Oli Scarff

Thesis

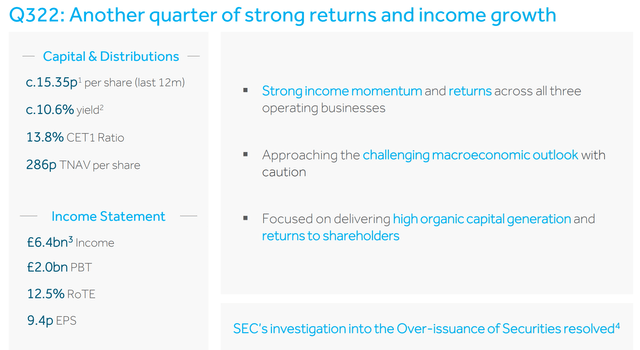

Barclays (NYSE:BCS) delivered a solid Q3 2022, easily topping analyst consensus with regards to both revenue and income. Moreover, management commentary indicates that strong income momentum will likely be carried into the future.

Reflecting on rising interest rates, which are likely to support £2 – 3 billion of incremental earnings by 2025, I aggressively raise my previous EPS expectations. And anchored on a residual earnings valuation framework, I estimate that BCS stock could comfortably triple by 2025.

For reference, Barclays is currently trading at a distressed valuation – priced at a P/B of about x0.4. Moreover, BCS stock is down about 28% YTD, versus a loss of approximately 17% for the S&P 500 (SPY).

Barclays’ Q3 Results

During the period from July to end of September, Barclays generated total revenues of £6.4 billion, which compares to approximately £5.5 billion for the same period one year earlier (17% year over year growth) and to £6.1 billion estimated by analyst consensus ( £300 million beat). Barclays’ Q3 pre-tax profitability expanded to £1.97 billion, which represents a 6% increase versus the same period one year earlier. Analysts had expected pre-tax net income of approximately £1.81 billion.

Reflecting on strong results, management commented that the better than expected performance was boosted by exceptional trading activity in fixed income and currency, as well as expanding NIM on the backdrop rising interest rates.

1) in the Corporate and Investment Bank, we continued to gain revenue share in our Markets business, driving the best Q3 income in both Markets and FICC in recent years. Notably our FICC performance was particularly strong and ahead of our US peers, with income up 63% in US dollars, as we supported our clients in very challenging markets.

2) In Barclays UK, we positioned ourselves well for rising interest rates, with a growing contribution from our structural hedge as we locked in higher yields.

3) Within the Consumer Cards & Payments business, growth in our US cards balances was delivered by a recovery in spending …

Rising Interest Rates Could Add More than £2 Billion to 2025 Net Income

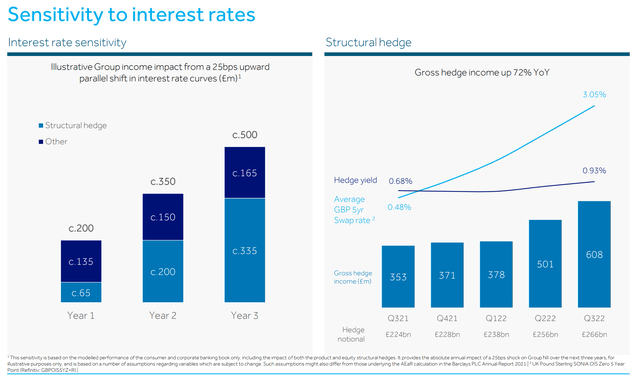

Barclays is poised to benefit handsomely from the rising interest rate environment. Personally, I estimate that the tailwind coming from NIM expansion could add approximately £2 – 3 billion to Barclays’ net income in 2025.

Here is a key excerpt of the bank’s analysis:

Moving on to the effect of interest rates, we have maintained a consistent hedge strategy for a number of years, the aim of which is to smooth the impact of the interest rate changes on net interest income. Each month, we currently roll 4 to 5 billion of the hedge, mainly into 3- to 5-year rates. The consequence of this is that Barclays has sensitivity, not just a base rate, but also to the yield curve.

The left-hand chart on the slide illustrates then for 25 basis point parallel shift in the curve. In year 1, the majority of the sensitivity comes from product decisions around the pass-through of increased base rates to customers. But thereafter, with a cumulative effect of the hedge rolling on to higher rates, the hedge impact becomes more significant and reaches around 2/3 of the [£500 million] increase by year 3. But of course, this is just illustrative, and is not a prediction of what will happen with multiple rate rises.

On the right-hand chart, we have shown the actual impact in recent quarters. Given the recent move in the yield curve, we were locking in an average 5-year swap rate of 3.05%, for example, in Q3 following the average yield on the hedge up to 93 basis points.

We have around £50 billion maturing in 2023. Although we don’t know exactly where swap rates will go, the likely uplift on the current hedge yield is clear, even if the rate cycle is shorter or shallower than current expectations. And of course, that is locked in with each passing month.

For reference, the yield curve in Europe & UK has shifted up by approximately 250 basis points. Thus, I estimate that the interest rate tailwind could add as much as £5 billion of incremental revenue by 2025 (year 3). And if we take reference from Deutsche Bank (DB) analysis, that higher net interest income is ‘only partially offset by higher funding costs’, leaving approximately 50 – 70% of net profits, then Barclays might add somewhere between £2.5 billion and £3.5 billion of incremental profits. For reference, Barclays’ current market capitalization is £25 billion.

Barclays Stock Could Triple By 2025

As of mid-November 2022, Barclays stock is trading at a TTM P/B of about 0.4. Such a multiple is ridiculously low – in my opinion. And anchored on rising interest rates, I believe this multiple will trend towards approximately x1 by 2025.

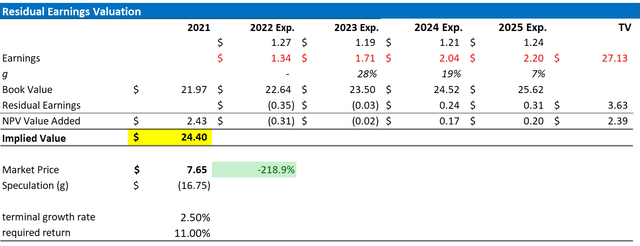

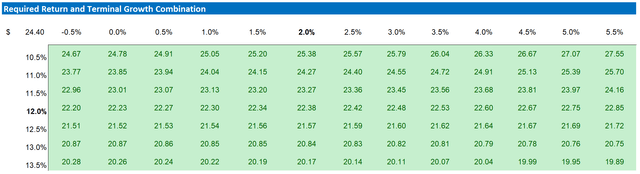

I am updating my EPS expectation for Barclays through 2025 and I am increasing my terminal growth outlook for the bank to 2.5%. However, I also increase my cost of equity estimate to reflect higher credit loss risk – up to 11%.

Given the EPS updates as highlighted below, I now calculate a fair implied share price of $24.40, as compared to $15.14 prior.

Author’s EPS Estimates; Author’s Calculation

Below is also the updated sensitivity table.

Author’s EPS Estimates; Author’s Calculation

Risks

With regard to risks related to investments in banks, I would like to highlight what I have written before:

While I believe that investments in banks are less risky than the market implies, the tail-risk exposure is still elevated and if materialized this might depreciate BCS share-price significantly. For reference, the company has still not recovered the share-price levels seen before the great financial crisis.

In any case, Barclays’ 14% CET1 ratio should puffer the company for most market stress scenarios, even severe ones.

Moreover, investors should closely watch any risk related to additional credit-loss provisions. In Q3 2022, Barclays set aside £381 million for potential losses, which compares to £120 million for the same period one year earlier.

Barclays’ group finance director Anna Cross estimates that credit loss provisions will…

Rise modestly over the coming quarters.

Conclusion

With rising interest rates, Barclays will likely see an enormous tailwind from expanding NIM. In an analysis anchored on the bank’s management guidance, I calculate that a 3 percentage point shift of the yield curve could add approximately £2.5 billion and £3.5 billion of incremental profits in 2025 versus 2021. For reference, Barclays’ current market capitalization is £25 billion.

Reflecting on the NIM analysis, I upgrade my EPS expectations for Barclays and now estimate a fair implied share price of $24.40, as compared to $15.14 prior. If my analysis is correct, BCS stock could be a 300% opportunity.

Be the first to comment