Peter Fleming/iStock Editorial via Getty Images

Investment thesis

The shares in Berkeley Group (OTCPK:BKGFY) have fallen given the U.K.’s uncertain macroeconomic conditions. On a longer-term basis, given the company’s strong position in the London housing market and a large high-quality land bank, we believe earnings visibility is high and the shares currently look undervalued. We rate the shares as a buy.

Quick primer

The Berkeley Group is a residential and mixed-use property developer in the U.K., operating primarily in London and the southern part of England in the mid to higher-end market with a housing shortage. It specializes in brownfield regeneration (development on derelict and abandoned sites), often working closely with local government authorities. The company has a track record of building a strong and disciplined land bank in under-supplied markets with long-term demand.

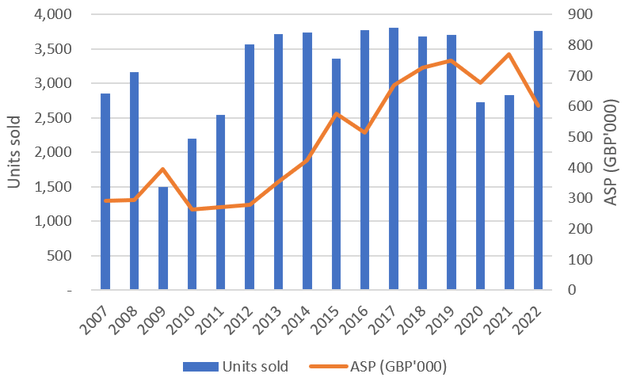

The company’s ASP (average selling price) for a home in FY4/2022 was GBP603k/USD723k which includes both flats as well single dwellings) – this fell 22% YoY (page 7). The company had 66,163 plots for housing construction in FY4/2022, with a total sales value post-development of GBP31.1 billion/USD37.3 billion.

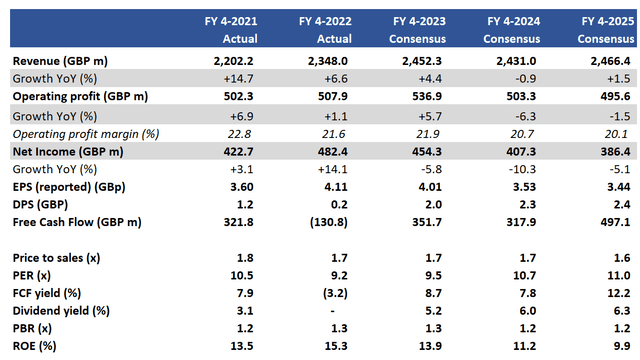

Key financials with consensus forecasts

Key financials with consensus forecasts (Company, Refinitiv (Note: DPS includes interim, final, and special dividends))

Our objectives

The economic backdrop for a residential real estate developer in the U.K. is currently negative, with rising financing costs and a cost-of-living crisis. Despite the cyclical nature of the real estate market, we want to assess whether the Berkeley Group has secular growth trends that will offset temporary headwinds in the economy, and allow the business to generate sustainable free cash flow.

Addressing a housing shortage

The company’s business model is simple to understand. Firstly, sought-after land (focused on brownfield sites) in an attractive location is acquired. Secondly, by keeping the cost of the land at around 10% of the total selling price, the property is developed with a target gross margin of approximately 25%. Thirdly, with an established track record of adding value, the company gains access to more land for development for its future pipeline. This has led to the company becoming the largest new home builder in the London area.

During FY4/2022 the company conducted a £412.5 million acquisition of the remaining 50% share of a joint venture with peer St William, allowing full control of 24 sites with the potential to deliver over 20,000 homes. With no major planning permission issues for the next 3 years, earnings visibility is relatively high. The company has a total land bank worth GBP3.4 billion/USD4.1 billion (two-thirds of current market capitalization), with a potential sale value post-development worth GBP31.1 billion/USD 37.3 billion.

Despite the home ASP falling 22% YoY in FY4/2022, we do not see this as a major negative as the company has been building cheaper developments outside of London, as well as more multiple dwelling units. The macro environment is a concern with high U.K. mortgage rates pushing down demand, particularly from first-time buyers, but one advantage the company has is its ability to adapt and tailor development solutions depending on what customers are looking for. Consequently, if there was more demand for starter homes or luxury housing, the company can tailor developments to market needs.

The shortage of housing in London is well-documented with a recent article from the New Statesman highlighting that 106,000 people are searching for rooms in the capital, but fewer than 15,000 are available. We believe this remains a secular growth driver for Berkeley Group, with its focus on delivering sites in and around the London area. Currently, the company is working on 43 development sites in London and 46 sites outside in neighboring areas.

Market cycle impact

Whilst current business conditions may result in a conservative outlook for the short term, the company mentions increasing costs for building materials but labor supply appears reasonable and on a blended basis sale prices have managed to offset cost pressures.

Looking back at the Great Financial Crisis (page 33), we saw that the company did experience a significant drop in units sold in FY4/2009, but took advantage of falling asset prices to acquire prime locations which helped the business grow and scale for over a decade. We believe a similar scenario is currently unfolding, although there will be neither quantitative easing nor fiscal loosening this time around.

Track record through last market cycle

Track record through last market cycle (Company)

The company will have to be well-capitalized in order to take advantage of opportunistic land purchases or to ride out a short period of falling customer activity. Fortunately, Berkeley Group had a low debt-to-equity ratio of 0.2x in FY4/2022 and had a total borrowing capacity of GBP1.2 billion/USD1.0 billion which should allow it to see out any major downturn.

Company pre-tax profit guidance for FY3/2024 is GBP600 million/USD720 million, which is above current consensus forecasts (see Key financials table above) of GBP540 million/USD648 million. Business conditions have markedly deteriorated since the fall of 2022, and we believe things will remain tough for the short term. However, we believe secular drivers over a housing shortage will begin to make a positive impact in the medium term.

Valuations

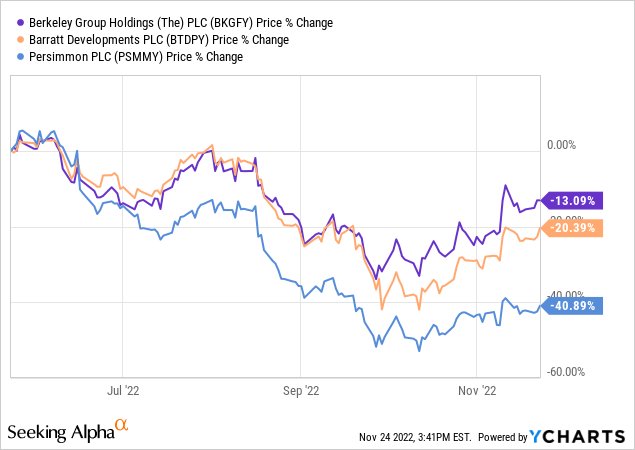

On consensus forecasts, the shares are trading on PER FY4/2023 10.7x on a free cash flow yield of 7.8%. We believe that this is a low valuation for a company with a solid 3-year development pipeline, aiming at the London market where demand remains high. We note that since the U.K. government mini-budget announcement (which resulted in rocketing borrowing costs) in September 2022, the shares have responded to a more orderly environment in the financial markets and have begun to outperform its peers such as Barratt (OTCPK:BTDPY) and Persimmon (OTCPK:PSMMY).

Risks

Upside risk comes from sustained demand for housing in the London area, as rents have risen significantly since the autumn mini-budget, and mortgage offers have begun to see falling rates from their peak. The U.K. government may introduce new measures to assist first-time home buyers to get on the property ladder.

Downside risk comes from a major decline in home ASP and volumes as customers are unable to afford Berkeley’s mid to higher-end housing. Limited demand may result in developments being put on hold, inflating inventory.

Conclusion

Investing in a real estate developer at the cusp of a recession may not sound sensible, but we believe on a long-term horizon the shares present a buying opportunity. The business is well-capitalized, has a strong market position in the London housing market with its secular growth theme, and valuations look cheap when considering its large asset base.

Be the first to comment