Darren415

This article was first released to Systematic Income subscribers and free trials on Nov. 12.

Welcome to another installment of our BDC Market Weekly Review, where we discuss market activity in the Business Development Company (“BDC”) sector from both the bottom-up – highlighting individual news and events – as well as the top-down – providing an overview of the broader market.

We also try to add some historical context as well as relevant themes that look to be driving the market or that investors ought to be mindful of. This update covers the period through the second week of November.

Be sure to check out our other Weeklies – covering the Closed-End Fund (“CEF”) as well as the preferreds/baby bond markets for perspectives across the broader income space. Also, have a look at our primer of the BDC sector, with a focus on how it compares to credit CEFs.

Market Action

BDCs had a strong weekly return, gaining 2% on average. Month-to-date the sector has gained nearly 5% on the back of strong overall Q3 results as well as a broader pick-up in sentiment from a downside surprise in inflation.

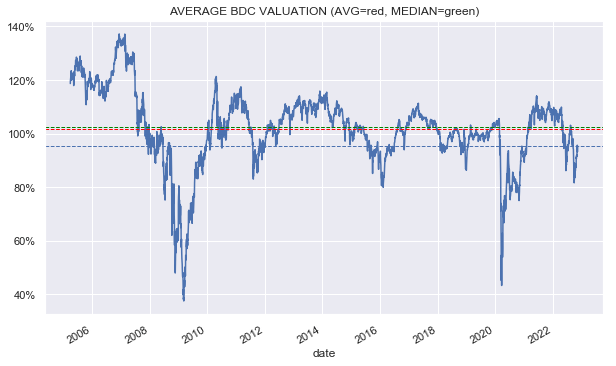

The average BDC valuation has risen to 95% – well above its near-80% trough that we saw just a few weeks ago. By historical standards the sector remains below its average valuation, however, the margin of safety is clearly not as high as it was in September.

Systematic Income

Market Themes

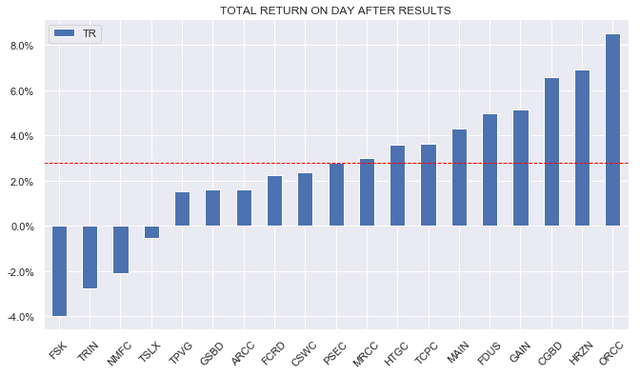

The price action of the BDC sector has been very interesting this earnings season. What we see in aggregate, if not with a 100% consistency, is that BDC prices have tended to jump on earnings results. As the following chart shows, the median change in the stock on the first day of trading after the earnings release is nearly 3%.

What this shows is that the sector continues to be surprised by these strong results, specifically, NAV resilience, net income jumps and dividend hikes. This somewhat pessimistic view was likely predicated on a roughly 3% average drop in the NAV in Q2 and the fact that net income did not actually move up during the previous hiking cycle.

Our own view has been more upbeat. As highlighted earlier, we expected net income to rise substantially and outperform the previous hiking cycle. And in a separate weekly we expected NAVs to outperform Q2 levels.

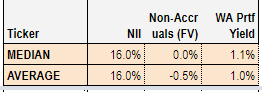

Q3 NAV changes are running at around -0.5% on average – slightly better than our -1% midpoint estimate. And net income has jumped considerably by 16% during the quarter which has allowed most BDCs to hike their dividends.

Systematic Income BDC Tool

This set-up, along with a fairly depressed average valuation, meant that the sector was well set up for a rally which we are witnessing now.

Market Commentary

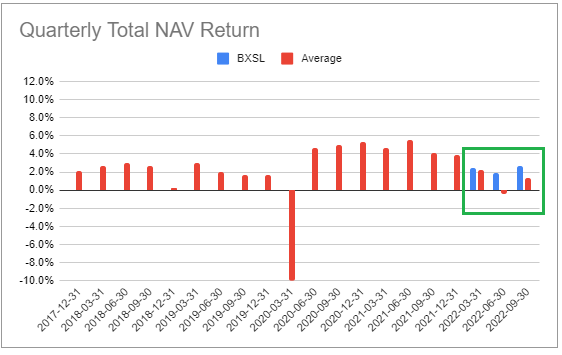

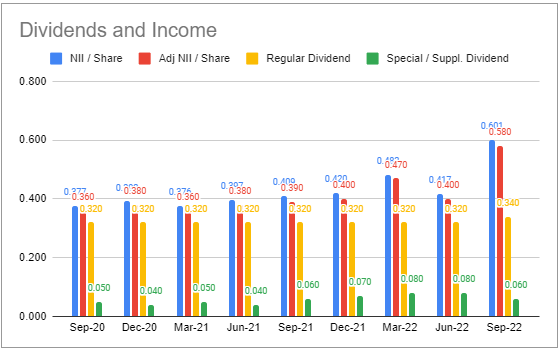

Blackstone Secured Lending (BXSL) declared Q3 results. NAV fell half a percent – roughly in line with the broader sector, biased lower from previous special dividends. Total NAV return for the quarter was +2.7%, outperforming the sector.

The company hiked its dividend earlier in September by 13%. It also repurchased $164m of shares at an average price of $23.82 – a bit below where it is trading now – during the quarter which drove an accretion in the NAV of about half a percent.

Net income was up 29% from the prior quarter, leaving coverage at 130%. Non-accruals remained at zero and there were net realized gains. BXSL has outperformed the sector each of the 3 full quarters since it has gone public. It remains a good option for a relatively boring / high-quality BDC given its nearly full first-lien portfolio, strong track record as a private entity, low management fee and low debt cost. It is trading 2% below the sector average valuation and remains a Buy in our Core and High Income Portfolios.

Systematic Income BDC Tool

Carlyle Secured Lending (CGBD) had a great Q3 – NAV increased by 2% while the base dividend was hiked 6% and the supplemental was increased as well. Net income jumped close to 50%, in part due to a holding coming back to accrual. Adjusted for this, net income was around 10% higher.

Systematic Income BDC Tool

The company increased the base dividend for the second quarter in a row. Non-accruals fell and portfolio quality, as gauged by internal ratings, improved. The stock has outperformed the sector for the fifth-quarter in a row in total NAV terms. It has a max 5% allocation in our High Income Portfolio and is rated a Buy.

There was more information on the bitcoin miner positions from Trinity Capital (TRIN). Management believe that the other two miner positions are fine (having much less leverage overall). The Core Sci loan worst case scenario is TRIN takes over the equipment, which they estimate at market value of $9-10m. This means the loan would be written down by another $10m or about 2% of NAV. That comes out to a valuation of around 83% versus sector average of 95%. The other driver of the NAV was the FemTec Health position which was placed on non-accrual and marked at 56.5%. Out of the 6.2% of total unrealized losses, 3.9% is due to credit issues. The rest appears to be due to the impact of higher rates on the mark-to-market of fixed-rate loans and this number should come back over the medium-term as the loans pull back to par.

Be the first to comment