JamesBrey

Introduction

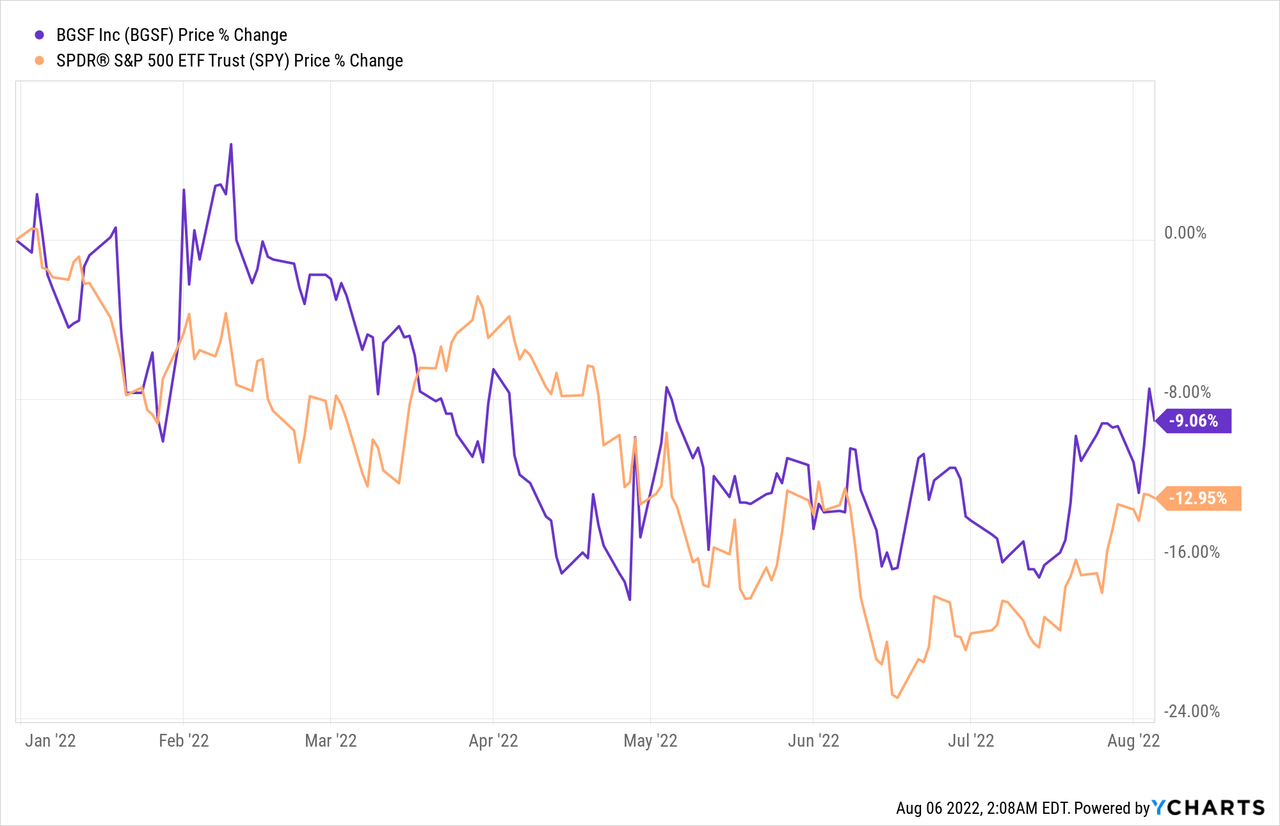

BGSF, Inc. (NYSE:BGSF) (also known as BG Staffing before its name change) is a company that provides specialized staffing services in segments like Real Estate and Professional Services. Despite the current macroeconomic environment, BGSF stock in the past year has shown resilience, as it gained 9.06% YTD while the broader market declined by nearly 13% during the same time frame.

It is my view that BGSF will continue to outperform the market based on the abundance of bullish tailwinds right now: impressive financials from Q2 results, attractive valuation, and more. Let’s dive into the primary drivers for my assumptions, starting off with company activity.

Company Activity

BGSF released its second-quarter results on August 3rd and demonstrated another strong financial performance. For instance, the company beat its EPS expectations by $0.11 (reaching $0.34) and I can strongly say that there are several tailwinds in favor of this company. To start, here is the Chair, President and CEO, Beth A. Garvey, recapping BGSF’s momentous performance despite the heavy inflationary conditions:

We are delighted to report continued momentum with second quarter results, which gives us confidence regarding the U.S. labor market and client demand. Revenues meaningfully improved quarter over quarter, as well as sequentially.

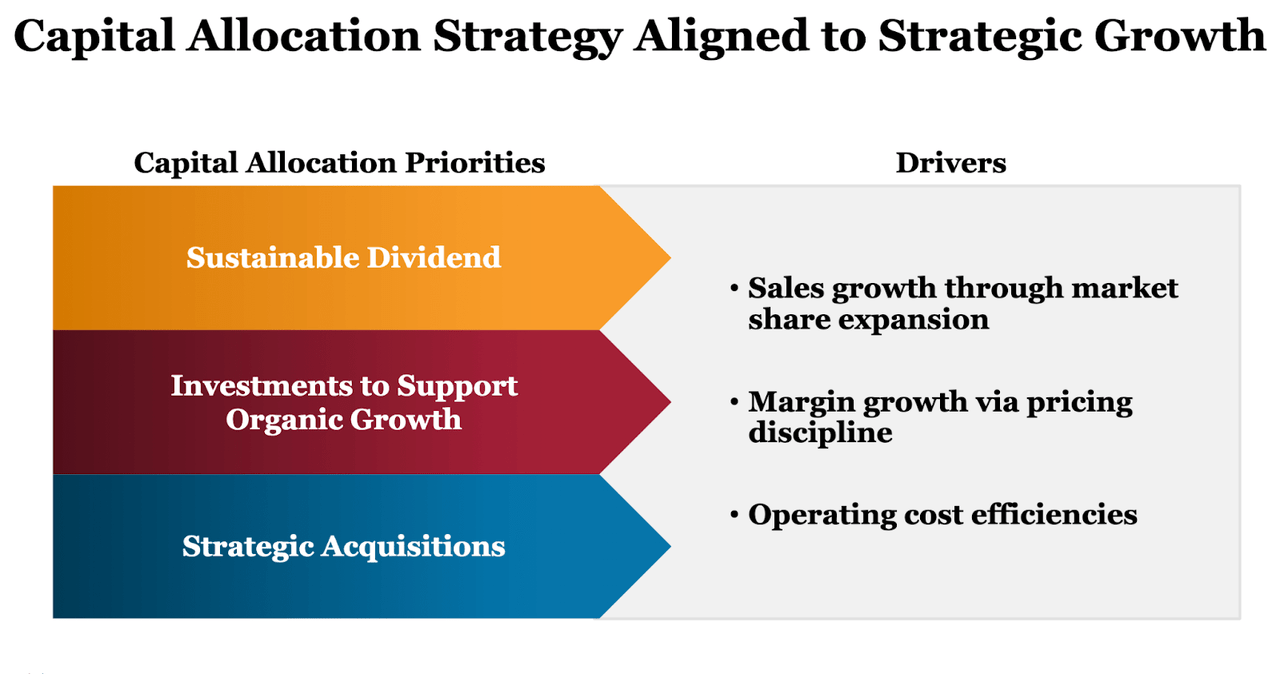

In addition, the company’s primary capital allocation properties for strategic growth have been reaping success. This focused strategy already has positive effects on its results. Mr. Garvey further provides his outlooks on this:

Our longer-term strategy of building and buying higher margin businesses, coupled with identifying additional revenue streams within our segments, are gaining traction this year. Additionally, we remain focused on solving business challenges for our clients and growing our market share through our well-aligned teams.

BGSF Investor Relations Presentation

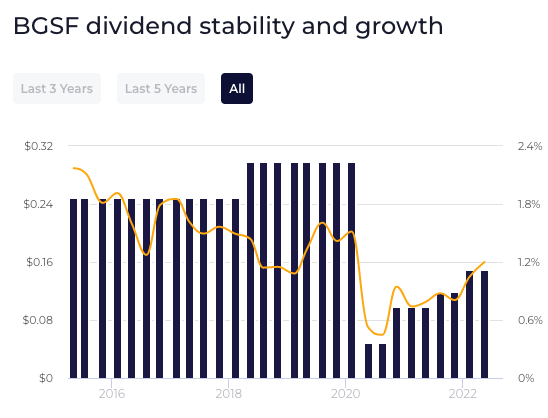

Since BGSF is continuing to produce strong operational results amid this uncertain environment, the company’s dividends are seeing ample recovery after reaching its all-time low during the pandemic—dividends actually grew 73.21% since 2020. The Board of Directors also announced a quarterly dividend of $0.15 per share payable on August 22 with a projected annualized yield to be at approximately 4.70%. To put this into perspective, the company currently has an annualized yield of 4.20% which already puts them in the top 25% of US dividend-paying companies. Furthermore, a strong EPS of $2.81 is more than enough to cover the annual dividend per share of $0.60 with a sustainable payout ratio of 17.40%. Such actions of continued growth and great momentum moving forward makes me believe that BGSF is well-positioned to improve dividend metrics for the foreseeable future and provide constant returns to fulfill investors’ needs.

WallStreetZen

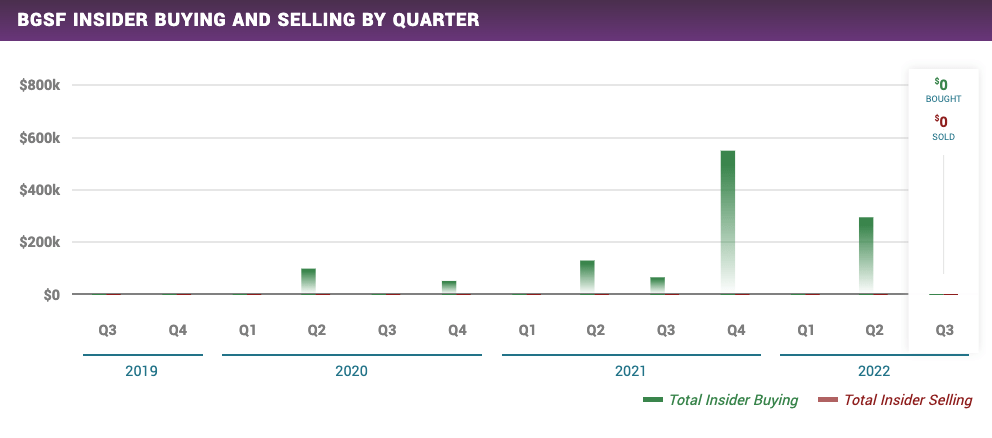

Lastly, it is worth pointing out that there has been tons of insider buying activity within the past 3 years. Insiders recently bought over $900,000 and I believe that this further validates the many bullish tailwinds and insider confidence in the company.

BGSF insider buying activity

Stock Valuation

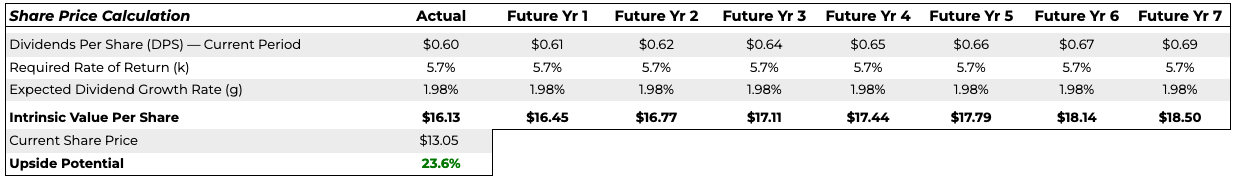

Since BGSF has an attractive dividend yield and is subject to more dividend growth down the line, I decided to use the Gordon Growth Model (GGM) under conservative estimates to provide a baseline valuation. The GGM method works by assuming a constant sustainable dividend growth rate and discounting it back into the current stock price using the required rate of return, which can be summed up into the equation: “value of the stock” = “dividend per share” divided by “discount rate – dividend growth rate”. This method would typically undervalue the stock as the dividend growth is conservatively assumed to be constant.

That being said, I first based my model on a $0.60 dividend per share (i.e., assuming 4 quarters of the most recent payout with no dividend growth) and derived a discount rate of 5.7% from the cost of equity based on a 0.88 levered beta. I am conservatively estimating that dividend growth will be similar to inflation, so I determined the growth rate to be the 5-year average of the 10-year treasury yield. Plugging these three key values, which are reasonable given stable growth trends guided by management, the model results in an intrinsic value of $18.50 per share at the end of a 7-year investment horizon which also is a 23.60% upside from its current price. This shows me that BGSF is still being undervalued by the market and presents itself as a great buy opportunity for investors.

Google Sheets

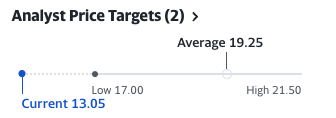

My conservative valuation using GGM is additionally supported by 2 analysts from Yahoo Finance. Their average price target resulted in a mean price of $19.25 and the range spanning from $17.00 and $21.50, providing additional evidence that the stock is currently undervalued by the market.

Yahoo Finance

Risk Headwinds

The biggest risk that I see fit for BGSF is the effects of monetary policy from the Federal Reserve in response to current inflation levels. Annual inflation rates still are accelerating despite the efforts of the government and central bank to reduce them. Kimberly Amadeo from the Balance recaps these increasing rates:

At its July meeting, the Federal Reserve announced that it would be increasing its target for the federal funds rate (the benchmark for most interest rates) by 0.75% to a range of 2.25% to 2.5%.

As a result of this, these increasing regulations and effects of a recession are likely to make it difficult for companies to operate in the Business Services Industry as profits can be substantially reduced and the staffing industry is negatively affected. However, I believe that BGSF is well positioned to tackle these incoming headwinds with its momentum moving forward and its expansionary business strategy to maintain quality services.

Competitor Comparisons

Finally, I am optimistic about BGSF based on its competitive positioning within the Business Services Industry. I created a table below to compare their shareholder return data from Yahoo Finance among competitors like Barrett Business Services (BBSI), HireQuest (HQI), and more.

From this, my table shows that BGSF outperforms all of the companies listed with regard to the dividend yield. BGSF also yielded promising results from a return on equity perspective as it mostly outperformed and ranked comparable with competitors. There is still plenty of growth ahead for BGSF and I strongly believe that BGSF has solid momentum moving forward to outperform the industry.

|

Company |

Ticker |

Dividend Yield |

Return on Equity |

|

BGSF |

4.66% |

16.50% |

|

|

Barrett Business Services |

(BBSI) |

1.49% |

23.45% |

|

HireQuest |

(HQI) |

1.71% |

19.99% |

|

Kelly Services |

(KELYA) |

1.39% |

6.66% |

|

Mastech Digital |

(MHH) |

N/A |

16.34% |

|

Hudson Global |

(HSON) |

N/A |

16.76% |

|

TrueBlue |

(TBI) |

N/A |

15.76% |

Conclusion

BGSF (BGSF) stock after their second quarter announcement is looking like an attractive buy opportunity for investors. Management consistently has been proving to be effective in maintaining strong financial performance and insiders are realizing the huge growth potential as they recently acquired over $900,000 in shares. Redistribution of capital for impressive dividend yields to supplement recovery is all reasons for buying this stock. The results from my GGM model show a 23.60% upside under very conservative assumptions and 2 analysts from Yahoo Finance also lend additional support to this thesis. For all these reasons and more, I recommend a “Buy” for BGSF before the market realizes the true value of the company.

Be the first to comment