Ultima_Gaina/iStock via Getty Images

Investment Thesis: Solid Small-Cap Dividend Grower

Located on Mount Desert Island just off the coast of Maine, Bar Harbor is a quaint and colorful town that has thrived with the influx of summertime tourists. It is also one of the easternmost places in the United States.

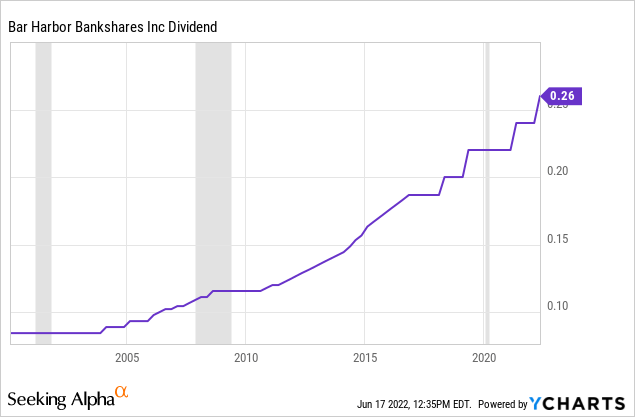

The center of business in this happy-go-lucky place is a longstanding financial institution called Bar Harbor Bank (NYSE:BHB). But BHB’s fortunes are not tied solely to this little Atlantic coast island. Operations and branch locations have spread southwest, and with this expansion has come two decades of regular dividend growth for shareholders, aside from brief pauses during the financial crisis and the pandemic.

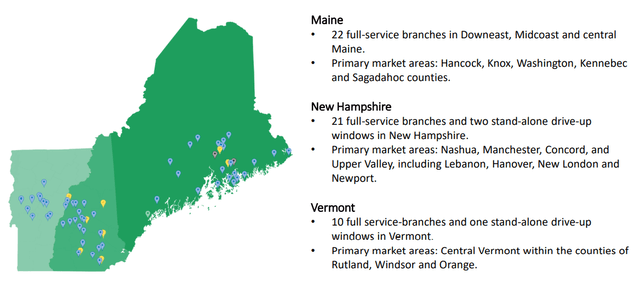

BHB is a small-cap bank with over 50 branch locations across the Northern New England states of Maine, New Hampshire, and Vermont. The bank’s market cap is less than $400 million as of this writing, and total assets amount to about $3.7 billion, but what BHB lacks in size it has historically made up for in growth.

This growth has come from four sources:

- Population growth: From 2020 to 2021, for instance, nearly every county in Maine saw population growth as domestic migration from urban areas more than offset a natural decrease from higher deaths than births.

- Opening of new bank branches and loan offices in new areas.

- Acquiring other local/regional banks in adjacent areas or states.

- Expansion of a diverse set of fee-based, non-interest income sources, such as $2.4 billion AUM in wealth management.

Though BHB’s service areas are largely dependent on the relatively cyclical tourism, agriculture, and fishing industries, the bank has managed to generate steady growth while never compromising on risk mitigation.

With a 4.1% dividend yield and a long history of steady growth, BHB looks attractive as a dividend growth play for investors who are okay with its small size and light trading volume.

Overview of Bar Harbor Bank

BHB has been operating in Maine for 135 years. In the last decade, the bank has expanded into its neighboring states of New Hampshire and Vermont.

Though these states (especially Vermont) are not the most business-friendly places, BHB’s long-tenured management team has ample experience of working profitably in them.

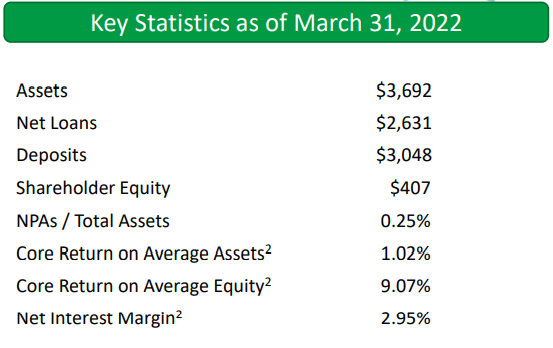

As of the first quarter of 2022, BHB had total assets just shy of $3.7 billion, including net loans of a little over $2.6 billion.

BHB Q1 2022 Presentation

The loan-to-deposit ratio is a conservative 0.86x. In other words, the bank’s loan book makes up 86% of deposits.

Actually, that is on the high end for US banks, which have struggled to generate loans sufficient to keep up with surging deposits during the pandemic. According to Bank Reg Data, the average loan-to-deposit ratio for US banks in Q1 2022 was 0.56x, or 56% loan value to deposits. For banks in BHB’s total asset size category ($1-$4.9 billion), the LDR was a bit higher at 71%.

Having a higher LDR is a good thing as long as the loans well-underwritten, resilient, and backed by strong assets, as it implies BHB is able to put a greater percentage of its ultra-low cost or no-cost deposits to work in productive loans in order to generate more income per dollar of deposits.

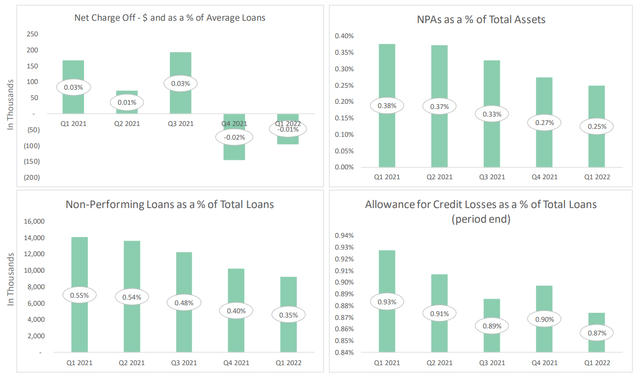

Of course, risk mitigation is crucial here. A bank should not seek to make loans simply to increase its LDR. One way to determine the quality of a bank’s loans is by looking at non-performing assets and/or loans as a percentage of the total.

As you can see, NPAs and NPLs (non-performing loans) as a percentage of their respective totals have come down nicely since the pandemic era. Non-performing assets represented a mere 0.25% of the total in the first quarter, compared to 0.38% in Q1 2021.

Tellingly, BHB had zero bank-owned real estate in the first quarter, which a sign either that foreclosures are rare or that any owned real estate sells quickly, or both.

BHB’s net interest margin (a crucial profitability metric for banks) of 2.95% is higher than Q1 2021’s 2.88%, and it compares favorably to the Q1 2022 average NIM for all US banks of 2.32% (source: Bank Reg Data).

Meanwhile, the bank is moderately well positioned to benefit from Fed Funds rate increases. As President & CEO Curtis Simard stated in the Q1 earnings press release:

The asset sensitivity of our balance sheet positions us to expect to further benefit from any potential Fed rate hikes.

At the same time, BHB has been positioning itself to handle a “lower for longer” interest rate environment, if the US economy was to return to that. Fee-based (non-interest) income as a percentage of total income rose from 17% in 2020 to 21% in 2021. In the first quarter, fee income increased 11% year-over-year.

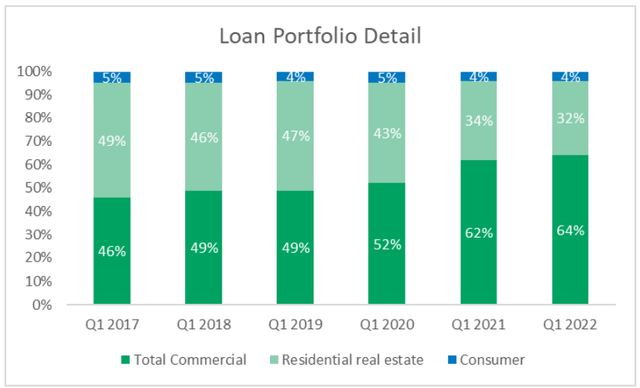

In Q1 2022, BHB reported remarkable commercial loan growth of 21%, up from the 10% commercial loan growth for the full year of 2021. Commercial loans now make up nearly 2/3rds of BHB’s loan book.

The bank purposely chose to shrink its portfolio share of residential mortgages by selling most of its newly originated mortgages on the secondary market. For most of 2020 and 2021, residential mortgage rates were ultra-low, making them less profitable for banks than commercial loans. Why would a bank want to hold a 30-year mortgage with an interest rate of 3% or less on its books when it could make a commercial loan at a variable rate or with a 5-year adjustment date?

However, now that the 30-year mortgage rate has surged back up to near 6%, it will be interesting to see if BHB decides to increase the portion of its loan portfolio in residential mortgages.

Also note that BHB’s efficiency ratio (lower is better as it implies less expenses per dollar of revenue) sat at 62.4% in Q1 2022, which is only slightly higher than the US bank average of 61.9% during the quarter (source: S&P Global Market Intelligence). However, In Q4 2021, BHB’s 60.7% efficiency ratio was lower than the US bank average of 63.1%. In short, there’s nothing of concern here.

Finally, though it should be noted that BHB’s core earnings were slightly inflated over the last year due to the temporary benefit of PPP loans (which should fully end in Q2 2022), the bank’s trailing four-quarter payout ratio was a mere 36% based on core earnings. In the first quarter of 2022, the payout ratio ticked up only slightly to 38.7% as the boost from PPP loans faded.

Bottom Line

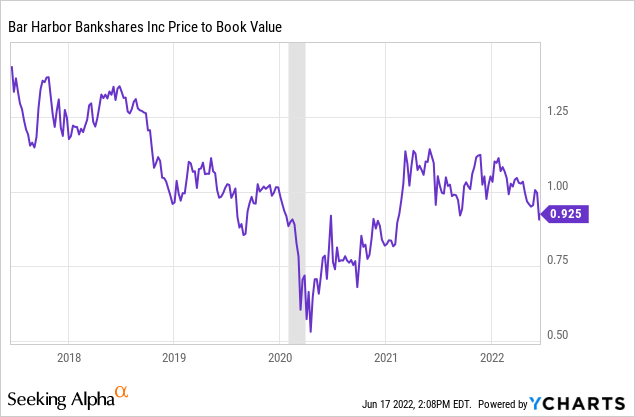

BHB’s tangible book value per share (excluding fluctuations in the securities portfolio) rose 7% on an annualized basis in Q1 2022 to $20.07. That gives BHB a price to tangible book value (excluding securities) of about 1.25x, based on a stock price of about $25 at the time of writing.

At the end of the first quarter, however, book value per share was $27.11, which means that BHB currently trades at about an 8% discount to book value. Outside the pandemic era, this is one of the cheapest prices to book value BHB has traded at over the past five years.

At a dividend yield of 4.1% and a two-decade history of steady dividend increases (including the most recent 8% dividend hike announced in April), BHB is a very interesting dividend growth stock for dividend investors to consider.

I owned it once from 2019 to sometime in 2021, but I sold out of fear that interest rates would stay as low as they were forever. I underestimated BHB’s ability to (1) survive in a low interest rate environment as well as (2) the bank’s ability to increase non-interest income. I now view it as an attractive long-term buy-and-hold for my very financials-light stock portfolio.

Be the first to comment