da-kuk/E+ via Getty Images

Dear Baron Opportunity Fund Shareholder:

Performance

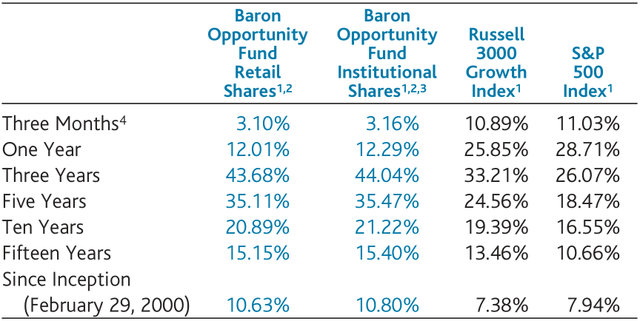

Baron Opportunity Fund (the “Fund”) posted gains in the quarter and for the year, but significantly lagged the broader market. For the fourth quarter, the Fund rose 3.16% (Institutional Shares), but trailed the Russell 3000 Growth Index, which increased 10.89%, and the S&P 500 Index, which climbed 11.03%. For the full year 2021, the Fund gained 12.29%, but underperformed the two indexes, which advanced 25.85% and 28.71%, respectively. As we emphasize at Baron with our philosophy, approach, and process, long-term returns are what really matter, and as shown in the table below, the Fund continues to outperform its benchmarks across all other trailing periods.

Table I.

Performance

Annualized for periods ended December 31, 2021

Review & Outlook

We are in the tumultuous waters of sweeping pullbacks and sector rotations. They impacted Fund performance in 2021, particularly in the fourth quarter, and it has provoked a challenging start to the year. The market and its herd of traders find themselves hyper-focused on and reacting to shifts in interest rate and inflation readings and expectations; the prospect of the Fed tapering bond purchases, hiking rates, and shrinking its balance sheet (referred to as quantitative tightening); and abrupt rotations in market sentiment and leadership, particularly sell-offs in technology-driven stocks and leadership rotations from growth to value; not to mention the elongated “reopening” trade and uncertainty regarding the end of the COVID pandemic, with the recent Omicron surge; continued political dissension and loss of confidence in Washington; and geopolitical fears regarding China and whether Russia will invade Ukraine.

Yes, that’s a lot. It has led to widespread investor fears. It has created enormous investor uncertainty. It has prompted risk-off trades and sell-offs of the winners of the last several years. Investors and traders have rotated, for now, out of the secular-growth industries we favor, such as software, internet, e-commerce, e-payments, genomics, and others. There has been a shift to shorter-duration earnings over longer-duration earnings – earnings today over the highest net present value of future earnings and cash flow driven by long-term growth. This is rarely a favorable environment for our strategy, and we have underperformed as a result.

While we believe it is virtually impossible to call when, how long, or how deep these economic, sentiment-driven cycles, rotations, or pullbacks will be, and we never attempt to do so, let me address several important questions.

Should we be worried about fundamentals?

The current pullbacks and rotations are not fundamentals driven. The fundamentals and growth opportunities across most of our companies and secular themes are intact and solid as ever. We see no change to the longer-term acceleration and inflection in many of the consumer and business trends we emphasize and have discussed in our letters over the last year or so. The pandemic – and consumer and business reactions to it – merely accelerated the changes underway from the last few decades of innovation, technology disruption, and digital transformation. The world is not going back. The human law of inertia is as inescapable as gravity. Change is hard, but once we do change, whether forced or voluntary, and learn that change is better, we seldom return to the way things were before. There is talk about “pull forwards” and unsustainable demand levels in certain industries. We believe these concerns are overstated, shortsighted, and often plain wrong. For some industry verticals, like e-commerce, video conferencing, streaming TV, and video games, we knew and acknowledged that engagement levels at the depth of the pandemic were unsustainable. But we’ve done a significant amount of research and analysis, and we believe our digital transformation and other themes, including the ones just listed, will benefit from a longer-term inflection in adoption, penetration, and growth rates. By this, we mean that our out-year, say 2025, revenue and usage projections are higher now than they were pre-pandemic.

Should we be worried about inflation and interest rates?

In response to inflation, unemployment, and GDP readings, among other things, the Fed will raise rates and will seek to normalize its balance sheet. That is a given. But the Fed responds to data, and trying to predict what that data will be next quarter or at year’s end is a fool’s game. Harvard economist John Kenneth Galbraith, once said: “We have two classes of [economic] forecasters: Those who don’t know and those who don’t know they don’t know.” And, when it comes to predicting inflation or interest rate levels, addressing just two inputs by way of example, there is no economist alive today with any experience in how quickly global, just-in-time, information-age supply chains will heal after a once-in-a-century pandemic, or whether and how quickly the four million U.S. workers who have left the work force will return to it as the pandemic turns endemic and now that unprecedented government stimulus and support, such as enhanced unemployment payments, have run out.

This week, reading reports by top market economists debating inflation and interest rate levels, I couldn’t help being struck by the wide divergence in their views. Without naming names, here is an example of two diametrically opposed projections. One research shop, which focuses solely on macro-economics, is forecasting inflation levels to fall throughout the year, with headline CPI (Consumer Price Index) falling to 1.4% year-over-year growth by the fourth quarter, and for the U.S. Treasury 10-year yield to tend towards 1.5% to 1.6% by year end. Another shop, a premier global investment bank, believes that inflation will “settle in around 3%” and that a year-end Fed Funds rate “of 3% seems plausible,” with the 10-year yield of course being even higher. A broader collection of predictions run the full spectrum of possibilities.

As I have emphasized in the past: we don’t try to predict the unpredictable and we don’t need to answer the unanswerable to deliver outstanding investment returns for our shareholders. As always, we continue to focus our research, analysis, and investment decisions on identifying the indisputable, powerful, durable secular growth trends that will drive economic growth going forward, regardless of short-term economic cycles or stock market gyrations, and the individual companies that are leading or riding those trends and possess sustainable competitive advantages, profitable business models, and long-term oriented managers.

I address the impact of interest rates on valuation multiples and our price targets below.

Should we try to trade this market environment?

We appreciate most investors crave for the market – and the funds they invest in – to steadily go up and to the right. A proverbial Goldilocks market – not too hot, not too cold. But, as we all know and have experienced, that’s just not the way it works. The market goes up, sometimes it keeps going up (occasionally too far, too fast), it plateaus or pulls back (sharp retreats, at times), and then it goes up again.1 But you never know what the market will do next – and it is almost impossible to predict – until you can look back in 20/20 hindsight.

Few investors trade these ups and downs beneficially. Ron told a great story about this in his September 30, 2020 “Letter from Ron”: “If you sell and you happen to be right and you’re lucky and stock prices fall sharply, and I then call you to buy back, you won’t. That’s because you will be too afraid and will miss a great opportunity. On the other hand, if you are wrong and stock prices keep rising, you will say, well I missed it, and you won’t buy back either. So, if you sell, you will have replaced great growth investments that are steadily increasing in value with cash that is inexorably losing value.”

In our view, trying to time the next flip-flop in market leadership or where interest rates will be at year end is far more difficult – and thus riskier – than whether we will journey a few more steps down the path paved by the durable long-term secular trends in which we invest. According to Howard Marks, the Chairman of Oaktree Capital Management, investors too often “swing in the wrong direction.” He counsels “ignoring the ‘noise’ created by the manic swings of others and focusing on the things that matter in the long term.” We at Baron agree. We run a consistent strategy in managing the Fund. Thus, some market phases are headwinds and others are tailwinds.

We believe it is difficult to predict changes in wind patterns. We focus on generating long-term returns for our shareholders – getting from point A to point B, despite the ups and downs of choppy waters. This is shown in our long-term results in the “Performance” table above. While we can make no promises or guarantees, we recommend that our shareholders mirror our long-term horizon and try not to trade these inevitable – but often short-term – gyrations in sentiment and market leadership. To quote famed investor Bill Miller, “we believe time, not timing, is the key to building wealth in the stock market.”

When will these sell-offs/rotations end?

Everyone wants to know how long this environment, pullback, trade will last. A note I read this morning said: “The #1 incoming question of the week: So, is it time to buy tech?”

Two answers: (1) as we readily concede, and I stated above, no one knows how long and how far these sentiment-or-fear driven cycles, rotations or pullbacks will go, and so I don’t know when this environment will end; but (2) for long-term investors, I do believe our portfolio, including our so-called “tech” investments, offers investors meaningful multi-year return potential.

Without minimizing how painful such markets are for many investors, I do believe we are dealing with a “normal,” “typical,” “reversion-to-the-mean” sell-off/rotation, not a longer-term paradigm shift. To repeat, fundamentals for the themes and investments we emphasize are solid and their long-term growth opportunities remain intact. We are not facing a vacuum after a period of hype, like we did in the wake of the “dot com crash,” over 20 years ago now. The key themes in the portfolio have been present for at least a decade (e.g., e-commerce and search took off in the mid-1990’s; the cloud has been disrupting the Information Technology sector for over a decade; e-payments and paying with one’s phone are now the norm rather than reaching into your wallet for cash; many kids have never experienced waiting for a disc jockey to play your song on the radio or waiting a week to watch the next episode of your favorite TV show, since they have grown up in a world of on-demand streaming) and the digital transformation inflection of these trends is real. Business models are now proven, and valuations are not based on made up metrics, like eyeballs, but on profit measures, like earnings and free cash flow (“FCF”). Even for earlier-stage, high-growth companies valued today on revenue multiples, we have countless examples of how the business models and profit margins of their more-proven peers have scaled, and so we can analyze unit-level economics and confidently project how the current generation of “all stars” will develop and value them on future profit and cash flow generation.

While I don’t know where and when this rotation or pullback will end, or whether stock prices and valuations will over-correct, I do believe – based on our research, analysis, modeling, and price targets – that our portfolio should yield solid returns over a longer period. I’ve communicated about our price target work in these letters many times – one-to-five-year price targets based on our own modeling and internal projections of revenues, earnings, and FCF for our companies, and our internal assessment of the appropriate long-term median/average multiples for industry groups and individual companies. I color code our price targets: blue for 15% to 20% internal rates of return and green for 20%-plus. Given the recent compression in valuations and decline in stock prices, our price target sheet is flashing blue and green.

Before I end this section, let me take on the expected pushback regarding higher interest rates. As addressed above and in past letters, we don’t dismiss that interest rates play a role in stock valuations.2 Setting price targets based on valuation multiples is a proxy for discounted cash flow analysis. So, in theory, higher rates – i.e., a higher discount rate – should lead to lower multiples and stock prices. But, first, historically, rates are not the only factor affecting multiples, which are also impacted for any company or industry by other considerations, such as long-term growth and profit expectations. Second, in our proprietary valuation work, we have taken a hard look at multiples over time and in different market, economic, and interest-rate environments. History proves that market and sector multiples vary over time, but always within long- established ranges. When we break out of these ranges on the upside or downside, we hit a top or bounce off the bottom. The upper and lower end of these ranges are never the “right price.” In our process, we never bet on a “new normal” in market or sector multiples; we don’t use prevailing multiples, whether in strong markets or weak; and we never expected the zero-interest-rate paradigm to persist. Rather, we have analyzed how multiples fluctuate with both macro inputs, including interest rates, and more fundamental business factors, such expected growth rates, profit margins, cash generation, and the like. We have calculated and established ranges of historically accurate median/average multiples for specific sets of comparable companies (reflecting industries and peer groups). We then select what we believe are appropriate multiples for each individual company when setting our price targets for that business. Considering this disciplined process and work, we have a high degree of confidence in our longer-term price targets and the healthy expected returns cited above, even in a world with higher interest rates than we’ve experienced over the last several years.

Why Growth vs. Value?

As acknowledged above, we are experiencing a rotation to perceived value, safety, lower risk. Earnings today versus more earnings and faster earnings growth tomorrow. However, as expressed, I believe we are in a painful but typical sell-off/rotation, not a paradigm shift.

Market leadership will inevitably cycle, but as I’ve stressed for years, we remain convinced that durable/secular growth will lead the market more often than not. Our reasoning is quite straightforward: longer-term market and stock returns are driven by growth in earnings (and FCF) and dividends. As we just discussed, multiples fluctuate up and down, but always revert to the mean over time. So, we need sustainable (as opposed to cyclical or one-time) expansion of a company’s “E” – earnings/FCF – to yield a reliably higher P, or price. Durable expansion of a company’s earnings or cash flow power can only be driven by profitable top-line growth – our “faster-for-longer” mantra.

Value needs a sustained acceleration in “normalized” or “underlying” economic growth to lead the market for longer than a “reversion-to-the-mean” or fear-driven rotation. Ask yourselves whether you see the ingredients or foundation for that to occur – not just easy growth compares against the depth of the pandemic, not just the reopening trade, not just unprecedented fiscal and monetary stimulus. Regarding the latter, which no doubt helped support and bolster the market since March 2020, we now have the end of fiscal stimulus – which some have called a “fiscal cliff,” with government transfers estimated to be down about $700 billion on a net basis in 2022 – and the opposite of monetary stimulus, with the now “hawkish” Fed signaling rate increases and shrinking its balance sheet (quantitative tightening, not easing). And on the macro front, easy comparisons will soon turn to tough comparisons against the reopening. We are already seeing early signs of this with worse- than-expected retail sales in the month of December and declining

U.S. PMIs. I’d rather be in the secular-growth winners from here.

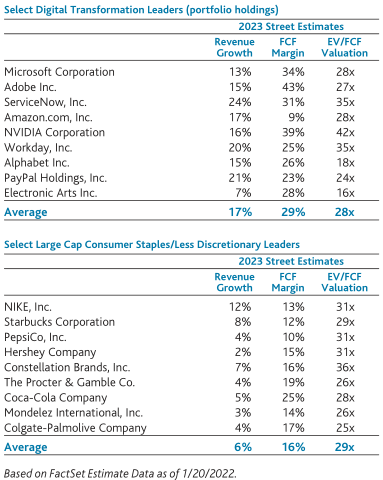

The tables below are comparisons I monitor on a regular basis – a select group of our higher-scaled digital transformation winners, which account for about 31% of our portfolio, versus a select set of large-cap consumer staples and less-discretionary leaders. As you can see, the digital transformation winners trade at effectively the same Enterprise Value to FCF multiples despite higher growth and more profitable (cash generative) business models. These relative valuations don’t make much sense to us and underscore our confidence in our investment approach.

Do you remain confident in the Fund’s strategy and approach?

If not obvious at this point, permit me to clarify: Yes.

We believe that sustainable/secular growth will be the predominant foundation of longer-term market leadership for both individual businesses and industry groups, if not every quarter or even every year, certainly over the long term. As emphasized above and in all my investor communications, we believe secular trends, durability of growth, and FCF generation at scale are the key factors that drive long-term stock returns. That is why, despite the market environment, we relentlessly focus our attention, research, analysis, and portfolio management on identifying the powerful and durable secular growth trends that will drive economic growth regardless of politics, short-term economic cycles, or stock market gyrations, and the individual companies that are leading or capitalizing on those trends. It is the bedrock of our long-term performance. Underlying this view is an investing tenet I firmly believe in and have written about over the years. Credited to Benjamin Graham, the mentor of Warren Buffett, is the famous quote: “In the short run, the market is a voting machine, but in the long run, it is a weighing machine.” Short-term market gyrations, like the one we find ourselves in today, are the market acting as a voting machine, and commonly driven by speculation and/or sentiment changes between hope and fear. But over the long term, the market acts as a well- calibrated weighing machine, valuing a business based on science not sentiment: put each company on the theoretical weighing machine; measure its revenues, profits, cash flow; apply a historically appropriate multiple for a business of that type; and the machine tells you what the company weighs, i.e., what it’s worth. Growth businesses, by definition, get larger over time and gain weight. That is why we stress finding businesses that will grow faster for longer and generate heavier loads of earnings and cash flow as time goes by, as opposed to obsessing about trying to time market cycles.

So, yes, given solid fundamentals, the fact that we are still in the early innings of the digital transformation and other themes reflected in our portfolio, that our price target spreadsheet is flashing blue and green, I remain confident in our strategy and approach, and the long-term return potential of the portfolio when the market goes back to behaving as a weighing machine, which it always does in the long run.

What are you doing with the portfolio?

We are sticking with our philosophy, strategy, and process, which have empowered the Fund to outperform the broader market indexes over the long term. Tactically, as we’ve done whenever we find ourselves in market environments like the current one, we are trying to improve the portfolio by increasing weights of our highest-quality, faster-for-longer, cash-generative long-term winners. I know it sounds cliché, but it’s true: as a portfolio manager you don’t love all your kids the same, so to mix metaphors, we are trimming/selling the weakest members of our herd to buy or add to the strongest members.

Below is a partial list of the secular megatrends we focus on. These themes will be the key drivers of revenue, earnings, and cash flow growth – and stock performance – for the companies in which we are invested:

- Cloud computing

- Software-as-a-service (“SaaS”)

- Artificial Intelligence (“AI”) and big data

- Mobile

- Digital communications

- Digital media/entertainment

- Targeted, people-based digital advertising

- E-commerce

- Genomics

- Genetic medicine

- Minimally invasive surgical procedures

- Cybersecurity

- Electric-drive vehicles/autonomous driving

- Electronic payments

By investing in businesses capitalizing on these potent trends, we have been able to build portfolios that have revenue growth rates that are multiples of the general economy, as reflected in broad market indexes. Below we compare the revenue growth rates of our Fund and three indexes for the trailing four quarters for which we have reliable data (please note that the data below for the most recent periods, particularly the broad market indexes, are skewed by reopening trends, not sustainable underlying growth):

Comparison of Revenue Growth (based on quarter-end holdings)

|

Actual Q3 2021 |

Actual Q2 2021 |

Actual Q1 2021 |

Actual Q4 2020 |

|

|

Baron Opportunity Fund |

26.0% |

37.1% |

35.4% |

29.9% |

|

S&P 500 Index |

17.1% |

26.0% |

13.0% |

2.9% |

|

Russell 3000 Index |

18.3% |

28.0% |

12.5% |

1.6% |

|

Russell 3000 Growth Index |

22.3% |

34.9% |

16.6% |

8.2% |

Source: BAMCO and FactSet.

Table II.

Top contributors to performance for the quarter ended December 31, 2021

|

Percent Impact |

|

|

Rivian Automotive, Inc. |

2.46% |

|

Microsoft Corporation |

1.57 |

|

Tesla, Inc. |

1.18 |

|

NVIDIA Corporation |

0.96 |

|

Alphabet Inc. |

0.55 |

During the quarter, we participated in the well-received IPO of electric vehicle (“EV”) company Rivian Automotive, Inc. The portfolio also benefited from the appreciation of our pre-IPO private holdings in the company, which we acquired over the past couple of years. Please see a longer discussion of Rivian in the Recent Activity section below.

Shares of Microsoft Corporation, a cloud-software leader and provider of software productivity tools and infrastructure, rose during the quarter, following a strong earnings report highlighting solid demand for its broad product stack and continued momentum migrating its business to the cloud. Microsoft’s results continued to be strong across the board, with total revenue growing 20% in constant currency, beating Street estimates by 3%; an acceleration in Commercial Cloud revenue to 34% constant-currency growth; operating margins expanding to just under 45%; earnings growth of 23%; and free cash flow growth of 30%. We believe the company is positioned to deliver 13% to 15% organic growth over the next three years, underpinned by total addressable market expansion and continued market share gains across its disruptive cloud product portfolio.

Tesla, Inc. designs, manufactures, and sells fully electric vehicles, solar products, energy storage solutions, autonomous driving software, and battery cells. Tesla outperformed during the quarter, as the company reported stronger-than-expected results, growing vehicle deliveries over 70%, while the rest of the automotive industry experienced significant production challenges due to supply-chain constraints. Tesla also achieved a substantial improvement in profitability throughout the year, achieving record automotive gross margins (excluding regulatory credits) approaching 29%. Gross margin outperformance was driven by the growing scale of Tesla’s more efficient and lower cost factory in Shanghai, improving product mix, and pricing activity. Record gross margins, together with strong cost control, also allowed Tesla to achieve record profitability and cash flow. Despite a meaningful increase in production volumes, the company is still supply constrained, as demand for Tesla’s vehicles remains robust. Catalysts for 2022 include Tesla’s internal battery production ramp and the opening of and ramp up of new manufacturing facilities in Texas and Berlin.

NVIDIA Corporation is a fabless semiconductor company and a leader in gaming cards and accelerated computing chips. NVIDIA is powering the growth of artificial intelligence from the data center to the edge. Shares of NVIDIA rose 42.0% in the fourth quarter on financial results and guidance that were significantly above Street expectations, driven by continued strength across both its gaming and data-center segments, which in turn benefited from the upgrade cycle to RTX (ray-tracing technology) and the growing adoption of artificial intelligence (“AI”) applications by both hyperscale cloud and enterprise customers. NVIDIA’s total third quarter revenues of $7.1 billion beat Street expectations by $282 million, growing 50% year-over-year, while fourth quarter revenue guidance was over $0.5 billion above expectations. Given its leading market share in gaming, data centers, and autonomous machines, the size of those markets and how early we are in the penetration of AI/big data, we believe NVIDIA can grow rapidly for years to come.

Alphabet Inc. is the parent company of Google, the world’s largest search and online advertising company. It also houses a market-leading cloud business. Shares outperformed in the quarter after Alphabet reported solid results across the board, with overall revenues growing 41%, driven by an outperformance in search and YouTube. The growth in YouTube was especially encouraging given near-term concerns about advertising trends. Overall operating profit also grew an impressive 88%, demonstrating meaningful improvements in cost controls. Management emphasized that AR/VR (artificial and virtual reality) will be an exciting part of the future and they are investing in hardware and tech to support that vision. Long term, we believe Alphabet is exposed to an array of upside optionality across a diverse range of secular growth tailwinds, including digital media consumption, cloud computing, local commerce, gaming, AR/VR, and self- driving.

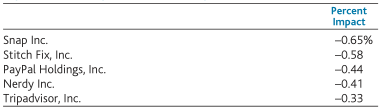

Table III.

Top detractors from performance for the quarter ended December 31, 2021

Snap Inc. is the leading social network among teens and young adults in North America and a growing number of overseas markets, including Western Europe and India. Shares fell this quarter on a greater-than- anticipated impact from Apple’s new privacy changes for iOS mobile devices. These changes made it more difficult for Snapchat to measure the effectiveness of ads shown on its platform. We believe this is a near-term, industry-wide issue for which Snap is already developing a solution. Longer term, we continue to view Snap favorably as the company sustains its rapid pace of product innovation and expands its premium partnerships with advertisers.

StitchFix, Inc. did not execute as well as expected in its transition from a closed, subscription-type offering to a more open e-commerce website for apparel. Our initial investment in Stitch Fix was predicated on a core subscription business that was stable, and a burgeoning e-commerce business which would significantly expand the company’s addressable market. Through most of 2021, the company articulated that the new venture should not impact the existing subscription business. However, as the company communicated on its last earnings call, there turned out to be substantial cannibalization of the core business, and management lowered its long-term outlook as a result. We chose to exit our position.

PayPal Holdings, Inc. enables digital payments for consumers and merchants worldwide. Shares fell after the company reported lower-than-expected quarterly results, and reduced guidance due to the faster roll-off of eBay’s processing business and slowing e-commerce growth as stores reopen. Shares were also pressured by rumors of a potential acquisition of Pinterest, as well as broader weakness across payment stocks during the quarter. We believe the share price decline is overdone given quarterly revenue growth of 25% (excluding eBay), and PayPal’s unmatched global scale with 416 million active accounts. We continue to own the stock because we believe PayPal is a prime beneficiary of the secular growth of e-commerce and digital financial services.

Nerdy Inc. operates a digital learning platform in the U.S. that provides live online tutoring in multiple formats, including one-on-one and small-to-large groups. The offering includes K-12 courses, college, professional, GMAT, SAT, and other prep. Though bookings for future classes remained healthy, many sessions were delayed from the fourth quarter as families opted to take longer holiday trips and kids resumed afterschool activities, making it more difficult to schedule tutoring, resulting in weaker-than-projected recognized revenues. Given near-term uncertainty, a short-term tax loss, and other investment opportunities, we chose to exit the position.

Tripadvisor, Inc. is primarily a hotel metasearch business, where users can browse various hotel options and read detailed user reviews, and then click away to a third-party hotel or online travel agency site to make their booking. We invested in Tripadvisor under the premise that they could further monetize their 460 million unique monthly active users through a “Trip Plus” travel-subscription program, where users could book hotels directly on Tripadvisor, allowing the company to participate more directly in the transaction and therefore capture incremental value. Despite initial positive traction, there were several roadblocks which led to the continued delay of the product launch and ultimately the exit of the several senior executives, including the CEO and the executive heading the Trip Plus experience. We learned that subscription businesses are hard to launch and there are more moving parts than may initially meet the eye. We significantly reduced our position.

Portfolio Structure

The Fund invests in secular growth and innovative businesses across all market capitalizations, with the bulk of the portfolio landing in the large-cap zone. The Fund is categorized as US Large Growth by Morningstar. As of the end of the fourth quarter, the largest market cap holding in the Fund was $2.5 trillion and the smallest was $791 million. The median market cap of the Fund was $27.5 billion.

The Fund had $1.7 billion of assets under management. The Fund had investments in 63 securities. The Fund’s top 10 positions accounted for 45.4% of net assets.

Fund inflows were positive for 2021.

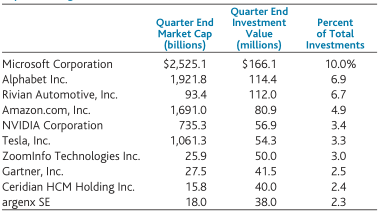

Table IV.

Top 10 holdings as of December 31, 2021

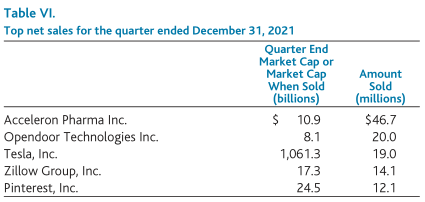

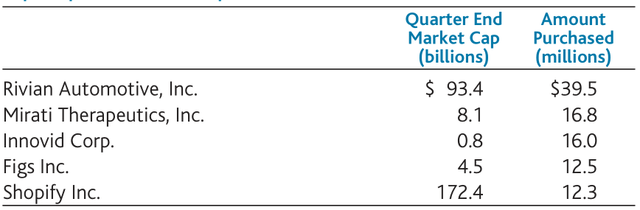

Recent ActivityTable V.Top net purchases for the quarter ended December 31, 2021

Rivian Automotive, Inc. designs, manufactures, and sells consumer and commercial EVs that share a similar underlying architecture, as well as associated software services. We initially made a private investment in Rivian during the second half of 2020. Following years of engagement with Rivian’s team as a private company, a recent enlightening factory visit, where we interacted with over 20 members of Rivian’s leadership, and a deep product and strategy review, we participated in the company’s fourth quarter IPO, one of the largest IPOs in recent history. We expect, over the next decades, that the automotive industry will continue its rapid shift from a combustion powertrain, human-driven, and unconnected fleet to an electrified, software-enabled, and connected industry. These are tectonic shifts that should meaningfully increase the size and profitability of the industry. With electric batteries and software as core competencies, the next generation of automotive leaders should be able to capture new and attractive growth opportunities, including software services, autonomous fleet operations, energy storage, and more. We believe Rivian has all the ingredients to follow Tesla as one of these leaders.

Rivian’s current product line, which received strong reviews from industry analysts, is addressing large and profitable segments of the automotive space that were slower to benefit from electrification, including last-mile commercial delivery vans, pickup trucks, and SUVs. On the commercial side of its business, Rivian should be able to capitalize on its unique and strategic partnership with Amazon. Amazon is both Rivian’s largest investor and a significant anchor commercial customer, committing to purchase 100,000 delivery vans from Rivian, a transaction estimated to be the largest EV deal in history, as well as license Rivian’s fleet management software, called FleetOS. To better address its large market opportunity, Rivian is launching multiple vehicle programs focused on both the consumer and commercial markets during its first year of manufacturing. While a parallel vehicle program launch may be complex, we expect it should enable the company to reach scale and collect data faster than many of its competitors. Armed with lessons learned from our long-term investment in Tesla, we appreciate the risks and opportunities involved in creating a new automotive company. We believe that Tesla’s trailblazing success, though extremely hard to replicate, should help Rivian’s management better address these risks and opportunities. We remain impressed with the Rivian management team, led by founder and CEO R.J. Scaringe, and believe that Rivian has the leadership, technology, vehicle design, manufacturing prowess, and market opportunity to scale to one million vehicle deliveries in even less time than EV-pioneer Tesla.

We established a position during the period in Mirati Therapeutics, Inc., a clinical-stage biotechnology company developing novel therapeutics targeting the genetic and immunologic drivers of cancer. The company’s lead drug, known as Adagrasib, targets a protein called KRAS that is a central node in driving tumor growth. We think Adagrasib has a best-in-class profile in a multi-billion dollar drug category. Currently, Amgen has a competing drug on the market, but clinical data on Adagrasib presented at the recent European Society of Medical Oncology meeting gives us confidence that Mirati’s drug has better attributes including residence time on target, efficacy response rates, longer duration of treatment, combinability opportunities, and blood-brain-barrier penetration.

During the period, we established a position in Innovid Corp. Innovid operates a software platform that enables the creation, delivery, and measurement of television ads across the entire connected-television (“CTV”) eco-system, including mobile, video, and streaming video services. Innovid (which stands for “innovation in video”) currently services over 40% of the top 200 U.S. TV advertisers. As an independent ad server, Innovid is uniquely positioned to benefit from the secular shift to CTV as more households opt to cut the cord and use various streaming platforms. Since it is not tied to a particular streaming service, Innovid will benefit from general industry growth, regardless of which specific platforms drive that growth. As Innovid grows in the emerging CTV market, it can continue to solidify its position as a neutral service provider, enabling advertisers to break free of market dominant players (such as Google) that have built large moats around other parts of the digital advertising ecosystem, but have yet to do so in CTV.

During the fourth quarter, the Fund increased its position in Figs Inc., an IPO from earlier in the year, at what we believe were attractive prices for a long- term investment. Figs, a founder-led health care apparel and lifestyle brand, is one of the fastest growing and most profitable digitally native, direct-to-consumer companies in the world. The traditional health care apparel market underserved the needs of health care professionals by selling commoditized products through an antiquated distribution network. Figs reimagined the health care professional’s uniform, engineering it for function and style. And by selling directly to consumers, Figs engages with customers in authentic and meaningful ways, giving the company a unique data advantage that the competition cannot replicate. This has enabled the company to maintain best-in-class customer acquisition costs even as it has scaled. With fewer than 2 million active customers out of 21 million health care professionals in the U.S., and even more internationally, we believe Figs has a long growth runway ahead.

During the quarter, as its stock fell to what we believed were compelling levels for longer-term investors, we initiated a position in Shopify Inc., the leading cloud-based commerce software platform. Shopify’s value proposition is to provide a single, easy to use, operating system for merchants to manage every aspect of their business, including selling across multiple channels (direct to consumer as well as on third-party marketplaces like Amazon), managing product listings, inventory, orders, payments, shipments, marketing, and customer relationships. The company has over 1.5 million merchants, who have processed nearly $120 billion of sales during 2020 (and are expected to pass $170 billion in 2021), making Shopify the second largest “behind-the-scenes” e-commerce player in the U.S. behind only Amazon, and ahead of Apple, Walmart, and eBay! Shopify has developed a scalable cloud platform that caters to merchants of all sizes, from a new entrepreneur just starting out to big brands like PepsiCo and Unilever. What we really like about Shopify is the ecosystem the company has built, creating network effects and a virtuous cycle that will be very hard for competitors to overcome. The more merchants join, adopt, and transact on Shopify’s platform, the more partners are attracted to its ecosystem, adding more features and options to the platform (through Shopify’s App store), increasing the company’s moats and value to merchants.

The big picture here is that Shopify is quietly building an Amazon competitor. But unlike Amazon, which also competes with its merchants (through first-party sales), Shopify is in the background, quietly helping merchants of all sizes to sell more online, aggregating the scale of the many merchants it has, to enable the benefits that only the largest merchants could get in the past. The opportunity for Shopify is two-fold. First, it is still early in the adoption curve, with the amount of gross merchandise value transacted on the platform expected to pass $170 billion in 2021 out of a $20 trillion-plus market opportunity (global commerce, ex-China), or less than 1% penetration. Second, as Shopify consistently continues to remove hurdles for merchants to sell online, the company can increase its share of the economics (or take-rate) from about 2.6% currently (Amazon charges between 10% and 20% on its fulfillment services). Lastly and perhaps most importantly, Shopify has a great culture, and it is led by a visionary founder, Tobi Lutke. One example of the company’s culture is a blog post from 5 years ago titled “Value Creation – Building for The Next 100 Years” (how many CEOs think, let alone talk about the next 100 years of their company?). The post starts with the following paragraph: “At Shopify, value creation is measured not just by growth of dollars and cents, but also by the growth of small business, computing literacy, and personal development. We are building for the long term.” In our view, Shopify has all the ingredients necessary to become a core holding and we are excited about its long-term potential.

AcceleronPharmaInc.was acquired by Merck during the period.

We sold Opendoor Technologies Inc., Zillow Group, Inc., and Pinterest, Inc. because we identified issues relating to our long-term theses in each company, and we decided to exit these positions to fund other purchases.

As set out above in our discussions of Tesla, Inc. and Rivian, nothing has changed regarding our conviction in the EV space and on the long-term growth and cash flow outlook for Tesla itself. Tesla remains a top 10 position in the portfolio. We trimmed our position, as discussed in prior letters, to maintain an appropriate position size and to help fund our purchase of Rivian.

To conclude, I remain confident in and committed to the strategy of the Fund: durable growth based on powerful, long-term, innovation-driven secular growth trends. As we approach the “new normal” after the COVID crisis, and given the sector retreats discussed above, we continue to believe that non-cyclical, sustainable, and resilient growth should be part of investors’ portfolios and that our strategy will deliver solid long-term returns for our shareholders.

Sincerely,

Michael A. Lippert Portfolio Manager

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment