milan2099

Introduction

I have been following Basic-Fit N.V.’s (OTCPK:BSFFF) story for the last few years. I already covered it in 2020. Basic-Fit is by far the biggest low-cost gym operator in Western Europe. In this article, I will discuss why the stock is attractive at current prices.

The Basic-Fit Thesis

Basic-Fit is the largest low-cost fitness club operator in the Benelux Union, France, and Spain. Through its scale in these existing countries, the company has already acquired significant operational leverage relative to its much smaller competitors – which provides customers with a good gym experience at a significantly lower price than any competitor can provide.

Low-cost fitness is a commodity, meaning customers will prefer a club with a lower price to a similar club with a higher price. When you go upmarket, customers pay up for an amazing personal experience, but at the low price point it’s practically a commodity business. Landlords like low-cost gyms from the well-financed market leader because they drive foot traffic, expand the value of the surrounding real estate, and are trustable tenants. Basic-Fit is providing customers with an unmatched value proposition and so turns fitness in Europe upside down. Basic-Fit’s stock is priced with significant pessimism about the viability of its business model, which in turn provides contrarians with a significant opportunity.

Ryanair

I believe a comparison should be made with Ryanair Holdings (RYAAY). Ryanair is a low-cost European airline that has acquired a significant moat through its operational leverage. Some of the benefits from operational leverage are also given back to customers through market-leading low airline fares. Just like low-cost fitness, short-haul air travel is a commodity business. People want to arrive at a destination at the lowest price possible. Ryanair’s relentless focus on lowering prices through scale has made the company one of the best growth stories of the 21st century.

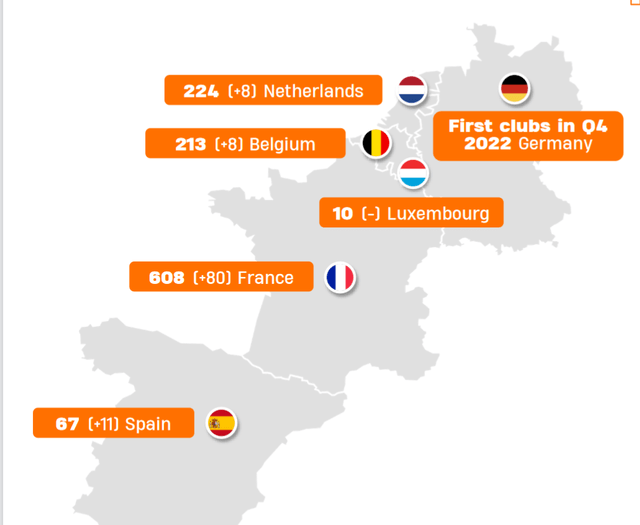

Basic-Fit’s Expansion

Basic-Fit is spending a huge portion of its capital expenditures on club expansion. During recent years, most of that expansion occurred in France and Spain. In my previous article from 2020, Basic-Fit had 357 clubs in France, now that is 608. Now Basic-Fit is set to open the first clubs in Germany. Basic-Fit aims to operate 3000-3500 clubs by 2030. Basic-Fit opens clubs in countries with relatively low fitness penetration, so Basic-Fit is essentially expanding the market. This under-penetration, combined with significantly lower prices than the competition, makes Basic-Fit essentially the first mover in markets like France, Spain, and even Germany.

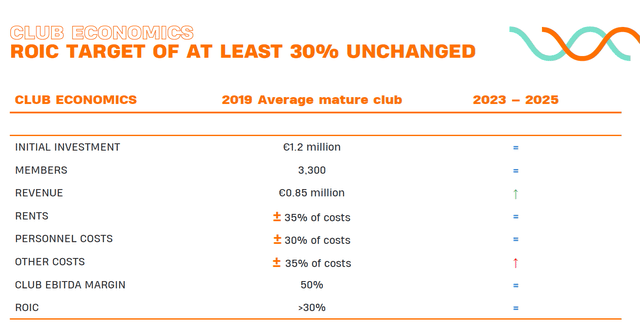

Basic-Fit’s ROIC and valuation

According to Basic-Fit, mature clubs already had a return on invested capital exceeding 30% in 2019. Mature clubs are clubs operating for more than two years. Most mature clubs at the time were located in the Benelux. If a significant number of the clubs can become mature and consistently sustain this level of ROIC; Basic-Fit will become an incredibly profitable company. Currently, Basic-Fit is loss-making due to a large number of capital expenditures related to opening new stores. At an ROIC of 30%, a club will generate €360,000 in EBIT. I estimate the company currently has around 700 mature gyms. Those gyms generate then €252 million in EBIT, which is €192 million in EBT. This means it is likely the company is selling at a P/E of 9.6 for this year if we exclude non-mature gyms.

So, even without expansion, Basic-Fit is selling at an estimated modest valuation. Especially considering the ROIC can be significantly higher than 30%. Add to this that Basic-Fit is investing its income into further growth, which is likely to lead to similar levels of ROIC. This can massively increase IRR for shareholders, especially at attractive stock prices. Incredible.

If Basic-Fit achieves its goal of 3000-3500 clubs by 2030, that could provide shareholders with €600 million in net income, one-third of the current market cap. At a 15 times earnings multiple, that would imply a stock price of €140. Currently, the share price on European markets is €25. That implies an IRR of 28%. At higher ROIC than 30% numbers, the implied return increases massively, too. I think the upside potential is clear. Let’s discuss the qualitative aspects of the company.

Basic-Fit’s Moat

But these high return on invested capital numbers are not nothing and require a business with a high barrier to entry. At first glance, a low-cost fitness club operator is not the type of company that can sustain those high ROIC levels.

The first barrier to entry is Basic-Fit’s network effect through its existing customer base. At Basic-Fit’s low price point, it is very difficult for a new entrant to steal Basic-Fit customers because Basic-Fit customer are already paying just 20 or 30 euros. First of all, because 15 euros will make less of a difference, secondly it is practically impossible for a small entrant to underprice Basic-Fit and be reasonably profitable in a place where Basic-Fit is already well-entrenched.

The second barrier to entry is operational leverage. For a low-cost fitness club, costs are mainly made up of buying and maintaining fitness equipment, rent and employee costs. Due to Basic-Fit’s scale, the company can buy fitness equipment at a 40% discount compared to an independent fitness club. Basic-Fit can demand this discount as gym equipment makers see Basic-Fit as a competitor, too. Basic-Fit has the number of clubs to potentially make their own fitness equipment and sell them to independent gyms, too.

Additionally, due to Basic-Fit’s size and the strong brand, landlords will be happy to allow a Basic-Fit to operate in their building at cheap rents. This increases the value of surrounding real-estate and drives foot traffic. And Basic-Fit is a trustworthy tenant, lowering risk for the landlord.

With automation, Basic-Fit can lower the number of employees required to operate a fitness club. Also, by being significantly scaled, Basic-Fit can operate with lower marketing cost per store than small sized chains can while having far better marketing recognition. Clearly, Basic-Fit can utilize its scale to lower all of its most significant costs and create a competitive advantage.

Basic-Fit’s barrier to entry is made up of network effects and multiple medium-sized scale benefits. All these benefits combined provide the company with the ability to sustain high ROIC levels in its existing entrenched markets like Benelux and even France now.

Lastly, Basic-Fit is the only well-financed low-cost gym operator in continental Europe. This means Basic-Fit is the only company currently able to jump on this opportunity and build this barrier to entry in new markets like Germany. So, Basic-Fit is opening far more clubs than any competitor.

Inflationary environment

The inflationary and recession environment is a plus for Basic-Fit. Customers will become more price aware, and some of Basic-Fit’s scale benefits like automation increase in value. Add to this that unhealthy fitness clubs might go bankrupt as increased costs are the last hurdle. Competitors are even more unlikely to expand.

The downside risks

Still, I see some downside risks in this narrative. Mainly, that further expansion will not provide the company with the same ROIC as the current mature clubs. The expansion in Germany is very exploratory and may never yield positive results. But a positive is that most competitors of Basic-Fit in Germany and Europe are small, highly levered, and do not have close to the operational leverage and brand awareness that Basic-Fit has. Basic-Fit has 174 million in liquidity available and strong cash flow from its mature clubs. Secondly, it is possible the strength of Basic-Fit’s barrier to entry is weaker than expected, which will lower ROIC across the board as the competition enters markets. Thirdly, long-term capital expenditures may turn out higher than expected as the maintenance of a gym is more expensive than generally expected.

Catalyst

We expect strong revenue and earnings growth in coming quarters and years. Two factors are driving growth: firstly, clubs are maturing, particularly in France and Spain; and secondly, penetration of fitness goers is increasing in all of Basic-Fit’s markets.

Takeaway

Basic-Fit’s stock is very modestly priced and provides contrarians with an opportunity to buy a company with tremendous underlying earnings power and significant reinvestment opportunities. In conclusion, Basic-Fit’s stock providers shareholders with an excellent risk-reward at current prices.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top Ex-US Stock Pick competition, which runs through November 7. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment