Drew Angerer/Getty Images News

Even if we weren’t in the midst of a huge growth-stock correction that has sliced down many high-flying names due to weakened sentiment alone, Beyond Meat (NASDAQ:BYND) would still be in hot water. The once-popular meat alternative has seen both consumer and investor confidence in the company plummet to surprising new lows.

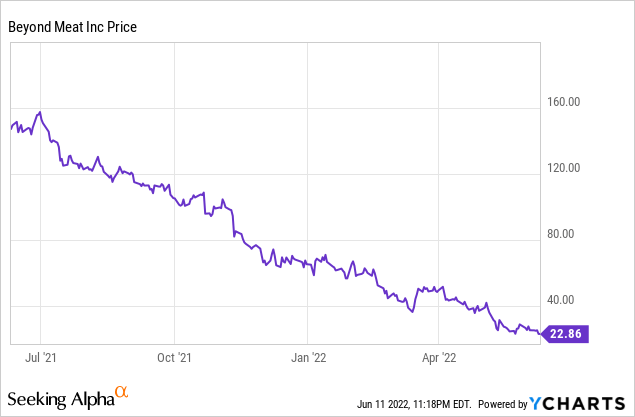

Year to date, Beyond Meat has seen its stock price plummet by a breathtaking 65%. It’s difficult to believe that at one point during the pandemic (yes, during the pandemic, when Beyond Meat’s food service sales plummeted due to shuttered restaurants!) this stock was once worth north of $175 per share.

In light of the continued worsening of Beyond Meat’s fundamentals to new lows, I’m downgrading my view of the stock to very bearish/strong sell. We’ll go through more details shortly, but the key reasons why Beyond Meat is in such a precarious position at the moment:

- Very weak demand. Beyond Meat can barely hold onto flat y/y growth. Especially in this inflationary environment, consumers are tightening their belts: meaning they are eating out less, as well as buying cheaper alternatives at the grocery store. This bodes poorly for expensive plant-based meats.

- Gross margin decay driven by price cuts. In an effort to try to spur customer demand and take market share from traditional meats, Beyond Meat has sliced its pricing across the board. This is competitor-driven as well; Impossible Foods last year cut the prices of its staples like plant-based patties by 20%.

- Liquidity in question. Beyond Meat’s widening losses has also bled over into steep cash burn, and with the company already stacked with debt, it’s unclear how much longer Beyond Meat can hold out without needing to raise additional capital (which will be tough, as the company is already indebted, and its diminished stock makes an equity raise look very unappealing).

I struggle to see any near-term catalysts that can save Beyond Meat from its current fate. I continue to hold fast to the belief that plant-based meats were a passing fad. Though there are certain to be some diehard fans who will continue to use Beyond Meat products as staples of their diet, it’s likely that the average consumer has flirted with trying plant-based meats and ultimately passed on making it routine. And with the fad getting much less coverage in social media and in mainstream news, it makes it much less likely for something like Beyond Meat to obtain a resurgence in popular support. This is on top of continued concerns that plant-based meats may not necessarily be the healthier alternative, after all (due to the extra amounts of sodium required in the product to achieve a similar umami taste as standard meats; see article here).

The bottom line here: Beyond Meat is a very dangerous stock to hold onto. There may have to be consolidation in the industry to save the individual players, but at the moment without any outside intervention or a sharp shift in consumer behavior, it’s difficult to see Beyond Meat spurring a recovery.

Q1 Recap

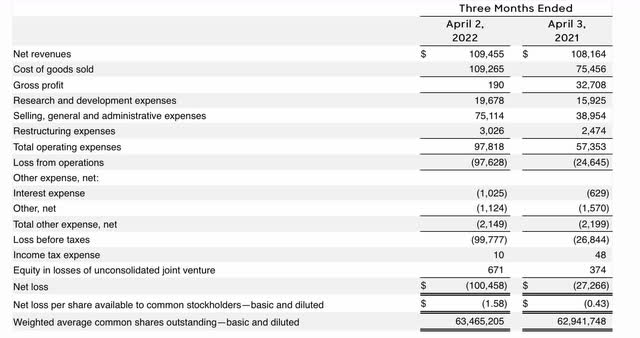

Let’s now highlight all the major red flags from Beyond Meat’s fiscal first-quarter results, released in mid-May. The Q1 earnings summary is shown below:

Beyond Meat Q1 results (Beyond Meat Q1 earnings release)

In Q1, Beyond Meat’s revenue was essentially flat, or +1% y/y, to $109.5 million. This missed Wall Street’s expectations of $111.7 million, or +3% y/y.

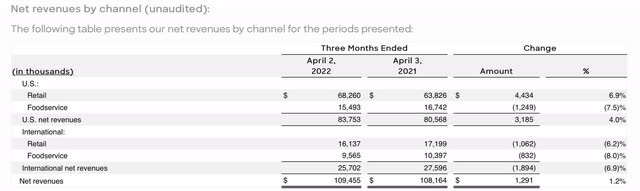

Looking at the revenue trends by channel is a bit surprising. First, note that U.S. retail sales were up only 7% y/y – reflecting the failure of the company’s price cuts in grocery stores to drive meaningful growth. International retail sales, meanwhile, continued to be down – driven by geopolitical turmoil in Europe and COVID outbreaks in Asia.

Beyond Meat Q1 revenue breakdown by channel (Beyond Meat Q1 earnings release)

The company’s CEO, Ethan Brown, commented specifically on retail sales weakness on the Q1 earnings call:

In U.S. retail, we saw an increase of 7% in net revenue. However, looking at SPINS takeaway data for the 12-week period ended March 20, our brand saw a decline of 3.3%, excluding Turkey versus a category increase of 2.8%. We believe this result is driven by four main factors: first, broader softness in the natural and specialty channel continues, and we over-indexed in this channel relative to the category. For context, total category sales in Natural & Specialty declined 7.5% year-over-year during the 12-week period compared to a 4% increase in MULO.

Second, across SPINS channels, MULO plus Natural and Specialty, we saw a shift in consumer purchase from refrigerated to frozen. Refrigerated plant-based meats, where we are heavily represented, were down 3.6% but frozen plant-based meats were up 7.2%. This change from refrigerated frozen in part reflects increased consumption of plant-based chicken in the frozen section versus plant-based beef in the refrigerated section.

Third, we faced increased competition in the category. Nonetheless, we are encouraged that Beyond Meat remains the number one brand in refrigerated plant-based meats. Our brand velocity, which was 2.4x greater than the category average, ranked highest among any of the top 25 plant-based meat brands.

And lastly, fourth, we increased our promotional spending resulting in lower net revenue per unit sold. This increase in discounting in part reflects competitive dynamics in the category. However, the main strategic driver for us with regard to price continues to be our own price parity goals, informed by the aforementioned cost-down program.”

What is additionally surprising, however, is that food service revenue is down, down -7.5% y/y in the U.S. and -8.0% y/y internationally. We are now in the post-pandemic period, with most restaurants open (versus many restaurant closures persisting at this point last year) – this is a reflection of shifting consumer tastes. Plant-based meats are no longer an interesting novelty when dining out; and indeed when people are eating out, they may choose tastier options than a Beyond Meat burger.

Adding insult to injury: Beyond Meat’s gross margin slid to zero this quarter, driven both by inflationary cost pressures plus its decision to cut prices. This is substantially weaker than a 30% gross margin in the year-ago quarter. There’s no way to understate this: it’s unclear how Beyond Meat intends to run a business at a zero gross margin. Now, Beyond Meat attributed 940bps of margin weakness this quarter to its early-stage scale-up of Beyond Jerky – but even so, a single-digit gross margin (if this product ever gets past nascence; it’s unclear if there is really a strong market for plant-based jerky) is not enough to sustain a company with such high fixed expenses.

Adjusted EBITDA in Q1 swelled to -$78.9 million, representing a -72% adjusted EBITDA margin – a full 62 points weaker than the year-ago Q1.

Beyond Meat adjusted EBITDA (Beyond Meat Q1 earnings release)

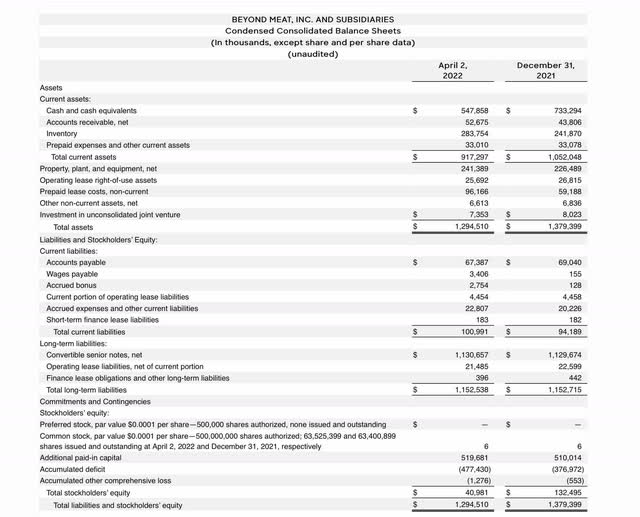

And as previously noted, we need to keep a close eye on Beyond Meat’s balance sheet, which currently has only $547.9 million of cash against $1.13 billion of debt.

Beyond Meat balance sheet (Beyond Meat Q1 earnings release)

In Q1, Beyond Meat burned through -$165.2 million of operating cash flow. Held at a steady run rate, Beyond Meat would run out of cash by the end of the year and be forced to raise capital on very expensive terms to stay afloat.

Key Takeaways And Potential Upside Risks

Beyond Meat is facing a confluence of disastrous circumstances: waning customer demand, huge inflationary pressures, unsuccessful price cuts, and a razor-thin balance sheet to support continued losses.

There are some (unlikely) upside drivers that could pose risk to my bearish thesis. The most prominent one is the potential of an acquisition at a premium. To me, however, the most potential likely outcome would be a merger of two similarly-struggling plant-based meat companies – and such a deal would likely be an exchange of stock that won’t give immediate upside to current shareholders. Fundamentally, another possibility is that Beyond Meat’s latest point-of-sale expansion efforts into more retailers and grocers could drive additional volume and economies of scale to start turning margins around. So far, however, we’ve only seen relatively sluggish revenue trend

Overall, in my view, there’s little that can be done to save this company. Continue to stay wary on the sidelines here.

Be the first to comment