ipopba

Always leave a way out, unless you really want to find out how hard a man can fight when he’s nothing to lose.“― Robert Jordan

Today we put Bicycle Therapeutics (NASDAQ:BCYC) in the spotlight for the first time. The company is developing drug candidates on a different technology platform that seems to have promise. We take a deeper look at this small but intriguing biotech development firm below.

Company Overview:

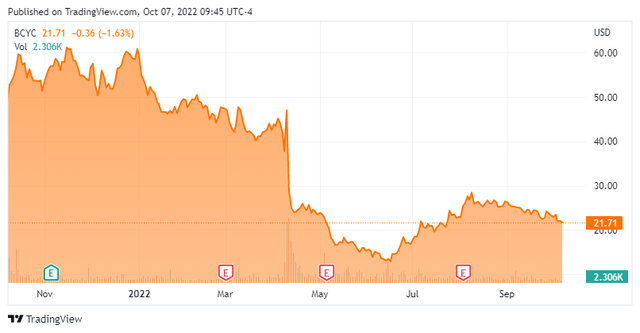

Bicycle Therapeutics is a clinical-stage biopharmaceutical company based in Cambridge, UK. The company is focused on developing a class of medicines for diseases that are underserved by existing therapeutics. The stock currently trades around $22.00 a share and sports an approximate market capitalization of $700 million.

September Company Presentation

The company is developing drug candidates via its bicyclic peptide technology which they have branded as a “bicycle”. The company believes this allows drug candidates to deliver the pharmacologic properties of a biologic such as an antibody with the pharmacodynamic and manufacturing properties of small molecules. Given their large surface areas, this allows complex proteins to be drugged without using an antibody.

September Company Presentation

The company has several candidates in development. Among the most advanced of its wholly owned candidates are:

September Company Presentation

BT5528:

September Company Presentation

This is a second-gen BTC targeting EphA2. EphA2 is a high value target for a variety of different cancers.

September Company Presentation

The company recently announced that the first patient was dosed in the expansion cohorts of the Phase I/II study of BT5528.

September Company Presentation

BT8009:

This is a second-generation BTC targeting Nectin-4. This compound is currently being evaluated in a Phase I/II trial targeting urothelial cancer (UC).

September Company Presentation

The Phase I interim results were presented at 2022 American Association for Cancer Research (AACR) Annual Meeting early this summer.

September Company Presentation

Finally, BT1718 is in a Phase I/IIa trial targeting tumors MT1-MMP.

September Company Presentation

In addition, Bicycle has several TICAs or Tumor-targeted Immune Cell Agonists that are partnered with larger drug companies. While promising, these are earlier stage efforts with the TICA entering clinical development late last year.

September Company Presentation

Analyst Commentary & Balance Sheet:

Since early July, seven analyst firms, including Needham and Barclays, have either maintained or assumed Buy or Outperform ratings on the stock. Price targets proffered range from $40 to $72 a share. Morgan Stanley reiterated its Equal Weight rating and lowered its price target on BCYC to $45 from $60 previously on September 9th.

Approximately 15% of the outstanding float is currently held short. The company ended the second quarter with just over $370 million in cash and marketable securities against approximately $30 million of long-term debt. There has been no insider activity in the stock so far in 2022.

Verdict:

Bicycle Therapeutics seems to have some potentially intriguing technology. It has strong analyst support and is well-funded at the moment as well. It also has partnerships around its TICA and other developmental efforts with large drug firms. The company recently announced an expansion of a Genentech exclusive strategic immuno-oncology collaboration, which triggered a $10 million payment in the third quarter of this year. Genentech exercised a similar option in October of last year.

In addition, in July of last year, Ionis Pharmaceuticals (IONS) entered into an exclusive licensing agreement with the company to increase the delivery capabilities of Ionis’ advanced LIgand Conjugated Antisense (LICA) medicines. This involved a $45 million upfront payment, which included an $11 million equity investment. Regulatory milestone payments on a program-by-program basis and royalties on product sales are part of both these licensing deals.

September Company Presentation

The company has some milestones on the horizon, but this company is still a very early-stage developmental concern and there is uncertainty within the analyst community around its BT8009 program. In a more positive overall market environment, BCYC would seem to merit a small ‘watch item‘ holding within a well-diversified biotech portfolio. However, given the volatile and negative market backdrop that has been present throughout 2022, I have no current investment recommendation on BCYC stock. The story is intriguing enough that we will circle back to this company in 2023 to see how its pipeline is progressing, however.

We do not place especial value on the possession of a virtue until we notice its total absence in our opponent.”― Friedrich Nietzsche

Be the first to comment