wutwhanfoto/iStock via Getty Images

Underlying Security Symbol: QCOM, NUE, AA, BBY, AAPL, DOW, PSX

The quarter ends today and I looked at the calls I wrote year-to-date. I’m interested in looking at which stocks created the most income from call premiums during the quarter. As my premise that concentrating your holdings provides for more opportunity to create income and yet maintain a position in those stocks around which you want to build your income portfolio

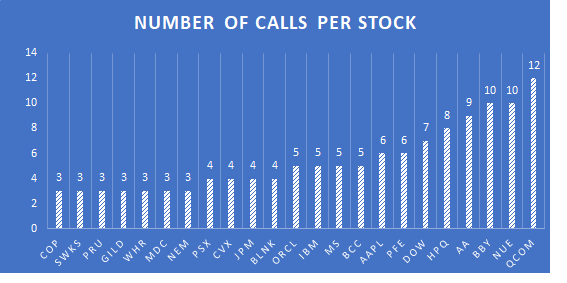

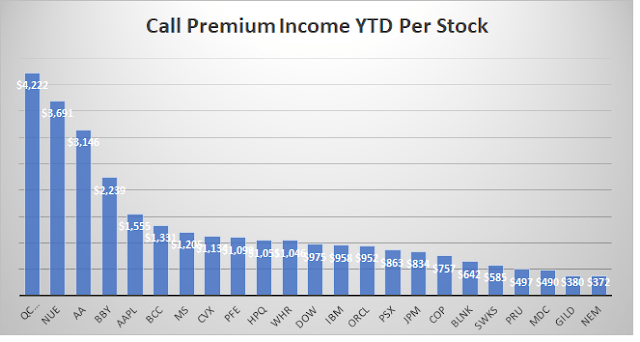

I sold 140 calls year-to-date. I sold them on 25 different stocks. I created $33,000 of call premium income. 24% of that income came from just two stocks and the next 20% came from three additional stocks. The chart below shows the number of calls per stock but I parsed the data to include only those stocks on which I sold 3 or more calls.

The first of the two stocks that created the most call option income is Qualcomm (QCOM). Qualcomm is a chipmaker and is doing poorly from a capital gains point. It pays a 1.72% dividend yield. Even though chip makers are under pressure, I have been able to sell calls, and although a few have been assigned, I continue to maintain a significant position on which I intend to continue to sell calls.

The second of the two stocks is Nucor (NUE). Nucor is a steel company. It is doing very well and pays a .87% dividend yield. As an income investor, I need NUE to create significant call premium income; otherwise, I am wasting a chunk of money that could be creating more income. NUE has been more active than QCOM, many contracts have been assigned and I have had to add to maintain a position. Due to the demand for steel, I will stick with this holding as long as the calls are good.

The next three stocks are Alcoa (AA), Apple (AAPL), and Best Buy (BBY). Like Qualcomm, and Nucor, Alcoa and Apple pay paltry dividends but Best Buy pays a better yield just above 2%.

The chart below shows the income per stock on those positions where I sold 3 or more calls.

Five stocks are high dividend yielders. These are: IBM (IBM) 4.97%, Gilead (GILD) 4.72%, M.D.C. (MDC) 4.6%, Phillips (PSX) 4.36%, and Dow (DOW) 4.36%. IBM, Gilead and MDC are dead money so being able to boost income above and beyond the dividend is important to me. Each of these three has a chance to deliver capital gains. We get paid nicely to wait which makes them a hold for me.

PSX and DOW are true winners. The catalyst for their growth is energy for PSX and chemicals for DOW. All are in demand right now. PSX and DOW are a strong hold for me and I may accumulate to make sure I maintain a position while still boosting my income from call premiums.

It is notable that the concentration of call frequency and call income does not seem to correlate to dividend yield. I do think this assessment confirms my thesis that having multiple options on a single position is valuable. Better to sell calls on 20 or 25 stocks than one call on 80 stocks.

Use covered calls to boost your income. MoneyMadam MM

Data from Schwab.com and Marketxls

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment