jetcityimage/iStock Editorial via Getty Images

Bank of America (NYSE:BAC) benefited from a sharp recovery in consumer spending following the Covid-19 pandemic, but record inflation, which is expected to worsen this year, will result in higher borrowing costs for the bank in the future.

While increases in consumer spending will continue to be positive for Bank of America, changing monetary policy in order to contain runaway inflation rates poses a significant risk to the stock in 2022.

Strong Recovery Gains

Bank of America has benefited from the economy’s strong recovery over the last year, with consumer spending and demand for new credit products increasing significantly. The U.S. government’s generous paychecks to Americans during Covid-19 aided the market recovery, not only in the economy but also in Bank of America’s hugely important consumer banking segment.

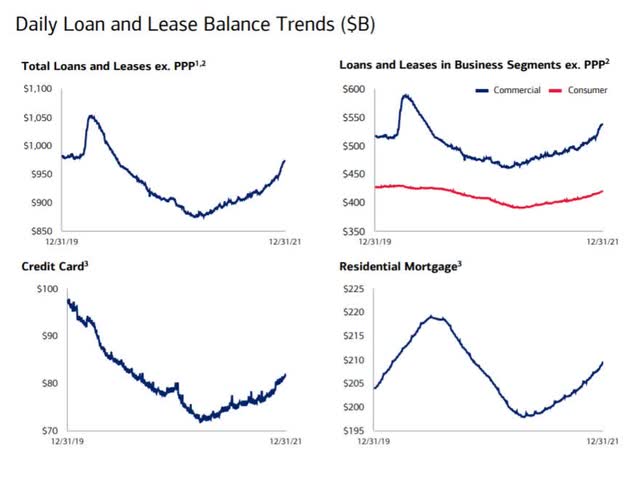

Loans, credit cards, and residential mortgages are among the key sectors of the financial industry that have seen a sharp turnaround in 2021. While many of these indicators remain below their pre-Covid highs, the credit market’s recovery has significantly aided Bank of America’s earnings rebound in 2021.

Daily Loan And Lease Balance Trends (Bank of America)

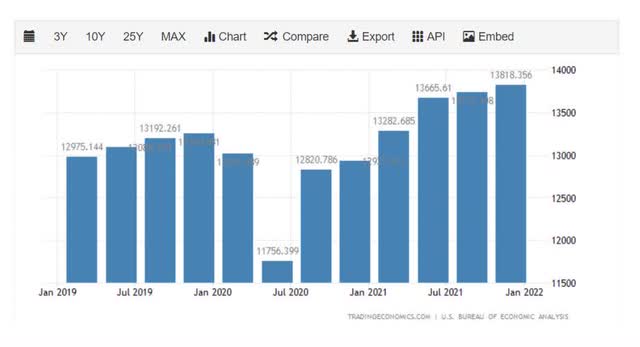

This recovery has been largely driven by factors that have benefited the financial health of the American consumer. Consumer spending increased dramatically in the second half of 2021, and Bank of America’s business benefited as a result.

Consumer Spending (Tradingeconomics.com)

Risks Are Growing For BAC

Having said that, the 20% drop in the valuation of Bank of America’s stock could be the start of a larger and longer correction, causing the stock price to fall much further than it has already. Inflation rates and monetary policy changes, I believe, will have a significant impact on Bank of America’s investment value in 2022.

Right now, the biggest risk for consumers and financial institutions like Bank of America is runaway inflation, which, let’s face it, is worse than anyone could have predicted. Inflation rose to 7.9% in February, and the March inflation report is expected to show a new 40-year high due to rising energy costs associated with the Ukraine conflict, which will now be fully factored into inflation figures.

Inflation in the U.S. climbed to 8.5% in March which only adds more pressure on the central bank to enact measures to counteract rising consumer prices. The central bank raised interest rates by 25 basis points in March for the first time since 2018, and it was only shortly after that, in the second half of March, that Bank of America’s stock price began to consolidate again.

Interest rates are now set at a range of 0.00% to 0.25%, which is woefully inadequate given that inflation rates are approaching (and likely exceeding) 8% (SOON).

Inflation is a risk not only because it is expected to raise Bank of America’s borrowing costs, lowering bank profitability, but it is also a risk because it significantly increases recession risks.

How Many Interest Rate Hikes Will There Be In 2022?

That depends on which investment bank you speak with. The majority of investment banks expect four interest rate hikes in 2022, but some see up to six 25-basis point hikes, like Morgan Stanley. The central bank, on the other hand, may act much more quickly to rein in runaway inflation, especially if inflation rates continue to rise this year.

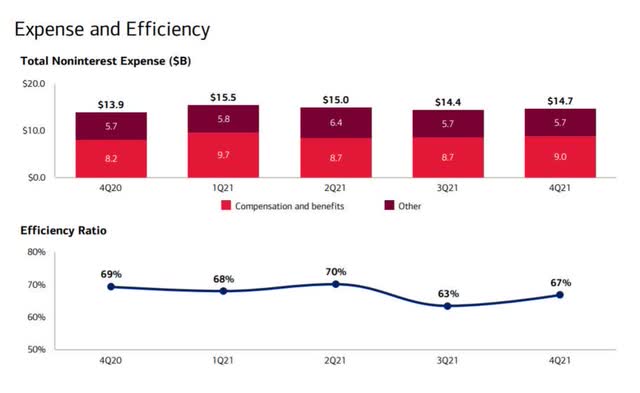

Rising Expenses Are A Risk To Bank Profitability

Bank of America’s costs increased in 4Q-21, despite a recovery in consumer spending. Bank of America’s efficiency ratio, which measures operating expenses in relation to revenues, increased from 63% in 3Q-21 to 67% in 4Q-21. The efficiency ratio is definitely a number to watch moving forward, and higher operating and interest costs would seriously undermine any remaining appeal of an investment in Bank of America.

Expense And Efficiency (Bank of America)

What Could Drive Bank of America Lower

Accelerating core inflation, higher borrowing costs, and weakening consumer spending are all serious risks for Bank of America that I believe investors are currently underestimating. The central bank may also raise interest rates much faster than the market anticipates, forcing investors to shift funds into assets that are considered better inflation hedges, such as banks and REITs.

BAC Stock Is Still Expensive

Despite the fact that an investment in Bank of America costs 20% less today than it did in February, I consider the bank to be anything but a bargain. Bank of America has an 83% premium to tangible book value, which means investors pay nearly twice the book value for the privilege of investing in the company. With the increasing headwinds, I am not convinced that this is an appropriate multiple to pay.

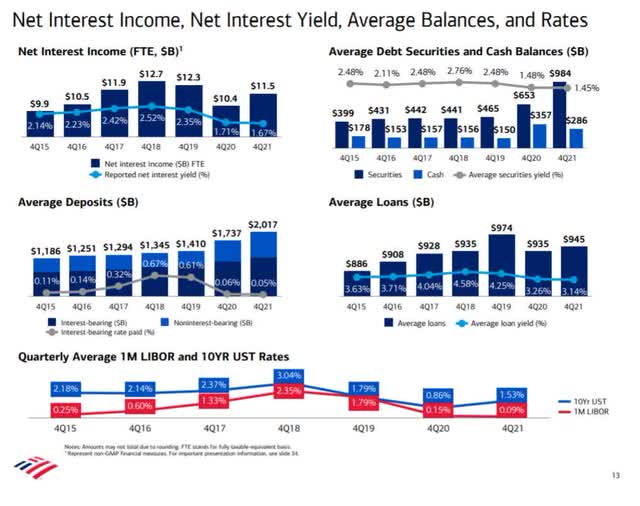

Bank of America’s Loan Business May Benefit From Higher Interest Rates

Bank of America, of course, has the option of passing on higher interest rates to borrowers and profiting from an already expanding loan business. The bank’s average loans increased to $945 billion in 4Q-21, and they may set a new high in 2022. However, I believe that rising inflation raises the risk of a recession and creates valuation headwinds for Bank of America.

Average Loans (Bank of America)

My Conclusion

Inflation will be a major headache for the economy, consumers, and the central bank, which is why Bank of America’s stock could fall even further. Higher capital costs could eat into the bank’s profits, and the risk of a recession is increasing. All of this suggests that buying Bank of America at such a high TBV multiple is a bad idea.

While consumer spending is not yet contracting and the credit market recovery has aided Bank of America 2021, recession risks are increasing. I believe that 2022 will be the year when the market resets inflation expectations and starts pricing in higher borrowing costs for the capital-intensive banking sector.

Be the first to comment