tupungato

Thesis

Bank of America Corporation (NYSE:BAC) investors went into its FQ3 earnings release last month expecting a relatively tepid report card. However, we turned bullish in late August after previously rating BAC as a Hold.

Notwithstanding, we highlighted to investors that there could be downside volatility implied in its price action, given the speed of BAC’s summer rally toward its August highs. Hence, investors who leveraged BAC’s pre-earnings September/October lows have benefited tremendously.

Accordingly, BAC has surged more than 30% from its October bottom, forcing a re-test of its previous August highs. We believe the market has likely priced in the near-term benefits of the Fed’s interest rate hikes through FY23, lifting Bank of America’s net interest income (NII) growth markedly.

However, we urge investors to remain on the sidelines at the current levels and assess whether the reward/risk is still reasonable after the recent recovery.

Our analysis indicates that the Fed’s rate hikes could be nearing a pause in H1’23, even though rates should remain elevated. The upcoming December FOMC should unveil clues relating to the Fed’s updated “dot plot.” Recent hawkish commentary by some Fed members also pushed the Fed fund rates (FFR) forward curve back to the 5% zone, causing market volatility.

We postulate that the improvement in BAC’s EPS growth should normalize by H2’23, leading to more challenging comps through FY24, given the surge in NII.

Notwithstanding, we assess that BAC’s valuation remains priced at an appropriate discount against its historical averages to reflect potential recessionary risks.

However, BAC’s valuation premium against its peers could reduce the potential for a material re-rating unless the market anticipates a robust recovery in EPS growth through FY24.

Hence, we urge investors not to chase its recent momentum surge, even though we are confident of its October lows. It’s reasonable to expect a pullback after a sharp recovery; therefore, investors should remain patient.

Revising from Buy to Hold for now.

BAC: EPS Growth Should Normalize In H2’23

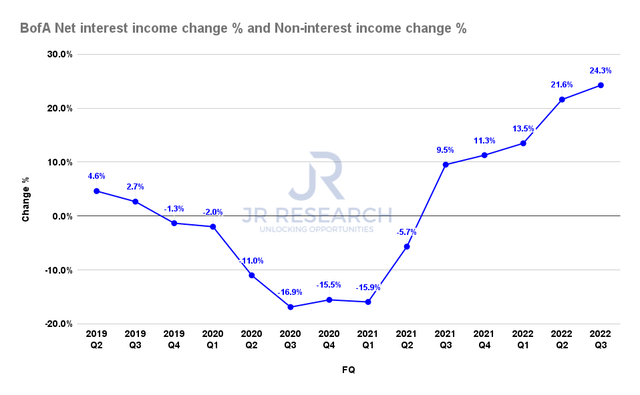

BAC NII change % (Company filings)

Bank of America posted a 24.3% uptick in its NII in FQ3 (up from FQ2’s 21.6%), with further growth expected in FQ4. Management updated that it has benefited significantly from the Fed’s record hiking cadence, as CFO Alastair Borthwick articulated:

We expect NII in Q4 to be at least $1.25 billion higher than in Q3. [We are] refreshing our expectation for Q4 at $1.25 billion. We’re now saying that aggregate quarterly improvement won’t be the $2 billion we initially thought, it’s increased to around $2.6 billion or more. (BAC FQ3’22 earnings call)

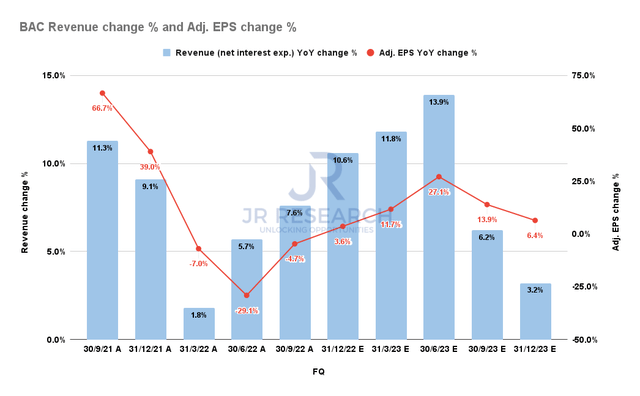

BAC Revenue change % and Adjusted EPS change % consensus estimates (S&P Cap IQ)

Therefore, we believe the consensus estimates (bullish) suggesting a surge in revenue growth through H1’23 is credible.

However, we urge investors to look ahead and ask themselves whether they expect the rate hikes to continue at a rapid pace. Or they anticipate a pause for the Fed to move into “data dependency” mode to assess the flow-through impact due to policy lags.

While still early, we believe the market’s bottoming process in October has likely anticipated a pause in the Fed’s hiking cadence in H1’23. Therefore, we don’t expect Bank of America to benefit from such surges in its NII growth in H2’23, leading to a substantial normalization of its EPS growth.

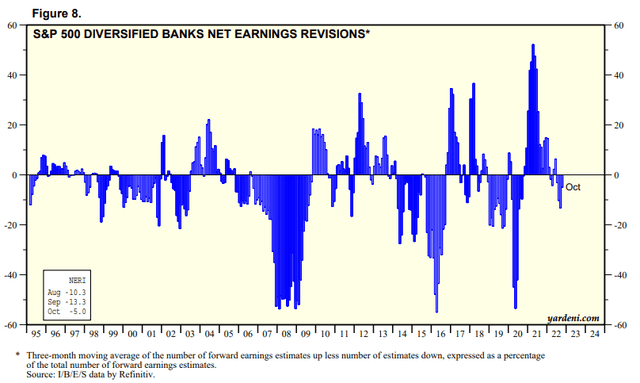

S&P 500 Diversified Banks industry net earnings revision % (Yardeni Research, Refinitiv)

Furthermore, FactSet reported that banks had lifted their credit provisions. However, the provisions are well below pandemic highs, suggesting the banking industry doesn’t anticipate a severe recession.

Furthermore, analysts’ revised earnings outlook suggests they don’t expect bank earnings to fall significantly in FY23, with downward revisions relatively mild compared to significant downturns previously.

Hence, we postulate that investors should maintain an appropriate discount in their assessment of BAC’s valuations to reflect a worse-than-expected downturn causing further earnings compression.

Is BAC Stock A Buy, Sell, Or Hold?

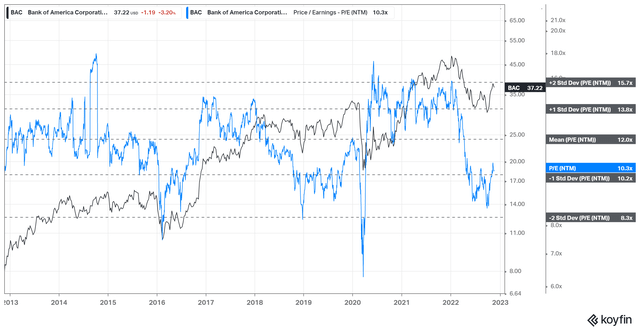

BAC NTM normalized P/E valuation trend (koyfin)

BAC’s NTM P/E has recovered markedly from its October lows, even though it remains below its 10Y mean of 12x. However, we postulate the discount is appropriate to reflect recessionary risks. Hence, we assess its valuation as relatively well-balanced, with the potential for upside re-rating.

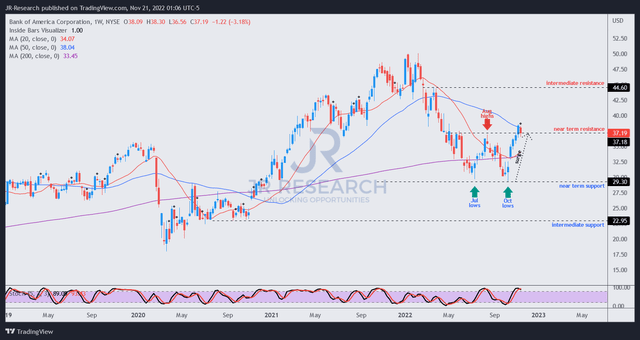

BAC price chart (weekly) (TradingView)

However, we gleaned that BAC re-tested its August highs recently, with the 50-week moving average (blue line) leaning in as a dynamic resistance zone.

Coupled with the surge in the recovery from its October lows, we urge investors to be cautious here.

We believe a pullback should help to improve its reward/risk further, and therefore, investors shouldn’t rush to join the recent buyers in its surge.

Revising from Buy to Hold for now as we await the potential retracement.

Be the first to comment