Justin Sullivan/Getty Images News

Shareholders soon may be papering their bathroom walls with their Bed Bath & Beyond (NASDAQ:BBBY) stock certificates instead of having to buy wallpaper at a store. Prior massive stock repurchases have severely weakened this retailer and vendors are currently making it very difficult, if not impossible, for BBBY to turn around. Some vendors have set much stricter standards for orders, which has resulted in BBBY being unable to properly stock their stores. Even with new financing they may not have enough capital to cover expected negative cash flows. I have serious doubts that the company can survive the recession without going into bankruptcy court, unless meme traders buy a lot more shares in any future stock offers. BBBY stock most likely would currently be trading much lower if meme traders did not discourage smart investors from selling it short.

Used Cash for Massive Share Repurchases

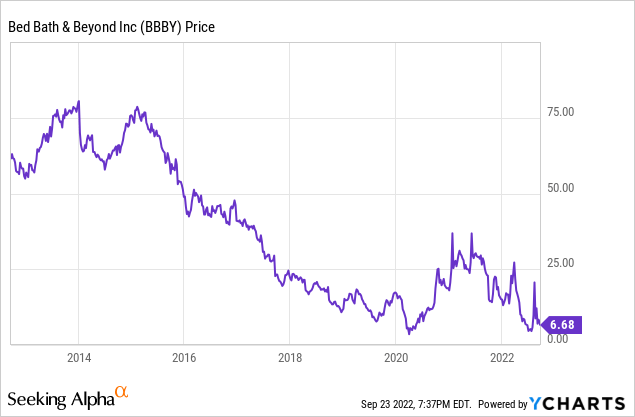

As everyone already knows the traditional retail industry has had a very difficult last 10 years and this includes BBBY. The major reason, in my opinion, why BBBY has gotten itself into such a difficult position is because of irrational prior massive stock repurchases. They have used a total of $11.728 billion of their cash to repurchase 264.7 million shares for an average price of $44.31, including repurchases over the past year, since 2004. These numbers compare to 91,779,205 shares outstanding, including the recent 12 million stock offering, or about a total equity capitalization of just $613 million.

How can the board of directors defend authorizing using $406.5 million cash from February 27, 2021, to November 27, 2021 to repurchase 14.182 million shares for an average price of $28.66? The company was already facing many problems and they burned cash on just trying to support their stock price. Why not use the cash to actually improve operations and their business model? This grossly irrational, in my opinion, use of cash continued, and they repurchased an additional 14.365 million shares using $130.5 million in the final quarter and 2.5 million shares for about $43 million during their 1Q of this year.

So let me get this straight. Earlier this year the company was making major repurchases of their stock that was authorized by the board of directors, but on August 31 they did a 180 degree turn and sold 12 million shares via Jefferies, which most likely raised about $100 million net, because they desperately need additional cash.

Vendors Have Become a Major Problem

Their vendors could be the ones that force BBBY into restructuring. Because of our complex bankruptcy process many vendors do not even want to deal with retailers who are facing financial troubles and other vendors are requiring stricter terms.

Often you see very small “ma and pa” stores paying cash to the drivers out of their cash register when they get a delivery. Larger stores, however, often get the merchandise and then receive an invoice, which is eventually paid. This allows larger stores to receive new merchandise without immediate payment and that allows them to use proceeds from selling the merchandise received to help pay that invoice. If vendors demand large deposits when an order is placed before they even ship the items or demand COD, that store needs a lot more cash to operate than if they can use normal invoice/billing operations.

BBBY is having serious problems with their vendors, and they stated in a recent prospectus filing, “as of August 30, 2022 certain of our vendors and suppliers have requested and/or been granted more stringent payment terms, stand-by letters of credit and/or earlier or advanced payment of invoices”. At this point, however, we do not know how many of their approximate 4,600 vendors are requiring stricter terms.

Vendors are worried that if BBBY eventually files for bankruptcy that they may not get paid at all because many of their claims would be classified as general unsecured claims, which are low priority for recoveries under many Ch.11 reorganization plans. Many vendors to U.S. retailers have been burned over the last few years as there have many store Ch.11 bankruptcy filings. Not only are the vendors now more cautious, but the vendor’s bankers are also demanding that the vendors be more conservative in their dealings with U.S. retailers.

Potential bankruptcy claims by vendors are actually very complex. While many vendor claims are unsecured claims, there are other potential classifications. Those goods constructively received within 20 days prior to the bankruptcy are considered administrative claims under section 503(b)(9) and have a relatively high priority under a plan. These claims are at the same level as vendors’ claims who deal with a retailer while they are in bankruptcy. In addition, often a retailer in bankruptcy will ask the court to allow them to pay their “critical vendors” during the bankruptcy process because the retailers worry that if these vendors are not timely paid, they will stop dealing with the retailer.

If these vendors claim classifications are not complicated enough, there is another vendor worry. If a vendor is paid within a 90 day period prior to the bankruptcy filing and the retailer was actually insolvent at the time of these payments, these “preferential transfers” might be subject to litigation trying to get the vendors to repay the money to the retailer’s bankruptcy estate under section 547. For example, a major part of Sears Holdings (OTC:SHLDQ) Ch.11 bankruptcy plan (docket 4476) includes an extensive use of section 547 preferential transfers in an attempt to get needed cash from their prior vendors to have their plan declared effective. So, a vendor may incorrectly assume that since they already got paid that they do not have to worry that the retailer filed for bankruptcy. Later, however, they may be shocked when they receive a preference transfer demand letter in the mail for repayment of the money. Often the fight is over if the retailer was or was not insolvent at the time of the payment.

Some vendors may also file “notices of reclamation” for their unsold merchandise if that merchandise was received within 45 days prior to the bankruptcy filing under section 546(c). The problem for vendors is if a retail debt holder has a secured claim on the retailer’s inventory, they will not be able to reclaim that merchandise.

My coverage of these vendor claim issues are just a brief summary, but I included them in this article to point out why vendors are reluctant to deal with financially weak retailers who they worry might eventually file for bankruptcy. These issues are very complex and difficult to understand, especially for overseas vendors with limited understanding of the U.S. Bankruptcy Code and associated case law. This is why BBBY is having major vendor issues.

This vendor problem and lack of merchandise to sell was very obvious when I visited the BBBY store on Sixth Avenue in Manhattan a few weeks ago. There were empty shelves and much lower variety of various types of products. The store also had very few shoppers. This specific store was very busy years ago with a lot of interesting merchandise.

Burning Cash Continues

BBBY is burning cash. At the end of 1Q 2022 they had only $107.5 million cash, which is down sharply from $439.5 million at the end of the latest fiscal year and down from $1.353 billion from the end of the prior fiscal year. In their August 31 filing, management stated that for the 2Q they had “free cash flow usage of approximately $325 million” (Usage is a nicer way of saying they had negative cash flow, or they burned cash.) Until the company actually files their 2Q report on September 29 we will not know how much their actual current cash position, but in one of their recent presentation exhibits shows “$0.2 billion cash and investments” for 2Q.

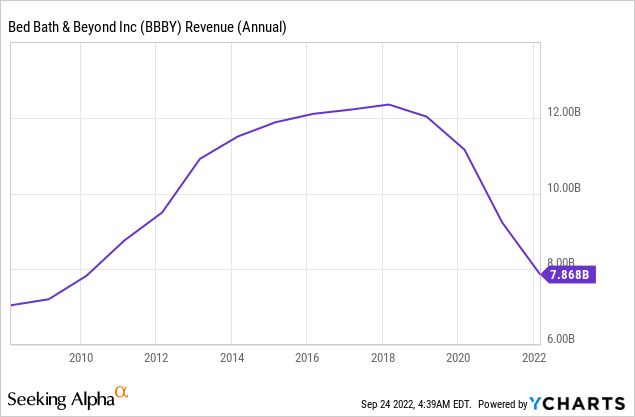

To help with the huge cash problem, they are borrowing $375 million under a new FILO loan and a modest increase in their ABL facility. I am also assuming that they raised about $100 million net cash in their 12 million stock sale. They are also closing 150 stores, cutting their workforce by 20%, and reducing CAPEX. The reality you just make cuts and borrow more to stay solvent-you need to grow the top line, but that is not happening. Management stated that 2Q comps will show a decline of 26% and sales of about $1.45 billion. These sales declines look even worse because total U.S. retail sales increased 1.0% in June, flat in July, and increased 0.3% in August. What happens when we slip deeper into a recession as the Fed raises interest rates?

BBBY needs a certain amount of cash just to operate and if they continue to burn cash, especially if the U.S. has a much weaker economy the next few quarters, they will have to raise new cash. Given that meme traders irrationally support this stock I would expect additional stock offers to raise cash. Another advantage for BBBY is that meme traders seem to ignore dilution that might be caused by future stock sales.

Some investors also think that the company could raise a significant amount of cash by selling their 135 buybuy Baby stores, which until recently were doing well and were performing better than the 709 Bed Bath & Beyond stores. They better do that sale soon before they get even close to being considered insolvent. The problem is that if BBBY does eventually file for bankruptcy in the future and any asset sale that closed within two years of that filing will be looked at by creditors to see if BBBY was insolvent at the time of that sale and if BBBY “received less than a reasonably equivalent value” for that asset. This could then present a section 548 problem and result in cancellation of that sale. Lenders to potential buyers are often sensitive to section 548 issues when the buyer is purchasing assets from destressed sellers. (Details of section of 548 is beyond the scope of this article.)

Conclusion

The massive stock repurchases really put BBBY into having serious financial problems. Now vendors are causing problems because they do not want to be stuck with BBBY not paying them if the retailer files for bankruptcy. The complexity of the U.S. Bankruptcy Code makes vendors become very uncomfortable about even dealing with BBBY.

There are many recent issues/events, such as their CFO committing suicide in New York, that add anxiety to investors holding BBBY securities. With their 3.749% 8/1/24 unsecured notes trading under 32 and their 4.915% 8/1/34 unsecured notes trading at 15, the debt market is factoring in a high probability that BBBY will at some point in the near future could be filing for Ch.11 bankruptcy. At this point, I think the only way BBBY stays out of bankruptcy court is if meme traders continue to support the stock and aggressively buy stock from any future stock offering used to raise additional cash. I rate BBBY a sell.

I have had many short sales of BBBY that I held open for just a very short period of time. On Friday, my limit orders to buy to close BBBY short trades were hit. I may again short BBBY depending upon future meme irrational trading and their September 29 financial report.

Be the first to comment