skodonnell/iStock Unreleased via Getty Images

Bank of America (NYSE:BAC) is a strong consumer bank with a great efficiency ratio. However, its ROE could use some work. Management is attempting to fix this by buying back shares to reduce the company’s total equity, however Wells Fargo has a higher buyback ratio and could outperform here. Furthermore, Wells Fargo (WFC) is reducing its headcount to lower noninterest expenses and improve its efficiency ratio, similar to Bank of America’s previous actions. Although Bank of America is set to thrive due to higher net interest income caused by higher interest rates, the much higher multiples the stock trades at might be too much for many investors to handle.

Bank of America Vs. The Other Big Banks

To truly see how Bank of America holds up against the other big banks in the market, we must compare each bank’s metrics. To do so, we will first compare the banks’ efficiency ratios. Then we will move on to return on equity. Next we will cover the share buybacks and dividends. Finally, we will end with the valuation multiples of the banks.

Bank of America Has One Of The Strongest Efficiency Ratios

The first metric that should be compared across the banking industry is efficiency ratio. Bank of America has one of the best efficiency ratio among the Big Four banks in the United States. Currently, Bank of America’s efficiency ratio sits at 63%. This is just worse than industry leader JPMorgan Chase (JPM) at 62%. However, it is better than Citigroup (C) at 69% and much better than Wells Fargo at 76%. Bank of America’s efficiency ratio is one of the strongest aspects of the bank.

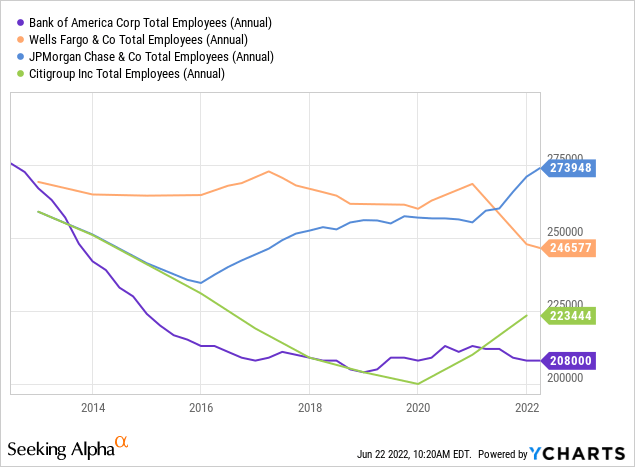

The main reasoning for this great efficiency ratio is due to the company consistently lowering its noninterest expenses over the past decade. Over the past 10 years, Bank of America has reduced its noninterest expenses by about 17.5%. This was accomplished by reducing the total headcount by nearly one-quarter. Since the biggest noninterest expense for many banks is involved with employee compensation and other related items, reducing headcount is one of the best ways to increase its efficiency ratio.

A great example of a bank that is beginning to follow the same strategy is Wells Fargo. As stated before, Wells Fargo has the worst efficiency ratio by far. This is because the bank has incredibly high noninterest expenses caused by a high headcount. Now, Wells Fargo is reducing its total number of employees, therefore improving its efficiency ratio. All in all, Bank of America has made smart decisions in the past to improve its fundamentals, and other banks are following in the same footsteps.

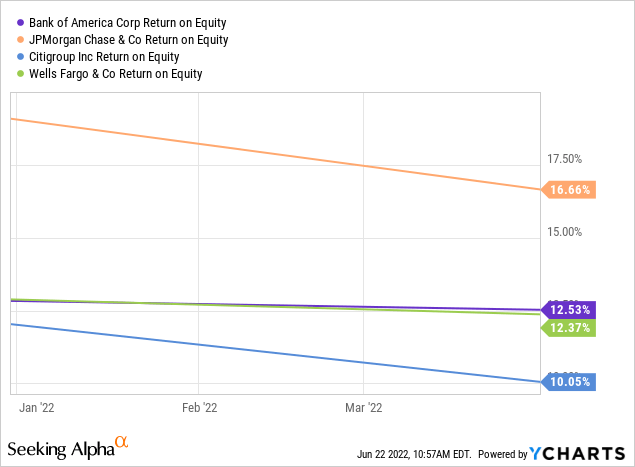

The Bank’s Return On Equity Needs To Be Improved Further

The bank’s ROE could use some work. Bank of America’s ROE is nearly identical to Wells Fargo and above Citigroup. However, it is far behind JPMorgan Chase.

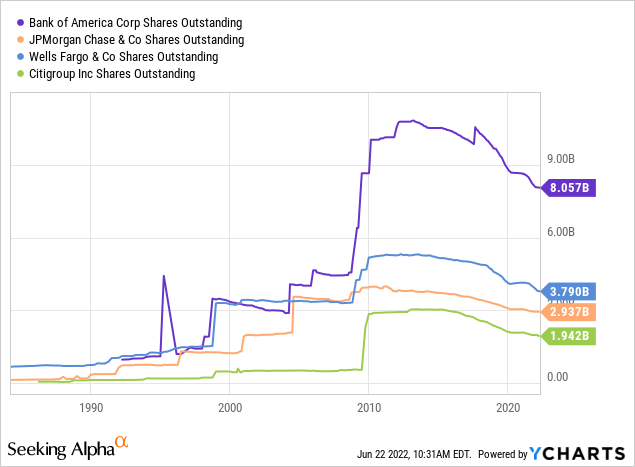

The reasoning for this is because of Bank of America’s high amount of equity on its balance sheet. This is mainly due to the company’s Common Stock line item being far above its competitors. Currently, the bank’s Common Stock line item comes in at nearly $60 billion. This is far above any of Bank of America’s competitors, with the second-highest value being $9 billion from Wells Fargo. The high Common Stock line item is caused by the far higher total shares Bank of America has over its competitors. Currently. Bank of America has just over 8 billion shares, while its competitors have only a few billion.

The history of this large difference in shares stems back to the 2008 recession. From 2003-2007, Bank of America bought back $40 billion worth of common stock and caused the company’s total capital to deplete heavily. After the crash occurred, the Federal Reserve ordered the bank to raise $34 billion in new capital to absorb losses and build reserves. To do this, Bank of America issued 3.5 billion new shares at an average price of $13.47. This heavily diluted current shareholders, and caused the company’s total equity on its balance sheet to skyrocket. This has led to the company having a lower ROE than it would have without this major dilution.

Bank of America Is Buying Back Billions Of Stock Instead Of Issuing A High Dividend

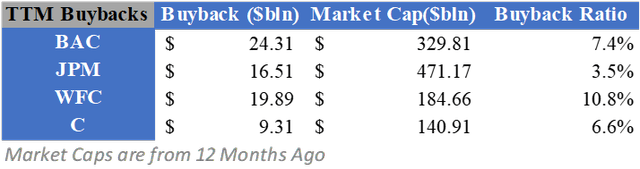

Bank of America is working on lowering its total equity by buying back billions worth of shares. In the past 12 months, Bank of America had one of the best buyback ratios among its competitors and only being behind Wells Fargo. Over the past 12 months, Bank of America has repurchased $24.31 billion worth of stock. When comparing this to the company’s market cap from 12 months ago, this calculates to a buyback ratio of 7.4%. This is only behind Wells Fargo’s buyback ratio of 10.8%.

This way, Bank of America is attempting to increase its ROE. By repurchasing stock, the company’s total equity will decrease. This is already underway, as the company’s Common Stock account has decreased by over 62% over the past 10 years.

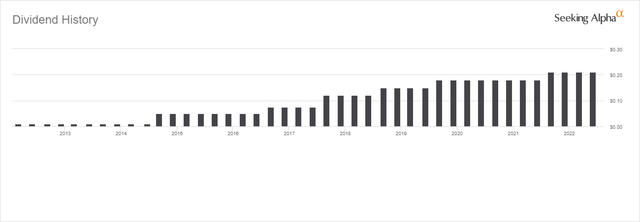

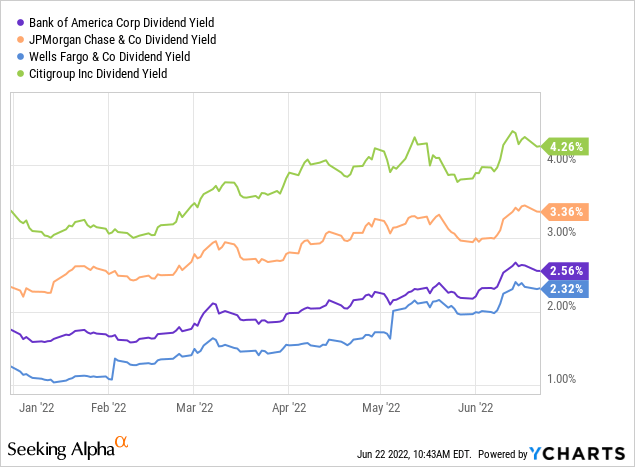

While the company’s share buyback program is strong, its dividend is behind competitors despite increasing steadily over the past 10 years. In the past decade, Bank of America’s quarterly dividend has increased from $0.01 to $0.21.

Bank of America Dividend History (Seeking Alpha)

The current dividend equates to a yield of 2.56%, which is the second lowest among the company’s competitors. The bank’s yield is only above Wells Fargo, and this makes sense because Wells Fargo is the only bank with a higher buyback ratio. Therefore, it is clear that Bank of America is focusing more on share buybacks rather than dividends. This is likely a good decision as the company needs to seriously focus on reducing its total equity. Without reducing its total equity, Bank of America will have trouble seeing improvements in its ROE. All in all, the decision to focus on share buybacks rather than a high dividend appears to be the right decision.

Bank of America’s Valuation Multiples May Be Too High For Some To Handle

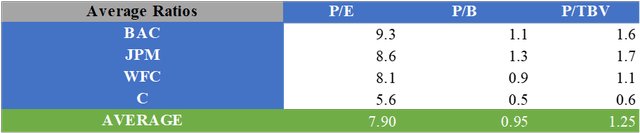

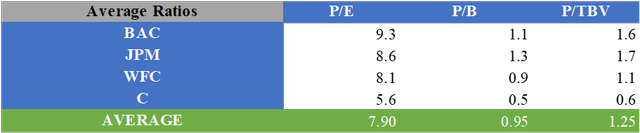

Bank of America trades at multiples comparable to JPMorgan Chase despite having lower metrics overall. Currently, Bank of America has the highest P/E ratio of the Big Four at 9.3. Furthermore, its P/B ratio sits at 1.1 and P/TBV is 1.6. The only other bank that currently has these ratios above 1.0 is JPMorgan Chase.

Valuation Multiples of Bank Stocks

Looking deeper into the reasoning behind these multiples is crucial. As mentioned previously, the share buybacks and dividends of Bank of America and Wells Fargo are very similar. Therefore, investors are looking to see which Bank outperforms in efficiency ratio. The winner here is Bank of America. Bank of America’s efficiency ratio is about 13% better than Wells Fargo’s. This could be the reasoning behind the higher multiples for Bank of America. It is important to restate that Wells Fargo is making an attempt to lower its noninterest revenues by reducing headcount. Therefore, Wells Fargo may be able to close the gap on Bank of America over time. This could lead to Wells Fargo’s multiples increasing, or Bank of America’s multiples decreasing.

Increasing Deposits And Rising Interest Rates Are Setting The Bank To Grow

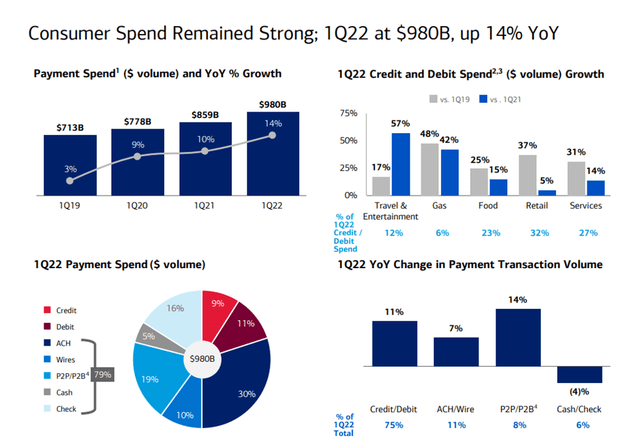

The two most major banks in the market are JPMorgan Chase and Bank of America. JPMorgan Chase is the leader in investment banking and focuses heavily on that market. On the other hand, Bank of America focuses more on consumer banking and this market is showing strong signs. In the company’s most recent quarterly report, deposits increased to $1.06T from $924.1 billion last year. This calculates to a record high growth of 14%. Furthermore, consumer spending remained strong. Since the first quarter of 2019, payment spend has increased from $713 billion to $980 billion.

Consumer Spending Stats (Company Presentation)

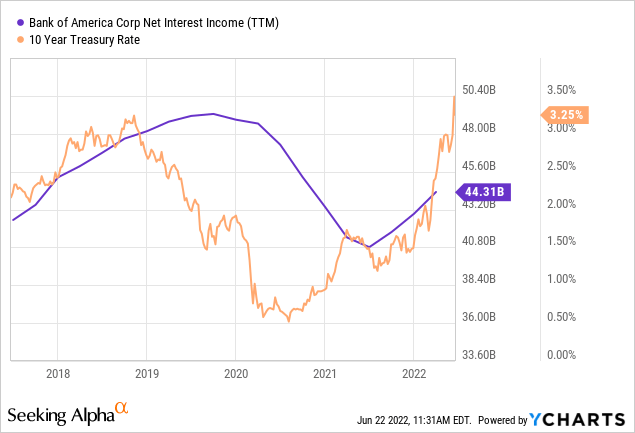

Bank of America is also set to thrive as interest rates increase. Higher interest rates allow Bank of America to earn higher net interest income. In the past, Bank of America’s net interest income has grown at a slight delay to interest rate changes. Since interest rates just recently started rising, Bank of America is just getting started growing its net interest income. Therefore, Bank of America will continue to see higher net interest income from current and future interest hikes.

Higher net interest income will also allow Bank of America to improve its ROE. With higher net interest income, the bank will generate higher income. Combine this with the company’s efforts to reduce its total equity and Bank of America could see a much higher ROE in the future.

Valuation

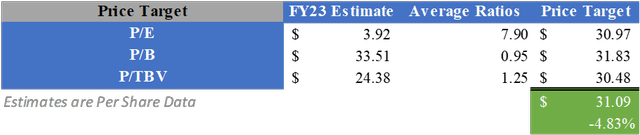

As stated previously, Bank of America has much higher multiples than Wells Fargo and Citigroup. While these multiples may be justified to some investors, I believe creating a conservative valuation is best to ensure protection for your portfolio. Therefore, I will use the average valuation multiples of Bank of America and its competitors.

By combining consensus analyst estimates for FY23 with the average valuation multiples for P/E, P/B, and P/TBV of Bank of America and its competitors, a fair value of $31.09 can be calculated. This means the stock is about fairly valued, but could see a drop of 4.83%.

What Does This Mean For Investors?

Bank of America is one of the strongest consumer banks in the market. The company has a great efficiency ratio and has made smart decisions in the past to lower its noninterest expenses. However, the return on equity could use some work to outperform competitors like Wells Fargo. The bank is attempting to improve this by buying back billions of shares, but once again Wells Fargo is outperforming here with a higher buyback ratio. Although, Bank of America is set to thrive due to higher interest rates, the higher much higher multiples might be too much for many investors to swallow. Due to these reasons, and the need for the stock to fall lower to provide a margin of safety, I believe applying a Hold rating is appropriate at this time.

Be the first to comment