canbalci

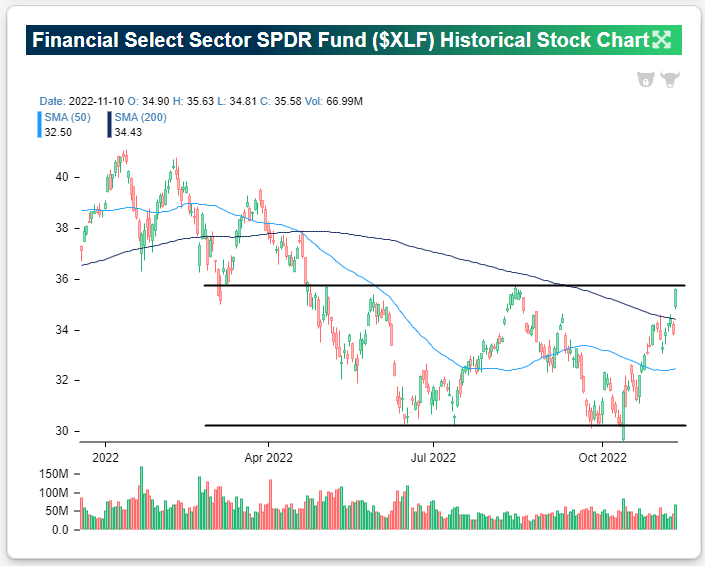

The Financial sector ETF (XLF) has been on fire since its intraday low of $29.59 on October 13th, which was the day of the hotter than expected September CPI report. From that low point on 10/13, XLF is up 20.2%. As shown below, the ETF is currently at the very top end of a wide sideways range that has been in place over the last six months.

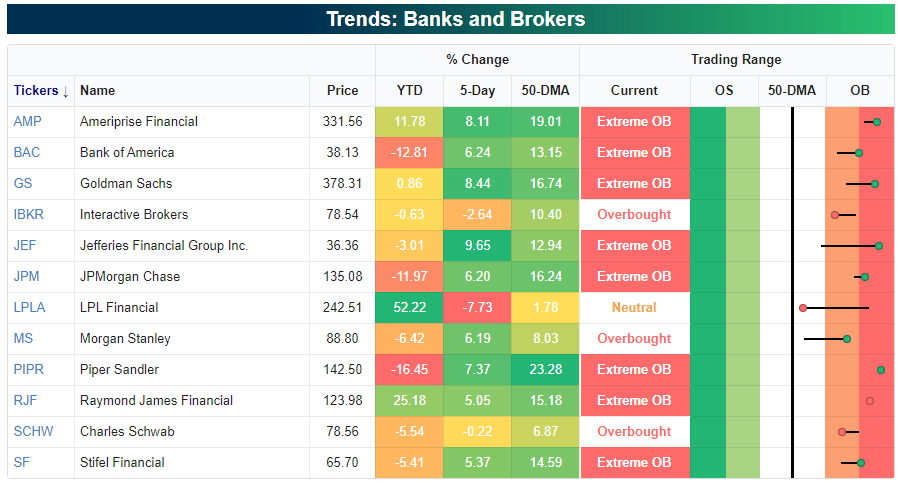

Below is a sampling of some of the most well-known banks and brokers that are part of the Financial sector. As shown, names like Goldman Sachs (GS), JPMorgan (JPM), Jefferies (JEF), Raymond James (RJF), and Stifel (SF) are all more than 10% above their 50-DMAs, and the only stock that’s not overbought (>2 standard deviations above 50-DMA) is LPL Financial (LPLA), which traded lower on earnings yesterday.

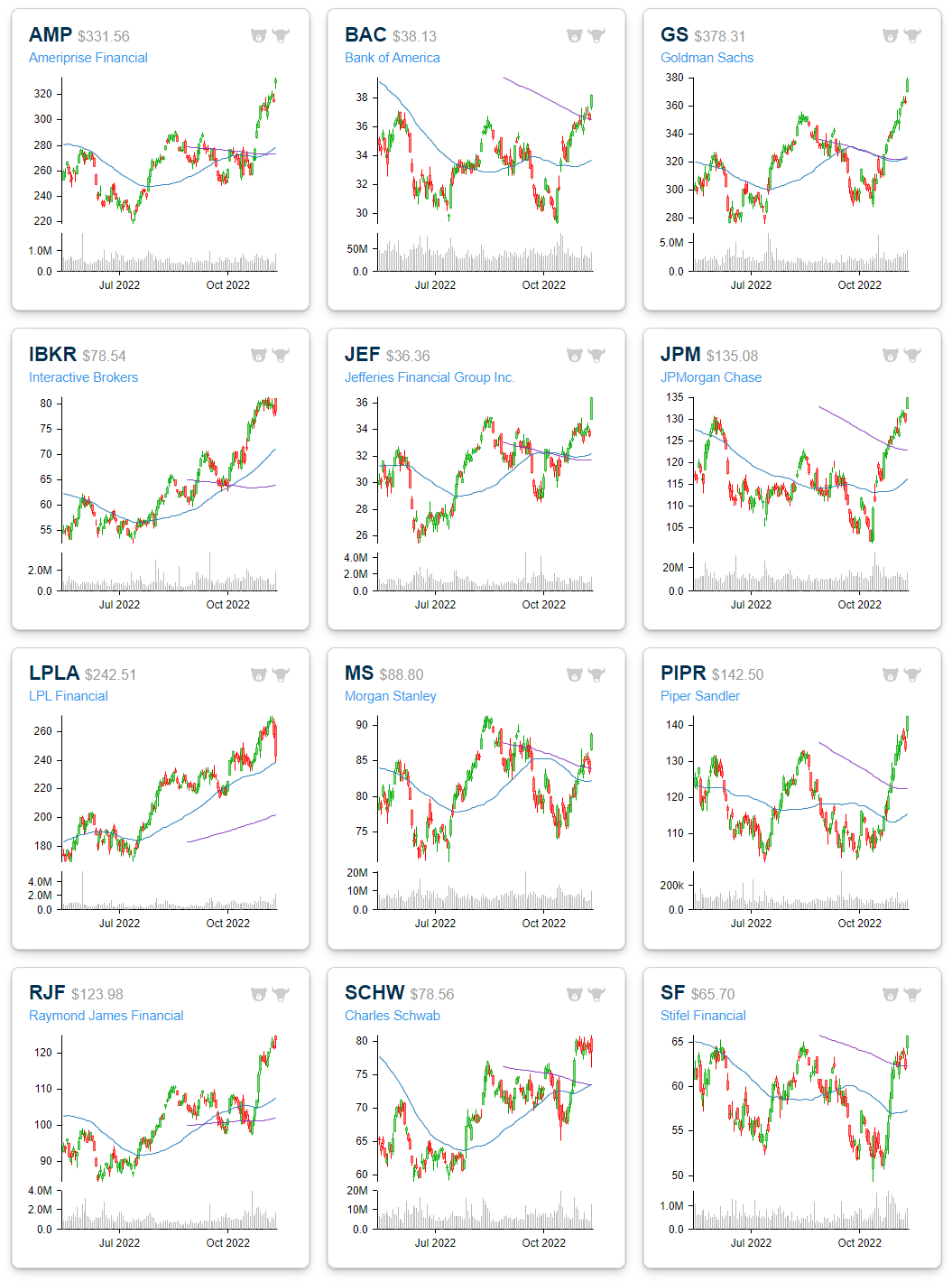

A quick look at the six-month price charts of the stocks listed in the table above gives you a glimpse into the huge rally that this area of the market has experienced since early October.

Investors have seemingly been loading up on them with short-term Treasury yields now significantly higher than the interest rates these banks and brokers are paying customers on deposits.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment