Michael M. Santiago/Getty Images News

Bed Bath & Beyond (NASDAQ:BBBY) reported disastrous Q4 results, posting a loss per share of 92 cents versus consensus estimates of 3 cents earnings per share. The results reflect very poorly on management’s execution and cast doubts on their ability to execute a turnaround. To make matters worse, on its earnings call, management commented that they would continue with their turnaround plans and rejected Ryan Cohen’s suggestion of selling their buybuy BABY business. The only silver lining among all this is that these results have dented management’s credibility and it should be relatively easier for Ryan Cohen to mobilize shareholders against them. This might be the reason why after slipping below March 4 levels (when Ryan Cohen first disclosed his stake) the stock posted some recovery. I believe if one is an ardent Ryan Cohen fan, the stock might make some sense. However, for other more conservative, non-meme type investors, it is best to sit on the sidelines until some clarity emerges on the company’s turnaround plan and management (either the current one or Ryan Cohen appointed one – if he wins the battle for control) makes some progress in terms of executing the turnaround plan.

Bed Bath & Beyond recently reported Q4 results with revenue of ~$2.05 billion, missing the consensus estimate of ~$2.07 billion, and declining ~22% Y/Y. Around 8% of the revenue decline was attributable to divestments of the non-core brands. The remaining 14% was due to core net sales decline. Adjusted diluted EPS turned significantly negative and came at -$0.92, compared to the consensus forecast of $0.03. The gross profit margin dropped to 28.8%, down by 400 basis points Y/Y. Out of the 400 bps decline, 360 bps can be attributed to increased port fees and freight and shipping inclination while the rest was primarily due to cost increases of 40 basis points net of product, pricing, and promotional optimization. Adjusted EBITDA fell to -$30 mn from $168 mn in the prior year same quarter while the company posted a net loss of $82 mn in comparison to a net profit of $47 mn same quarter last year.

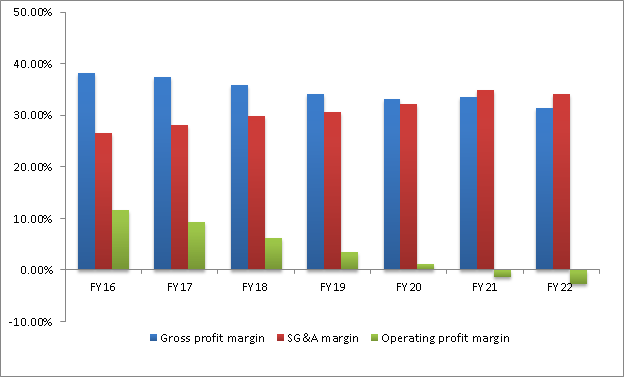

The company’s stock price made an intraday low of $15.80 post-earnings vs the prior day’s close of $17.97. However, this decline is not something new for its investors who have seen the company’s stock price on a downward trajectory since 2015 driven by increasing SG&A expenses and decreasing gross margins.

Bed Bath & Beyond Gross Margins, SG&A and Operating Margins (Company Data, GS Analytics Research)

Last fiscal year, management devised a 3-year comprehensive transformation strategy to turn the corner. This strategy is built on three pillars: elevating the customer experience, unlocking the omnichannel capabilities, and upgrading tools and processes to improve speed.

The plan calls for the remodelling of 400 Bed, Bath and Beyond stores to provide a better in-store customer experience along with the closure of 200 Bed Bath & Beyond stores that do not adhere to the 4-wall profitability concept. Management is also working on opening four Regional Distribution Centers (RDC) to reduce store replenishment time and strengthen its delivery network. They’ve signed a statement of intent for the West Coast RDC in Southern California, with building set to begin in 2022.

Another aspect is the launch of owned brands, as well as digital expansion through the development of an Omnichannel to drive in-store and virtual sales while also using stores as fulfilment centres. They’ve already launched eight of the ten brands they are planning to include.

The company is taking multiple courses of action as a part of its transformation strategy in order to achieve better margins, limit expenses and provide a better customer experience to drive customer acquisition and profitability. However, the results are not favouring the viability of the transformative plan.

In a recent letter to the company, Ryan Cohen, Manager of RC Venture LLP, alluded to the same point highlighting his concerns regarding the company’s complex transformation strategy that focus on multiple initiatives. Frankly looking at Q4 results, Ryan Cohen’s apprehension seems valid. He proposed a few changes to the strategy like spinning off the buybuy BABY business to improve valuations by reducing debt and buying back shares; reducing executive compensation which at ~$36 mn appears high given the dire state the company is in; and focusing on the company’s operational capabilities and modernizing its supply chain.

However, I believe management is not considering his suggestions at all. In the recent Q4 conference call, there was no mention of Ryan Cohen’s proposed changes and transformative initiative and management shared their disagreement with selling buybuy BABY banner. It is one thing when a business is posting healthy numbers and doesn’t bother to consider external suggestions, but for companies like BBBY going against or not feeling the need to take advice from outside while significantly lagging behind its peers is something shareholders would likely not approve of.

I believe the results were really bad but there is a silver lining to it. These results have further dented the credibility of management and Ryan Cohen’s job of convincing shareholders to vote against the current management has become a bit easier. Given Ryan Cohen’s success with gaining control of GameStop (GME) and the way retail investors rallied behind him, there is hope that better days may come for Bed Bath & Beyond as well. However, there is a lot of uncertainty involved and I am a more conservative investor who likes to see some progress in actual business before initiating a long position. So, I don’t think the stock is a buy just based on the hope of a potential turnaround. However, I won’t recommend going short either despite bad results given the involvement of Ryan Cohen and meme stock investors. Hence, I have a neutral rating on the stock.

Be the first to comment