ljubaphoto

Company Snapshot

Banco Santander-Chile (NYSE:BSAC) is a Chilean-based bank involved in rendering a broad range of retail and commercial banking services. It is perceived to be the largest bank in Chile by way of aggregate loans, where it enjoys a market share of nearly 18%. BSAC is also the second-largest holder of deposits in the country, with a market share of 17.5%. As things stand, the bank has 324 branches across Chile and services over 4.2m clients there.

A Few Reasons To Consider The BSAC Stock?

BSAC looks like an intriguing bet for technically-minded investors that are on the lookout for EM-themed opportunities offering good value and yields.

The first chart highlights how the BSAC stock is positioned relative to the global banking space, as represented by the iShares Global Financials ETF (IXG). We can see that this ratio currently looks relatively oversold and is a long way from the mid-point of its long-term range.

StockCharts

The second chart shows Banco Santander-Chile’s relative strength versus BlackRock’s flagship portfolio of 25 Chilean stocks (incidentally, Santander-Chile is amongst the top 10 names within this portfolio). We can see that over the last 15 years BSAC has been gaining strength over its Chilean counterparts in the shape of an ascending wedge; currently, that ratio is trading around the lower boundary of the wedge, implying favorable risk-reward for a potential mean reversion play.

StockCharts

Similar dynamics can also be witnessed on BSAC’s long-term standalone chart, where the price action appears to be close to a support zone, and is a long way from its upper boundary.

Investing

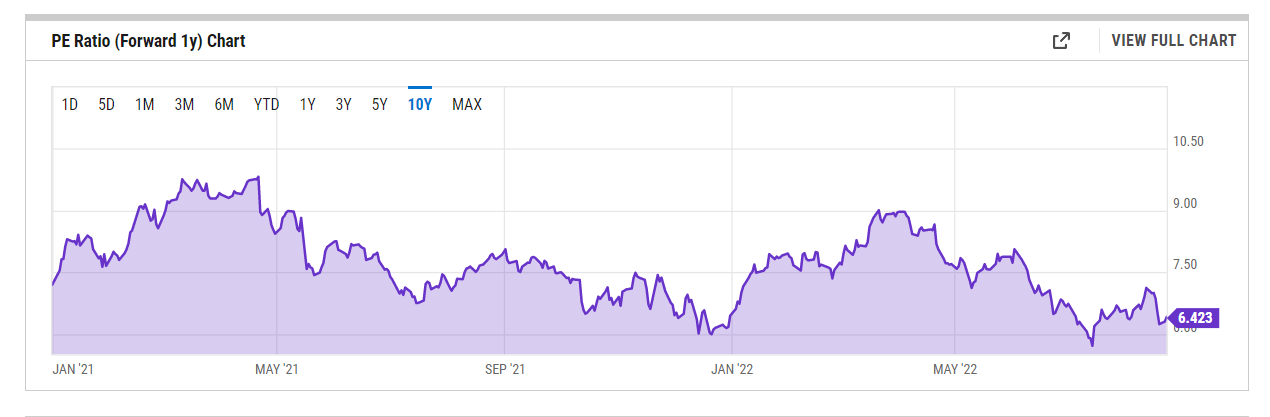

Augmenting these technical imprints, we also have an attractive valuation and income backdrop. Based on consensus EPS estimates for FY23, the stock only trades at a forward P/E of 6.4x, which also represents a ~17% discount to its 5-year average multiple.

YCharts

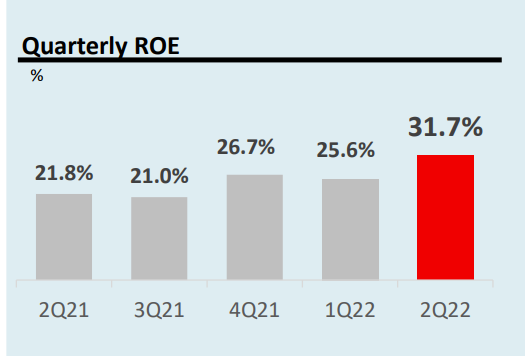

This feels inordinately cheap for a banking play that has just delivered all-time high ROEs of 32% (just to put this into context, closer to home in the US, banks typically only deliver ROEs within the mid-teen range).

Q2-22 Presentation

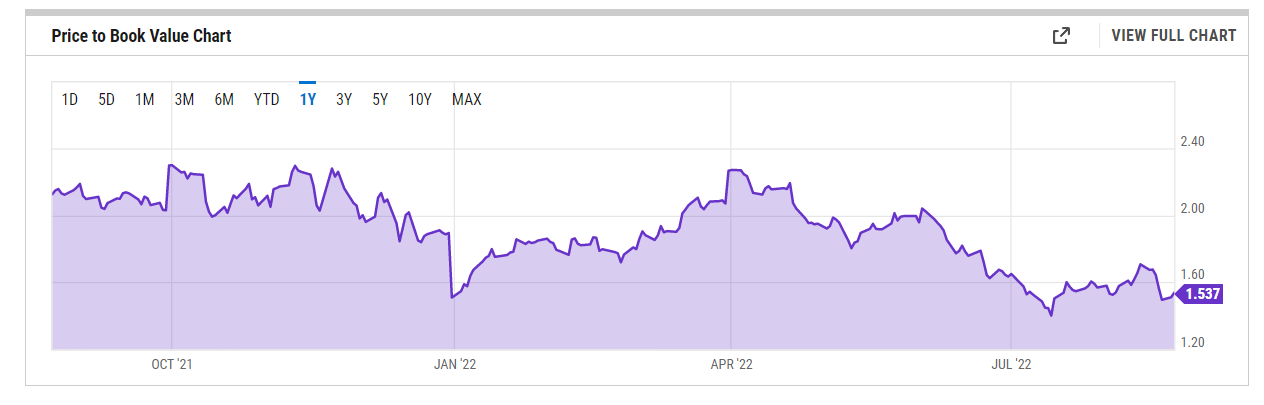

On a price-to-book value basis, which is the more appropriate valuation metric for gauging banks, the valuation discount is even greater with the stock trading at 1.53x, a 37% discount to its long-term average.

YCharts

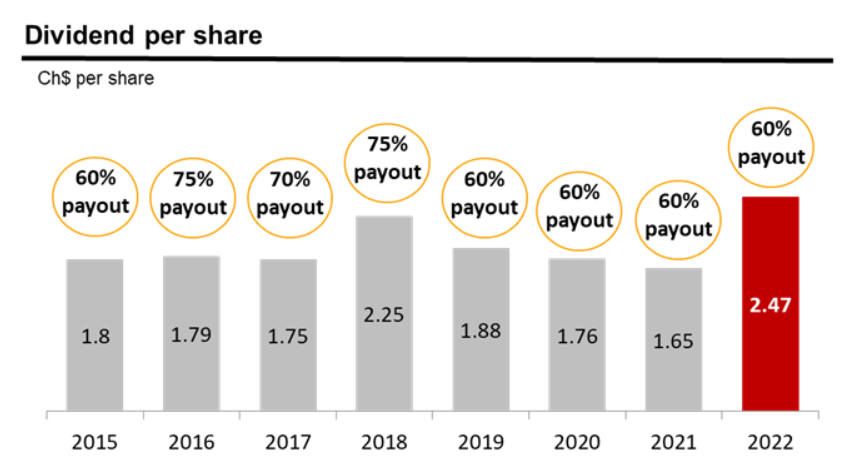

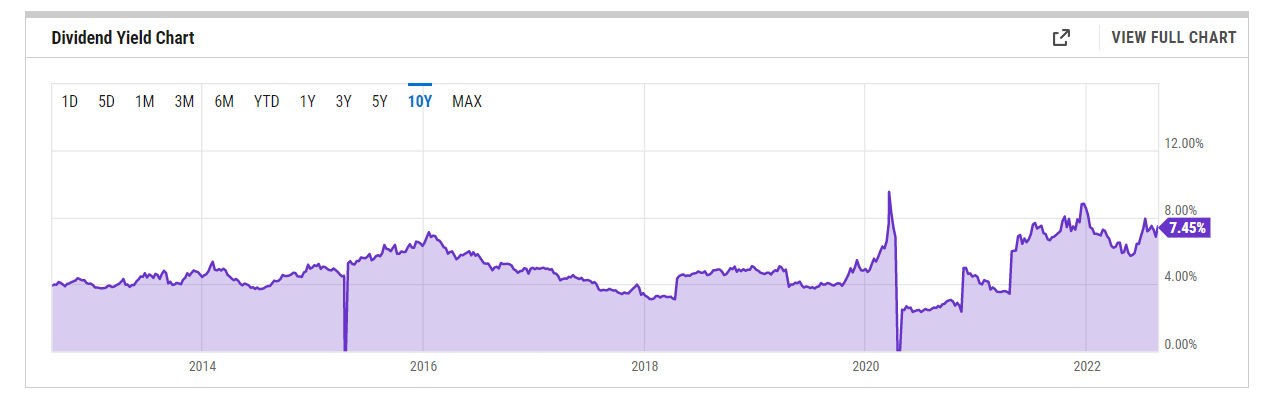

Finally, also consider the extremely attractive income angle on offer; this is an entity that has a long track record of paying out 60-75% of its earnings as dividends.

Company Website

With elevated payouts of this sort, compared with a depressed share price, you’re looking at a very attractive yield of 7.45%, which is a good 260bps greater than the average yield that one typically gets from the BSAC stock.

YCharts

But Beware, The Outlook Isn’t Great

Based on the previous section, investors may be forgiven for thinking that I’m only viewing the investment credentials of BSAC stock with rose-tinted glasses; that certainly isn’t the case, and I’m afraid the outlook prevents me from being bullish on this stock.

Firstly, growth dynamics in Chile are expected to skid quite profusely; after delivering 11.7% GDP growth last year, no one was expecting a repeat of the same, but the recent Q2 numbers have remained stagnant on a sequential basis, coming in at mid-single digit terms. Crucially, H2 growth is expected to be a lot slower, with FY22 GDP forecasts pointing to figures of less than 1.5%. If Chile is expected to grow at 1.5%, BSAC management expects their loan growth to be in the 8-10% range, implying a loan to GDP multiplier of 6x.

The more worrying challenge revolves around 2023 when GDP growth is actually expected to decline by 1%, could we see BSAC’s loan growth stall? It doesn’t help that the Chilean administration currently appears to be pursuing a program of tax reform that has already dampened enthusiasm for fresh investment projects. If large corporations – most of which are from the mining sector – are unwilling to show ample credit appetite on account of these developments, the onus will fall on Chilean consumers to make up the load; I think that’s asking for a bit much particularly when monthly household budgets remain crippled on account of steep inflation levels which have recently broached the 13% mark!

Heightened inflation has also left its mark on BSAC’s OPEX base in Q2 which rose by 16% on a quarter-on-quarter basis (management linked this to higher personnel costs and administrative costs whilst the depreciation of the Peso has also left its mark on IT-related costs denominated in USD). It’s worth noting that Banco Santander-Chile has recently gotten into a two-year investment plan worth $260m designed to upgrade their IT systems. Expect this to weigh on the pre-provision profits of the bank in the coming quarters.

To counter steep levels of inflation, the Chilean Central Bank has already raised rates by 925bps over the past year with the policy rate currently at 9.75%; July’s hike of 75bps is unlikely to be the last, with economists there pointing to a year-end policy rate of 10.5% at the very least.

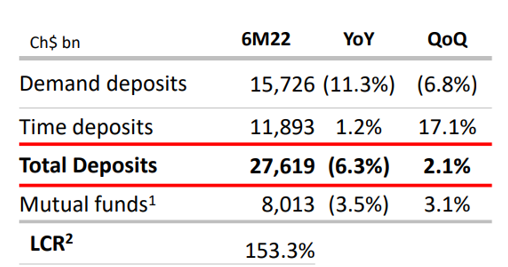

Unfortunately for BSAC, these aggressive rate hikes won’t reflect well on its NIMs as its liabilities gets repriced at a much faster pace than its assets. Besides, given the uncertainty surrounding Chilean equities, and the higher yield on offer with time deposits, BSAC will likely see its deposit base rotating away from the low-cost demand deposits. In fact, in H1, the bank saw its demand deposit growth slump by 7% on a quarterly basis, even as its time deposits surged by 17%.

Q2-22 Presentation

The weakening outlook can be summed up by the ROE guidance provided by the management. Whilst BSAC generated an ROE of 28.7% in H1, their expectations for the whole year are only around 21-22%; this implies an H2 ROE of only around the mid-teens levels. That is indeed quite a drop-off!

Closing Thoughts

In addition to the stock-specific and macro issues, also consider that you’re likely to see a lot of volatility ahead of the Chilean referendum vote on the 4th of September, where the outcome appears to be rather uncertain. All things considered, I would sit on the fence with BSAC.

Be the first to comment