Scharfsinn86

Investment Thesis

Hydrogen sounds like a dream in theory. No heavy batteries and long charging times as with electric vehicles. No exhaust fumes as with diesel vehicles. Instead, quickly fill up with hydrogen and drive off. Ballard Power (NASDAQ:BLDP), a manufacturer of electrolyte fuel cells, could benefit significantly from such a future. But unfortunately, the company’s development is far from what was hoped for, and the situation seems unlikely to change significantly until at least 2025. So, I would suggest not investing here.

Company overview

Ballard Power is a Canadian company specializing in the production and sale of fuel cells. They currently employ around 800 people and have offices in four countries. The largest shareholder is the Chinese company Weichai Power, which currently holds 15% of the shares. However, Ballard also holds a 49% stake in a joint factory in China, where fuel cells are manufactured based on Ballard’s technology. Weichai Power is an automotive industry supplier and is active in engine construction.

Ballard earns its money with the development, sale, and service of PEM fuel cells. The company has decades of experience and over 1,400 patents and applications. This number is from the investor presentation. I don’t know how many are granted and how many are pending. Looking at the link, there are 17 pages of patents, which would be very far from 1400.

The main business area is commercial vehicles. So far, the company has delivered fuel cells for around 1400 buses, 2200 trucks, 23 trains, and 8 ships. China is the most important market, boosted by the cooperation with Weichai Power. 1,100 buses run in China, meaning a 25% market share for Ballard Power. However, favored by the European Union’s policies, Europe currently accounts for half of the $102M backlog. The order backlog is up 11% from the previous quarter.

Their solutions

The company manufactures so-called polymer electrolyte fuel cells (PEM-cells). These are low-temperature cells up to approx. 90°C. However, it is not possible to generate the desired power with just one; therefore, PEM cells are combined into so-called stacks. These are separated by bipolar plates, which can pass the current from cell to cell and are used for cooling. Graphite, metal, or ceramics are used as materials for the plates. By connecting them in series, the power can be multiplied, i.e., scaled.

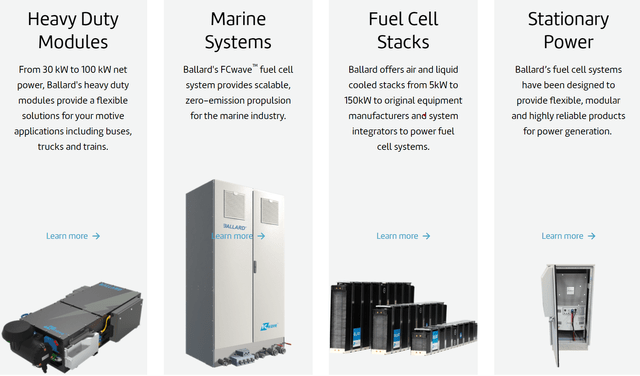

ballard.com

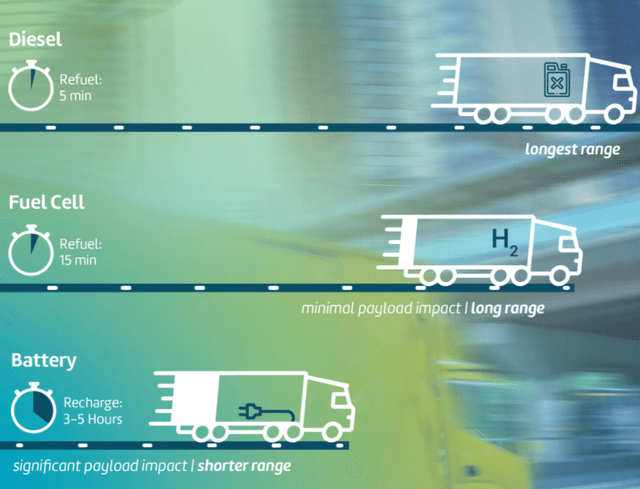

Due to this modular design, the system is very flexible. It can be used in almost all vehicles and as a stationary system when another power supply is impossible. The company sees advantages, especially for large and heavy vehicles such as trucks, buses, trains, and ships. Hydrogen-powered cars are superior here because the refueling time is significantly shorter and the range longer.

investor presentation

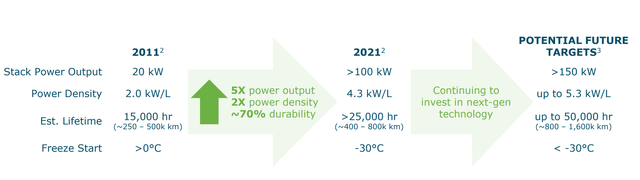

This is also due to the continuous development of fuel cells. The energy density has more than doubled from 2011 to 2021. At the same time, the cells’ lifetime has increased by 70%, and the cold start temperature has been reduced from 0 degrees to -30 degrees. According to the company, the total addressable market is more than $250B.

investor presentation

Outlook for PEM cells

The total addressable market is undoubtedly huge, as potentially every form of transport can be included. Still, it is tough to predict, as the focus on zero-emission solutions only began a few years ago. It is simply not yet known whether this type of hydrogen drive will become established in trains and ships, for example. This always depends on how the production costs develop and the competition, namely electric cars and oil. Will there be more powerful batteries in the future that may also weigh less? What will the oil price be in 2026? The answers are unknown. Therefore, all outlooks should, of course, always be viewed with caution.

In 2020, the market size for PEM cells was $1.56B and is expected to grow 40% annually through 2027, according to Research and Markets. According to another report by Transparency Market Research, growth could be even faster:

The cost of PEM fuel cell materials has decreased by more than 60% over the last 10 years. The cost of PEM fuel cell materials is expected to decline further in the near future. This decrease in the prices of PEM fuel cell materials is estimated to boost the PEM fuel cell materials market during the forecast period. In terms of revenue, the global PEM fuel cell materials market is projected to reach US$ 19 Mn by 2030, expanding at a CAGR of ~58% during the forecast period

Recent results & Valuation

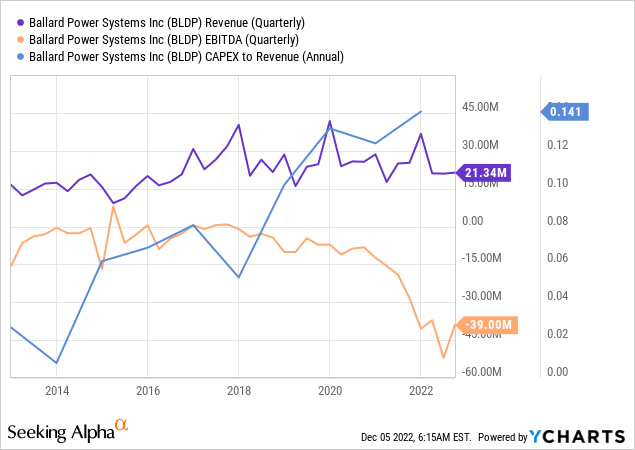

But so far, there is no sign of such growth in the company’s revenue. In a 10-year chart, we see that the revenue has hardly changed, and recently also, due to higher CapEx costs, the EBITDA has further deteriorated. Since the company has raised a lot of money during the stock bubble period (more on this below), I think higher CapEx spending in this phase to prepare for a possible future boom makes sense.

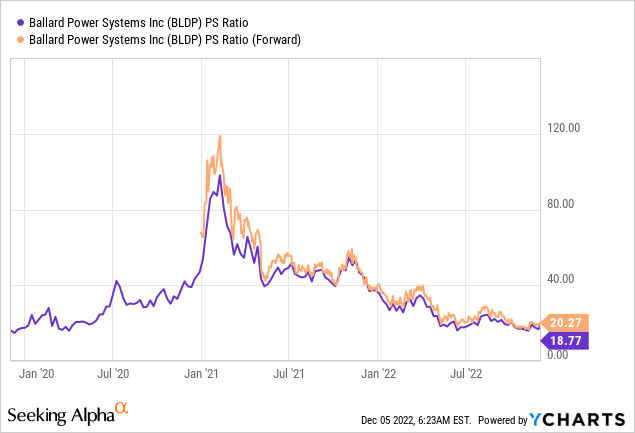

The company is currently valued at an enterprise value of $914M. Market cap is $1.87Bb, and net debt is $15M. Since Ballard Power has neither positive cash flow nor earnings, making a fundamental valuation of the share is difficult. But P/S (price-sales ratio) can be used for valuation purposes. The P/S forward ratio is estimated to be even higher than the last 12 months, as weak sales are expected for the following quarters.

In the last quarter, revenue was $21.3M, which is 15% less than the year before. They also missed estimates by $2.64M. The CEO’s comment didn’t sound very promising for next year either.

We continue to advance on our product cost reduction roadmap, with measured progress from technology innovation, supply chain developments and advanced manufacturing initiatives. We are running ahead of our cost reduction targets which we expect to enable significant gross margin expansion in our long-term financial plan. This quarter our revenue and gross margin were $21.3 million and (22)%, respectively. As previously communicated, we continue to see a challenging gross margin picture which we expect to persist through 2023 until our volume ramps and our product cost reduction initiatives move into production. We exited the quarter with a strong balance sheet to support our growth strategy.

Future outlook

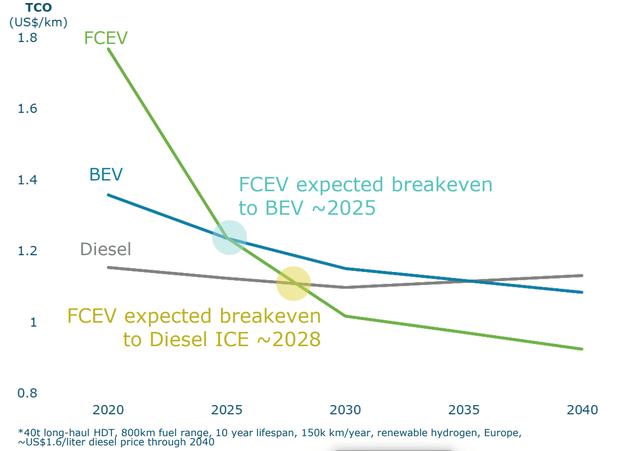

According to the company, hydrogen trucks will reach cost parity with electric vehicles by 2025. Of course, this assumes that hydrogen continues to become cheaper as quickly as is currently estimated. From 2028 onwards, hydrogen trucks are expected to achieve cost parity with diesel trucks. But at the moment, the trend looks rather different. As hydrogen production is connected to gas and electricity costs, in July 2022, the price was $16.80/kg, “three times recent price norms, according to S&P Global Commodity Insights.” (source)

Investor Presentation

Whether this development will really happen remains to be seen and is by no means certain. It sounds as if potential customers will have considerable disadvantages in using hydrogen vehicles at the moment. On the one hand, the costs are higher; on the other hand, the charging infrastructure is even worse than for electric cars, and it’s not good there either. But at least there are more and more electric vehicles on the roads, making expanding the infrastructure more attractive. Let´s suppose in 2030, hydrogen is the cheapest form of propulsion. In that case, things could look quite different again, and perhaps we will eventually live in a world where electric vehicles and hydrogen vehicles coexist.

Risks

Some risks were already mentioned, like charging infrastructure, and still higher than that of electric vehicles. Additionally, despite the promise of hydrogen fuel cells, there is still a lot of uncertainty about their long-term viability. Finally, there is the risk that government subsidies and incentives for hydrogen technology could be cut or reduced. Hydrogen is also part of the Inflation Reduction Act. According to Brenor Brophy, vice president of project development at Plug Power, this support could lead to hydrogen even reaching a negative price. Ballard Power benefits indirectly because they manufacture the cells needed to convert the hydrogen into energy. The cells are the engine, and the hydrogen is the fuel, so if the fuel is cheap, potential customers have more incentive to buy more cells. But at some point, every subsidy ends, and then hydrogen has to be economical enough by itself.

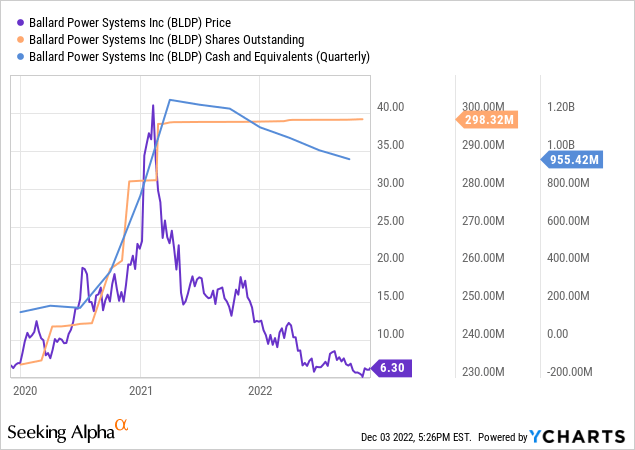

Share dilution and insider selling

One thing I always want to look at, especially with companies that are not yet profitable, is stock dilution and whether there is insider selling. In 2020 and 2021, the company issued many new shares at relatively high share prices. They have built up a huge cash cushion that they can draw on for years to come. However, I have not found any information about insider sales.

Conclusion

The company was fortunate that it was able to take advantage of the stock hype of 2020 and 2021 to raise a lot of money that it can now invest in research and development in the coming years. But the company has potential for the future if the cost of hydrogen and the associated cells continues to fall rapidly enough to make the technology a serious competitor to electric vehicles. While generally less efficient, there are other advantages, such as less material consumption than a battery and fast charging times.

The company has potential in the future, but at the moment, I see no reason to invest. Sales have been stagnant for years, while the valuation is high, and even according to the company’s statements, it will only reach cost competitiveness with electric vehicles in 2025. So I could as well hold on until 2024 and see how far the technology is then. But for now, there are many much better opportunities on the market right now.

Be the first to comment