tupungato/iStock Editorial via Getty Images

Introduction

It’s difficult to navigate through these muddy waters on the markets. On the one hand, I would like to protect my portfolio against the raging inflation, but on the other hand, we also know inflation is per definition a temporary element. Inflation will always fall back down again but that doesn’t mean that is a painless experience as it can cripple an entire economy: if the demand for products falls, the inflationary pressure will decrease as well but that clearly doesn’t mean the economy is better off.

I have lately been aggressively increasing my exposure to preferred shares as the higher interest rates on the markets have resulted in better yields on this type of securities. Fixed rate preferred shares are obviously hit harder than floating rate of fix-to-float securities and my portfolio contains a mix of both.

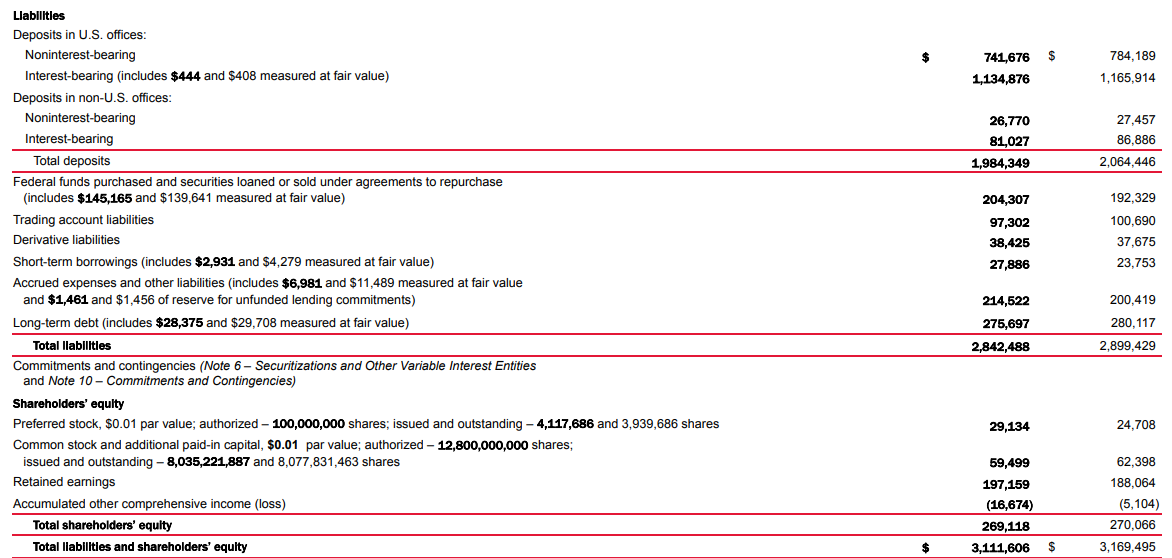

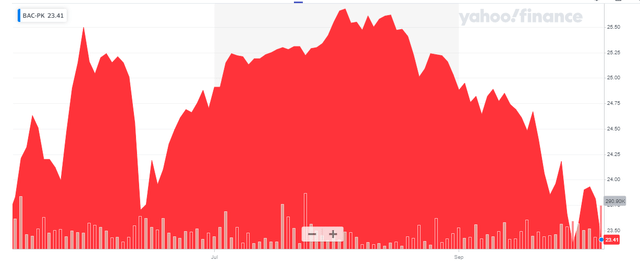

In this article, I’d like to explain an investment thesis that could be useful for investors expecting a Fed pivot in the next few quarters. Bank of America (NYSE:’BAC’), a large financial institution no one really needs to be introduced to, has an attractive preferred share series which can be called from July 2023 on. This series is now trading at a discount to its principal value, but given the small discount to the par value of the Series HH preferred share, trading as (NYSE:BAC.PK), it is not unlikely these securities could get called next year if interest rates come down a little bit.

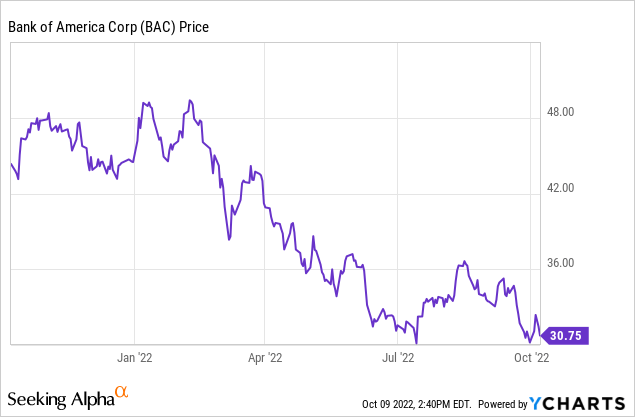

Bank of America’s H1 results were robust, but the second half of the year may be more interesting

In order to figure out how interesting an investment in preferred shares would be, we obviously have to have a look at how the bank is performing as that will ultimately decide how safe the preferred dividend payments are, and how much equity is ranking junior to the preferred shares.

In the first half of this year, Bank of America reported a net interest income of in excess of $24B, which is an increase of almost 20% compared to the first half of last year. And as interest rates started to increase in the second quarter, BAC recorded a noticeable increase in its net interest income.

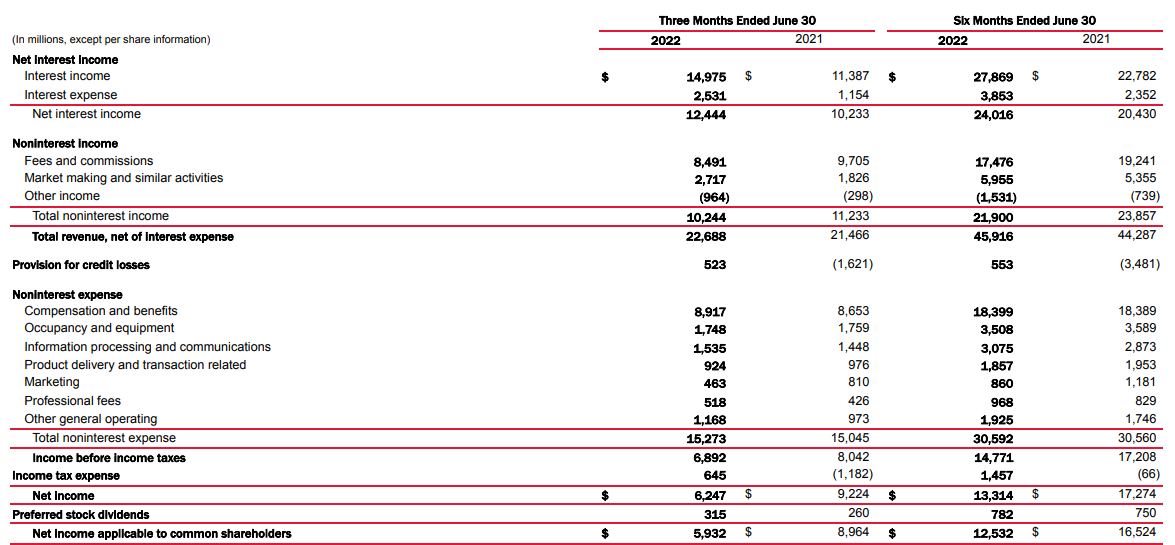

Bank of America Investor Relations

The bank also reported a total non-interest income of $21.9B which is slightly lower than in the first half of last year, but fortunately, the total net non-interest expenses remained virtually unchanged. This helped the bank to record a strong increase in its pre-tax and pre-loan loss provision income. In H1 2021, the reported pre-tax income was $17.2B, but after deducting the $3.48B contribution from the reversal of loan loss provisions, the normalized pre-tax income was $13.73B. As you can see in the image above, Bank of America recorded a $553M loan loss provision in the first half of the current year which reduced the pre-tax income to $14.77B. Excluding these loan loss provisions, the underlying result was a very attractive $15.3B, an increase of more than 10% compared to the first half of last year. Of course, we cannot just ignore loan loss provisions, but I wanted to explain that why despite the decrease in the reported earnings, Bank of America’s first half of the current financial year was actually pretty decent.

The net income in the first semester of this year came in at $13.3B, and after deducting the $782M in preferred dividends, the net income attributable to the common shareholders of Bank of America was $12.5B, representing an EPS of $1.54.

A closer look at BAC’s preferred shares series HH

There are several series of preferred shares available, but there’s one I’d like to discuss in more detail.

The Series HH are trading as BAC.PK and offer a 5.875% non-cumulative preferred dividend. This means the annual preferred dividend is $1.46875 per preferred share per year, payable in four equal quarterly tranches. This series closed at $23.41/share on Friday which means the current yield is approximately 6.27%. That is not bad but what I also like about this series is the July 2023 call date.

Should the interest rates on the market decrease between now and July 2023 (for instance, because the Federal Reserve is relaxing its monetary tightening a bit), we can definitely not rule out seeing the Bank of America calling these preferred shares. If that would indeed happen, investors would realize a 6.7% capital gain in just 9.5 months’ time for a total return of approximately 11.5%. And if there’s no noticeable Fed pivot and/or the interest rates don’t come down, you’d still own a security with a yield of almost 6.3% on your cost basis as that won’t change.

While a bank stands to benefit from increasing interest rates as this traditionally results in expanding net interest margins and thus a higher net interest income, a tightening monetary policy will also put the economy and the borrowers of the bank under pressure which means loan loss provisions will continue to increase.

That being said, if we look at the percentage the bank currently has to spend on the preferred dividends, we see that in the first semester only $782M was spent on preferred share dividends, and this even dropped to just $315M in the second quarter. This means that less than 6% of the H1 net income and just around 5% of the Q2 net income had to be spent on these preferred dividends, resulting in an excellent coverage ratio.

Secondly, I also wanted to have a look at the asset coverage ratio. Bank of America has about $3.1T in assets, and as you can see below, approximately $269B consists of equity. The tangible equity is approximately $200B after deducting the $69B in goodwill on the balance sheet.

Bank of America Investor Relations

The value of the preferred equity is just under $30B which means there’s approximately $170B in equity ranking junior to the preferred shares of Bank of America. That’s a solid ratio.

Investment thesis

Despite the non-cumulative status of the preferred shares of Bank of America, I still like the Series HH (trading as BAC.PK) due to the strong preferred dividend coverage ratio and the potential for the securities to be called in 2023. This will only happen if/when the interest rates on the financial markets decrease so an investment in BAC.PK could be seen as some sort of call option on slightly lower interest rates within the next six to nine months. And if that doesn’t happen, an investor will still be receiving a preferred dividend of almost 6.3%. Of course, this isn’t the only security where this could apply, and Bank of America could also call the BAC.PB issue, the Series GG preferred shares with a 6% preferred dividend which are also callable in 2023. Those securities have a lower current yield of less than 6.2%, but a higher likelihood of being called, so it is a trade-off.

And if the interest rates continue to increase, the preferred shareholders should enjoy even better dividend coverage ratios as Bank of America’s net income should be positively impacted by increasing interest rates, despite likely having to record higher loan loss provisions.

I currently have a small long position in the Series L preferred shares but am contemplating initiating a small long position in BAC.PK as well.

Be the first to comment