Bruce Bennett

Earlier today, Bank of America Corporation (NYSE:BAC) released its second quarter earnings. The release was a slight miss on both revenue and earnings. Revenue came in at 22.7 billion, up 6% year-over-year, while earnings came in at 6.2 billion, down 32%.

Much of the decline in net income was attributable to an increase in provisions for credit losses (“PCLs”). Banks are required by regulations to keep a certain amount of money aside to cover losses, in order to maintain their capital ratios. This results in some variability in earnings. This year, we are widely thought to be entering a recession, and banks like BAC are having to raise their PCLs in order to cover potential defaults. For Q2, BAC’s reserve increase was $523 million, which took a substantial bite out of net income.

However, the earnings growth would still have been negative without the reserve build. In Q2 2021, BAC earned $9.2 billion. If you had $523 million to the recent quarter’s earnings, you only get to $6.723 billion, which is still down 26%. Increased income taxes and low investment banking fees took a bite out of earnings. On the other hand, buybacks helped temper the negative growth on a per share basis, as EPS declined 29%, less than net income.

Overall, it was not a bad quarter at all. Revenue growth was positive, and although earnings declined, much of the decline was an “on paper” decline brought on by higher PCL and last year’s income tax benefit. In the meantime, the Federal Reserve is raising interest rates, which could eventually prove to be a positive for BAC should the current yield curve inversion disappear. For this reason, I consider Bank of America a pretty good buy at today’s prices, as I’ll explain in more detail in the ensuing paragraphs.

A Diversified Bank

One of the big advantages of BAC compared to other banks is its operational diversification. Bank of America operates in retail banking, commercial banking, brokerage, and investment banking. This is a mix of businesses that can do well overall.

Some of this year’s trends are actually favorable for lenders. For example, higher interest rates. Banks borrow on the short end of the yield curve, and lend on the high end. Therefore, as long as interest rates go up in parallel across the yield curve, banks earn higher margins when rates rise. This year, the interest rate increases haven’t been parallel; instead, the yield curve has inverted. So we haven’t really seen an explosion in net interest income. Should the yield curve situation reverse, it could mean higher future profits for BAC.

Investment banking is in a less fortuitous position than retail banking. A bank that does only investment banking will suffer this year, because the tech IPO business has dried up. Tech IPOs were a big money maker for banks last year, but this year they don’t have as much of it. So, many big banks are seeing their revenue decline.

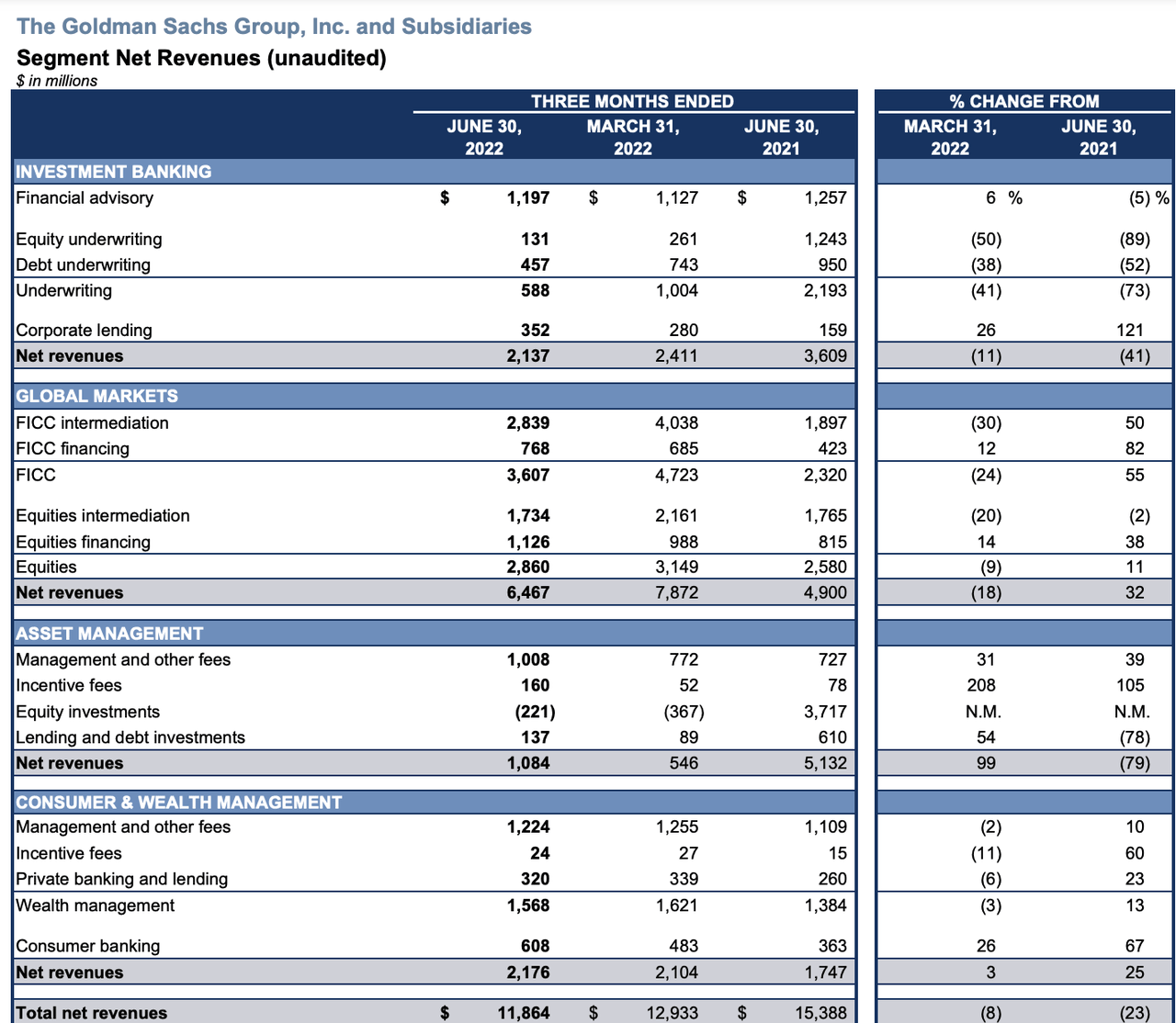

Banks that are heavily concentrated in i-banking are doing much worse than lenders this year. Goldman Sachs (GS) released its earnings around the same time BAC did, and it reported a 23% decline in revenues, compared to 6% growth for Bank of America. GS’s investment banking revenue fell even more than whole enterprise revenue, declining 41%.

Goldman Sachs revenue (Goldman Sachs)

For Bank of America, investment banking is only a side business, so it is less exposed to issues in that industry compared to its competitors. To demonstrate this, I’ve created a table below that shows three major banks’ investment banking earnings as a percentage of total earnings. Some of these banks bundle i-banking with other segments, like market-making, in their financial reports. This results in a comparison that’s not 100% apples-to-apples, but that only strengthens my argument, as BAC’s “global banking” segment (i-banking/treasury services combined) is smaller as a percentage of earnings compared to other banks’ i-banking segments alone.

Here’s the data for full year 2021:

|

Total earnings |

Investment banking earnings |

I-banking as percentage of total earnings |

|

|

Bank of America |

$31.9 billion |

$9.8 billion |

30.7% |

|

JPMorgan (JPM) |

$48.3 billion |

$21 billion |

43.5% |

|

Morgan Stanley (MS) |

$15 billion |

$11.8 billion |

78.6% |

As you can see, BAC has the least investment banking exposure out of these three banks. Now, as I mentioned previously, these banks don’t report investment banking as a segment in itself. They only report investment banking fees within combined segment results, they don’t report the margins on i-banking individually. However, if we look at “investment banking fees as a percentage of revenue,” we get a similar result. For example, JP Morgan did $13.4 billion in investment banking fees on $121 billion in total revenue in 2021. Bank of America did $8.9 billion in investment banking fees on $89.11 billion total revenue the same year. So JP Morgan is 11% i-banking while Bank of America is only 10%. Therefore, BAC is less exposed to the tech IPO collapse than JP Morgan is.

Bank of America: Key Banking Data

Having looked at Bank of America’s earnings and position relative to its industry, we can now look at some key banking related metrics. Banking is a peculiar industry, with several metrics that apply to it but not other industries. Some of these metrics determine how much earnings a bank can report, so they’re worth taking a look at.

Some of BAC’s relevant banking ratios in the second quarter included:

-

CET1 ratio – 10.5 (above regulatory requirements but not the highest out there).

-

Risk-weighted assets: $1.64 trillion.

-

Tier 1 leverage ratio – 6.5.

-

Supplementary leverage ratio – 5.5.

-

Tangible equity ratio – 6.5.

-

Tangible common equity ratio – 5.6.

Banks are required to have an 8% capital ratio, of which 6% must be tier 1, so BAC’s 10.5 CET1 ratio is well ahead of regulatory requirements. The tier 1 leverage ratio is also above the Basel III requirement (3%) and the common equity ratio indicates a healthy amount of tangible equity. Note that tangible equity ratio is a non-GAAP metric, not a regulatory requirement, but is commonly used by banks.

Valuation

Having looked at BAC’s recent financial metrics, we can turn to valuation. Like most banks these days, BAC trades at a discount, boasting valuation multiples like:

-

Price to earnings – 9.21.

-

PEG – 0.18.

-

Price/sales – 2.9.

-

Price/book value – 1.04.

These multiples are fairly low. The PEG ratio is particularly impressive, although that’s mostly due to the TTM still including several strong 2021 quarters. That will evaporate as more 2022 results lower the earnings growth rate. On the profitability front, BAC boasts a 0.96% return on assets (“ROA”), a strong metric for a lender. For comparison, the higher-yielding Toronto-Dominion Bank (TD), has only a 0.81% return on assets.

We can also do a discounted cash flow analysis to gauge what BAC is worth. BAC had $3.51 in earnings per share in the most recent quarter. If we assume that grows at 5% for five years, then growth tapers off to 0% later, and use a 10% discount rate, we get a $43 fair value for BAC. If we assume no initial period of growth, we get a $35 fair value, which is still slight upside to today’s price!

Risks and Challenges

As we’ve seen, BAC is a very cheap stock whose recent earnings missed but were not terrible. The company managed positive revenue growth, which many other banks couldn’t achieve in the same period. So, it was a comparatively good showing.

However, there are many risks and challenges for investors to look out for, including:

-

A recession. The U.S., Bank of America’s main market, has been recording negative real GDP growth for many months now. Many people think the country will soon enter a recession. If that happens, then consumers and businesses may default on their loans. An increase in PCLs is virtually guaranteed, loans actually defaulting in reality is less certain, but is possible. At any rate, the reserve build will take a bite out of on-paper net income immediately when it occurs.

-

Yield curve inversion. At the time of this writing, the U.S. 10 year-2 year yield curve was inverted. If this continues, then BAC’s profit on long term loans like mortgages will suffer. I’ve mentioned in this article that high interest rates can be good for banks, but that’s only true if rates rise in parallel along the yield curve. If short term rates rise while long term rates fall, bank margins start to suffer.

-

Continued weakness in investment banking. Equity underwriting fees are declining year over year due to the tech stock crash. It is not ideal for tech startups to go public in this environment, because the demand for their issues is low. This is resulting in negative growth in investment banking fees this year. Bank of America is less exposed to this than, say, Goldman Sachs or Morgan Stanley. But it’s exposed enough that continued weakness could be a drag. In 2019, BAC was America’s top equity underwriter. With that distinction the company’s recent past, some weakness relative to the base period is expected.

All of these risks are serious enough for investors to consider. However, they do not damage the bullish thesis on BAC. The stock is cheap enough that it could thrive even with continued macro weakness. Investors should be patient, though, because the current economic malaise will take a while to settle down.

Be the first to comment