sefa ozel/iStock via Getty Images

A Quick Take On Belite Bio

Belite Bio (BLTE) has filed to raise an undisclosed amount in an IPO of its American Depositary Shares representing underlying ordinary shares, according to an F-1 registration statement.

The company is a clinical stage biopharma developing treatments for currently untreatable eye diseases.

When we learn more information about the IPO, I’ll provide a final opinion.

Company & Technology

San Diego, California-based Belite was founded to develop a pipeline of treatment candidates for age-related macular degeneration and autosomal recessive Stargardt disease (STGD1).

Management is headed by founder, Chairman and CEO Dr. Yu-Hsin Lin, who has been with the firm since inception in June 2016 and was previously founder, Chairman and CEO of Lin BioScience, a major investor in the company.

The firm’s lead candidate, LBS-008, or Tinlarebant, is a once-per-day oral treatment candidate for STGD1 designed to reduce the accumulation of toxic vitamin A by-products in ocular tissue.

LBS-008 is currently in Phase 3 trials, with patient enrollment in Taiwan, the U.K., Hong Kong and Switzerland.

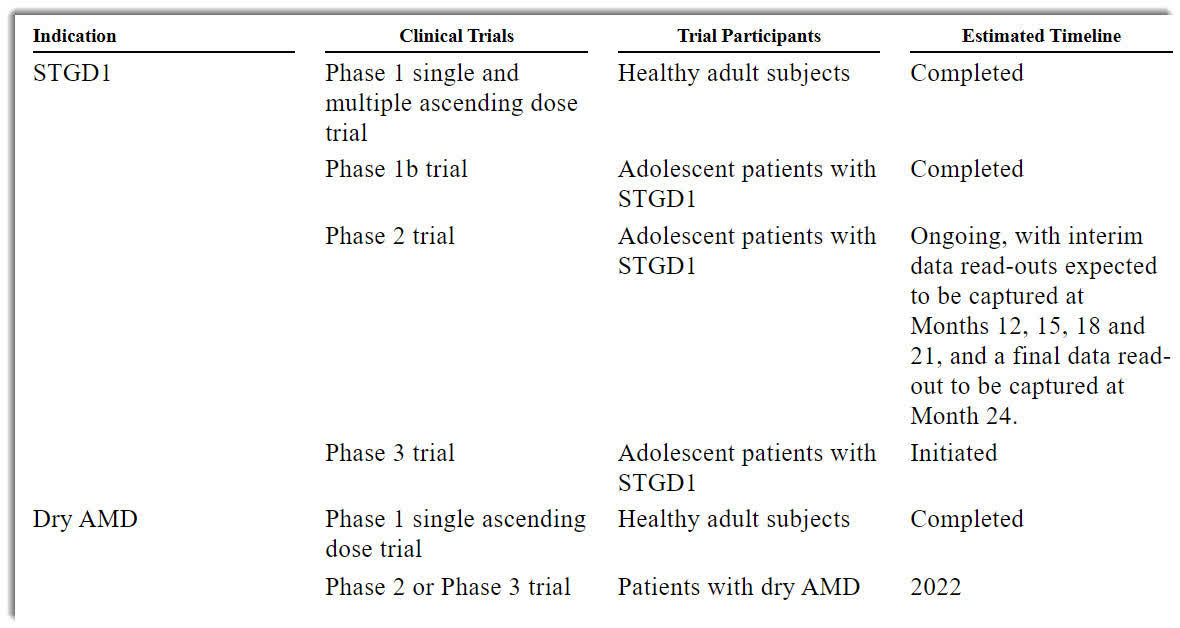

Below is the current status of the company’s drug development pipeline:

BLTE Pipeline (SEC EDGAR)

Belite has booked fair market value investment of $40.6 million as of December 31, 2021 from investors including Lin BioScience International Ltd.

Belite’s Market & Competition

According to a 2021 market research report by Coherent Market Insights, the global market for the treatment of Stargardt disease is expected to reach $1.7 billion in market size by 2028.

This represents a forecast CAGR (Compound Annual Growth Rate) of CAGR of 31.7% from 2020 to 2027.

Key elements driving this expected growth are an increase in the number of treatment options for patients.

Also, the current primary treatment option for Stargardt disease is Emuxistat.

Major competitive vendors that provide or are developing related treatments include:

Kubota Pharmaceutical Holdings Co., Ltd., Stargazer Pharmaceuticals Inc, Iveric Bio, Sanofi S.A., Alkeus Pharmaceuticals, Astellas Pharma, CHABiotech Co., ReVision Therapeutics, Biogen, and F. Hoffmann-La Roche AG.

Belite Bio Financial Status

The firm’s recent financial results are typical for a clinical stage biopharma firm in that they feature no revenue and significant R&D and G&A expenses associated with its pipeline development efforts.

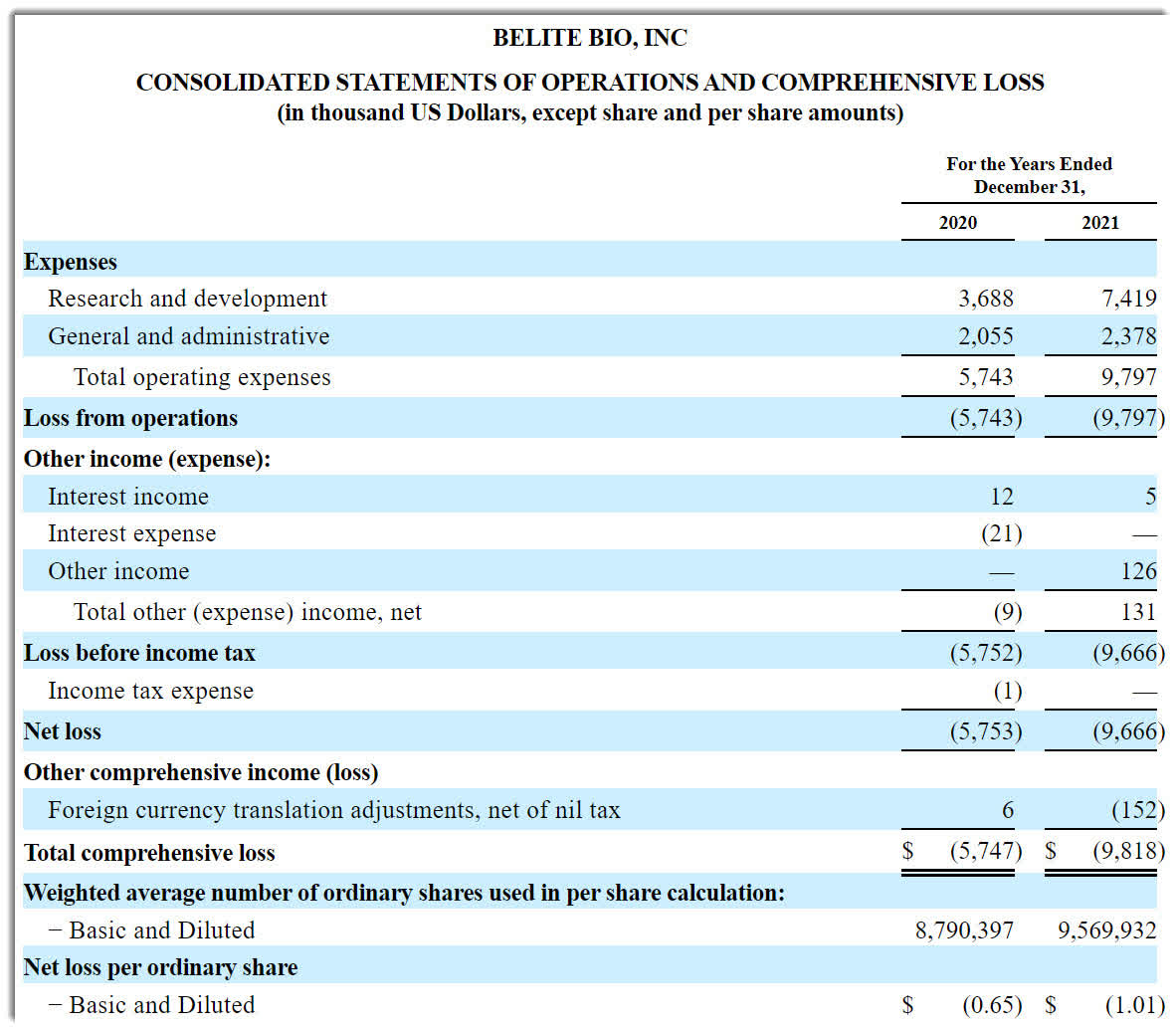

Below are the company’s financial results for the past two calendar years:

BLTE Financials (SEC EDGAR)

As of December 31, 2021, the company had $17.3 million in cash and $1.6 million in total liabilities.

Belite Bio IPO Details

Belite intends to raise an undisclosed amount in gross proceeds from an IPO of its American Depositary Shares representing underlying ordinary shares.

Existing shareholder Lin BioScience has indicated an interest to purchase shares of up to $15.0 million in the aggregate at the IPO price.

Management says it will use the net proceeds from the IPO as follows:

We intend to use approximately 6.1% of the net proceeds for our Phase 3 clinical trial of LBS-008 for STGD1, approximately 60.2% of the net proceeds for further clinical development of LBS-008 for dry AMD, such as Phase 2 or Phase 3 clinical trials, and the remainder for working capital and other general corporate purposes.

(Source)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management says the firm is not currently a part of any legal proceedings that it believes would have a material adverse effect on its financial condition or operations.

The sole listed bookrunner of the IPO is The Benchmark Company.

Commentary About Belite’s IPO

BLTE is seeking U.S. public market capital to fund its pipeline advancement efforts.

The firm’s lead candidate LBS-008, is a once-per-day oral treatment candidate for STGC1 designed to reduce the accumulation of toxic vitamin A by-products in ocular tissue.

LBS-008 is currently in Phase 3 trials for STGD1, with patient enrollment in Taiwan, the U.K., Hong Kong and Switzerland and is also being trialed for the treatment of AMD.

The market opportunities for these treatments are large and are expected to grow significantly in the year ahead.

Management has not disclosed any major pharma firm collaborations.

The company’s investor syndicate includes primary shareholder Lin BioScience.

The Benchmark Company is the sole underwriter and IPOs led by the firm over the last 12-month period have generated an average return of negative (35.0%) since their IPO. This is a lower-tier performance for all major underwriters during the period.

When we learn more IPO pricing and valuation expectation details, I’ll provide an update.

Expected IPO Pricing Date: To be announced.

Be the first to comment