Oleksii Liskonih/iStock via Getty Images

Contrary to most other banks, BancFirst Corporation’s (NASDAQ: NASDAQ:BANF) stock price has surged during the recent market rout. The company surprised me with remarkable loan growth in the first quarter of the year, which was partly fueled by the acquisition of Worthington National Bank. Going forward, I’m expecting organic loan growth and some margin expansion to support the bottom line. On the other hand, normalization of the provision expense will likely drag earnings. Overall, I’m expecting the company to report earnings of $4.73 per share in 2022, down 6% year-over-year. Compared to my last report on BancFirst, I have revised upwards my earnings estimate mostly due to an upward revision in my loan growth estimate. The year-end target price suggests a significant downside from the current market price. Therefore, I’m downgrading BancFirst Corporation to a sell rating.

Loan Growth to Remain Decent After 1Q’s Acquisition

BancFirst surprised me with strong loan growth of $325 million, or 5.3%, in the first quarter of 2022, which was mostly fueled by acquired loans. As mentioned in the earnings release, BancFirst completed the acquisition of Worthington National Bank in the first quarter of 2022, which added $261 million worth of loans to the portfolio.

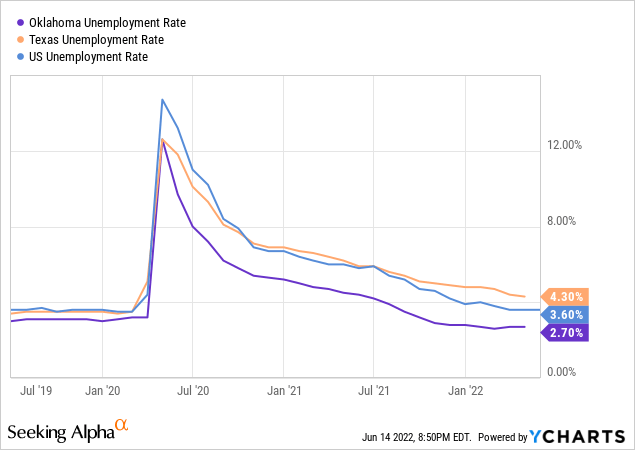

Although the first quarter’s performance will likely not get repeated, the loan growth will likely remain at a decent level in the year ahead. The outlook is positive for organic loan growth because the regional economic environment appears satisfactory. BancFirst mostly operates in Oklahoma with some presence in Texas through its subsidiaries, Pegasus Bank and Worthington National. Oklahoma is doing better than other states when it comes to the unemployment rate. Although Texas is trailing other states in terms of the unemployment rate, Texas’s GDP growth is quite strong, which also bodes well for loan growth.

Considering the first quarter’s acquired loan growth and outlook on organic loan growth, I’m expecting the total loan portfolio to increase by 10% by the end of December 2022 from the end of 2021. In my last report on BancFirst Corporation, I estimated loan growth of 6% for 2022. I have significantly revised upward the loan growth estimate solely because of the acquisition of Worthington National Bank in the first quarter of the year. At the time I wrote my last report on the company, there was no announcement of an acquisition.

Meanwhile, I’m expecting deposit growth to match loan growth in the remainder of this year. However, for the full year, the deposit growth will outpace loan growth because of the acquisition of Worthington National Bank in the first quarter. The following table shows my balance sheet estimates.

| FY17 | FY18 | FY19 | FY20 | FY21 | FY22E | ||||

| Financial Position | |||||||||

| Net Loans | 4,670 | 4,925 | 5,608 | 6,303 | 6,086 | 6,700 | |||

| Growth of Net Loans | 7.3% | 5.4% | 13.9% | 12.4% | (3.5)% | 10.1% | |||

| Other Earning Assets | 2,019 | 1,976 | 2,150 | 1,945 | 2,381 | 5,195 | |||

| Deposits | 6,415 | 6,605 | 7,484 | 8,065 | 8,092 | 11,765 | |||

| Total Liabilities | 6,478 | 6,671 | 7,561 | 8,144 | 8,234 | 11,973 | |||

| Common equity | 776 | 903 | 1,005 | 1,068 | 1,172 | 1,248 | |||

| Book Value Per Share ($) | 23.8 | 27.0 | 30.2 | 32.2 | 35.3 | 37.5 | |||

| Tangible BVPS ($) | 21.8 | 24.1 | 25.0 | 27.1 | 30.3 | 31.4 | |||

|

Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

|||||||||

Asset Sensitivity to Benefit the Topline

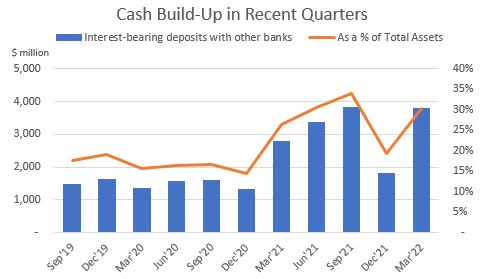

Partly due to the acquisition of Worthington National Bank in the first quarter of 2022, the asset mix shifted significantly towards cash and cash equivalents. Interest-bearing deposits with other banks, which is the biggest cash component, surged to $3.8 billion by the end of March 2022 from $1.8 billion at the end of December 2021.

SEC Filings

The excess cash on BancFirst Corporation’s books gives the company the flexibility to start earning higher yields quite soon after interest rate hikes. Moreover, the loan mix is suitable for a rising interest-rate environment. According to details given in the latest 10-K filing, around 42% of total loans will mature in 2022.

Further, the margin will benefit from sticky deposit costs. Around 46.4% of total deposits were non-interest bearing at the end of March 2022. As these deposits will not re-price after interest rate hikes, they will keep the average deposit cost upward sticky in a rising interest-rate environment.

As mentioned in the 10-K filing, more assets than liabilities will mature in 2022. This asset-liability gap was around $423 million, or 5.45% of total assets, at the end of December 2021. Considering the scheduled repricing, I’m expecting the net interest margin to increase by fifteen basis points in the last nine months of 2022 from 2.78% in the first quarter of the year.

Provisioning Normalization to Drag Earnings

After last year’s heightened provision reversals, the provision expense returned to a normal level in the first quarter of the year. I’m not expecting any big provision reversals this year as the current allowance level appears comfortable relative to the portfolio’s credit risk. Allowances made up 1.34% of total loans, while nonaccrual loans made up 0.27% of total loans at the end of March 2022, as mentioned in the earnings release. Further, it’s not wise to release reserves when there are threats of an economic recession.

Overall, I’m expecting the provision expense to make up around 0.18% of total loans in 2022. In comparison, the provision expense averaged 0.14% of total loans from 2017 to 2019, and 0.25% of total loans in the last five years.

Expecting Earnings to Dip by 6%

Higher provisioning will likely drag earnings this year relative to last year. On the other hand, double-digit loan growth and significant margin expansion will likely support the bottom line. Overall, I’m expecting BancFirst to report earnings of $4.73 per share in 2022, down 6% year-over-year. The following table shows my income statement estimates.

| FY17 | FY18 | FY19 | FY20 | FY21 | FY22E | ||||

| Income Statement | |||||||||

| Net interest income | 227 | 260 | 282 | 307 | 316 | 350 | |||

| Provision for loan losses | 9 | 4 | 8 | 63 | (9) | 12 | |||

| Non-interest income | 118 | 125 | 137 | 137 | 170 | 175 | |||

| Non-interest expense | 200 | 222 | 241 | 258 | 286 | 317 | |||

| Net income – Common Sh. | 86 | 126 | 135 | 100 | 168 | 157 | |||

| EPS – Diluted ($) | 2.65 | 3.76 | 4.05 | 3.00 | 5.03 | 4.73 | |||

|

Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

|||||||||

in my last report on BancFirst Corporation, I estimated earnings of $4.03 per share for 2022. I have significantly revised upwards my earnings estimate because I have increased my loan growth estimate following the Worthington National Bank acquisition in the first quarter of the year.

Actual earnings may differ materially from estimates because of the risks and uncertainties related to inflation, and consequently the timing and magnitude of interest rate hikes. Further, the threat of a recession can increase the provisioning for expected loan losses.

Downgrading to a Sell Rating

BancFirst Corporation is offering a dividend yield of only 1.6% at the current quarterly dividend rate of $0.36 per share. The earnings and dividend estimates suggest a payout ratio of 30.5% for 2022, which is close to the five-year average of 34.8%. Therefore, there is no threat to the dividend level from the earnings outlook.

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value BancFirst Corporation. The stock has traded at an average P/TB ratio of 2.15 in the past, as shown below.

| FY17 | FY18 | FY19 | FY20 | FY21 | Average | |

| T. Book Value per Share ($) | 21.8 | 24.1 | 25.0 | 27.1 | 30.3 | |

| Average Market Price ($) | 50.2 | 57.9 | 56.0 | 45.5 | 64.5 | |

| Historical P/TB | 2.30x | 2.40x | 2.24x | 1.68x | 2.13x | 2.15x |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $31.4 gives a target price of $67.5 for the end of 2022. This price target implies a 26% downside from the June 14 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 1.95x | 2.05x | 2.15x | 2.25x | 2.35x |

| TBVPS – Dec 2022 ($) | 31.4 | 31.4 | 31.4 | 31.4 | 31.4 |

| Target Price ($) | 61.3 | 64.4 | 67.5 | 70.7 | 73.8 |

| Market Price ($) | 91.3 | 91.3 | 91.3 | 91.3 | 91.3 |

| Upside/(Downside) | (32.9)% | (29.5)% | (26.0)% | (22.6)% | (19.2)% |

| Source: Author’s Estimates |

The stock has traded at an average P/E ratio of around 15.2x in the past, as shown below.

| FY17 | FY18 | FY19 | FY20 | FY21 | Average | |

| Earnings per Share ($) | 2.7 | 3.8 | 4.0 | 3.0 | 5.0 | |

| Average Market Price ($) | 50.2 | 57.9 | 56.0 | 45.5 | 64.5 | |

| Historical P/E | 18.9x | 15.4x | 13.8x | 15.2x | 12.8x | 15.2x |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/E multiple with the forecast earnings per share of $4.73 gives a target price of $72.0 for the end of 2022. This price target implies a 21.2% downside from the June 14 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 13.2x | 14.2x | 15.2x | 16.2x | 17.2x |

| EPS 2022 ($) | 4.73 | 4.73 | 4.73 | 4.73 | 4.73 |

| Target Price ($) | 62.5 | 67.2 | 72.0 | 76.7 | 81.4 |

| Market Price ($) | 91.3 | 91.3 | 91.3 | 91.3 | 91.3 |

| Upside/(Downside) | (31.5)% | (26.4)% | (21.2)% | (16.0)% | (10.8)% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $69.8, which implies a 23.6% downside from the current market price. Adding the forward dividend yield gives a total expected return of negative 22%.

My new target price isn’t much different from the previous target price given in my last report on BancFirst. However, I’m now expecting more price downside than before because BancFirst’s stock price has rallied in recent months despite the overall market rout. In my opinion, the recent market price hike is unwarranted. Even if BancFirst has some more quick acquisitions up its sleeves, I believe the premium is not worth it. Based on the total expected return, I’m downgrading BancFirst to a sell rating from my previous rating of hold.

Be the first to comment