bowie15/iStock via Getty Images

Investment Thesis

Bed Bath & Beyond (NASDAQ:BBBY) once again picks up retail interest as a meme mania stock.

The backdrop? The worse the company’s prospects, the more crowded the short side becomes, and the more attractive it becomes as a meme stock.

While there’s really nothing wrong with speculating on meme stocks. It does not lead to the path to financial independence. Avoid this stock.

A BBBY Meme Stock, Again?

In the past month, BBBY has seen its stock soar 100%, including the 14% sell-off in yesterday’s market. The reason for the sudden uptick?

I believe that BBBY has seen a significant amount of short-covering. As a reminder, BBBY’s stock is approximately 40% shorted.

Indeed, a theme that has picked up over the last few weeks where the most ”hated” business models, with the most crowded shorts, have seen algos covering their short positions.

And as more and more shorts covered their positions, this led to retail traders picking up stocks such as BBBY and running with them.

And this leads me to discuss the current market environment we find ourself in.

The problem with investing is also its biggest opportunity. In the short term, it’s all about perception. Psychology plays a significant role in how an investor positions themselves. And a change in psychology can lead to a rapid change in investment flows towards a stock.

And then, to compound matters, together with a change in psychology, a stock that was formerly left-for-dead, becomes a stock that is suddenly ”perceived” to be a value stock. This culminates in a lollapalooza that suddenly catches upward momentum.

This leads to an overwhelming urge from shareholders to hold on to see if indeed BBBY’s stock goes to the moon.

Investors start to believe that Bed Bath is something that it’s not. The business has been struggling for years.

Even if during the Covid period, we can see in hindsight, that it had a period of abnormal prosperity.

After all, we were all stuck at home with too few outlets to spend cash outside of our homes.

And now? Looking ahead BBBY is likely to be little more than a trading sardine.

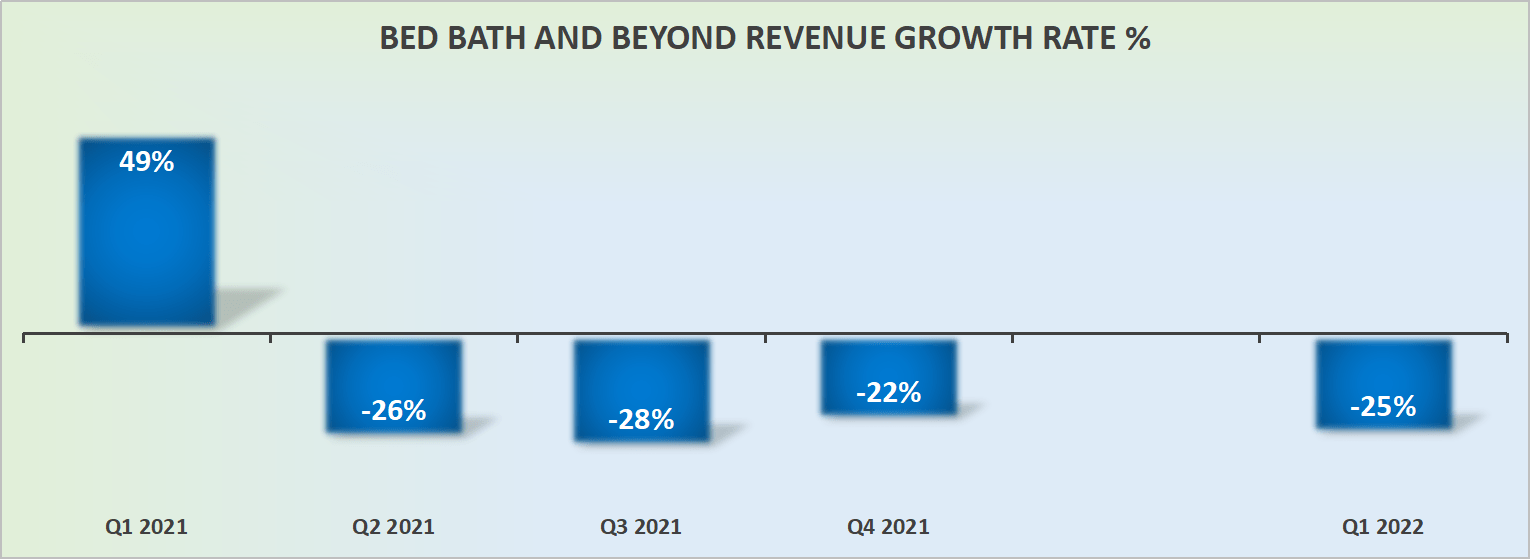

Revenue Growth Rates Stay Negative

BBBY revenue growth rates

BBBY’s Q1 2022 saw -23% comparable sales growth. This figure is a no-gimmicks, nowhere to hide, clean comparable figure to the same period a year ago.

Even though I recognize that BBBY was up against a very challenging comparable with last year.

However, the fact of the matter is that the Board clearly recognizes that BBBY isn’t making enough progress to gain market share or even to remain a viable business, which led to CEO Mark Tritton stepping aside recently after slightly over two years at the helm of this business.

But there again, I pause and ask, am I overthinking what’s at play here?

BBBY Stock Valuation — Difficult to Quantify

From where I see things, BBBY is an overleveraged business with declining sales.

By my estimates, I believe that when BBBY reports its Q2 2022 results next month, we’ll see a business with a net debt position of approximately $1.5 billion. If not slightly higher.

This compares with its equity, which is only being valued at close to half that amount.

And this leads to repeat what I said last month about BBBY:

You have an over leveraged business that’s highly shorted, which is likely to see short squeezes over time.

The Bottom Line

twitter.com/WeAreYellowWolf

BBBY is once again a trading sardine. A trading sardine that has no real value. Why get rich slowly if you can get rich quickly?

The answer is this. Because it makes no difference how much capital you make. It matters how much capital you keep. And this business is on a slow march towards bankruptcy. Simply put, BBBY will not make you wealthy.

Be the first to comment