BrianAJackson

Canadian banks are often considered as extremely solid – and compared to its peers in the United States, banks in Canada are often seen as a solid investment. Especially the solid performance during the Great Financial Crisis contributed to a great reputation for Canadian banks.

However, it would be rather dangerous to just assume that Canadian banks will always perform great – no matter the economic environment. And considering that another recession seems to be on the horizon, we should take a closer look at the Canadian banks as well – like I did in my previous articles about U.S. Bancorp (USB) as well as Wells Fargo (WFC). In this article, I will take a closer look at the number three in Canadian banking: The Bank of Nova Scotia (NYSE:BNS).

Quarterly Results

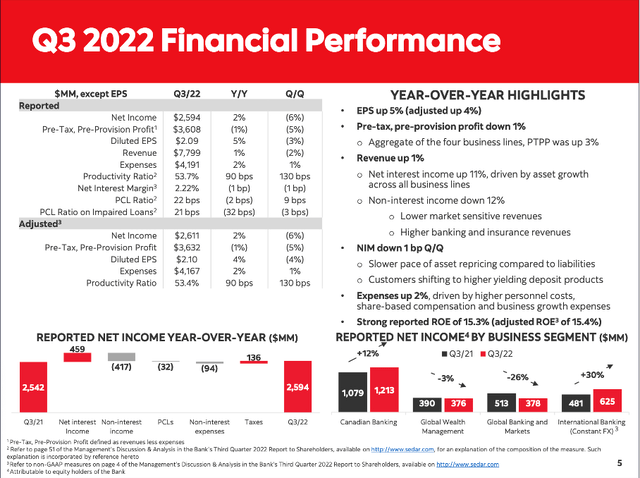

Third quarter results were once again solid for Bank of Nova Scotia and are still painting the picture of a healthy business. Total revenue increased slightly from $7,757 million in Q3/21 to $7,799 million in Q3/22 – resulting in 0.5% year-over-year growth. And while net interest income could increase 10.9% year-over-year from $4,217 million in the same quarter last year to $4,676 million this quarter, non-interest income declined 11.8% YoY from $3,540 million in Q3/21 to $3,123 million in Q3/22. Provision for credit losses increased slightly from $380 million in the same quarter last year to $412 million this quarter. And finally, diluted earnings per share increased from $1.99 in the same quarter last year to $2.09 this quarter – resulting in 5.0% year-over-year growth.

Bank of Nova Scotia Q3/22 Earnings Presentation

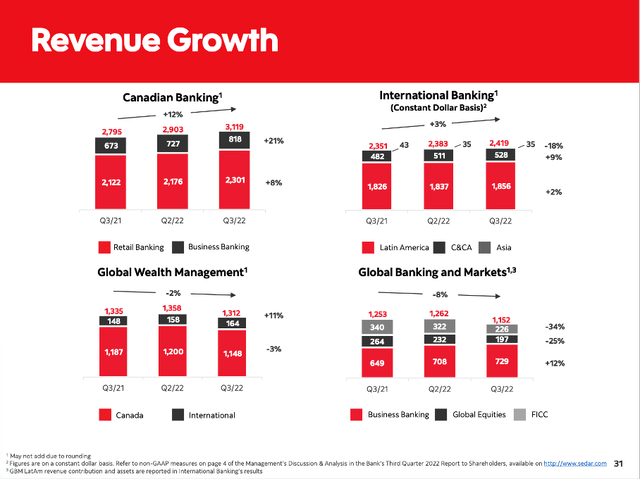

When looking at the different segments, Canadian Banking could increase net income from $1,079 million in Q3/21 to $1,213 million in Q3/22 (resulting in 12% growth). Revenue for the segment could also increase 12% YoY to $3,119 million. Aside from Canadian Banking, International Banking could also report high growth rates. Net income increased 30% from $481 million in the same quarter last year to $625 million this quarter. Revenue also increased slightly (3% year-over-year) to $2,419 million.

The other two segments, however, reported declining net income. And while net income for Global Wealth Management declined only slightly from $390 million to $376 million (resulting in a 3% year-over-year decline), net income for Global Banking and Markets declined 26% from $513 million in Q3/21 to $378 million in Q3/22.

Bank of Nova Scotia Q3/22 Earnings Presentation

Recession

With the yield curve recently inverting, the ISM Purchasing Manager Index declining and the inflation rate being way above 5%, we can be quite sure the United States will be hit with another recession in 2023 (see here for more details). And not only the United States will be hit by a recession but also most European countries and Canada.

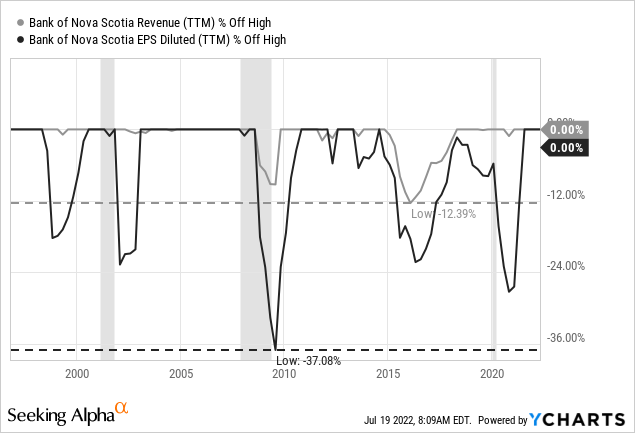

When looking at the last three decades, we can clearly see that the Bank of Nova Scotia is reacting to recessions. In all three recessions in the last three decades, earnings per share of Bank of Nova Scotia declined and when considering that almost all banks have troubles during recessions, this statement is not surprising.

However, revenue for Bank of Nova Scotia was pretty stable during the last recessions. And earnings per share also declined “only” 37% during the Great Financial Crisis, which is pretty impressive when remembering how many other banks (especially in the United States and Europe) performed horribly during the Great Financial Crisis.

And the solid performance of Canadian banks during the Great Recession led to a reputation for most major Canadian banks as if these banks are somehow recession-proof. However, that is not true and a rather dangerous assumption for a bank. I certainly don’t want to trash Canadian banks like the Bank of Nova Scotia, as they are well-run banks. But we should not ignore the risks these banks are also facing – like an overvalued Canadian housing market.

Housing Market and Debt

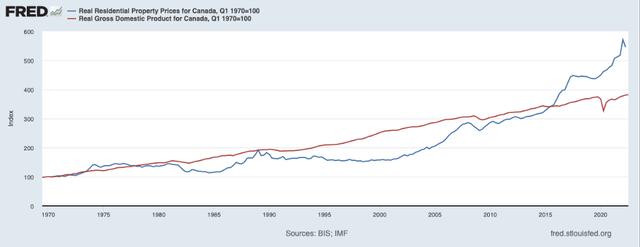

When talking about the Canadian economy and especially Canadian banks there is usually one major single risk identified by all analysts: the extremely overvalued Canadian housing market. And although Canadian banks withstood the storm of the collapsing housing market in the United States in 2007, we should be cautious and take nothing for granted.

The Canadian housing market seems extremely expensive and the risk that we are dealing with a similar bubble as in the United States in 2006/2007 is quite high. When looking at the long-term chart (since 1970) it is not like Canadian housing prices have been completely decoupled from the gross domestic product. However, we see housing prices increasing with a high pace since 2000, and especially in the last few years housing prices clearly decoupled from GDP growth in Canada, which is posing a systemic risk in my opinion.

Additionally, government debt to GDP in Canada is 112.8%, which is the highest ratio in the last 50 years (aside from 2021). Household debt to GDP in Canada is 105.6%, which is also close to the highest ratio in the last few decades (the ratio actually declined a little bit in the last few quarters). Such high debt levels pose a huge risk to every economy and especially to banks which will suffer if creditors are not able to repay outstanding debt. And I don’t care how well-run banks are, a decoupling of housing prices from the economy combined with high debt levels is posing a high risk to the economy and the money-lending banks.

Good Credit Quality?

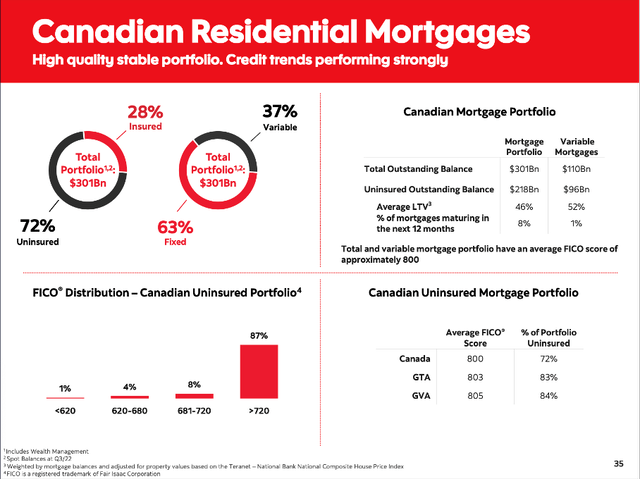

When looking at the available data from the Bank of Nova Scotia, we must assume good credit quality and can start with the FICO scores. Part of the reason why the U.S. housing market was the source for a global disaster were the banks which issued loans to customers with extremely low FICO scores.

When looking at the Bank of Nova Scotia, it is good to know, that the average FICO score of the residential mortgages portfolio in Canada is 800 with 87% having a FICO score above 720 and only 1% having a FICO score below 620.

Bank of Nova Scotia August 2022 Investor Presentation

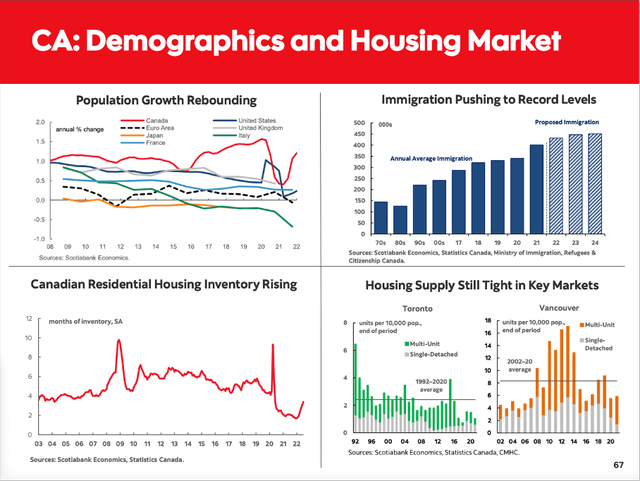

And while the Canadian housing market is without doubt extremely expensive, we can counter the data a bit by making the case for still growing demand in the next few years. Not only is the population growth rebounding in Canada (compared to most other high-developed countries), but it is also expected that immigration is pushing towards record levels (more than 400,000 people annually) which will keep the demand for housing high.

Bank of Nova Scotia August 2022 Investor Presentation

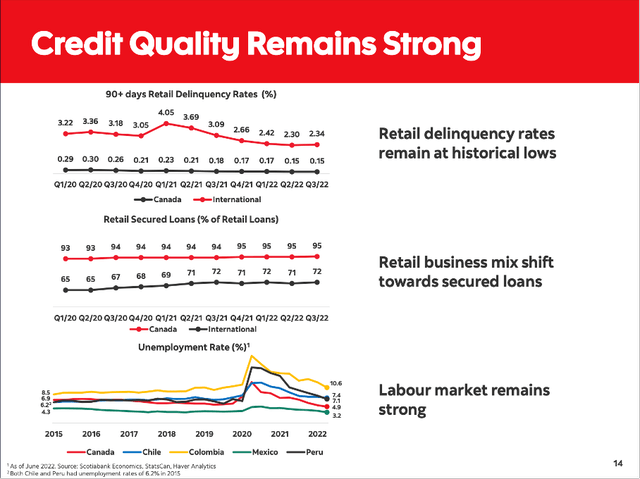

And overall credit quality for the Bank of Nova Scotia remains strong. When looking at the 90+ days retail delinquency rates, we have 2.34% for the international business and only 0.15% for its Canadian business. And it is also a positive sign that the percentage of retail secured loans (as a percentage of total retail loans) is increasing over the last years. In Canada, the percentage increased from 93% in Q1/20 to 95% in Q3/22, and for its international operations, the percentage increased from 65% in Q1/20 to 72% in Q3/22.

Bank of Nova Scotia August 2022 Investor Presentation

In case of The Bank of Nova Scotia, we can differentiate between the Canadian business which is reporting great metrics and seems to be associated with extremely low risk and the International Business (mainly South America) which is reporting metrics that are not so great. The biggest part of write-offs as well as provision for credit losses is also associated with the International Business.

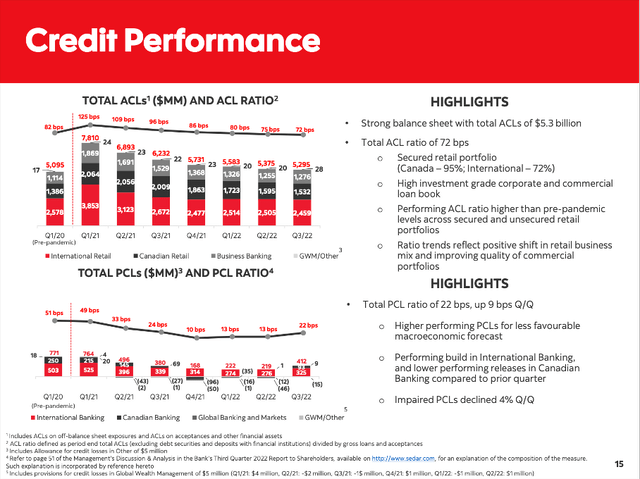

Overall, we see improving credit quality – with one exception. Bank of Nova Scotia is starting again to build higher reserves and is preparing for challenging times. In the third quarter, provision for credit losses was $412 million (compared to around $220 million in the previous two quarters). As reason for the higher PCL, management is quoting less favorable macroeconomic forecasts.

Bank of Nova Scotia August 2022 Investor Presentation

Credit quality of the Bank of Nova Scotia seems to be solid and there seems to be no reason for concern. However, it is not the problems that are clearly visible at first looks, but rather the underlying problems that are not visible right away.

Dividend

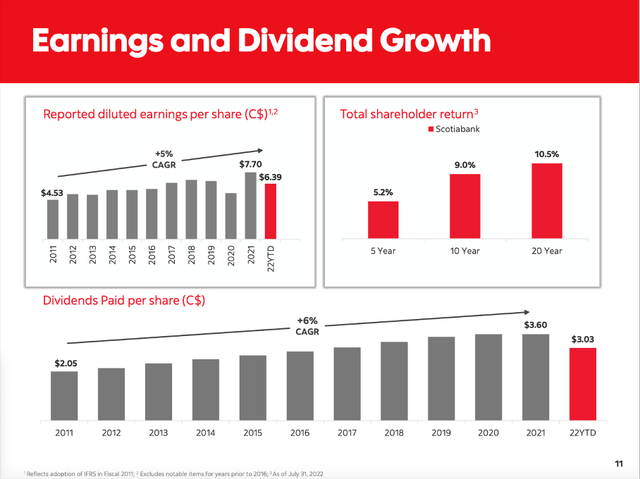

The Bank of Nova Scotia is once again interesting for its dividend. And the Bank of Nova Scotia has been a reliable dividend payer in the past. Not only has the bank made continuous dividend payments since 1833, it also increased the dividend in 43 of the last 45 years (according to the bank it has one of the most consistent records for dividend growth among major Canadian corporations).

And after the bank paid the same quarterly dividend for nine quarters in a row during the COVID-19 crisis, it raised the dividend twice within a very short time (instead of only annual increases). After the 10% dividend increase in November 2021, the Bank of Nova Scotia increased the dividend another 3% in May 2022.

Bank of Nova Scotia August 2022 Investor Presentation

Right now, the Bank of Nova Scotia is paying a quarterly dividend of $1.03 resulting in an annual dividend of $4.12 and a dividend yield of 6.0%. While the landscape changed in the last few quarters (for example 10-year U.S. treasury bonds yielding already 3.8%), a dividend yield of 6.0% is still tempting. And when comparing the dividend to the earnings of the last four quarters ($8.36), we get a payout ratio of 49% which is in line with usual payout ratios in the banking industry and no reason to worry about the dividend not being sustainable.

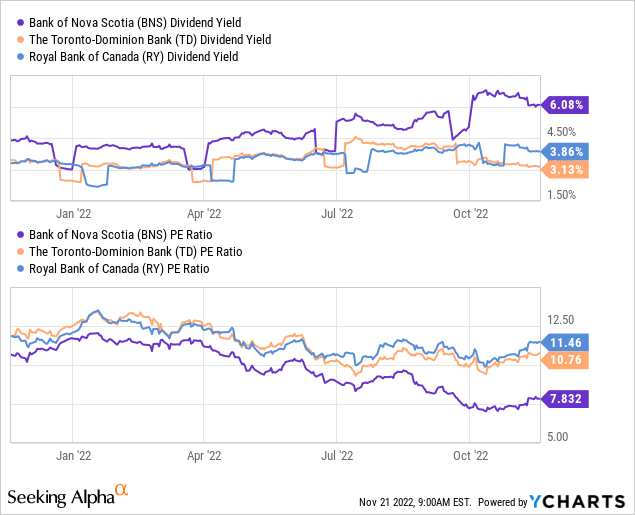

Not Buying Banks

If I had to invest in any banks, it probably would be Canadian Banks like the Bank of Nova Scotia as it is trading for an extremely low valuation multiple (we will get to that) and has a high dividend yield. And while one can make the argument that The Toronto-Dominion Bank (TD) as well as the Royal Bank of Canada (RY) are better positioned, but the almost twice as high dividend yield in combination with the lower P/E ratio is making the Bank of Nova Scotia certainly attractive.

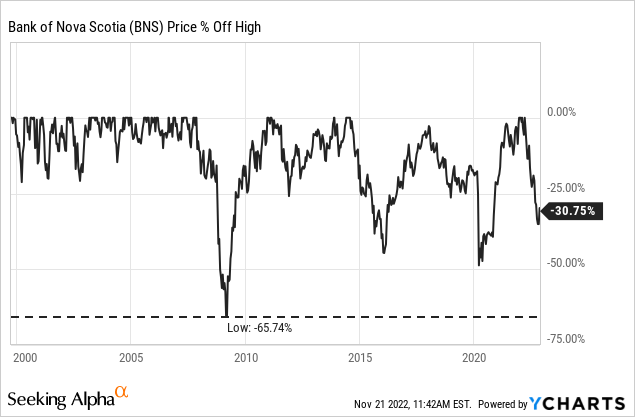

That being said I am still not investing in banks at the eve of a global recession and bear market that might be brutal. It is hard for me to imagine that banking stocks (including the major Canadian banks) already reached the bottom – despite the rather low valuation multiples. I have argued several times that banks usually drop steeper than “only” 30% during bear markets and recessions. And since 2000, we already saw three steeper declines for the Bank of Nova Scotia.

Intrinsic Value Calculation

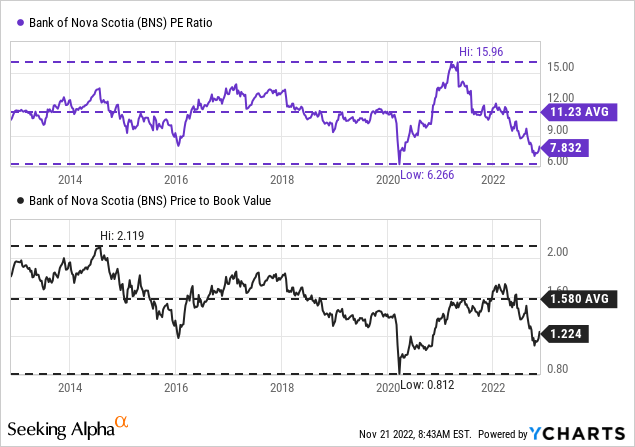

And although I am expecting a steeper decline for the Bank of Nova Scotia, we must admit that the current valuation multiples are extremely low. Right now, the stock is trading for 7.8 times earnings, and this is not only close to the low of the last 10 years (6.3) but also below the average P/E ratio of 11.23 during the last ten years (which is already an extremely low P/E ratio).

But we should not forget that earnings per share can decline extremely steep in case of a recession which has a huge impact on the P/E ratio. And I already wrote in past articles that we could also see a world again where low-single-digit P/E ratios are the norm for several years or decades and a stock trading for 7.8 times earnings is just an average investment and not considered an extreme bargain.

Conclusion

Next week, the Bank of Nova Scotia will report fourth quarter results and I am expecting results for the bank to get worse over the next few quarters. We will most likely not see a complete collapse of the business in the coming months, but we must expect higher provision for credit losses leading to lower earnings per share. We are already seeing earnings per share being revised down in the last few months, but in my opinion, the estimates for stable earnings per share in the coming three years are way too optimistic.

Be the first to comment