Drew Angerer/Getty Images News

By Valuentum Analysts

We are huge fans of Warren Buffett and view Berkshire Hathaway’s (NYSE:BRK.A) (NYSE:BRK.B) capital appreciation upside potential quite favorably. Recently, Buffett (CEO and Chairman of Berkshire) released his latest annual letter to shareholders, which included plenty of important information regarding the conglomerate’s financial performance and investing practices at large. Shares of BRK.B are trading near their all-time highs as of this writing, and we see room for its stock to climb even higher.

Overview

One of the things that stuck out in Buffett’s latest annual letter to shareholders, a topic that he has brought up often in the past, is his belief in betting on America. In the letter, Buffett notes that “our country would have done splendidly in the years since 1965 without Berkshire. Absent our American home, however, Berkshire would never have come close to becoming what it is today.” For reference, Buffett took control of Berkshire back in 1965.

We are also big believers that the number one place for investors to be invested is in U.S. equities. Specifically, large cap U.S. tech stocks with “moaty” business models, fortress-like balance sheets, incredible free cash flow generating abilities, and growth outlooks underpinned by secular tailwinds represent some of our favorite ideas alongside U.S. energy giants (a shorter term tactical play in the face of the ongoing inflationary environment) and high-quality U.S.-focused firms like Berkshire. We appreciate Buffett’s longstanding commitment to utilizing discounted free cash flow analysis to locate and invest in undervalued enterprises based in the U.S.

We value Berkshire Class B stock at $384 per share at the upper end of our fair value estimate range. Please note that under our “base case” scenario, we give Berkshire Class B stock a fair value estimate of $320 per share, though given the company’s rock-solid performance of late, it is outperforming our base case assumptions by a significant margin.

The First Two Of Berkshire’s Four Giants

Berkshire refers to its largest business operations and marketable security holdings as its “Four Giants” or “Big Four.” Understanding these different segments of the conglomerate’s business is essential to gauging why Berkshire’s capital appreciation upside is considerable.

The first of its four giants is its various insurance businesses. Berkshire “effectively owns 100% of this group” which includes GEICO (primarily offers auto insurance policies in the U.S.), Berkshire Hathaway Primary Group (a collection of independently run insurance companies offering a wide array of insurance policies, primarily in the US), and Berkshire Hathaway Reinsurance Group (a collection of firms that offer a wide array of reinsurance policies in two dozen countries). Most of Berkshire’s insurance operations are focused on the U.S., and the company primarily uses the related insurance float to invest in the equity of high-quality enterprises.

On March 21, Berkshire announced it was acquiring Alleghany Corporation (Y) for $848.02 per share in cash through a deal worth $11.6 billion by equity value. Alleghany provides property and casualty insurance and reinsurance services, including specialty insurance services, and also owns non-financial businesses through its wholly-owned Alleghany Capital unit. The deal is expected to close by the fourth quarter of 2022. We appreciate that Berkshire is putting part of its vast cash hoard to work, though the conglomerate still has ample financial firepower on the books even after taking this acquisition into consideration.

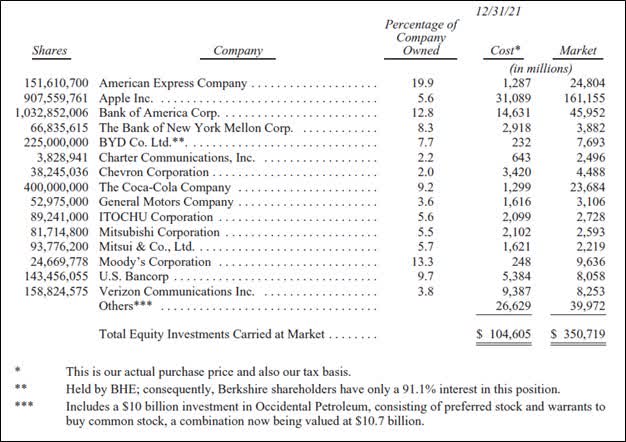

That gets us to Berkshire’s second giant, its enormous equity stake in Apple Inc (AAPL). As of the end of December 2021, Berkshire owned almost 908 million shares of AAPL that had a cost basis of $31.1 billion and a market value of $161.2 billion. Buffett noted in Berkshire’s 2021 letter to shareholders that at times it can be easier to acquire “pieces of wonderful businesses at wonderful prices” when acquiring equity stakes in publicly traded companies as compared to outright purchases of a company, especially as deal-making premiums have been quite generous in recent years.

As an aside, we are huge fans of Apple’s capital appreciation potential and dividend growth story. We covered our thoughts on Apple in a Seeking Alpha article that was published back in February 2022 which can be viewed here.

Berkshire also owned a sizable equity position in another firm that has done exceptionally well of late, Chevron Corp (CVX), and had sizable equities holdings in Coca-Cola Co (KO) and Moody’s Corporation (MCO) along with various other entities at the end of December 2021.

Additionally, Berkshire owned sizable equity stakes in Kraft Heinz Co (KHC) and Pilot Travel Centers LLC at the end of last year through equity method accounting practices. In 2022, Berkshire has been steadily acquiring a sizable equity position in Occidental Petroleum Corporation’s (OXY) common equity, on top of the large preferred equity position Berkshire already owned in the integrated U.S. oil & gas firm at the end of last year.

An overview of Berkshire’s largest equity holdings as of the end of December 2021. (Berkshire – 2021 Annual Report)

In the recent past, Buffett noted that competing with special purpose acquisition companies (‘SPACs’) for deals is not viable when it comes to shareholder value creation which is why Berkshire has a large cash-like position on its balance sheet. Put another way, it has been hard for Berkshire to locate a large company that it could acquire for a reasonable price (meaning at a discount to its intrinsic value according to Berkshire’s calculations) given the competition from investment vehicles with arguably questionable conflicts of interest.

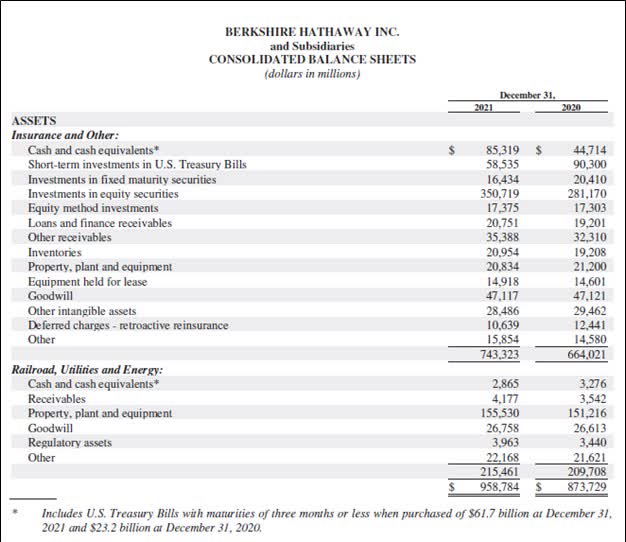

At the end of December 2021, when excluding the cash holdings of Burlington Northern Santa Fe (‘BNSF’) and Berkshire Hathaway Energy (‘BHE’), Berkshire had ~$144 billion in cash-like assets on the balance sheet including ~$120 billion in U.S. Treasury bills that are maturing in less than a year. Its deal for Alleghany represents an example of Berkshire attempting to find good deals that will generate shareholder value, though compared to its cash-like holdings, the recent acquisition is relatively modest in size.

Buffett noted in his latest annual letter to shareholders that he and his business partner Charlie Munger (vice chairman of Berkshire) “will always hold more than $30 billion of cash and equivalents” on the balance sheet when including the cash holdings of BNSF and BHE, though clearly the firm’s current cash-like position easily exceeds that threshold. At the end of December 2021, Berkshire’s ‘Railroads, Utilities and Energy’ operating segment had $2.9 billion in cash equivalents on hand to enable the industrial entities included in this group to meet their immediate financing needs.

Berkshire had an enormous cash-like position on its balance sheet at the end of December 2021. (Berkshire – 2021 Annual Report)

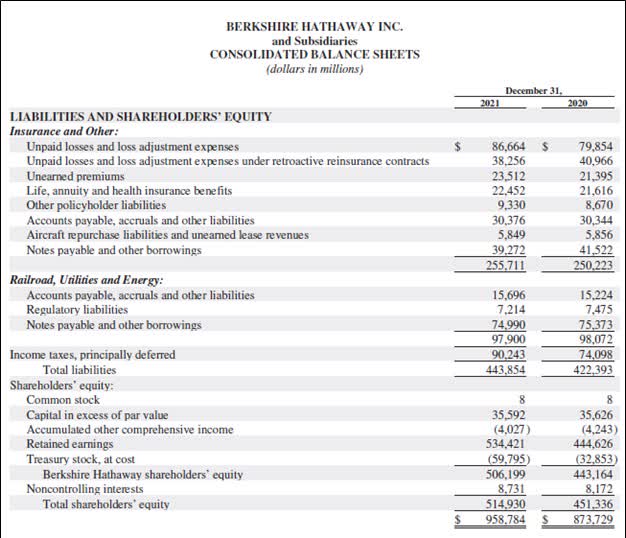

Please note that beyond Berkshire’s total debt load (which inclusive of short-term debt stood at ~$114 billion at the end of December 2021), it has substantial non-cancelable liabilities on the books as one can see in the upcoming graphic down below.

Berkshire has substantial liabilities on the books to be aware of, primarily a product of its large insurance and industrial operations. (Berkshire – 2021 Annual Report)

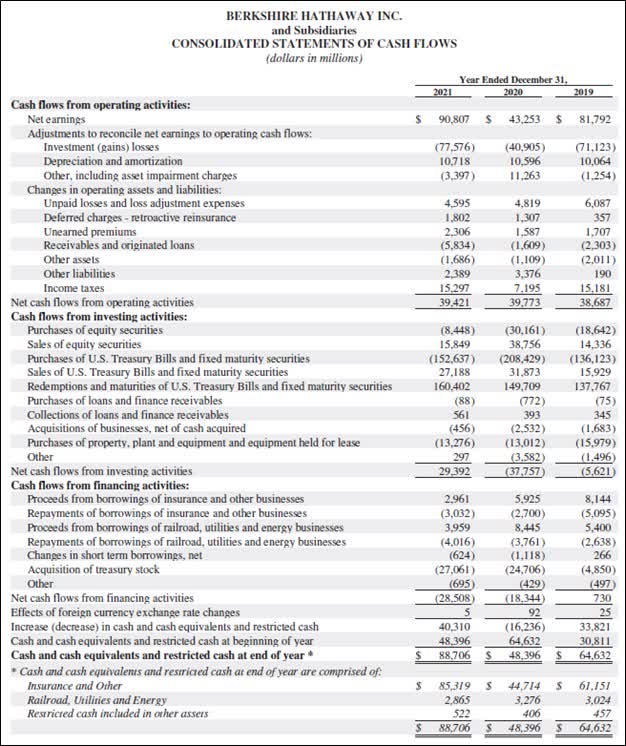

Share Buybacks And Stellar Free Cash Flows

Berkshire has opted to deploy a lot of its cash towards share buybacks in recent years, particularly as its cash-like balance swelled higher. The conglomerate spent $27.1 billion buying back its stock in 2021, up sharply from $4.9 billion in 2019 and up significantly from $24.7 billion in 2020. Beyond its insurance float, one of the reasons why Berkshire has a large cash-like position is due to its tremendous free cash flow generating abilities. The firm generated $26.1 billion in free cash flow in 2021 and its annual free cash flows averaged ~$25.2 billion from 2019-2021.

Berkshire is a free cash flow generating powerhouse. (Berkshire – 2021 Annual Report)

Here is what Buffett had to say regarding the role share buybacks have at Berkshire within his latest annual letter to shareholders:

Our final path to value creation is to repurchase Berkshire shares. Through that simple act, we increase your share of the many controlled and non-controlled businesses Berkshire owns. When the price/value equation is right, this path is the easiest and most certain way for us to increase your wealth. (Alongside the accretion of value to continuing shareholders, a couple of other parties gain: Repurchases are modestly beneficial to the seller of the repurchased shares and to society as well.)

Periodically, as alternative paths become unattractive, repurchases make good sense for Berkshire’s owners. During the past two years, we therefore repurchased 9% of the shares that were outstanding at yearend 2019 for a total cost of $51.7 billion. That expenditure left our continuing shareholders owning about 10% more of all Berkshire businesses, whether these are wholly-owned (such as BNSF and GEICO) or partly-owned (such as Coca-Cola and Moody’s).

I want to underscore that for Berkshire repurchases to make sense, our shares must offer appropriate value. We don’t want to overpay for the shares of other companies, and it would be value-destroying if we were to overpay when we are buying Berkshire. As of February 23, 2022, since year-end we repurchased additional shares at a cost of $1.2 billion. Our appetite remains large but will always remain price-dependent.

We view Berkshire’s share repurchases as a good use of capital as shares of BRK have been trading at a discount to our estimate of their intrinsic value for some time, based on our calculations, and continue to do so under more optimistic scenarios.

Berkshire’s Other Two Giants

Pivoting to Berkshire’s other giants, that includes BNSF Railway, a large Class I freight railroad company based in the U.S. Its operations include a third-party logistics services business. BNSF Railway serves customers across North America, with its core geographical focus on western and southern domestic markets and the related ports.

The firm transports all types of goods across over 32,500 route miles of railway in 28 U.S. states and three Canadian provinces (that includes over 23,000 route miles of owned tracks and over 9,000 route miles of trackage rights that let BNSF Railway utilize third-party railroads). Through third-party railroads and other assets, BNSF Railway can offer freight and other logistics services in Mexico.

BNSF Railway’s operations are supported by ~200 shortline railroads, numerous logistical facilities, and a vast locomotive fleet. When including single and multiple train tracks, sidings, and yard tracks, the total BNSF Railway network is represented by over 50,000 miles of operated track. Last year, 38% of BNSF Railway’s freight revenues were generated by transporting consumer products, 24% from industrial products, and 15% from coal. We caution that BNSF Railway will eventually see its freight revenues from transporting coal dwindle, though the railroad company is in a good position to pivot towards other products.

Berkshire’s fourth giant is Berkshire Hathaway Energy or BHE (Berkshire owned 91.1% of BHE’s equity at the end of December 2021). Among other things, BHE owns four regulated utilities including PacifiCorp (provides electric utility services to customers in Washington, Idaho, Oregon, California, Utah, and Wyoming), MidAmerican Energy Company (provides electric and natural gas utility services to customers in Iowa, Illinois, South Dakota, and Nebraska), and the energy holding firm NV Energy Inc which is home to Nevada Power Company (provides electric utility services to customers in Nevada) and Sierra Pacific Power Company (provides electric and natural gas utility services to customers in Nevada). These regulated utilities serve 5.2 million customers combined.

Additionally, BHE owns electric distribution utility assets in the U.K. (serves 3.9 million end users), a regulated electric transmission utility in Canada (serves ~85% of the province of Alberta’s population), five interstate natural gas pipeline companies in the U.S. (which combined have ~21,100 miles of pipeline capable of transporting up to 21 billion cubic feet of gas per day), a sizable equity stake in a liquefied natural gas (‘LNG’) export terminal in Maryland, and renewable energy power generation assets (including assets in California, Texas, Illinois, Nebraska, New York, Arizona, Minnesota, Kansas, Iowa, and Hawaii). Berkshire also owns wind farms in Canada through BHE Canada.

Underlying Businesses Firing On All Cylinders

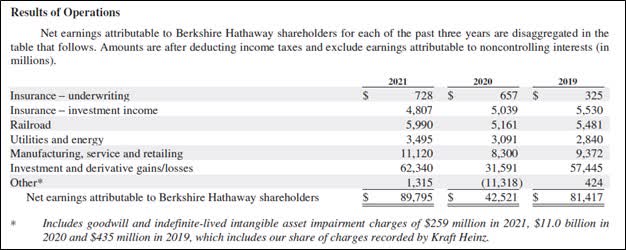

With all of this in mind, Berkshire’s underlying businesses put up great financial performance in 2021. Due to its large investment portfolio, the company’s GAAP profitability can be a misleading metric, something Buffett has stressed numerous times in the past. When removing ‘investment and derivative gains/losses’ segment from its underlying earnings performance, Berkshire posted $27.5 billion in operating earnings last year (a non-GAAP metric that the conglomerate views as better reflecting its underlying performance), up from $21.9 billion in 2020 and $24.0 billion in 2019.

Most of Berkshire’s core business segments grew their operating earnings in 2021 versus both 2020 and 2019 levels as one can see in the upcoming graphic down below.

Most of Berkshire’s businesses have been firing on all-cylinders of late. (Berkshire – 2021 Annual Report)

Concluding Thoughts

Here, we will conclude with what we mentioned near the start of this article, and that is Buffett’s belief that betting on America is the best bet investors can make. We are firm believers in that strategy at Valuentum. Berkshire continues to deliver for its shareholders, or as Buffett likes to say, “partners,” and the company’s stock has room to run. We view Berkshire’s capital appreciation upside potential quite favorably.

Be the first to comment