Klaus Vedfelt

Q3 recap and thesis

Both Apple (NASDAQ:AAPL) and Berkshire Hathaway (NYSE:BRK.A)(NYSE:BRK.B) have recently released their Q3 earnings reports (“ER”). And I assume, by this time, plenty of other SA articles have fully dissected most aspects of their Q3 ERs. So here I will just directly get to the point. The thesis of this article focuses on a less discussed topic of their ER: their double buybacks. In the remainder of this article, you will see me detailing why such double buybacks is so overpowering. It essentially puts these two already powerful compounders on steroids.

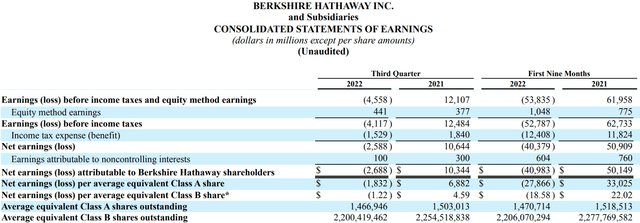

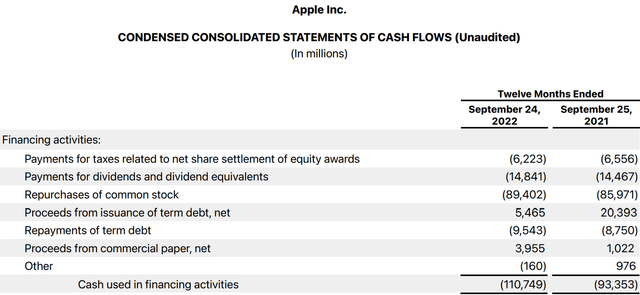

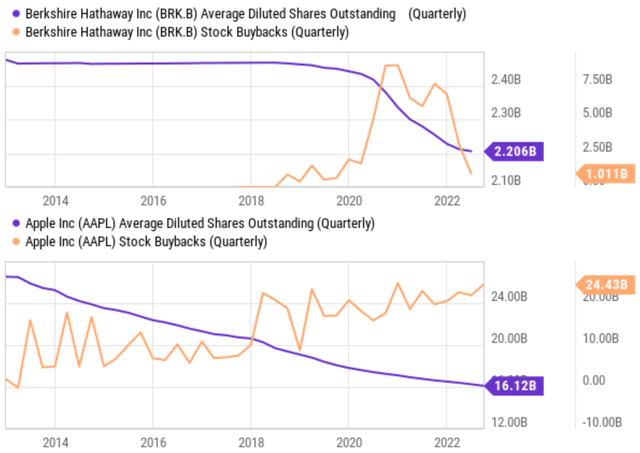

Both companies have been aggressive buyers of their own shares in recent years. And Q3 is no exception. Both reported continued share repurchase activities. To wit, BRK’s ER showed a total of $1.05B share repurchase during the quarter. Its share counts (all quoted in equivalent Class B shares outstanding hereafter) shrank to 2.20B shares in Q3 from 2.25B a year ago as you can see from the following chart. To provide more context, it also repurchased ~$1.0B in Q2 and $3.2B in Q1 this year. On a YOY basis, its operating earnings increased 20% (despite insurance underwriting loss due to Hurricane Ian), providing plenty of ammunition for future repurchases. The picture is quite similar to AAPL. As you can see from the second chart below taking from its Q3 ER, AAPL’s repurchases of its own common stock totaled a whopping $89.4B during the twelve months that ended Sept 2022. It is about $3.5B more than it spent in the previous twelve months that ended Sept 2021 ($85.9B).

As quintessential examples of perpetual compounders, BRK and AAPL’s repurchases are already potent enough when done separately. And next, you will see when considered together, these buybacks are even more overpowering. Simple math dictates the combined benefits to shareholders to be more than 2% when each of them buys back 1% of their outstanding shares.

Source: BRK Q3 ER Source: AAPL Q3 ER

BRK and AAPL buybacks: historical perspective

A typical comment I receive in my AAPL and BRK articles involves their dividend yields. Many readers debate the pros and cons of the lack of dividends from BRK and/or the low dividend from AAPL. My overall thoughts are twofold:

- First and foremost, my fundamental view is that total shareholder returns, not dividend yields, are ultimately what matters. Total shareholder return is an underappreciated concept from my observation. I’ve noticed there are plenty of dividend growth strategists and articles. However, there are not many on buybacks, which is a major flaw in these strategies that can miss out on stocks like AAPL and BRK.

- Second, you can always sell some shares (to take advantage of the share price appreciated created by the repurchase) and pay yourself a dividend. This way, you have better control over the timing, amount, and tax issues yourself (you can pick when to sell and which shares to sell to minimize your taxes).

With this overall background, BRK started repurchasing its own share in earnest only since 2018 as shown in the top panel of the following chart. Buffett often commended the beauty of share buybacks, but he did do this till 2018. My stipulation of the reason is that there are plenty of good opportunities for BRK to deploy cash before. But in recent years, the overall market has become expensive (it is not cheap even now) and the cash BRK needs to deploy is so enormous that its pool of candidates narrows substantially.

Once he started in 2018 though, Buffett did it aggressively and nonstop. To wit, as seen from the following charts, the repurchase peaked near $2.60B in 2020. The equivalent B shares decreased from about 2.46B to 2.20B rapidly (and to 2.2B as disclosed in the Q3 ER), a 10.6% reduction in less than 3 years.

AAPL has a longer history of aggressive repurchases as seen in the bottom panel of the following chart. Its share count was 27 billion shares in 2013, and now it is only 16.1B, translating into a reduction of more than 40%. Looking forward, there is no sign of slowing down as CFO Luca Maestri commented during the Q&A session in its Q3 ER below (slightly edited and emphases added by me):

In terms of cash deployment, obviously, we like to look at the capital return program over the long arc of time. And we have done, since the beginning of the program, we’ve done over $550 billion of buyback at an average repurchase price of $47. So, the program has been incredibly successful.

We are still in a position where we have net cash. And we said all along, we want to get to cash-neutral at some point. Our cash generation has been very, very strong over the years, particularly last year… I mentioned in the prepared remarks, we did $111 billion of free cash flow. That’s up 20% year-over-year. And so, we will put that capital to use for investors.

No matter how you slice and dice these numbers, the message is quite clear to me: AAPL has plenty of free cash to keep buying its own shares.

BRK and AAPL double buybacks

Now, after looking at their buyback individually, let’s look at the overpowering potency of the double buybacks. Buffett has already touched on the overpowering nature of this dark magic in his 2021 shareholder letter (slightly edited and emphases added by me):

Apple – our runner-up Giant as measured by its yearend market value – is a different sort of holding. Here, our ownership is a mere 5.55%, up from 5.39% a year earlier. That increase sounds like small potatoes. But consider that each 0.1% of Apple’s 2021 earnings amounted to $100 million. We spent no Berkshire funds to gain our accretion. Apple’s repurchases did the job. It’s important to understand that only dividends from Apple are counted in the GAAP earnings Berkshire reports – and last year, Apple paid us $785 million of those. Yet our “share” of Apple’s earnings amounted to a staggering $5.6 billion. Much of what the company retained was used to repurchase Apple shares, an act we applaud.

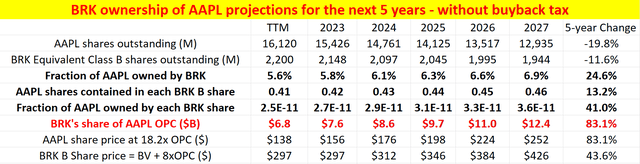

I am not sure if Buffet has performed a simple projection to see what could happen if what he said above continues for a couple more years. If he did not, probably he would be surprised to see the results himself, as shown in the table below. This table shows my estimate of the power of the double buys if both BRK and AAPL continue their current repurchase pace for 5 more years. These estimates were based on a few simple assumptions that were detailed in my earlier articles analyzing their individual buyback activities:

- For AAPL, the assumptions are that it uses a constant percentage of its operating cash flow on repurchases, and the percentage is taken to be 78%, the average in recent years. Its profits grow at an 8% CAGR according to consensus estimates. And an average repurchase price that equals 18.3x of its operating cash, its current TTM valuation multiple.

- For BRK, the assumptions are the same in essence except for three small differences. First, the percentage of operation income spent on repurchase was assumed to be 68%, the average from 2019 to 2022 thus far. Second, I assumed the repurchases were made at a price that equals the worth of its BV plus 8x of its operating cash, which is what its current valuation is thanks to the recent corrections. And I view it as an attractive valuation as detailed in my earlier analysis.

Lastly, let’s also assume BRK’s AAPL holdings to remain constant at 894.8M shares according to its more recent disclosure.

Under these assumptions, AAPL shares outstanding are projected to decrease by 19.8% in the next five years from its current level. At the same time, BRK’s share count is projected to shrink by another 11.6%. BRK currently owns 5.6% of all outstanding AAPL shares. And this percentage would increase to 6.9%, an increase of 1.3%. This 1.3% increase is not a small potato. As Buffett commented above, each 0.1% of Apple’s 2021 earnings amounted to $100 million. And remember, AAPL’s operating income is likely to grow at 8% CAGR, and each 0.1% would be worth much more than $100M in 5 years.

Actually, BRK’s share of Apple’s earnings (shown in the row highlighted in red below) would grow to a staggering $12.4 billion in 5 years. Compared to its share of $6.8B currently, the double buybacks would almost double (increase by 1.83x to be more exact) BRK’s claim to AAPL’s total earnings in 5 years! Note here that 1.83x is much more than the combination of their share count shrinkage (i.e., 19.8% and 11.6% combined). Again, as mentioned earlier, it’s a simple case of 1+1>2.

To put things from a different perspective, BRK’s operating income has been on average “only” $20B in recent years. When/if its claim of AAPL’s earnings reaches $12.4B, AAPL probably would not be BRK’s runner-up 4th giant anymore. It probably would be BRK’s largest operating unit in disguise.

Source: Author based on Seeking Alpha data

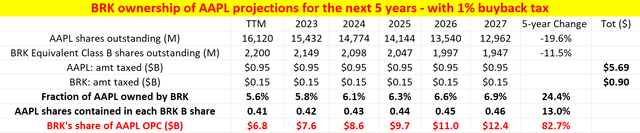

The impact of 1% buyback taxes

Some of our readers also asked about the effects of the 1% buyback taxes recently signed into law. And the following table provides my estimate of the impact on AAPL and BRK. These projections are made under the same assumptions mentioned above. The only difference, of course, is that I applied a 1% tax on the amount spent each company spends on their buybacks.

As seen, AAPL will need to pay a cumulative total of $5.69B of taxes and BRK $0.90B for their repurchases, respectively. There are certainly considerable sums for the purposes of levying taxes. But they only create a minor impact on the overpowering nature of the double buybacks.

To wit, the 1% buyback taxes would cause AAPL’s share shrinkage to be a bit muted to 19.6% in five years (vs. 19.8% without the taxes). And it would cause BRK’s share shrinkage to be 11.5% in five years (vs. 11.6% without the taxes). These effects are in the 3rd decimal point and won’t move the needle for most shareholder returns. For example, their share price projections would only differ by about 10 cents.

Source: Author based on Seeking Alpha data

Risks and final thoughts

Risks specific to AAPL or BRK have already been thoroughly analyzed in other SA articles (and some of our own articles too). So here I won’t further add on. Instead, I will just focus on the risks of double buyback dynamics analyzed in this article. First, the analysis is based on the assumption that BRK’s holdings of AAPL remain constant at 894.8M shares according to its more recent disclosure. This obviously could change. BRK could buy more or even begin to sell its AAPL shares at some point. But considering the fact that Buffett has been holding some of his top holdings for decades (such as KO and AXP), I see the odds of trimming unlikely. Second, BRK’s book value (which primarily consists of its equity investment portfolio) changes on a daily basis. And it can change quite a bit from day to day given the recent market volatilities. My analysis is based on its BV reported in its Q3 ER, and its true BV as of this writing is most likely different already.

To conclude, as quintessential examples of perpetual compounders, BRK and AAPL’s repurchases are already potent enough when done separately. And when considered together, it becomes overpowering and puts their compounding on steroids. The recent price corrections simply accelerated the compounding when viewed from a long-term perspective, easily offsetting the minor headwinds from the 1% buyback taxes. As a BRK and AAPL shareholder, I can only wish that such a situation perpetuates. More specifically, I can only wish their valuation stays low for as long as possible, they spend as little money paying out dividends as possible, and they spend as much as they can keep buying back their shares.

Be the first to comment