xefstock

B&G Foods (NYSE:BGS) is a company that manufactures, sells and distributes a multiplicity of shelf-stable and frozen foods as well as household products. Popular brands include Green Giant, Ortega and Cream of Wheat.

Since the beginning of 2022, the price per share of this company has plummeted 56%, manifesting very high volatility despite belonging to the consumer staples sector. Investing in a company that produces food and household products at first glance may be associated with a low-risk investment, but B&G Foods is an exception in my opinion. In the current macroeconomic environment, I would not be surprised if it reached support positioned at $10.50 per share.

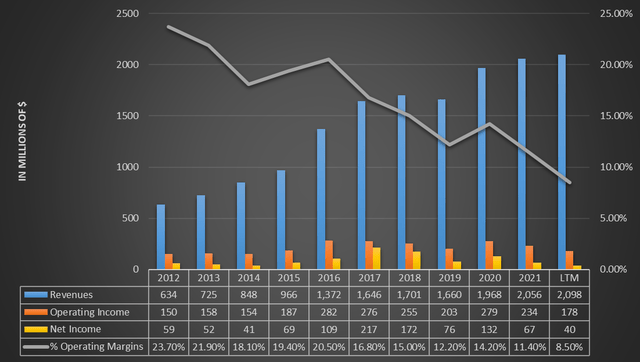

Increasing revenues, shrinking margins

As the first aspect to analyze we have income and operating margin growth.

From this graph, we can see that revenues have achieved steady improvement over time, but the same cannot be said for profits. This is all a consequence of deteriorating margins over time visible through the collapse of the operating margin from 23.70% in 2012 to the current 8.50%. Clearly, B&G Foods is struggling to be as profitable as in the past.

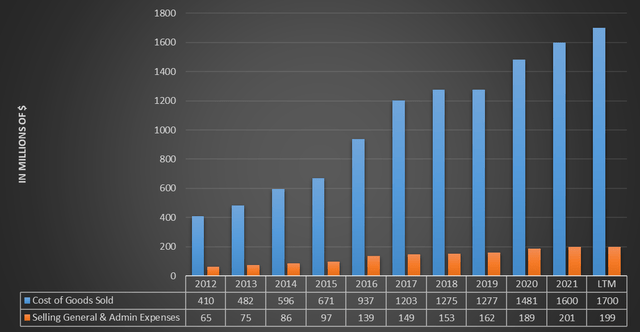

Delving deeper into why margins have shrunk, we can see from this other graph that the main reason is due to the sharp increase in the cost of goods sold not supported by an equally high increase in revenues. In fact, from 2012 to the last 12 months, cost of goods sold has increased by 314% while revenues by only 231%: the differential is what resulted in a drastic drop in margins. This trend has been going on for at least 10 years, and from a short-to-medium-term perspective I do not see how it can be solved in the current macroeconomic environment. The company has been very clear about this:

We have also seen and expect to continue to see material cost inflation for various inputs, including ingredients, packaging, other raw materials, transportation and labor attributable to a number of factors, including the COVID-19 pandemic, the war in Ukraine, climate and weather conditions, supply chain disruptions (including raw material shortages) and labor shortages. We have initiated various revenue enhancing activities (including list price increases and trade spending initiatives) and cost savings initiatives to offset these costs but there can be no assurance at this point of the ultimate effectiveness of these activities and initiatives. To date, our revenue enhancing activities and cost saving measures have not been sufficient to fully offset increases to these costs. To the extent we are unable to avoid or offset any present or future cost increases by locking in our costs, implementing cost saving measures or increasing prices to our customers, our operating results could be materially adversely affected. In addition, if input costs begin to decline, customers may look for price reductions in situations where we have locked into purchases at higher costs.

Summing it up, the company expects the current macroeconomic environment to continue to be adverse, and that it will not be able to transfer the increase in sourcing/operating costs to consumers. Moreover, even if input costs start to decline, the company would find it difficult to reduce the prices of marketed products. For all these reasons, I argue that B&G Foods’ margins are unlikely to reverse their trend, at least in the short to medium term.

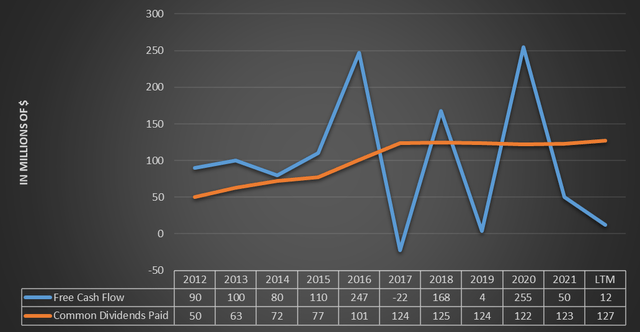

12% dividend yield is not sustainable

The second aspect that makes me not invest in B&G Foods is that I do not find the issuance of such a high dividend sustainable. Reading the latest quarterly report, the company expresses reasonable and reassuring concepts about the dividend policy but that is not reflected in the facts. Here are the company’s statements:

Our dividend policy reflects a basic judgment that our stockholders are better served when we distribute a substantial portion of our cash available to pay dividends to them instead of retaining it in our business. Under this policy, a substantial portion of the cash generated by our company in excess of operating needs, interest and principal payments on indebtedness, capital expenditures sufficient to maintain our properties and other assets is distributed as regular quarterly cash dividends to the holders of our common stock and not retained by us.

All correct, but the numbers say otherwise.

The dividend has more than doubled since 2012, but free cash flow has never reached a continuity to support the issuance of such a high dividend from 2017 onward. Moreover, it can be clearly seen that since 2017 the growth of dividend issued has stopped, while in the previous 5 years the company was not afraid to increase it by double digits every year. Personally, I do not think the day is far off when this company will declare a dividend cut, but now it seems that it is not willing to back down. Issuing a dividend of a larger amount than the company can produce is destructive behavior, as it results in a constant weakening of the capital structure. The reason B&G Foods is continuing on this path anyway may be due to their desire to attract as many investors as possible, especially those who are eager to get a very high dividend from their investments. However, investors need to examine how sustainable this is, as it is clear that no company can last long if it shells out more than it earns. Finally, it should be pointed out that free cash flow is not only used to issue dividends, but also has other roles such as making buybacks, acquisitions, and reducing debt. Regarding the latter, I consider it much more important than the dividend itself, and in the next section I will explain why.

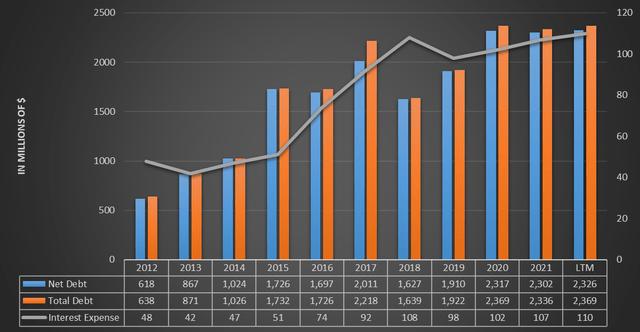

Dangerous Debt

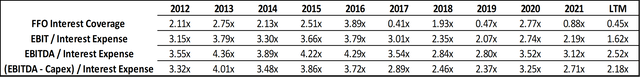

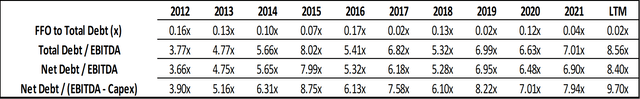

Net debt has gradually increased and along with it the cost of interest, further affecting the reduction in marginality. The most worrying aspect related to debt, however, is not its increase but the worsening of its sustainability. Here is in detail how B&G Foods manages to cope with total/net debt and related interest.

Cash flows generated from ordinary activities are not sufficient to cover the cost of interest, and we can see this from the FFO Interest Coverage ratio that is well below unity: this is quite concerning. Also, an EBIT/Interest Expense ratio of 1.62x is rather low and does not give a margin of safety needed to succeed in easily paying interest. While higher than unity, even for this ratio my opinion is negative. In the past, FFO interest coverage easily exceeded 2x, while EBIT/Interest Expense exceeded 3x: as time has passed there has been a deterioration.

Comparing income results with total debt, the result does not change: in the past, debt was more sustainable. EBITDA for the past 12 months is 8.5 times less than total debt, in 2012 only 3.7 times. If we excluded Capex from EBITDA, we would reach almost double digits. In my opinion this is not currently an unrecoverable situation, but it certainly needs to be monitored as B&G Foods struggles to improve its free cash flow and EBIT.

In light of these considerations, if I were a shareholder in this company I would be happier to see a substantial reduction in debt than to get a 12% dividend yield with questionable sustainability. My impression is that management is thinking more about meeting short-term needs such as remunerating shareholders rather than pursuing long-term balance. Of course I could be wrong, reasonable criticism is welcome.

Price multiples

Even if a company is in a difficult situation does not mean that it cannot be a good investment. However, I personally do not think this is the case with B&G Foods, let’s see why.

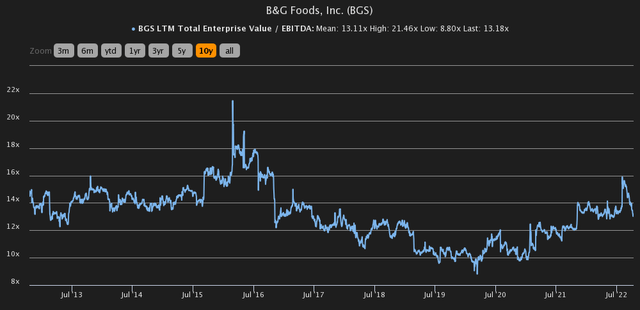

The current EV/EBITDA (13.18x) is in line with the average EV/EBITDA (13.11x) for the past 10 years, thus not registering an undervaluation based on past values.

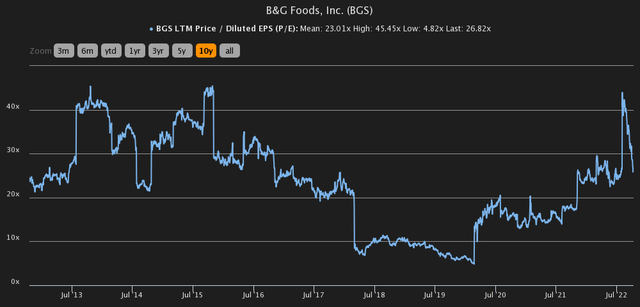

An LTM P/E of 26x for B&G Foods is too high in my opinion for the following reasons:

- A strong competitive advantage is not present, and the decreasing margins testify to this.

- The company does not have high growth expectations. The current macroeconomic environment certainly does not help.

- The company’s margins are not high at all.

What is more, the current P/E is higher than the average P/E (23.01x) for the past 10 years. I cannot find a reason to buy this company at such high multiples.

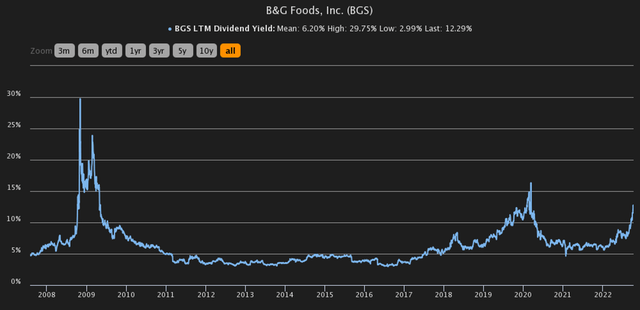

If we looked at the dividend yield, B&G Foods would be considered undervalued. The current dividend yield (12.29%) is almost double the historical dividend yield (6.20%); with the exception of the great financial crisis and the pandemic outbreak, the current figure is the highest in 15 years. The problem, however, is that the issuance of such a high dividend is not a foregone conclusion as I have expressed several times in this article, and in the event of a cut, the dividend yield would be reduced.

Latest Thoughts

My overall opinion of this company is rather negative, especially considering that it is a consumer staples. Companies in this sector should provide predictable cash flows and sustainable dividends to face even the darkest economic periods, and that’s not the case with B&G. The main weakness is not related to revenues, which are growing year after year, but to the dangerous reduction in operating margin that does not allow debt reduction: years ago, debt was more sustainable. Finally, I don’t agree with continuing to issue a huge dividend when that cash can be used to make a strategic acquisition, reduce debt, or anything else that serves to lay the groundwork for a better future. These are just my thoughts on the matter, I don’t doubt that I could be wrong.

Be the first to comment