Scott Olson

Article Thesis

Berkshire Hathaway (NYSE:BRK.A)(NYSE:BRK.B) reported its most recent quarterly results on Saturday. The company’s underlying performance was strong, despite headwinds from items such as Hurricane Ian. While Berkshire Hathaway may look overvalued based on reported net profits, I do believe that shares are actually a good value below $300, as I will explain in this article.

Berkshire Hathaway Performed Relatively Well Despite Headwinds

Berkshire Hathaway reported a net loss of $2.7 billion for the third quarter, but that was not reflective of the company’s underlying business performance and its cash generation. Instead, the net loss was driven by mark-to-market losses in its equity portfolio. These shouldn’t be regarded as equally important as the profits from its operating companies, in the same way it also makes sense to back out mark-to-market gains in Berkshire’s equity portfolio.

When we look at Berkshire Hathaway’s operating profits, where fair value changes in its equity portfolio are not included, the performance was pretty good during the most recent quarter. Operating profit totaled $7.8 billion during the period, which is slightly more than $30 billion annualized. That was up 20% versus the previous year’s period, which is almost perfectly in line with the year-to-date growth rate of 19%, as Q1-Q3 operating profit in 2022 totaled $24.1 billion, versus $20.2 billion one year earlier.

Looking into the different business units’ performances, there were some that fared better and some that fared worse during the quarter. Insurance underwriting income was a negative $1.0 billion, down from negative $0.8 billion one year ago. Hurricane Ian, which hit in late September and which caused damages of more than $50 billion, played a role in the weaker profitability of the insurance business. That was, however, offset by stronger investment gains in the insurance portfolio, as those gains grew $250 million year over year. Rising interest rates help Berkshire Hathaway generate higher interest income from the money it puts into fixed-income investments such as treasuries and corporate bonds, which explains why the insurance float generated higher profits during this year’s third quarter, relative to one year earlier. Since interest rates keep rising, I expect that Berkshire’s insurance investment income will climb further in Q4 and likely beyond, especially as lower-yielding bonds are repaid over time which allows Berkshire to reinvest those proceeds into higher-yielding investments.

Berkshire’s railroad business, Burlington Northern Santa Fe, performed surprisingly badly. The unit still generated an operating profit of $1.44 billion during the period, close to $6 billion annualized, but profits were down 6% year over year. Many other railroad companies grew their profits over the last year, such as Union Pacific (UNP), which was able to grow its operating profit by 13% during the most recent quarter. Relative to this peer, BNSF thus unperformed by close to 20% when it comes to profit growth, which was worse than expected. That also was a reversal from the trend during Q1 and Q2, when BNSF saw its operating profits rise on a year-over-year basis.

Luckily, this could be offset by stronger profits in Berkshire’s utilities and energy business, where operating profits rose by $90 million year over year, hitting $1.6 billion for the quarter. All in all, Berkshire’s operating businesses performed relatively well, although the performance was a bit uneven. As the year-to-date trend remains positive, I believe that there is a good chance that Q4 results will be up considerably versus the previous year’s period as well, with the energy crisis and rising interest rates being tailwinds (for Berkshire’s utilities/energy unit and its insurance investment income, respectively).

Balance Sheet And Equity Portfolio

Berkshire Hathaway’s operating businesses have considerable value, but that also holds true for the company’s equity portfolio, which is worth hundreds of billions of dollars, making it an important part of the company’s total value.

At the end of the third quarter, Berkshire’s equity portfolio totaled $306 billion on a mark-to-market basis, i.e. at then-current prices. Since the end of September, equity prices have moved, so let’s take a look at the most important positions:

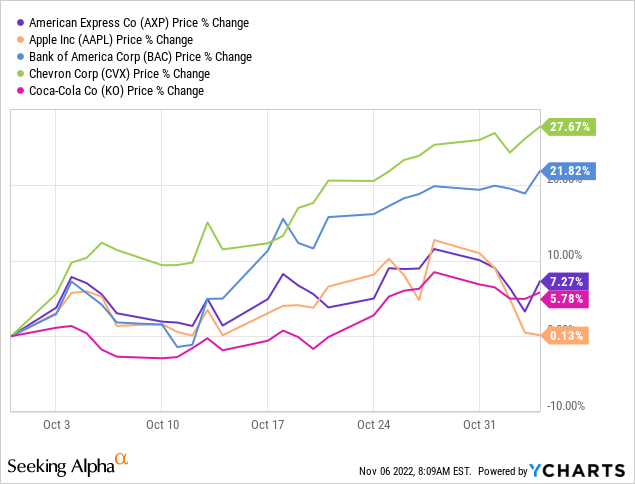

American Express (AXP), Apple (AAPL), Bank of America (BAC), Chevron (CVX), and Coca-Cola (KO) all rose since the end of the third quarter, with Chevron and Bank of America showing steep double-digit gains, while AAPL was up only marginally. The strong performance by Chevron and BAC can be explained by a positive macro environment for these two companies, due to OPEC production cuts that caused oil prices to rise and due to rising interest rates, which help expand banks’ net interest margins. Both companies also reported strong Q3 results, to which the market reacted positively.

Since these five companies make up around three-quarters of Berkshire’s total equity portfolio, their performance is most important for the company’s total equity portfolio value by far. Based on the individual fair value amounts at the end of Q3 for these five positions and the gains experienced since, I estimate that the equity value in these five positions has increased by $16 billion. In order to be conservative, let’s reduce that to $14 billion and assume that other positions have not experienced any gains, which gets us to a current equity value of $320 billion.

Berkshire Hathaway also owns a vast cash position, although one can argue how that should be factored into a fair value calculation of Berkshire as a company. Some believe that it should be taken at face value, which would be very meaningful, as the cash position totaled $109 billion at the end of the third quarter. Others believe that the cash position should not be added to the company’s value, as it is part of the insurance float. That’s a more conservative approach, arguably even a too-conservative approach, but let’s use this approach anyways in order to have a built-in margin of safety. So let’s assume that the present value of the cash position is zero and that the equity portfolio is worth $320 billion right now. Berkshire Hathaway’s market capitalization stands at $631 billion, based on a share count of 2.2 billion class B shares, each valued at $287 at the time of writing. The market thus ascribes a value of $311 billion to Berkshire’s operating businesses ($202 billion if we were to add the company’s cash position at face value).

I believe that $311 billion is a pretty undemanding price for Berkshire’s operating businesses. Those generated operating profits of $24.1 billion so far this year and are on track to earn $32 billion in 2022. The operating businesses are thus currently valued at an implied 9.7x operating earnings multiple, which seems pretty low to me. Not only is that a low valuation in absolute terms, but it also does not reflect the strong market position of many of these businesses and the fact that they are experiencing compelling growth. BNSF, for example, has a wide moat as railroads are an oligopoly, and since none of these companies are actively encroaching on the turfs of their peers. Publicly-traded railroad companies are mostly valued at a 15x to 20x earnings multiple, implying that BNSF would be valued at way more than 10x earnings if it were a standalone company. Likewise, many utilities trade at way higher earnings multiples (15x earnings and more) than the implied valuation of Berkshire’s operating businesses, and so on.

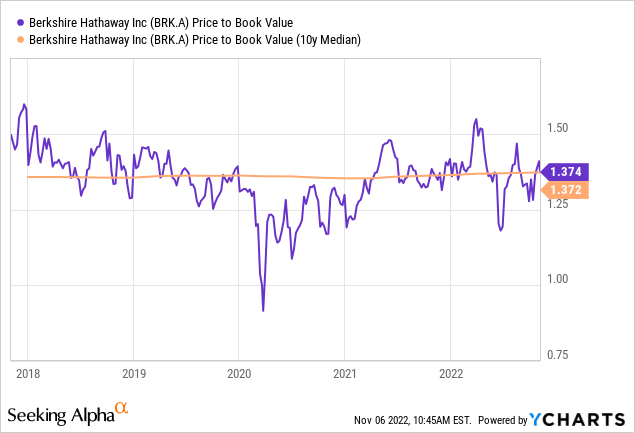

One of Buffett’s favorite metrics to value Berkshire Hathaway is the price-to-book multiple. On that basis, Berkshire Hathaway trades almost perfectly in line with the long-term median:

When we account for the fact that Berkshire’s equity portfolio has risen in value since the end of September, the current price-to-book multiple is slightly lower than 1.37, however, suggesting a minor discount relative to how Berkshire was valued in the past.

It is also noteworthy that Buffett seems to believe that Berkshire can be a good investment even when trading at the median book value multiple or above. Over the last 1.5 years, a time when Berkshire repeatedly traded above 1.37x book value, Berkshire has spent many billions of dollars on share repurchases, suggesting that the insiders that know the company very well deem Berkshire a solid value at 1.35x to 1.4x book value. For outside investors, Berkshire likely is a solid value at that valuation as well. Combined with the sum-of-the-parts analysis done above, this makes me believe that Berkshire Hathaway is a compelling investment at current prices. The fact that shares have pulled back by 21% versus the highs that were hit earlier this year also suggests that right now could be an opportune time to enter or expand a position.

Takeaway

Berkshire Hathaway has reported compelling quarterly results, as its operating businesses grew their profits at an attractive pace, despite some headwinds. The equity portfolio has risen since September 30, which is why the Q3 book value number is understating BRK’s current value. A sum-of-the-parts valuation also suggests that Berkshire is inexpensive right here, even when we do not ascribe any value to Berkshire’s vast cash position. Overall, I believe Berkshire continues to be a high-quality compounder that is currently trading at a compelling valuation.

Be the first to comment