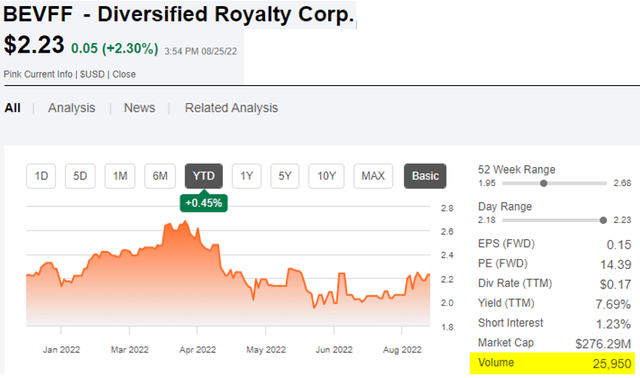

Diversified Royalty Corp. (OTCPK:BEVFF) is a Canadian royalty corporation that trades OTC in the U.S. and on the Toronto Stock Exchange (DIV:CA).

For American investors not used to seeing royalty structures, BEVFF owns the rights to various brand names and operates a franchise pool related to them. As their franchisees conduct business, a percentage of revenue goes directly to BEVFF which in turn is paid out to shareholders. BEVFF unlike other royalty corps has multiple brands and revenue sources to keep money flowing.

These brands include oil change locations, restaurants, in-home nursing care services, and educational tutoring. As the prices for the services rise, BEVFF collects higher revenue from the percentage coming their way. The easiest way to know if BEVFF can cover or raise its dividend is simply the health of its pool of companies.

so how is BEVFF doing? Great actually!

What drove the record results? Price increases due to inflation and stronger economic activity in their brands within Canada.

The prudent investor may look at BEVFF and worry about its low volume:

This volume is not its actual trading volume, but only the volume of the BEVFF OTC ticker for them in the U.S. The OTC ticker tracks the Canadian listed shares of BEVFF and when you purchase or sell shares of BEVFF it will go into the volume of BEVFF traded in Canada

TSX

This level of volume means that there should be no issue getting in or out of BEVFF.

This monthly dividend is paid in Canadian dollars, so the income to U.S. investors will vary slightly with the currency exchange rate. This high-yield company offers excellent income here and now for investors to benefit from lingering inflation. If its revenue remains exceptionally strong, then BEVFF can be expected to hike its monthly dividend.

Shutterstock

Conclusion

By investing in AQNU and BEVFF, we can receive high-yield income from two well-run companies within Canada. AQN has a large exposure to the United States in an essential sector. Boring but stable income pours from AQNU into our coffers every quarter. BEVFF is in the meat and potatoes of the Canadian economy, providing healthcare, restaurants, and car services that meet everyday consumers where they are. It also meets investors where they are by providing reliable and recurring monthly dividends into your account.

I have long said I like to get income from essential sources – like AQN – and everyday sources – like BEVFF – so that everything I do, I get paid back for in the end.

So go get your oil changed, sit down and enjoy a meal, or turn your faucet on to do dishes. I get paid for it all, and so can you.

That’s the kind of retirement income we all can enjoy.

Be the first to comment