OtmarW/iStock via Getty Images

The beat the TSX portfolio (hypothetical ticker BTSX) has a wonderful longer term habit of beating the market. The strategy is dead simple. BTSX will simply hold the top ten yielding stocks from the TSX 60. It will change the constituents (holdings) for the first trading day of each year, and it will continue to hold those ten stocks throughout the year. The Beat The TSX portfolio underperformed in the pandemic year of 2020 as value was certainly out of favour. But it is charging back. The BTSX portfolio is back to its winning ways in 2021 and 2022.

The portfolio strategy finds profitability, moats and value, as it will often find more beat up stocks that have fallen in value and hence, lifting the dividend yields available. This would be a great time to remind you that past performance does not guarantee future returns.

That said, the Beat The TSX portfolio has a very solid long term performance beat over the market.

Beating the market for over 30 years

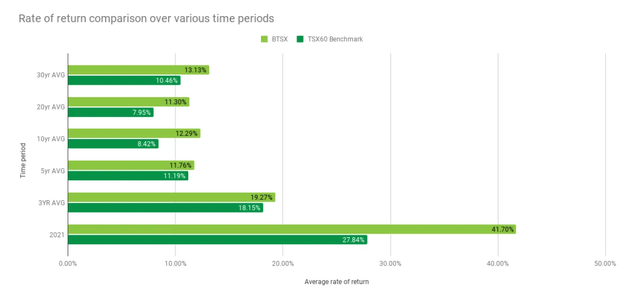

From the dedicated Beating the TSX site, dividendstrategy.ca.

As of the end of 2021, the 30-year average rate of return using the “Beating the TSX” method was 13.13%. To put this in context, the benchmark index rate of return was 10.46% over the same time period.

BTSX has outperformed the benchmark over the last 3, 5, 10, 20 and 30 years.

Beat the TSX historical returns (dividendstrategy.ca)

Dividendstrategy.ca points out that with respect to total returns, the Beat The TSX portfolio has actually more than doubled up on the index.

What this means in real terms is that $10 000 invested using the BTSX strategy 34 years ago would be worth $369,752 today. That same $10 000 invested in the benchmark index would be worth only $173,859 – a 113% difference.

That’s crazy. As in crazy good for investors.

How does it work?

As a dog of the TSX approach, the selection process will find incredible value. As it seeks out the highest yielding stocks on the blue chip TSX 60, it will often find the most beat up stocks and beat up sectors.

The Canadian market is also unique in that the Canadian wide moat stocks operate in an oligopoly setting. Those moats are mostly found in the financials, telco, utilities and pipelines. The approach combines value with wide moats.

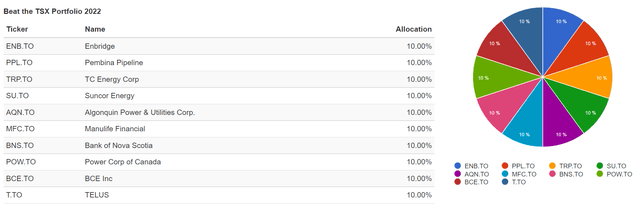

From the Beat The TSX portfolio for 2022, traditional energy also makes an appearance by way of Suncor (SU).

Beat The TSX 2022 (Cut The Crap Investing)

Given the current inflationary environment it will be no surprise that the BTSX Portfolio (with 5 energy contributors) is performing very well in 2022.

The big beat in 2022

The beat is on in 2022. The portfolio has delivered returns of 14.7% to the end of May 2022.

- BTSX 2022 up 14.7%

- Canadian stocks down 1.4%

- U.S. stocks down 12.8%

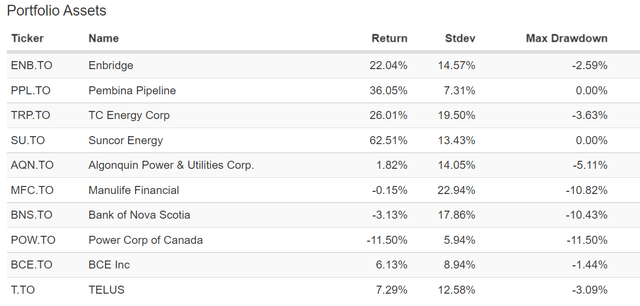

Here are the returns for the individual assets in 2022.

Beat The TSX 2022 Assets (Author, Portfolio Visualizer )

We see the pipelines and Suncor leading the way in 2022.

Here’s the tickers for additional research. Enbridge (ENB), Pembina Pipeline (PBA), TC Energy (TRP), Suncor (SU), Algonquin Power & Utilities (AQN), Manulife (MFC), Bank of Nova Scotia (BNS), Power Corp. (OTCPK:PWCDF), Bell Canada (BCE), Telus (TU).

Over a year ago on my Seeking Alpha blog, I had suggested that U.S. investors might take a look at Canadian stocks. On my CTCI blog, in October of 2020, I had suggested Canadian energy stocks.

These were obvious trends due to favourable valuation and the supply and demand oil and gas imbalance created by lack of investment and anti-traditional-energy trends and sentiment.

Even though the choice today might between a recession or stagflation, I still like the oil and gas position. A recession will simply be a pause of the favourable supply and demand dynamic for oil and gas.

Energy equities were a strong performer during stagflation and are a sector that is known to prosper during inflation. It is a wonderful inflation hedge to own.

I have Canadian oil and gas holdings near a 10% portfolio weighting. The pipelines add another 12%.

Putting Beat The TSX to work

I do not know of any investor who employs the BTSX strategy, sticking to the strict script. That said, the approach certainly has a history of identifying and finding value on a consistent basis.

I like the idea of building around those Canadian wide moat sectors (identified above). An investor might then layer in some BTSX members as they see fit. I’d suggest you continue to hold the BTSX stocks, even when they are removed in any annual reset.

That said, the Beat The TSX portfolio has certainly proven its worth over time. You may choose to adopt the strategy in full while being aware of the times when it can fail vs the market.

Team USA and Canada

The U.S. market fills in the many portfolio holes of the Canadian market and for the Canadian investor. In the U.S., we’ll find the best companies in the world. We can layer in technology and healthcare and consumer stocks to top the list of needed portfolio sectors that are lacking north of the border.

Here’s a recent update, the outperformance of our U.S. stock portfolio.

U.S. investors might consider the benefit of the Canadian wide moat stocks with generous dividends. While a Canadian investor might be wise to hold a greater weighting in U.S. stocks compared to Canadian, the opposite might be true for U.S. investors. That said, you might consider a 10% to 15% weighting in a combination of BTSX and Canadian energy stocks.

Keep in mind that is more beneficial to hold Canadian stocks in certain retirement accounts, where you will not face the withholding taxes on dividends.

Check out this tax guide from Sure Dividend.

And as always, consult a tax expert to make sure you get things right.

Thanks for reading. We’ll see you in the comment section.

Be the first to comment