J2R/iStock Editorial via Getty Images

BBVA (NYSE:BBVA) has reported a strong quarter with earnings increasing by 34% YoY, beating market estimates, a trend that is likely to persist in the short term.

As I’ve analyzed recently, BBVA is one of the best income investments within the European banking sector, as it offers a high-dividend yield and has an attractive valuation considering its better growth profile than peers.

As the bank reported its quarterly financial figures last week, in this article I analyze its most recent financial performance to see if the bank’s investment case remains the same, or if the prospects of an economic downturn are a threat to its dividends in the next few quarters.

Earnings Analysis

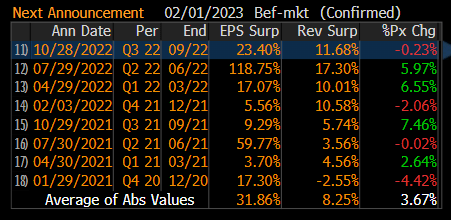

BBVA has reported last Friday its earnings related to Q3 2022, beating market estimates both at the top and bottom lines. As can be seen in the next graph, BBVA’s revenue was 11.7% above expected, while its EPS surprise was positive by more than 23%.

Earnings surprise (Bloomberg)

Its core revenues, which include net interest income (NII) and commissions, increased by 38.4% YoY. Its NII was boosted by higher interest rates and loan volumes (net loans +15% YoY), leading to a strong increase in NII in the last quarter (+45% YoY to €5.26 billion).

This clearly shows that BBVA’s business is highly geared to interest rates, boding well for NII growth in the coming quarters as interest rates are expected to continue in a rising trend for a little longer. By segments, BBVA reported very strong operating momentum in Mexico, where NII was up by 29% YoY with customer spreads improving to nearly 11%, while in Spain NII was up by 6.8% YoY.

Its net fee and commission income increased by 17.4% YoY to €1.38 billion, while trading income increased to €574 million (+54% YoY). Total revenues were €6.85 billion, up by 33.6% YoY, boosted largely by NII that represented some 76% of total revenue.

Regarding expenses, they also increased significantly due to inflationary pressures that led to wage growth across its geographies, leading to total operating expenses of €2.8 billion in Q3, an increase of 20% YoY. Its efficiency ratio was 42.9% in the first nine months of 2022, an improvement from the same period of last year, as revenue growth was above cost growth. This represents a very good level of efficiency and is among the best levels for European banks, showing that BBVA’s efforts to cut costs and investments in digitalization over the past few years were the right strategy.

Its credit quality remained quite good, despite the economic slowdown, considering that its cost of risk ratio was 86 basis points in the first nine months of 2022, a decline from 93 bps reported in 2021. This is a level that is below the bank’s guidance, set at below 100 bps at the beginning of the year, which is another positive tailwind for earnings growth.

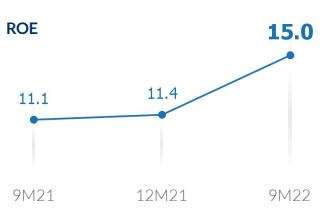

Due to strong revenue growth and resilient credit quality, BBVA’s net income increased to €1.84 billion, up by 34% YoY, and its return on equity ratio, a key measure of profitability within the banking sector, was 15% in the first nine months of 2022 (vs. 11.4% in 2021).

ROE (BBVA)

Regarding its capitalization, BBVA maintained a good capital position, a profile that is not expected to change much in the coming quarters. Its CET1 ratio was 12.45% at the end of Q3, a level that is above its capital requirements and its medium-term target range of 11.5%-12%.

BBVA delivered a very good quarter and this trend is not expected to change much in the short term, as the bank benefits from higher interest rates in Mexico and Europe, while credit quality continues to be the biggest uncertainty over the coming quarters.

So far, credit quality has remained resilient and BBVA is likely to report a lower cost of risk in 2022 compared to the previous year, and even lower than before the pandemic. Nevertheless, uncertainty regarding this issue is considerable and a pick-up in loan loss provisions is likely next year, due to macroeconomic concerns and the prospects of a global recession.

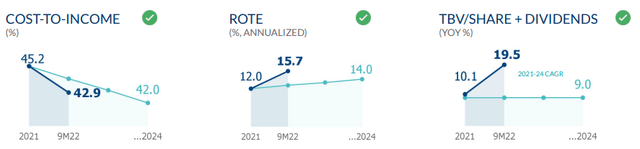

However, as revenue is expected to maintain a rising trend due to higher interest rates and the re-pricing of the loan book, BBVA is likely to report positive earnings growth and relatively high levels of profitability in the coming quarters, achieving quite easily its 2024 financial targets.

Financial Targets (BBVA)

Considering this background, BBVA should maintain its shareholder remuneration policy of distributing excess capital to shareholders, both through dividends and potential share buybacks, while small bolt-on acquisitions are possible in a few selected areas, such as fintech.

As expected, the bank did not announce anything new regarding dividends or share buybacks this quarter, but it’s likely to raise its final dividend and announce further buybacks when it releases its 2022 annual earnings, at the beginning of 2023.

Its last interim dividend (the bank pays dividends twice per year), was recently raised by 50% to €0.12 per share, and according to analysts’ estimates, its total annual dividend is expected to be about €0.42 per share, which means its final dividend should be about €0.30 per share (which will probably be paid next April).

This means that BBVA currently offers a forward dividend yield of more than 8%, which is very attractive for income investors.

Conclusion

BBVA reported a very good quarter, maintaining a positive operating momentum across its businesses, with Mexico being a key growth driver. While there aren’t many signs of deteriorating credit quality yet, this is likely to be a headwind in 2023, but doesn’t seem to be a major threat for the bank’s capital return policy.

Therefore, BBVA’s high-dividend yield remains quite interesting for income investors, and its valuation is also quite undemanding considering its growth profile. Indeed, BBVA is currently trading at 0.68x book value, at a discount to the European banking sector, while it has superior profitability and higher growth prospects, which justify a premium valuation to peers instead of a discount.

Be the first to comment