Paul Morigi/Getty Images Entertainment

Berkshire Hathaway (NYSE:BRK.B) stock is currently near all-time highs. Trading at $351, it’s just a stone’s throw away from its highest level ever – $362. These highs come after a record year for the company. In the last 12 months, Berkshire has grown its earnings to record levels, bought back shares, and added a brand new insurer to its portfolio. It’s been a great run, and the market has rewarded Berkshire with record highs.

When a stock achieves such a run in a correction, it’s natural to wonder whether the gains can continue. Many stocks are down this year, as are the S&P 500 and NASDAQ-100. Is it reasonable to expect Berkshire to keep outperforming when so many of its mega-cap peers are undergoing difficulties?

I would argue that, yes, it is reasonable to expect that. The thing about Berkshire Hathaway is that its portfolio of assets was built with quality in mind. Although Buffett started off his career as a “deep value” investor looking to make a quick buck off of radically underpriced stocks, he later evolved into a long term investor who favors a “fair” price on a great asset. As a result, Berkshire is now based on assets with strong moats, high profit margins, and adequate growth.

Today, investors are increasingly turning to these kinds of assets. If you watched the recent big tech earnings season, you’ll have noticed that the markets were absolutely merciless with stocks that showed the slightest sign of weakness. Meta’s (FB) 4% earnings beat resulted in a 26% crash, Shopify (SHOP) slid over 50% on mixed earnings, and Netflix (NFLX) crashed after delivering muted guidance. Even when companies are doing pretty well, the markets are punishing them for slight vulnerabilities.

That’s precisely what makes Berkshire’s collection of assets so appealing right now. Warren Buffett is well known for investing in companies with “economic moats”–long term advantages that keep competitors at bay. Because these companies were acquired on the basis of quality rather than momentum or one fluke earnings release, they are likely to deliver consistent results over time. That will translate to solid results for Berkshire itself, which could lead to steady appreciation of its stock price. So, it would be wise for investors to ignore the fact that Berkshire is near an all-time high. Its collection of resilient assets provide a solid foundation for continued gains.

Berkshire’s Moat

It is well known that Berkshire Hathaway invests in companies that have economic moats. These include:

-

Companies in industries with high barriers to entry (banks, utilities).

-

Companies whose customers face high switching costs.

-

Companies with strong brand identities like Apple (AAPL).

There are plenty of stocks with moats in Berkshire’s portfolio. The specific moats vary quite a bit from company to company. The Berkshire Hathaway Energy companies are mostly utilities, which are protected by high barriers to entry. Companies like Apple enjoy high brand loyalty which ensures customers keep coming back for more.

Moats increase the likelihood of solid earnings results because, among other things, they give companies pricing power–the ability to raise prices without reducing demand. When a company faces little competition, it can raise prices easily, because its customers have no alternative suppliers. They may seek out substitute goods, but they won’t be able to get the exact same thing elsewhere. So, when inflation is high, a company with an economic moat can raise its prices to a level commensurate with the CPI change. This ability gives such a company protection against adverse economic conditions.

The end result of this phenomenon is that moat companies generally put out solid results over long periods of time. Any random stock may rise on a fluke earnings beat, but with a moat stock in a good industry, you have a reason to believe that the company’s earnings will continue to be good.

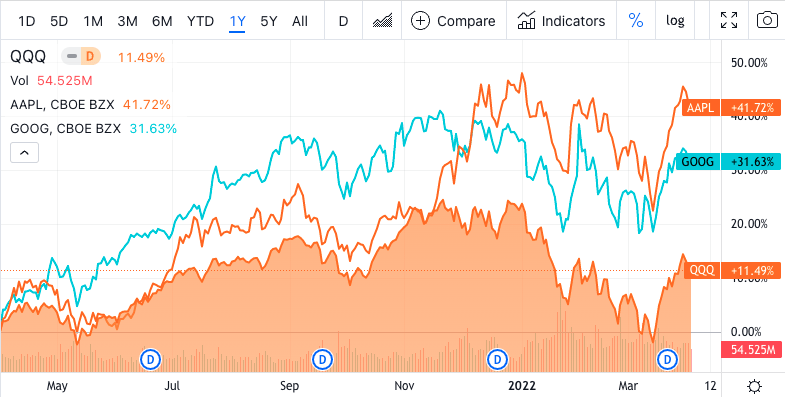

Companies that have this “moat” quality are doing better in 2022 than companies that lack it. If you look at the recent tech stock selloff, for example, you’ll noticed that two companies are doing much better than the class average:

Apple and Alphabet (GOOG).

These stocks are only 4.23% and 5.3% off their all-time highs, respectively. This is in contrast to the NASDAQ which is still down 10.3% from its highs, and therefore still in a correction. As the chart below shows, AAPL and GOOG are beating the NASDAQ-100 over a 1 year period:

Seeking Alpha Quant

Why this outperformance from Apple and Google?

On the surface, it would look like the recent earnings releases may have played a part in it. Both companies’ recent earnings beat expectations, which would explain the outperformance to an extent: many other tech companies missed in Q4. But you’ve got to ask why these two companies were able to beat on earnings when many of their competitors badly missed and posted negative year-over-year growth.

It comes down to quality. When a company enjoys an economic moat, a strong balance sheet, and high profitability, it’s more likely to deliver strong earnings than a company that lacks these qualities. The economic moat, as explained, provides pricing power, leading to fatter margins. A strong balance sheet reduces interest expenses, which tends to raise net income. Finally, high profit margins provide a company with the ability to re-invest in future growth. Take all of these three characteristics together, and you get a company whose earnings are likely to be good more often than not. Surprise, surprise, Apple and Google both have them in spades.

Berkshire Hathaway has spent decades building up a portfolio of stocks and wholly-owned subsidiaries that have the characteristics described above. Such assets should lead to solid financial performance for their owner, and indeed, they are. This fact becomes abundantly clear when we take a deep look at Berkshire’s own financials.

Financials and Valuation

Berkshire Hathaway’s financials are, as you’d probably expect, fantastic. I covered its fourth quarter earnings in a recent article – in sum, the quarter was a beat, featuring strong growth in revenue, earnings and EBIT. Analysts were expecting $2.96 in earnings per class B share, Berkshire actually delivered $3.27.

For the full fiscal year, Berkshire reported:

-

Revenue: $276.09 billion in revenue, up 12.46%.

-

Operating income: $114.8 billion, up 64.75%.

-

Net income: $89.79 billion, up 111%.

-

Free cash flow: $61.69 billion, up 47.9%.

-

Common equity: $514.9 billion.

These metrics show that Berkshire’s strong performance in the most recent quarter was no fluke, because the entire year was similarly strong. We can also use these results to get some profitability metrics for Berkshire, like:

-

EBIT margin: 41.5%.

-

Net margin: 32.5%.

-

FCF margin: 22.3%.

-

Return on equity: 17.4%.

All strong results, demonstrating that Berkshire’s investments are contributing to its profits.

And what about Berkshire’s balance sheet?

As mentioned earlier, a company’s balance sheet goes a long way in determining how its future performance will turn out. Among other things, it determines the company’s ability to meet interest payments, and how much of a bite interest takes out of earnings. So, let’s take a look at some of Berkshire’s balance sheet metrics to see how it stacks up:

-

Assets: $958.78 billion.

-

Liabilities: $443 billion.

-

Current assets: $208 billion.

-

Current liabilities: $51.3 billion.

-

Long term debt: $105.77 billion.

-

Common equity: $514.9 billion.

From these metrics we can compute a number of ratios on Berkshire to gauge its financial health.

-

Return on assets: 9.3%.

-

Return on equity: 17.4%.

-

Current ratio: 4.

-

Long term debt to equity: 0.2.

These are all solid numbers. The returns on assets and equity show that Berkshire is producing a lot of performance for every dollar of what shareholders own, the current ratio suggests strong liquidity, and the debt-to-equity ratio suggests that the company is highly solvent. All very good signs.

When you look at Berkshire’s overall package of growth, profitability, and balance sheet strength, you’d think that the stock would trade at a premium. After all, it’s without a doubt a high-quality asset. But when we look at some of Berkshire’s key valuation multiples, we can see that it isn’t overpriced at all. At today’s prices, BRK.B trades at just:

-

8.9 times GAAP earnings.

-

2.89 times sales.

-

1.54 times book value.

-

19 times operating cash flow.

These are all fairly low multiples. They’re certainly not “deep value” territory, but they’re modest by the standards of mega-cap stocks these days. So, Berkshire offers a solid overall package of growth, profitability, balance sheet health and valuation.

Risks and Challenges

As we’ve seen, Berkshire is an extremely high quality stock with piles of profit and cash flows under the hood. It certainly looks like a winner. But every investment thesis faces some risks and challenges, and Berkshire is no exception. Some of the more pressing risks include:

-

CEO succession. Warren Buffett’s investing skills are thought to have been a key part of Berkshire Hathaway’s success. At 91 years old, Buffett won’t be around forever. Potentially, the person who takes over after Buffett won’t manage the portfolio as well as he has. We know that Howard Buffett will take over as Chairman and Greg Abel as CEO when Buffett is gone. These individuals are intimately associated with Berkshire and know the business well, but it remains to be seen whether the investment team will do as well as Buffett has under their leadership.

-

Berkshire’s conglomerate status. Berkshire Hathaway is a conglomerate, meaning a company that owns a collection of other companies. Many investors think that Berkshire would be worth more if broken down into separate components. Their argument is plausible enough. If you own Apple directly instead of through Berkshire, you get to collect Apple’s dividend. Through Berkshire, you don’t. The same applies to Berkshire’s many wholly owned subsidiaries. So Berkshire could become a takeover target after Buffett is gone.

-

A limit on returns. Berkshire Hathaway’s sheer size makes it unlikely that its future returns will match its past returns. A small fund manager can potentially get dramatically outsized returns by investing in small cap stocks. Berkshire can’t. With its $293 billion portfolio, a $1 billion investment makes up just a fraction of 1% of its total holdings. If you invest $10,000 in a $1 billion small cap company and it grows to $10 billion, you multiply your investment 10-fold. If Berkshire buys that entire company and sells it for $10 billion, then the $9 billion gain is only a 3% gain on the total portfolio. So, Berkshire’s scale gives it a certain disadvantage when it comes to performance.

All of the risk factors above are worth keeping in mind. They are not, however, enough to damage the bullish thesis on Berkshire Hathaway stock. Near all-time highs, it’s still cheap relative to its overwhelmingly solid fundamentals. And in today’s market, quality counts.

Be the first to comment