Feverpitched

Preparing for a recession scenario

As we have heard multiple times over the news and by market experts, the global economy looks poised to slow down and the recession is fast approaching. The Federal Reserve is relentless in their approach to achieving their 2% inflation target by continuing to raise rates to slow growth in the near-term.

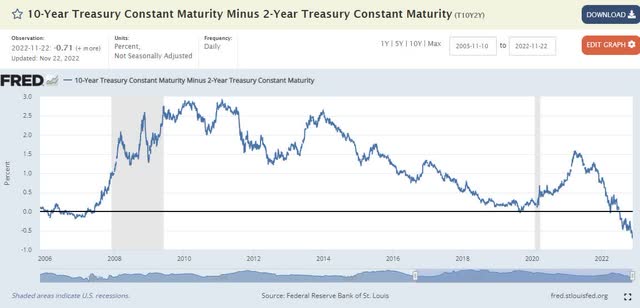

The yield curve inversion, the commonly regard signal for an impending recession, is flashing red and at the strongest it has been over 40 years. I illustrate below that the yield curve inversion is now stronger than it was before the 2008 global financial crisis.

Worst yield inversion in more than a decade (St Louis FED)

In addition, there are a chorus of top businessmen that have warned of an impending recession, including Tesla’s (TSLA) Elon Musk and Amazon’s (AMZN) Jeff Bezos.

As such, I think that it would be wise for investors to be positioning their portfolios for an impending recession, and to ensure that they are in stocks that can do relatively well during recessions. These may be companies with idiosyncratic growth factors that are not affected by the global economy, or companies that are defensive in nature, selling essential products and services that are still needed during a recession.

Recession stock 1: Microsoft

Microsoft (MSFT) has built a business model that is largely unaffected by a recession, given its low exposure to B2C segments. As can be seen below, the Productivity and Business Processes segment and Intelligent Cloud segment continued to grow 15% and 26% in FY1Q23 on a constant currency basis, while the only weaker segment was the More Personal Computing segment, which grew 3% on a constant currency basis in the FY1Q23 quarter. As a result, 74% of the business are more resilient to a recession scenario and will likely continue grow even as global growth slows, while 26% of its business is slightly more affected by the recession scenario, although I will elaborate below that only 6% of the business is more exposed to the business cyclicality.

Microsoft 1Q23 business segment results (Microsoft IR)

I will now attempt to delve deeper into each segment to demonstrate the resilient nature of the Microsoft business model.

Resilient recurring revenue business model

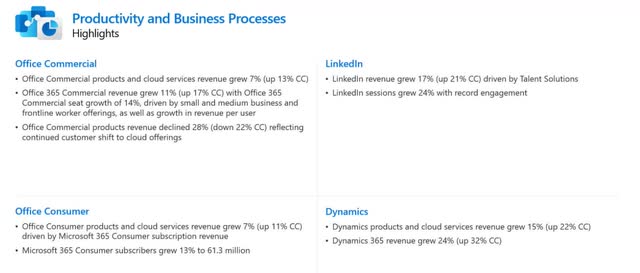

In the Productivity and Business Processes segment, we can see that LinkedIn and Dynamics both grew more than 20% on a constant currency basis, while Office Commercial and Office Consumer still remained resilient and grew more than 10% on a constant currency basis. Office 365 Commercial and Microsoft Office 365 Consumers were the main drivers of Office Commercial and Office Consumer segments respectively, and I continue to take the view that Microsoft’s 365 subscription model brings consistent, recurring revenues to Microsoft in a world where there is lots of uncertainty today. There are more than 61 million Microsoft 365 Consumer subscribers today and this business model has made the consumer segment of Office more durable and resilient.

Productivity and Business Process segment remains resilient (Microsoft IR)

Intelligent Cloud is relatively straightforward as it mainly involves Microsoft Azure as its main driver. Microsoft Azure, although showing deceleration, continued to post a rather respectful 42% growth on a constant currency basis in FY1Q23 as demand for Microsoft’s cloud offerings continue to grow. In my opinion, Microsoft’s Azure segment is its crown jewel for the company’s next phase of growth as companies continue to shift to the cloud and demand for Microsoft’s consumption-based services will continue to increase. Therefore, I continue to believe that the business will continue to grow in a slowing economy.

Intelligent Cloud driven by Azure (Microsoft IR)

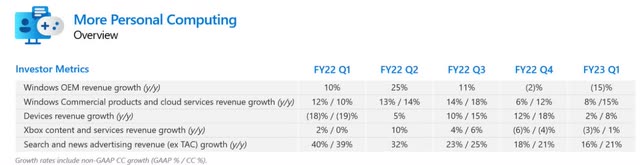

Last but not least, Microsoft’s More Personal Computing segment is probably the one to watch in a recession scenario as it does not involve recurring business models. Of interest, the Windows OEM segment brought the weakest growth in FY1Q23 Aas it contracted 15% in the quarter. Windows OEM basically refers to the part of its business where it provides a license to manufacturers for Windows to be installed in their new devices. As a result, this is a one-off revenue model that is affected by the cyclicality of the personal computer market. As the PC market is in a downturn this year, this segment will likely be negatively affected by the lower PC demand as well. To put this into perspective, this segment only contributed to $3 billion in sales for the FY1Q23 quarter, which saw total revenues across all segments of $50 billion, translating to a 6% contribution to revenue mix.

Microsoft’s More Personal Computing segment (Microsoft IR)

Risks

The main risks surrounding Microsoft is the recession will likely test the extent to which Microsoft’s recurring revenue business model is truly a sticky business model. If subscribers end up cancelling their 365 subscriptions, the business model may not prove to be as resilient as it is thought to be.

I have covered Microsoft in an earlier article, including the valuation and target price for Microsoft, which I think is relevant for those of you considering Microsoft as your recession stock pick.

Recession stock 2: SentinelOne

While many other discretionary spending will be cut during the impending recession, cybersecurity remains one area that is a priority and deemed essential in the minds of many C-suites as it pertains to business resilience.

My top recession pick for the recession scenario will be one that continues to have very strong growth due to its relative smaller size, providing investors with an idiosyncratic growth opportunity to benefit from, and the company is called SentinelOne (S).

I have done a deep dive on SentinelOne in an earlier article, which can be found here.

Investment case

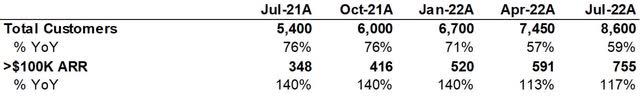

To me, in the most recent quarter ending in July 2022, I liked that the large customer growth continued to be very impressive even as the cybersecurity industry is warning of budget scrutiny. The 117% growth seen in the recent quarter for large customers reaccelerated relative to the prior quarter and continued to provide evidence that business momentum is strong at SentinelOne as demand remains resilient.

SentinelOne large customer growth (Author generated; SentinelOne IR)

Revenues continued to show hyper growth in the recent July 2022 quarter, as revenue growth came in 124% higher than the prior year and it was up 31% sequentially from the prior quarter. The company continued to show resilience in the business despite macroeconomic uncertainties, which further proves that SentinelOne is able to provide the best-in-class protection and superior platform value.

In particular, what makes SentinelOne such a great stock to own during a recession is its ability to take over market share from current legacy cybersecurity incumbents like McAfee, Trend Micro (OTCPK:TMICF), amongst others. This is a great position to be as SentinelOne operates within a market that continues to post strong growth while at the same time taking market share from legacy vendors.

Lastly, SentinelOne’s key value proposition is its technology, and it was regarded as leader by Gartner in Endpoint Protection Platforms due to its strong execution, innovation and protection. This will enable SentinelOne to continue to gain share from other players in the market as it continues its path of strong growth in the future.

Magic Quadrant for Endpoint Protection Platforms (Gartner)

Risks

The main risk surrounding SentinelOne is expectations as the current expectations around the company is high and if management does not execute as well as expectations, this may lead to weakness in the stock.

Recession stock 3: FREYR Battery

Another company that is unlikely to be adversely affected by a recession is FREYR Battery (FREY). For FREYR Battery, the next year or two is about execution and ramping up of production, which makes the company relatively unaffected by a recession.

FREYR Battery is a developer of clean, next generation battery cell production capacity, with plans to have its first Giga Arctic in Norway and its second Giga America in Georgia in the United States.

I have written multiple articles about FREYR Battery, that can be found here.

Large number of off-take agreements

FREYR Battery currently has 130 GWh of off-take agreements, which includes both conditional and firm off-take agreements. Recently, FREYR Battery also said that they have a legally binding 38 GWh firm sales agreement with Nidec (OTCPK:NJDCY) until 2030. With Giga Arctic’s expected manufacturing capacity eventually reaching 29 GWh, this recent conversion of a large sales agreement is very much a good sign for the utilization of FREYR Battery’s manufacturing capacity in the future.

Differentiation in technology without long and costly R&D

FREYR Battery signed with 24M a licensing agreement that allows them to use the company’s innovative lithium-ion battery manufacturing process for mass producing battery cells. The 24M process helps to reduce costs of production and improve the performance of the battery as well as makes it easier to recycle.

Riding wave of battery demand and supply chain localization

In my view, FREYR Battery benefits from 2 main tailwinds. First, the battery supply chain has been heavily dominated by Asian players, particularly those in China. As a result, FREYR Battery has a strong positioning as a European player, with its locations in the United States and Europe, enables these countries to improve localization of their battery supply chain and reduce reliance on Asia. Second, there is no doubt that the electric vehicle boom has resulted in a shortage of lithium-ion batteries needed not just for electric vehicles, but also the much-neglected ESS segment. FREYR Battery has attracted large ESS customers and plugged the demand gap as it seeks to bring in substantial supply in the future.

Even in a recession scenario, with the continued exponential growth in demand for lithium-ion batteries for the electric vehicles and ESS market, as well as the prioritization of supply chain resilience today, I am of the view that FREYR Battery could bring idiosyncratic opportunities in the near-term

Risks

The main risk for FREYR Battery is the need to execute well and ramp up production and if it does not go according to the timeline and schedule management planned, there could be reduction confidence in the ability of the company to execute according to its strategy.

Recession stock 4: Waste Management

Waste Management (NYSE:WM) may not be a very popular stock, but it has a defensive business model that has both pricing power and a resilient earnings profile.

Waste Management is a leading waste management environmental services company operating in the United States and Canada. It operates and owns more than 260 landfill sites, the largest network in North America. Waste Management is also a leading recycler in North America, handling materials like plastic, metal, glass etc.

Duopoly market structure creates pricing power

Waste Management and Republic Services (RSG) are the two largest players in the waste management industry, occupying 480 landfills out of the 2,627 landfills across the US. This translates to 18% of total landfills in the US. As a result of a strong industry position as well as high barriers to entry, Waste Management has strong pricing power that is able to offset the increasing inflationary pressures we see today.

Resilient and defensive earnings profile

Waste Management’s business comprises of collection, landfill, transfer and recycling services. These segments are not affecting by the business cycle, nor are they affected by macroeconomic uncertainty. As a result, the company’s business can be regarded as “essential” or like a staple that is required regardless of market cycles.

Valuation

My 1-year target price for Waste Management is $195, implying an upside potential of 20% from current levels. This is based on a 16x 1-year forward EV/EBITDA.

Risks

Since municipal solid waste volume growth is driven by housing, a slowdown in new housing may affect sales growth and put downward pressure on the stock.

Conclusion

To prepare for a recessionary scenario in 2023, the stocks that I am watching are those with defensive businesses, with idiosyncratic opportunities, and could continue to drive growth even in a global economic slowdown. These are big tech firm Microsoft, hypergrowth cybersecurity firm SentinelOne, battery producer FREYR Battery and environmental services company Waste Management.

*Author’s note: I am starting a marketplace service, Outperforming the Market, which will be launching on 10 Jan 2023. Outperforming the Market aims to help investors identify high conviction growth and value stocks to form a barbell portfolio that outperforms the market.

Mark your calendars, because early subscribers can reserve a spot as a Legacy Discount Member, which gives you generous introductory prices. Thank you for reading and following my work. See you there!

Be the first to comment