Sean Gallup/Getty Images News

Thesis

On August 4th, Bayer Aktiengesellschaft (OTCPK:BAYRY, OTCPK:BAYZF) published Q2 earnings and delivered strong results across all divisions. Moreover, the company raised the full year outlook for 2022 and reiterated confidence in the business’ resilience even amidst a challenging macro-environment in Germany. As Werner Baumann said:

Bayer does not currently see any material financial impact in 2022 from any potential gas supply bottlenecks as a result of the war in Ukraine.

Bayer stock is up almost 10% YTD, versus a loss of about 15% for the DAX 40 (DAX:IND) (Germany’s stock market benchmark).

As I have outlined in my coverage initiation article, I am very bullish on Bayer and believe the company’s stock has considerable upside. After a strong 1H 2022, I am confident to reiterate my Buy recommendation and raise the target price to $24/share – on the backdrop of EPS estimates upgrades.

Bayer’s Q2 Results

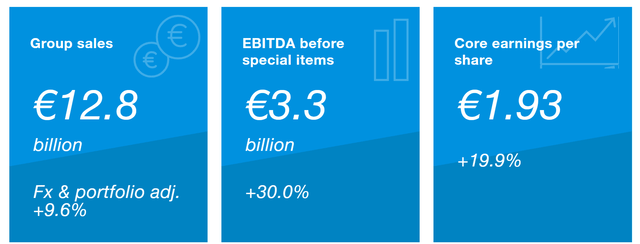

During the period from April to end of June, Bayer generated total revenues of EUR 12.8 billion, which is an increase of 9.6% year-over-year. EBITDA before special items jumped by more than 30% to EUR 3.3 billion. After a EUR 2.1 billion material expense related to an impairment charge in Crop Science and ongoing litigation expenses in connection with Glyphosate, Bayer generated a net loss of EUR 298 million, or EUR 0.3/share (versus a EUR 2.38 loss in Q2 2021). If investors look past the special charges, Bayer generated Core EBIT of 2.28 billion, increasing about 40% year over year. Respectively, core earnings increased to EUR 1.93/share (versus EUR 1.61/share the same period one year prior).

The company’s outstanding quarter was driven by growth in all segments, but Crop Science and Consumer Health stood out. Sales for Bayer’s agricultural business (Crop Science), increased by 17.2 percent to EUR 6.46 billion euros. According to the company, the strong performance was driven by a “substantial improvement in the market environment” and higher prices. The segment’s EBITDA jumped by approximately 72% to EUR 1.75 billion. Bayer’s Consumer Health segment grew by 6.8% to EUR 1.5 billion and generated EBITDA of EUR 330 million (up almost 20% as compared to the same period one year prior). Pharmaceuticals increased by only 2.1 percent year over year to EUR 4.8 billion. EBITDA grew by 4.9%to EUR 1.48 billion.

Improved Outlook and ESG Rating

Given a favorable business outlook, especially for the agriculture segment, Bayer announced:

In view of our good business performance and higher growth expectations, we have raised our full-year guidance

For the full year 2022, Bayer expects to generate revenues between EUR 50 billion EUR 51 billion euros, versus EUR 47 billion as expected previously. If materialized, this would imply approximately 8% topline growth year over year. EBITDA margin is expected to increase by one percentage point to 26%, which would result in an FY 2022 EBITDA of EUR 13 billion (versus 12.0 billion guided previously). Core earnings are estimated at around EUR 7.70/share (previous guidance: EUR 7.10/share).

Notably, Bayer also announced that MSCI ESG Research improved Bayer’s ESG rating significantly:

… recently updated their ESG Controversies Report and lifted the red flag related to “environmental concerns over GMO crops” as well as their related allegation of a breach of the UN Global Compact Principles. Following the removal of the Institutional Shareholder Services (ISS) red flag related to neonicotinoid insecticides last year, this is another important improvement in our ESG rating profile.

This is very important for the stock as many buy-side participants (e.g., asset managers) are constrained to buy only stocks with acceptable ESG ratings. As a consequence, given Bayer’s ongoing Monsanto litigations, many want-to-be buyers of the stock could not buy. That said, the improved ESG rating could broaden the universe of Bayer’s potential shareholder base – adding buying pressure.

Conclusion and Recommendation

Bayer remains a great company with an incredibly undervalued stock. Bayer’s Q2 results indicated that my bullish stance towards the company is justified, and I am confident to reiterate my Buy recommendation. Moreover, on the backdrop of a booming agriculture segment, I am upgrading long-term EPS expectation by about 10% and accordingly raising my price target to $24/share (more than 60% upside).

My coverage initiation article: Bayer: Risk/Reward Skewed To The Upside

Be the first to comment