bodnarchuk

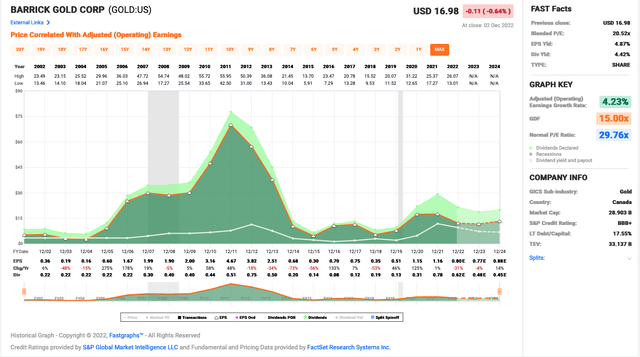

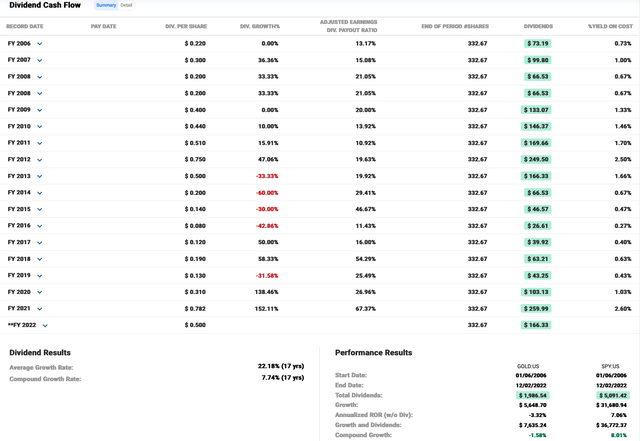

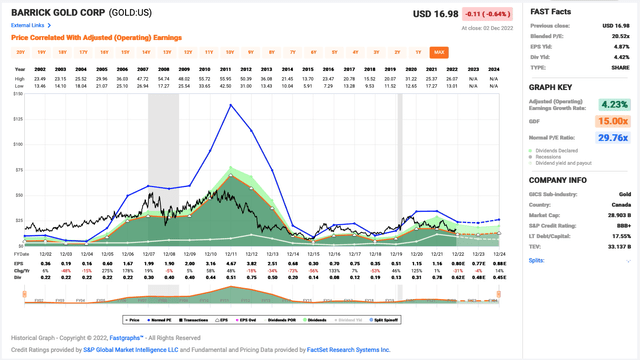

Miners are higher-risk stocks even when it comes to a large-cap gold miner like Barrick Gold Corporation (NYSE:GOLD, TSX:ABX:CA). Barrick’s earnings are highly volatile and unpredictable. The FAST Graph below shows a history of Barrick’s adjusted earnings per share (the orange line), which has also led to volatile and unpredictable dividends.

[The company reports in U.S. dollars, so the figures in this article are in US$ unless otherwise noted.]

When the operating environment is good and Barrick grows its earnings and cash flows, Barrick would allow for dividend increases. However, when things turn south, Barrick also has no choice but to cut its dividend. This will happen over and over again. Buying and holding the stock as a part of a long-term portfolio may result in disappointing returns that are low or even in the red, as shown below. So, investors must take an active approach when taking a position in Barrick stock — perhaps aim for timely trades.

Management is navigating multiple challenges including higher input costs and softened gold and copper prices.

Higher Input Costs

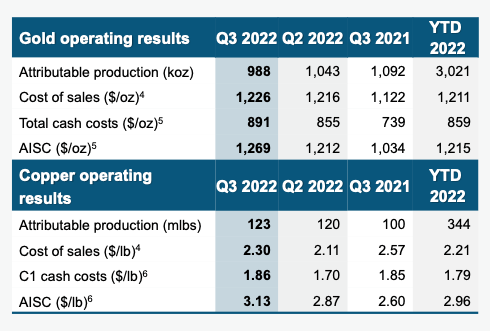

Higher inflation has elevated Barrick’s input costs. Its all-in sustaining cost (“AISC”) in Q3 for its gold production was 23% higher year-over-year to $1,269 per ounce. The copper production’s AISC cost increase of 20% wasn’t far behind.

Q3 Presentation

A strong U.S. dollar

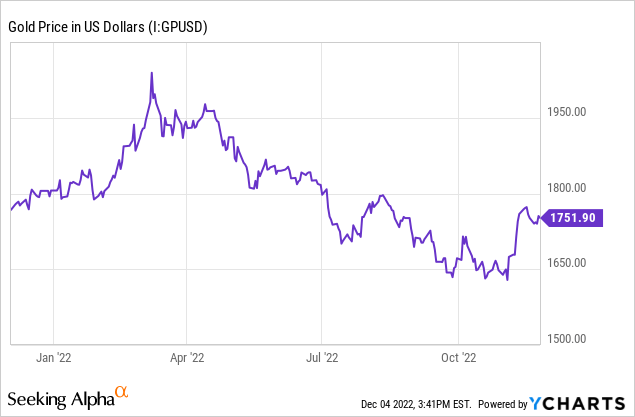

A relatively strong U.S. dollar generally weighs on gold prices. Producing gold as its main product, Barrick Gold’s bottom line is more or less dependent on gold prices.

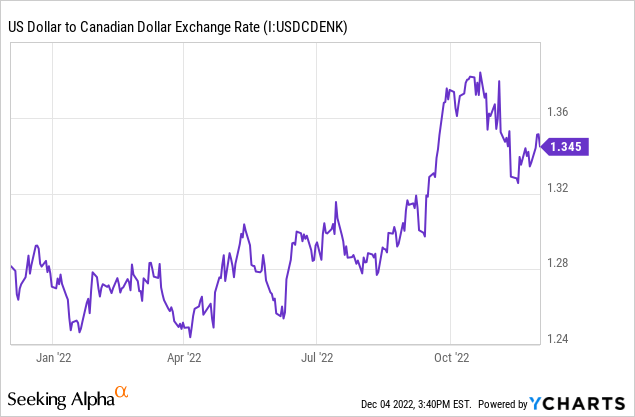

Below is a graph showing the stronger U.S. dollar against the commodity currency Canadian dollar.

As the U.S. dollar has strengthened, gold prices have weakened in dollar terms.

Recent Results

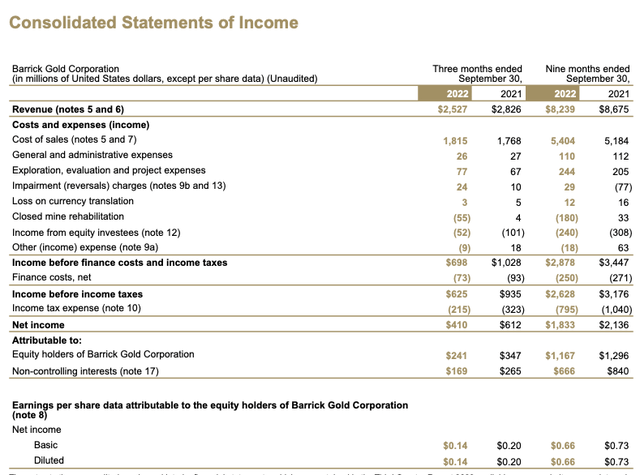

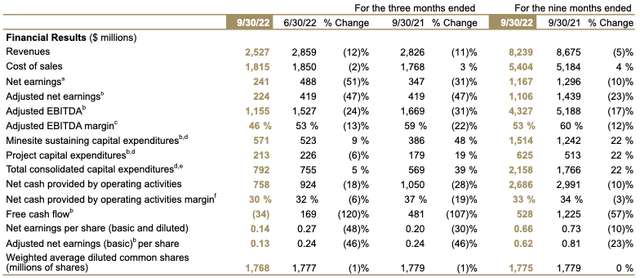

Revenue have dropped 5% year-to-date, to $8,239 million. Management has put a curb on general and administrative expenses, which is down 2%. However, exploration, evaluation and project expenses rose 19% to $244 million. Ultimately, the bottom line is the net income falling 14% to $1,833 million and the diluted EPS falling 10% to $0.66.

The adjusted results provide a clearer picture on the operating business. Year to date, the adjusted net earnings declined 23% to $1,106 million. The adjusted EBITDA, a cash flow proxy declined 17% to $4,327 million, while the margin compressed 7% to 53%.

Sustaining and project capital expenditure rose 22%. Net cash provided by operating activities dropped 10% to $2,686 million, while free cash flow shrank 57% to $528 million. Ultimately, the adjusted EPS fell 23% to $0.62.

Positives

Management did report a few positives in the Q3 presentation:

- Grade uplift in Q4 to drive delivery of 2022 gold production targets

- Strong production performance at Lumwana and Jabal Sayid has copper trending at midpoint of guidance

- New exploration management team builds momentum with strong results from a range of exciting targets across portfolio

- On track to grow reserves net of depletion by year-end.

Other catalysts that could drive better results at Barrick are higher commodity prices, disinflation, or a reduced strength in the U.S. dollar.

Financial Position

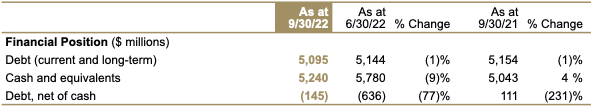

Barrick Gold enjoys an investment grade S&P credit rating of BBB+. At the end of Q3, its cash and equivalents could also cover its debt with leftover.

Q3 Press Release

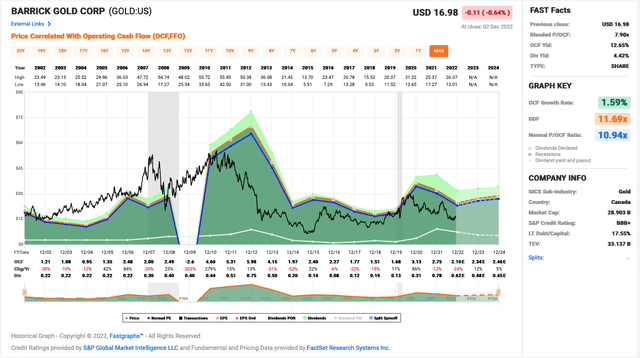

In the trailing 12 months, Barrick generated over $4 billion from net cash provided by operating activities.

Additionally, financing activities included $93 million in debt repayment, $564 million in common stock repurchases, and over $1 billion in dividend payments. Two-thirds of the stock buybacks were in the last two quarters in which the common shares were relatively cheap.

Valuation

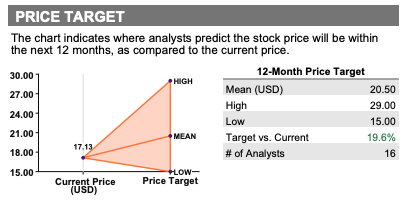

From a P/E perspective, Barrick Gold appears fairly valued, with analysts projecting a further decline in earnings next year.

From a cash flow perspective, the gold stock seems to have some upside potential.

This may be why the 12-month analyst consensus price target indicates prospects of about 21% upside.

Reuters

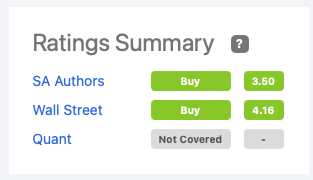

Seeking Alpha authors and Wall Street think Barrick Gold stock is a buy.

Seeking Alpha

Investor Takeaway

Personally, as dividend focused investors, we’re not that interested in Barrick Gold. It’s not the type of the stock that one could ever rely on a safe dividend if there’s a stumble in the business. That said, the stock could be a potential idea for investors looking for a speculative trade. Right now, even for a speculative trade, we think it’s too risky as there’s not enough margin of safety. So, at best, we’d rate Barrick Gold Corporation as a “hold” at current levels.

Be the first to comment