mixmotive/iStock Editorial via Getty Images

Introduction

My thesis is that Berkshire Hathaway (NYSE:BRK.A) (NYSE:BRK.B) is a good long-term investment at today’s levels despite the fact that the equities on their balance sheet and other considerations have caused their overall valuation to dip. Much of the logic from my February valuation article remains intact but key updates need to be made.

Cash, T-bills & Fixed Maturities were $160 billion on the 4Q21 balance sheet. Today these first 3 balance sheet lines come to just $122.5 billion so they have cumulatively fallen by $37.5 billion. Stocks were worth $351 billion back at the end of 2021 but this 4th line on the 2Q22 balance sheet shows Berkshire’s stocks are only worth $327.7 billion now –$23.3 billion lower. Union Pacific’s (UNP) market cap has gone down nearly $20 billion from almost $161 billion to around $142 billion. I think the valuation for BNSF is down about $20 billion as well. A recent BHE buyback partially offsets these negative considerations and shows that Berkshire’s interest in BHE is nearly $25 billion higher than what it appeared to be based on past buybacks.

BNSF

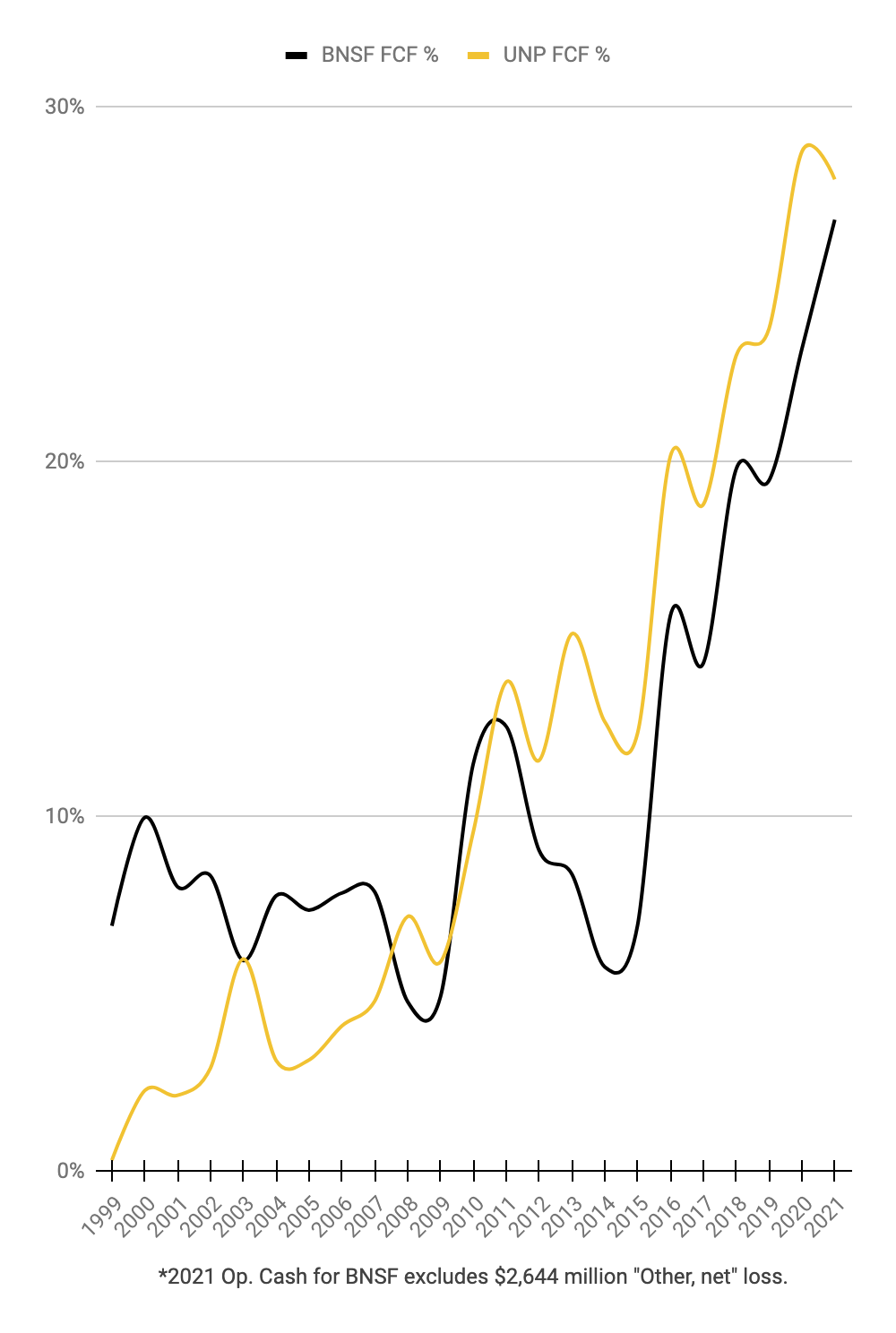

Berkshire CEO Warren Buffett has said that railroads are a bet on the U.S. economy and he has talked about the fact that BNSF and Union Pacific are advantaged being west of the Mississippi. When it was announced that Berkshire was buying BNSF in November 2009, BNSF had a history of enjoying a higher free cash flow (“FCF”) margin than Union Pacific. Part of the reason for this is that Union Pacific was paying large sums in compensation and benefits at the time because of inefficiencies like suboptimal train lengths. We lionize CEO Buffett for this acquisition as he somehow knew that the FCF margins for BNSF and Union Pacific would improve drastically after 2009:

BNSF FCF margin (Author’s spreadsheet)

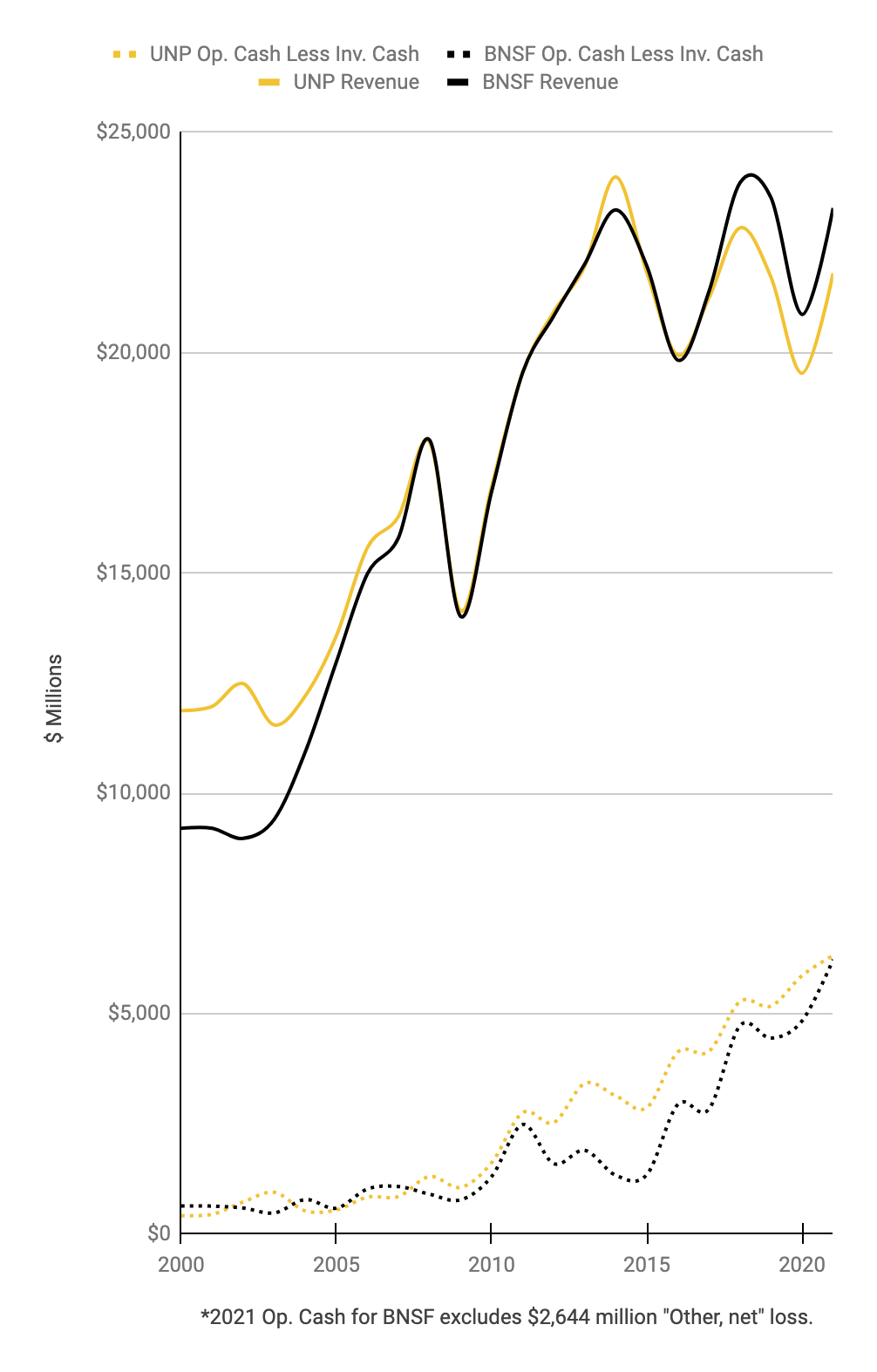

Capex tends to be the biggest part of cash used in investing activities for railroads such that FCF tends to be close to operating cash flow (“OCF”) less cash used in investing activities. We see that both BNSF and Union Pacific have grown OCF less cash used in investing activities substantially since Berkshire acquired BNSF:

BNSF OCF less cash used in investing activities (Author’s spreadsheet)

Per their 2Q22 10-Q, Union Pacific has 1H22 FCF of $2,522 billion [$4,167 million – $1,645 million] on revenue of $12,129 million for a 21% margin. Meanwhile, BNSF has 1H22 FCF of $2,320 million [$3,761 million – $1,441 million] on revenue of $12,608 million for a margin of 18% per their 2Q22 10-Q. Inflation is going up and it is important to watch the differences between FCF and net income for these capital-intensive rails. Union Pacific’s 1H22 net income is $3,465 million but their FCF is only $2,522 billion. The 1H22 net income for BNSF is $3,035 million but their FCF is only $2,320 million. The market cap of Union Pacific has gone down by about $20 billion to around $142 billion since my February article and I think BNSF’s valuation should be down by about the same amount.

BHE

The 2Q22 BHE 10-Q reveals that BHE bought back 740,961 shares from Vice Chairman Greg Abel in June 2022 for $870 million which comes to $1,174.15 per share. The 2Q22 10-Q shows 75,627,913 BHE shares outstanding as of August 4th, implying a market cap of $88.8 billion.

Looking at page 7 of Berkshire’s 2021 parent letter to shareholders, we see $7,693 million for BYD Co. Ltd. with a note saying, “Held by BHE; consequently, Berkshire shareholders have only a 91.1% interest in this position.” The total for this equities section in the letter comes to $350,719 million which is the “Investments in equity securities” line of the balance sheet. What can be confusing is that this 4th line of the balance sheet is under the “Insurance and Other” heading instead of the “Railroad, Utilities and Energy” heading. Looking at the BHE 2Q22 10-Q, assets come to $135,295 million while the BNSF 2Q22 10-Q shows $92,368 million in assets such that the combination is $227,663 million. However, $9,003 million in the BHE total are from BYD so the new total without this consideration is $218,660 million which is close to the $219,016 million figure that the parent 2Q22 10-Q shows for Railroad, Utilities and Energy assets.

Seeing as I count the BYD equities in part of the parent valuation outside of BHE, we need to take the $9 billion BYD investment out of our BHE consideration such that our effective BHE market cap drops $9 billion from $88.8 billion to $79.8 billion. The Berkshire parent owns 92% of this and 8% is owned by former board member, Walter Scott. As such, the Berkshire parent consideration is $73.4 billion while the noncontrolling interest consideration is $6.4 billion. I only valued Berkshire’s 92% share of the non-BYD BHE consideration at $48.6 billion in my February Berkshire article so it was understated by nearly $25 billion!

Valuation

Given the considerations above, I think Berkshire is about $55 billion less valuable than it was at the time of my February article when I figured the upper end of my valuation range was close to $850 billion. As such, I now think the upper end of the valuation range is close to $795 billion. Per the 2Q22 10-Q, there were 1,468,461 equivalent A shares as of June 30th. As such, the upper end of my valuation range is now close to $541,383 per A share and $361 per B share. The August 8th A and B share prices were $439,167 and $292.34, respectively, so I think the stock remains undervalued.

Disclaimer: Any material in this article should not be relied on as a formal investment recommendation. Never buy a stock without doing your own thorough research.

Be the first to comment